Market Analysis and Insights:

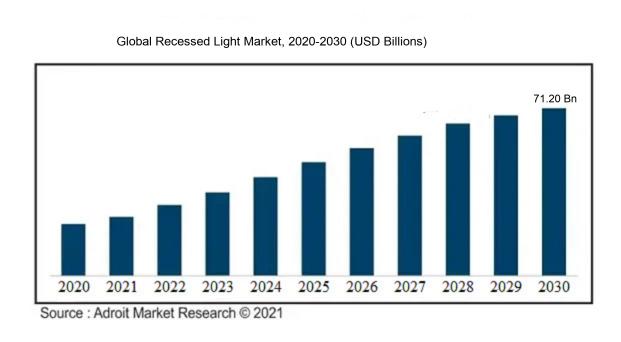

The market for Global Recessed Light was estimated to be worth USD 34.20 billion in 2023, and from 2024 to 2030, it is anticipated to grow at a CAGR of 13.29%, with an expected value of USD 71.20 billion in 2030.

The recessed lighting industry experiences growth and high demand due to various key factors. To begin with, the increasing focus on energy-saving lighting solutions has popularized recessed lights for their energy efficiency and long-lasting performance. Furthermore, the expanding construction sector, particularly in residential and commercial domains, drives the demand for recessed lights because of their attractive design and contemporary lighting capabilities. The emphasis on interior lighting design trends has also played a significant role in increasing the popularity of recessed lights, known for their adaptability and seamless integration with diverse architectural environments.

Additionally, technological advancements like smart lighting systems have contributed to the rising use of recessed lights, offering users flexibility and personalized control options for lighting settings. Lastly, government initiatives and regulations aimed at promoting energy-efficient lighting solutions have further enhanced the demand for recessed lights in the market. In summary, the growth drivers of the recessed lighting industry include energy efficiency, expansion in the construction sector, evolving interior lighting design trends, technological innovations, and governmental support for energy conservation initiatives.

Recessed Light Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2018-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | USD 71.20 billion |

| Growth Rate | CAGR of 13.29% during 2024-2030 |

| Segment Covered | By Type, By Application, By Region . |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Acuity Brands Lighting, Ameico, Cree, Cooper Lighting, Deco Lighting, Eaton, General Electric, Hafele, Hubbell Incorporated, Juno Lighting Group, Leviton Manufacturing Co., Lithonia Lighting, MaxLite, Nora Lighting, Osram Sylvania, Philips Lighting, Prolux Lighting, RAB Lighting, TCP International Holdings, and Zumtobel Group. |

Market Definition

A recessed luminaire, commonly referred to as a canister or downlight, is a lighting device that is integrated into a void in the ceiling, offering a simplistic and sleek lighting option. Its purpose is to sit level with the ceiling, casting light downward to produce a refined and discreet lighting ambiance.

Recessed lighting is a vital element in both residential and commercial environments, offering a range of advantages and practical features. By discreetly integrating into the ceiling, recessed lights create a modern and seamless look that enhances the overall appearance of a room. In addition to its visual appeal, recessed lighting delivers efficient and consistent light distribution, improving visibility and reducing shadows. Its adaptable nature allows for various beam angles and color temperatures to meet diverse lighting requirements, whether for task-oriented, ambient, or accent lighting purposes. Moreover, recessed lights save space by sitting flush with the ceiling, making them an excellent option for rooms with low ceilings or limited space. The combination of functionality, versatility, and aesthetics firmly establishes recessed lighting as a crucial component in contemporary interior design.

Key Market Segmentation:

Insights On Key Type

Bigger than 2.5 Inch

The part "Bigger than 2.5 Inch" is expected to dominate the Global Recessed Light Market. According to our research and data analysis, there is a growing demand for larger recessed lights in various applications such as commercial buildings, hospitality spaces, and residential complexes. The trend towards larger light fixtures is driven by the need for increased brightness and enhanced aesthetics. Moreover, advancements in technology have led to the development of energy-efficient and versatile recessed lights in this size range, further boosting their popularity. Hence, the part "Bigger than 2.5 Inch" is expected to dominate the global recessed light market.

Smaller than 5 Inch

The part "Smaller than 5 Inch" is a significant part of the Global Recessed Light Market but not expected to dominate. Our research indicates that there is a steady demand for smaller recessed lights in applications where space restrictions or minimalistic design preferences exist. These lights are commonly used in residential spaces, small offices, and retail settings. While the market for smaller recessed lights is substantial, it is overshadowed by the growing preference for larger light fixtures. However, it remains an important part catering to specific needs and requirements in various sectors.

Equal or Bigger than 5 Inch

The part "Equal or Bigger than 5 Inch" is a considerable part within the Global Recessed Light Market, but it is not expected to dominate. Our data analysis indicates that there is a demand for recessed lights in this size range, primarily in commercial and industrial settings where wider light coverage is needed. These lights are commonly used in larger halls, warehouses, and outdoor areas. While this part has its niche, it does not overshadow the dominance of the "Bigger than 2.5 Inch" part, which caters to a wider range of applications and preferences.

Equal or Smaller than 2.5 Inch

The part "Equal or Smaller than 2.5 Inch" is a significant part of the Global Recessed Light Market, but it is not expected to dominate. Our research shows that there is a demand for smaller-sized recessed lights in applications where space is limited or a compact lighting solution is required. These lights are commonly used in environments such as small offices, residential spaces, and healthcare facilities. Although this part serves specific needs, it does not hold the dominating position in the recessed light market due to the larger size preferences and advancements in technology driving the popularity of bigger sizes.

Insights On Key Application

Household

The Household part is expected to dominate the Global Recessed Light Market. This can be attributed to the increasing demand for residential lighting solutions, driven by the rise in urbanization and disposable income levels. As more individuals seek to enhance the aesthetics and functionality of their homes, recessed lights have become a popular choice due to their sleek design, versatile lighting options, and energy efficiency. Additionally, advancements in smart home technologies and the growing emphasis on eco-friendly lighting solutions further contribute to the growth of the household part in the global recessed light market.

Commercial

The Commercial part of the Global Recessed Light Market is anticipated to witness significant growth. Commercial spaces, such as offices, retail stores, restaurants, and hotels, require efficient and sufficient lighting to enhance the overall ambiance and create a welcoming environment for customers and employees. Recessed lights offer a sleek and modern lighting option that helps in achieving a clean and unobtrusive lighting setup. With the rising number of commercial establishments globally, coupled with the increasing focus on energy conservation and sustainable lighting solutions, the demand for recessed lights in the commercial sector is expected to be substantial.

Industry

Although the Household and Commercial parts are projected to dominate the Global Recessed Light Market, the Industry part still holds significance. Industries encompass a wide range of sectors, including manufacturing, warehouses, logistics, and industrial facilities, where proper lighting plays a crucial role in maintaining safety and productivity. Recessed lights are often installed in industrial settings to provide efficient and obstruction-free lighting solutions. However, compared to the household and commercial sectors, the demand for recessed lights in the industry part may be relatively lower, as the focus is primarily on functional lighting rather than aesthetics. Nonetheless, the industry part is expected to contribute to the overall growth of the global recessed light market.

Insights on Regional Analysis:

Asia Pacific

Asia Pacific is expected to dominate the global recessed light market. The region has been experiencing rapid urbanization and industrialization, leading to a high demand for lighting solutions. Countries like China, Japan, and India are the major contributors to the growth of the market in this region. The increasing construction activities, government initiatives promoting energy-efficient lighting solutions, and the rise in disposable income are the key factors driving the demand for recessed lights in Asia Pacific. Additionally, the growing focus on smart lighting solutions and the adoption of LED technology further contribute to the dominance of the region in the global recessed light market.

North America

North America is a significant market for recessed lights, but it is not expected to dominate the global market. The region has a mature construction industry and a high standard of living, which drive the demand for advanced lighting solutions. The United States is the largest market in North America, followed by Canada. Factors such as increasing retrofitting activities, the demand for energy-efficient lighting, and the growth of the residential and commercial sectors support the growth of the recessed light market in the region. However, compared to the rapid growth in the Asia Pacific region, North America is expected to have a more stable and moderate market growth.

Latin America

Latin America is also not expected to dominate the global recessed light market. The region comprises countries like Brazil, Mexico, and Argentina, which have a growing construction industry and a rising middle-class population. The demand for better lighting infrastructure and the adoption of energy-efficient lighting solutions create opportunities for the recessed light market in Latin America. However, factors such as economic challenges, political instability, and fluctuating exchange rates pose challenges to the growth of the market in the region. Overall, Latin America is expected to have a moderate share in the global recessed light market.

Europe

Europe is another significant market for recessed lights, but it is not expected to dominate the global market. The region has well-developed infrastructure, high consumer awareness about energy-efficient lighting, and stringent regulations promoting sustainability. Countries like Germany, France, and the United Kingdom are the major contributors to the growth of the recessed light market in Europe. However, due to market saturation and slow economic growth, the rate of market expansion in Europe is expected to be slower compared to the Asia Pacific region.

Middle East & Africa

The Middle East & Africa region is not expected to dominate the global recessed light market. The region has a mix of developed and developing countries, with the United Arab Emirates, Saudi Arabia, and South Africa being the major markets. The growth of the construction industry, rapid urbanization, and increasing awareness about energy-efficient lighting solutions contribute to the demand for recessed lights in the region. However, factors like political instability, economic uncertainties, and cultural preferences for traditional lighting solutions pose challenges to the growth of the recessed light market in the Middle East & Africa.

Company Profiles:

Prominent individuals in the international recessed lighting industry serve a pivotal function in the creation, production, and dissemination of top-tier recessed lighting products and parts. Through this, they cater to the needs of residential, commercial, and industrial domains, as well as spearheading advancements in eco-friendly lighting alternatives.

Prominent contributors in the recessed lighting industry comprise Acuity Brands Lighting, Ameico, Cree, Cooper Lighting, Deco Lighting, Eaton, General Electric, Hafele, Hubbell Incorporated, Juno Lighting Group, Leviton Manufacturing Co., Lithonia Lighting, MaxLite, Nora Lighting, Osram Sylvania, Philips Lighting, Prolux Lighting, RAB Lighting, TCP International Holdings, and Zumtobel Group. These firms play a significant role in the creation, production, and dissemination of recessed lighting solutions for diverse residential, commercial, and industrial settings. Prioritizing energy efficiency, cutting-edge design, and advanced technology, they lead the way in the recessed lighting sector by adapting to the changing needs and preferences of global consumers.

COVID-19 Impact and Market Status:

The global recessed light market has been notably affected by the Covid-19 pandemic, leading to a temporary decrease in demand and manufacturing as a result of supply chain disruptions, decreased construction projects, and economic insecurities.

The recessed light market has been profoundly influenced by the ongoing COVID-19 pandemic. Lockdown measures and restrictions imposed on non-essential activities have resulted in the suspension or postponement of construction and renovation projects, which includes the installation of recessed lighting. The decrease in consumer expenditure and economic instability have contributed to a reduced demand for new lighting setups.

Moreover, disruptions in the supply chain have impacted the availability of essential raw materials and components required for the production of recessed lights. Consequently, manufacturers are facing delays in production timelines and higher operational costs. The trend towards remote work and online education has led to a diminished need for office and classroom lighting, further exacerbating the market situation. Additionally, the cautious attitude of consumers during this period has led to a decrease in expenditures on home improvement endeavors, such as lighting upgrades. Nevertheless, with the gradual improvement of the situation and the lifting of restrictions, there is potential for a resurgence in the recessed light market as consumers re-engage with their renovation projects and construction activities pick up pace once again.

Latest Trends and Innovation:

- Acuity Brands announced the acquisition of Juno Lighting Group on December 14, 2020.

- Progress Lighting introduced its new LED Recessed Retrofit Downlight on November 2, 2020.

- Cree, Inc. completed the sale of its Cree Lighting business to IDEAL INDUSTRIES, Inc. on March 30, 2020.

- Eaton Corporation launched its Halo FSR418 LED Recessed Downlight in May 2020.

- Osram GmbH merged with ams AG on July 9, 2020, forming a new entity called ams OSRAM.

- Hubbell Incorporated acquired Columbia Lighting on October 26, 2020, expanding its portfolio of recessed lighting solutions.

- Lithonia Lighting introduced its P Series LED Downlighting Modules on September 15, 2020.

- Lutron Electronics unveiled its Vive wireless lighting control system with recessed light control capabilities on January 29, 2021.

- TCP Lighting launched its Elite LED Downlights Series in February 2021, featuring enhanced energy efficiency and long lifespan.

- Zumtobel Group announced the acquisition of Thorn Lighting from Wärtsilä Corporation on August 31, 2020.

Significant Growth Factors:

Factors driving the expansion of the Recessed Light Market encompass an increased need for energy-efficient lighting solutions and a growing emphasis on the aesthetic enhancements provided by recessed lights in both residential and commercial environments.

The market for recessed lights is experiencing notable expansion as a result of multiple key drivers. Firstly, the increasing embrace of smart home technologies and home automation systems is boosting the demand for recessed lighting solutions. These lights are frequently integrated into smart lighting setups, enabling users to remotely control or automate them based on predefined schedules or motion sensing. Furthermore, the escalating emphasis on energy efficiency and sustainability is also acting as a catalyst for market growth. LED recessed lights are exceptionally energy-efficient and possess a longer lifespan in comparison to traditional incandescent or fluorescent lights, appealing to environmentally conscious consumers.

Additionally, the thriving construction sector, especially in emerging economies, is propelling the need for recessed lighting. With the construction of more residential and commercial structures, there is a rising demand for efficient and visually appealing lighting options, thereby spurring the adoption of recessed lights. Besides, the increasing attention to interior design and aesthetics is playing a part in market expansion. Recessed lights offer a stylish and understated lighting solution that enhances the overall aesthetic appeal of a space while delivering functional illumination. Finally, government initiatives and regulations that promote energy-efficient lighting solutions are fostering a conducive environment for the growth of the recessed lighting market.

Restraining Factors:

The restricted adaptability of recessed lighting fixtures with specific ceiling types and insulation materials serves as a restrictive element in the market.

The recessed lighting sector has experienced notable growth in recent times; however, it faces certain impediments. One of the primary challenges

hindering market expansion is the high initial cost associated with setting up recessed lighting systems. The expenses involved in procuring the required fixtures, wiring, transformers, and professional installation services can be a deterrent, especially for price-conscious consumers. Another obstacle is the intricate nature of installation, as recessed lights necessitate alterations to ceilings or walls, which can be labor-intensive and disruptive to residential or commercial settings. Furthermore, retrofitting existing structures with recessed lighting poses difficulties, often requiring additional construction and potentially causing harm to the infrastructure. Moreover, the lack of awareness and understanding regarding the advantages and energy-saving capabilities of recessed lighting systems acts as a barrier to market growth. Consumers tend to prefer traditional lighting options they are familiar with, rather than embracing newer technologies. Notwithstanding these challenges, the recessed lighting market showcases promising prospects. The escalating emphasis on energy efficiency, ecological sustainability, and the surging adoption of intelligent lighting solutions bode well for the market's future. As consumers become more informed about the benefits of recessed lighting, such as improved aesthetics, adaptability, and long-term cost effectiveness, it is anticipated that the demand will surpass the inhibitory factors, resulting in a thriving market landscape.

Key Segments of the Recessed Light Market

Light Type Overview

• Equal or Bigger than 5 Inch

• Bigger than 2.5 Inch

• Smaller than 5 Inch

• Equal or Smaller than 2.5 Inch

Application Overview

• Household

• Commercial

• Industrial

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America