Rechargeable Batteries Market Analysis and Insights:

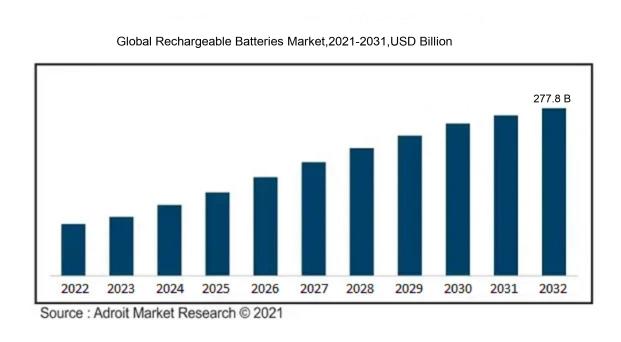

In 2023, the size of the worldwide Rechargeable Batteries market was US$ 113.47 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 10.46 % from 2024 to 2032, reaching US$ 277.8 billion.

The market for rechargeable batteries is influenced by several factors, including advancements in technology, ened consumer interest in portable electronic gadgets, and the shift towards renewable energy options. The surge in the use of smartphones, laptops, and electric vehicles (EVs) creates a demand for effective and eco-friendly energy storage systems, leading to innovations in battery technology, notably in lithium-ion and solid-state variants. Moreover, governmental policies that support clean energy and electric mobility are spurring market expansion by offering incentives to both consumers and manufacturers alike. The growing consciousness regarding environmental issues further fuels the search for batteries that minimize carbon emissions and utilize sustainable materials. Additionally, the increasing requirement for energy storage solutions in renewable energy sectors, such as solar and wind, significantly drives the growth of the rechargeable batteries market, exemplifying the transition towards more sustainable energy options. Together, these elements foster a vibrant and evolving environment for the rechargeable battery industry.

Rechargeable Batteries Market Definition

Rechargeable batteries function as energy storage systems that permit multiple cycles of charging and discharging, enabling the retention of electrical energy for future application. In contrast to single-use batteries, these devices can regain their charge by linking them to an electrical supply once they have been fully used.

Rechargeable batteries are crucial in today's technological landscape and in promoting sustainability. They serve as a greener option compared to disposable batteries by minimizing waste and conserving resources. Their ability to be recharged multiple times not only reduces the overall cost per charge but also mitigates the environmental issues related to battery disposal. As innovations in energy storage continue to progress, the importance of rechargeable batteries in advancing a sustainable future and aiding the shift to cleaner energy alternatives is becoming more pronounced.

Rechargeable Batteries Market Segmental Analysis:

Insights On Battery Type

Lithium-ion

Among the various battery types, Lithium-ion batteries are expected to dominate the Global Rechargeable Batteries Market due to their high energy density, lightweight nature, and efficiency. The continuous advancements in technology have further improved their performance, extending the lifecycle and enhancing charging times. As the world shifts towards sustainable energy solutions, the uptake in electric vehicles and renewable applications propels the Lithium-ion market 's growth, making it the forefront leader in this competitive industry.

Lead-acid

Lead-acid batteries are widely used in automotive applications and stationary power systems due to their reliability and cost-effectiveness. Their well-established manufacturing and recycling infrastructure also contributes to their relevance in certain sectors, especially in regions where cost constraints are significant. However, the growth in their market share is limited due to competition from more efficient rechargeable options like Lithium-ion batteries, which have overtaken many applications.

Nickel-cadmium

Nickel-cadmium batteries have historically served various applications, especially in the industrial sector due to their robust performance and ability to handle deep discharges. However, their adoption is diminishing in consumer electronics and portable applications because of concerns regarding environmental impact and cadmium toxicity. They are still present in specialized devices where performance under extreme conditions is crucial, but regulatory pressure and the rise of alternatives such as Lithium-ion are restricting their usage across many markets.

Nickel-metal hydride

Nickel-metal hydride batteries offer a middle ground between Nickel-cadmium and Lithium-ion technologies. While they are still utilized in hybrid vehicles and some consumer electronics, they face challenges due to competition from newer technologies that provide better efficiency and charge cycles. The weight-to-energy ratio of Nickel-metal hydride batteries is appealing, yet it is overshadowed by the advantages of Lithium-ion. As technological advancements favor lighter and more efficient solutions, the growth potential for Nickel-metal hydride batteries is restrained, requiring manufacturers to innovate continuously to maintain a foothold in specific niches.

Lithium-polymer

Lithium-polymer batteries are recognized for their versatile nature and thin profile, making them particularly advantageous in applications where space and weight are critical, such as smartphones and tablets. However, despite their attractiveness in niche markets, their performance relative to Lithium-ion batteries is often seen as insufficient in energy density and overall lifecycle. While manufacturing advances are ongoing, and improvements in safety are being made, the broader consumer preference towards Lithium-ion makes it challenging for Lithium-polymer batteries to capture extensive market share. Thus, their growth remains inherently limited compared to their more dominant counterpart.

Insights On Application

Energy Storage

Energy Storage is expected to dominate the Global Rechargeable Batteries Market due to the increasing demand for renewable energy solutions and grid stability. Moreover, as electric vehicles become more prevalent, the need for advanced battery systems to enhance energy storage efficiency is paramount. Governments and industries alike are investing heavily in energy storage technology to combat climate change and reduce carbon emissions, driving growth in this vital area.

Consumer Electronics

Consumer Electronics is a significant sector for rechargeable batteries, driven by the growing proliferation of portable electronic devices such as smartphones, laptops, and tablets. The continuous advancements in technology and functionality of these devices necessitate more powerful and efficient batteries. The market for consumer electronics remains robust, fostering innovation and leading to the widespread adoption of rechargeable battery technologies.

Industrial Machinery

The Industrial Machinery sector represents a notable application for rechargeable batteries, particularly in manufacturing equipment and automated systems. The growth of Industry 4.0 and the rising trend of automation have propelled the need for reliable power sources. Rechargeable batteries offer advantages such as durability and the capacity to handle heavy-duty tasks without the interruptions of traditional power sources. As industries prioritize efficiency and productivity, the relevance of rechargeable batteries in powering machinery is expected to grow significantly.

Transportation

In the Transportation sector, the demand for rechargeable batteries is surging primarily due to the rise of electric vehicles (EVs). Governments worldwide are implementing strict emissions regulations and promoting electric mobility, creating an urgent need for high-capacity batteries that offer greater range and quicker charging times. With advances in battery technology and decreasing costs, rechargeable batteries are crucial for the successful transformation of the transportation landscape, ensuring cleaner and more efficient means of travel.

Medical Devices

The Medical Devices industry increasingly relies on rechargeable batteries for portable and implantable devices, including hearing aids and infusion pumps. As healthcare advancements push for more compact and efficient devices, the role of rechargeable batteries in enhancing patient care and monitoring becomes even more significant. Innovations in battery technology are likely to bolster the market for rechargeable batteries specifically tailored for medical purposes.

Insights On Capacity

2 Ah to 5 Ah

The 2 Ah to 5 Ah is expected to dominate the Global Rechargeable Batteries Market due to its versatility and wide application range. These batteries are commonly utilized in a variety of consumer electronics, electric vehicles, and renewable energy systems, where the demand for higher energy density and efficiency is critical. With the increasing adoption of portable electronic devices and the growing emphasis on renewable energy sources, this capacity range meets both power and longevity requirements. The rise in electric vehicle adoption and energy storage solutions further boosts the need for batteries within this capacity range, making it a focal point in the market.

Less than 500 mAh

Batteries with a capacity of less than 500 mAh cater primarily to small electronic devices such as remote controls, hearing aids, and compact gadgets. Although this category may not dominate the market, it holds significance due to the consistent demand for lightweight and compact energy sources. The trend toward miniaturization in electronic devices fuels the need for compact batteries that provide sufficient energy without bulk. Furthermore, ongoing advancements in battery technology improve energy density, which may enhance the appeal of this capacity range for specific niche applications.

500 mAh to 1 Ah

The 500 mAh to 1 Ah range is pivotal for applications that require moderate energy levels, such as toys, wireless peripherals, and portable audio devices. This category serves a niche but essential market that seeks efficiency and reliability in battery performance. The rise of smart gadgets that utilize Bluetooth and other wireless technologies drives demand for these batteries, making them crucial for everyday use. Continuous improvements in battery design, particularly for rechargeable varieties, promise increased performance and charging cycles, bolstering their market position even if they do not lead in overall consumption.

1 Ah to 2 Ah

Batteries in the 1 Ah to 2 Ah capacity range play a significant role in powering medium-sized electronic devices, including personal care products, cameras, and handheld gadgets. This range supports a growing where the balance between size and capacity is vital. As manufacturers focus on creating more powerful yet compact devices, these batteries become increasingly sought after. Enhanced energy density and quick charging capabilities also contribute to their growing importance in consumer electronics, though they may lag behind the higher-capacity options in market dominance.

Over 5 Ah

The Over 5 Ah category mainly serves applications requiring substantial power output, such as electric vehicles and large-scale energy storage systems. While this is critical for high-performance needs, it faces increased competition from more flexible options that meet varied consumer requirements. As the electric vehicle market continues to evolve, there’s a growing focus on not just high capacity but also the overall efficiency and weight of batteries. Thus, although significant, this may not dominate the overall market as the flexibility offered by mid-range batteries aligns better with broader consumer demands.

Insights On Voltage

24V

Among the various voltage categories, 24V is expected to dominate the global rechargeable battery market. This voltage level has seen substantial growth due to its widespread applications in various sectors including electric vehicles (EVs), renewable energy systems, and industrial applications. The 24V batteries are known for their balance of size, weight, and energy capacity, making them suitable for high-demand applications where enhanced performance and efficiency are critical. The surge in electric vehicle adoption and the increasing relevance of renewable energy storage systems further establish 24V as a leading choice in rechargeable batteries. Thus, its prevalence in both consumer and commercial markets reinforces its market leadership.

1.2V

The 1.2V category primarily consists of nickel-metal hydride (NiMH) batteries, widely used for household applications and small electronic devices. As the demand for rechargeable formats grows in consumer electronics, this voltage remains relevant. However, its market share may be limited by rising competition from newer technologies, such as lithium-ion batteries, that offer higher capacities and energy density, thereby not keeping pace with the expected growth of 24V and other higher voltage categories.

3.6V

The 3.6V range is dominated by lithium-ion batteries, often used in portable electronics and some electric vehicles. While these products are growing due to their efficiency and energy density, their market dominance is centered around niche applications compared to more versatile options. The lasting impact will depend heavily on advancements in battery technology and recycling practices, which may allow the 3.6V range to hold steady against increasing competition from higher voltage options.

7.2V

Batteries in the 7.2V range typically find their application in larger portable devices and specialized industrial equipment. While these batteries meet specific market needs, such as power tools and medical equipment, their overall market potential is affected by the increasing push toward higher capacity solutions. This voltage level could face challenges unless technological advancements make it more competitive in terms of performance and longevity against alternatives like the more popular 12V or 24V options.

12V

The 12V category serves as a standard in automotive and backup power applications, thus maintaining a strong foothold. Its versatility allows for extensive use in various sectors, including home inverter systems and automotive batteries. However, it faces pressure from higher voltage categories like 24V and 48V, appealing to industries seeking greater capacity and efficiency. Continued advancements in battery technology, particularly in lithium technologies, will ultimately shape its ongoing relevance.

48V

Batteries in the 48V category are increasingly used in industrial applications and electric vehicles, especially where higher power output is required. This is gaining traction due to a push for energy efficiency, especially in renewable energy systems. Despite this growth, competition from 24V and higher voltage systems could limit market expansion unless specific innovations cater to potential users' needs for higher reliability and energy demands.

Insights On Form Factor

Cylindrical

Cylindrical rechargeable batteries are expected to dominate the global market due to their widespread usage in consumer electronics, electric vehicles (EVs), and energy storage systems. Their robust design offers a higher energy density and excellent thermal performance, making them suitable for a variety of applications. Additionally, major players like Tesla and Panasonic have heavily invested in cylindrical lithium-ion batteries, which further propels their demand. The standardized format allows for easier production scaling, lower costs, and effective OEM integration. With the growth of renewable energy and electrification of vehicles, cylindrical batteries continue to capture a significant market share due to these advantages.

Prismatic

Prismatic rechargeable batteries have gained traction in applications like mobile devices and electric vehicles, known for their space efficiency. Their flat design allows for flexible arrangements, maximizing the use of available space in compact products. This format is particularly appealing in industries focusing on slim designs and weight reduction. However, the manufacturing costs associated with prismatic batteries can be higher compared to cylindrical types. While they represent a notable share of the market, their growth rate currently trails that of cylindrical batteries, limiting their dominance in the overall market landscape.

Pouch

Pouch batteries are primarily favored in consumer electronics for their lightweight characteristics and flexibility in design. Their thin form allows manufacturers to create slim devices, which aligns with current consumer preferences for portable technology. While they offer advantages in weight and packaging density, pouch batteries can pose challenges in terms of structural integrity and thermal management. The market growth for pouch batteries is growing, but they have not yet reached the same level of dominance as cylindrical batteries. Factors such as safety and durability issues when compared to cylindrical options might limit their usage in high-demand scenarios like electric vehicles.

Global Rechargeable Batteries Market Regional Insights:

Asia Pacific

The Asia Pacific region is expected to dominate the Global Rechargeable Batteries market due to several factors. Firstly, a significant increase in the production and sales of electric vehicles (EVs) is observed in countries like China, Japan, and South Korea, which are leading in battery manufacturing and utilization. Moreover, government initiatives in these countries towards promoting renewable energy sources and reducing carbon emissions have bolstered the demand for rechargeable batteries. Additionally, the region hosts major players in the electronics and automotive sectors, driving substantial investments in battery technology and production capacity. The rapid urbanization and increasing disposable income in countries like India and Southeast Asian nations further contribute to a growing need for consumer electronics, which in turn fuels the rechargeable battery market in Asia Pacific.

North America

North America is also a significant player in the Global Rechargeable Batteries market, primarily driven by advancements in technology and innovation in battery solutions. The presence of several established automotive companies and a growing emphasis on renewable energy sources, particularly in the United States, creates substantial demand for rechargeable batteries. Initiatives to increase EV adoption and commitments to environmental sustainability bolster this growth. Furthermore, the region's solid infrastructure for research and development fosters innovations in battery technology, making it a competitive landscape for manufacturers.

Latin America

Latin America is witnessing gradual growth in the rechargeable batteries market, primarily driven by an increase in electronic device usage and a burgeoning interest in renewable energy resources. However, the market remains relatively smaller compared to other regions like Asia Pacific and North America. Challenges such as limited manufacturing capabilities and reliance on imports can hinder rapid growth. That said, emerging electric vehicle markets and governmental efforts to integrate solar energy solutions could provide future growth opportunities in rechargeable battery adoption throughout the region.

Europe

Europe shows a promising trajectory in the rechargeable batteries market, mainly driven by stringent regulations on carbon emissions and a strong push towards electrification in transport. Countries like Germany and Sweden are at the forefront of research and development in battery technologies, focusing on sustainability and efficiency. The EU's strategic initiatives to establish a competitive European battery production ecosystem also highlight the region's commitment to reducing dependency on external suppliers. However, competition from the Asia Pacific region and the need for extensive infrastructure development pose challenges that need addressing.

Middle East & Africa

The Middle East & Africa region has a nascent rechargeable battery market that is gradually developing. There is growing interest in the energy storage sector, spurred by the rising adoption of renewable energy sources like solar and wind power. However, the market faces challenges such as limited infrastructure and high costs of importing battery technologies. While local demand for rechargeable batteries is expected to increase, driven by mobile device usage and potential EV market growth, extensive development and investment are essential for significant market penetration and competitiveness in this region.

Rechargeable Batteries Market Competitive Landscape:

Prominent participants in the worldwide rechargeable battery sector, including leading manufacturers and technology pioneers, propel progress in battery performance and eco-friendliness as they vie to satisfy the increasing demand from diverse industries like consumer electronics and electric vehicles. Their commitment to research and development promotes innovation and cultivates a more competitive environment.

Prominent participants in the rechargeable battery sector encompass Panasonic Corporation, Samsung SDI Co., Ltd., LG Chem Ltd. (now LG Energy Solution), BYD Company Limited, Contemporary Amperex Technology Co., Limited (CATL), Johnson Controls International plc, Toshiba Corporation, A123 Systems LLC, EnerSys, Duracell Inc., Sony Corporation, Saft Groupe S.A., Varta AG, Exide Technologies, and GS Yuasa Corporation.

Global Rechargeable Batteries Market COVID-19 Impact and Market Status:

The Covid-19 pandemic considerably impacted the worldwide market for rechargeable batteries, leading to complications in supply chains, a decrease in production levels, and a noticeable change in consumer preferences toward portable energy alternatives.

The COVID-19 pandemic had a profound impact on the market for rechargeable batteries, presenting both obstacles and opportunities. At the outset, extensive lockdowns and disruptions in supply chains severely impacted production and distribution, resulting in delays and shortages of battery supplies. Conversely, the rise in remote work and digital interactions resulted in a ened demand for rechargeable batteries, particularly in consumer electronics, electric vehicles, and renewable energy storage systems. This period expedited the acceptance of electric vehicles and portable gadgets, spurring innovation and investment in battery technologies. Additionally, an increased focus on sustainable energy solutions prompted both governments and corporations to emphasize cutting-edge battery technologies, thereby fostering market expansion. Ultimately, the rechargeable batteries market experienced a significant transformation, emphasizing resilience and adaptability, which has laid the groundwork for sustained growth in the post-pandemic era.

Latest Trends and Innovation in The Global Rechargeable Batteries Market:

- In August 2023, Panasonic announced its intention to invest $4 billion in its Kansas-based battery plant to ramp up production of electric vehicle batteries, emphasizing its commitment to meet the growing demand for electric mobility.

- In July 2023, LG Energy Solution and Honda established a joint venture called "LG Honda Battery" aimed at producing advanced battery cells for electric vehicles in North America, with the facility expected to begin operations in 2025.

- In June 2023, Tesla completed the acquisition of Maxwell Technologies, a company specializing in ultracapacitor technologies, to enhance its battery technology and improve energy storage solutions in its electric vehicles.

- In April 2023, CATL (Contemporary Amperex Technology Co., Limited) announced its development of a new sodium-ion battery prototype capable of functioning efficiently at lower temperatures, marking a significant breakthrough in battery technology for electric vehicles.

- In March 2023, Northvolt, a Swedish battery manufacturer, secured a $1.1 billion investment from various institutional investors to expand its battery manufacturing facilities in Europe, aiming to increase production capacity amid rising demand for renewable energy and electric vehicles.

- In February 2023, Solid Power announced a partnership with Ford and BMW to accelerate the development of solid-state battery technology, potentially revolutionizing the industry with safer, more efficient, and higher-capacity batteries.

- In January 2023, A123 Systems, a subsidiary of Wanxiang Group, launched its new generation of lithium iron phosphate (LFP) battery technology which offers improved energy density and thermal stability, targeted towards the commercial electric vehicle market.

- In December 2022, Samsung SDI revealed plans to build a new battery manufacturing facility in the United States with an investment of up to $1.5 billion aimed at supporting the growing electric vehicle market and local production of lithium-ion batteries.

- In November 2022, Ford announced its investment of over $11 billion in EV and battery production in Michigan, including plans for new battery plants in partnership with SK Innovation, focusing on creating thousands of jobs in the region.

- In October 2022, Fisker Inc. entered a strategic partnership with CATL to secure a supply of sustainable battery materials for its upcoming electric models, enhancing both companies’ commitments to sustainability in battery production.

Rechargeable Batteries Market Growth Factors:

The expansion of the rechargeable battery sector is fueled by a growing need for electric vehicles, innovations in energy storage solutions, and a ened dependence on portable electronic gadgets.

The expansion of the rechargeable battery market is influenced by several pivotal elements. Firstly, the continuous surge in demand for portable electronic devices—smartphones, laptops, and tablets—fuels this market, as these gadgets require reliable energy sources to function effectively. Secondly, the growing prevalence of electric vehicles (EVs) plays a crucial role, as the automotive sector transitions towards eco-friendly transport solutions, which in turn necessitates cutting-edge battery technology for improved efficiency. Moreover, the increasing integration of renewable energy sources, such as solar and wind, escalates the need for effective energy storage systems, where rechargeable batteries are essential. Innovations in battery technology, particularly advancements in lithium-ion and solid-state batteries, contribute to greater energy capacity and faster charging times, captivating consumer interest. Environmental concerns, alongside governmental policies encouraging sustainable energy practices, further drive market expansion by advocating for the development of eco-conscious battery options. Additionally, the rise of battery recycling efforts aims to lessen environmental impact, promoting a circular economy within the industry. Together, these dynamics highlight a favorable growth trajectory for the rechargeable battery market, mirroring a wider commitment to sustainability and energy efficiency across various domains.

Rechargeable Batteries Market Restaining Factors:

Significant challenges facing the market for rechargeable batteries encompass elevated manufacturing expenses along with constraints in both battery longevity and performance efficiency.

The market for rechargeable batteries is hindered by various challenges that may impede its expansion. One significant factor is the steep production costs tied to cutting-edge technologies, including lithium-ion and solid-state batteries, which can restrict their accessibility and broader market penetration. Furthermore, issues surrounding the procurement of essential materials such as lithium, cobalt, and nickel present notable obstacles, as variations in their availability and pricing can disrupt production consistency. Environmental issues related to the extraction of these resources and the safe disposal of used batteries also generate regulatory scrutiny and community pushback. In addition, performance drawbacks—encompassing energy density, charging duration, and overall lifespan—may discourage consumers from shifting entirely to rechargeable alternatives. Competing solutions, such as supercapacitors and conventional disposable batteries, offer viable options that might hinder market development. Nonetheless, ongoing innovations in battery technology, ened investments in research and development, and growing consumer recognition of sustainability initiatives are fostering advancements that could mitigate these challenges, potentially leading to a more robust and environmentally friendly rechargeable battery market in the future.

Segments of the Rechargeable Batteries Market

By Battery Type

- Lead-acid

- Nickel-cadmium

- Nickel-metal hydride

- Lithium-ion

- Lithium-polymer

By Application

- Consumer Electronics

- Industrial Machinery

- Transportation

- Energy Storage

- Medical Devices

By Capacity

- Less than 500 mAh

- 500 mAh to 1 Ah

- 1 Ah to 2 Ah

- 2 Ah to 5 Ah

- Over 5 Ah

By Voltage

- 1.2V

- 3.6V

- 7.2V

- 12V

- 24V

- 48V

- 110V

By Form Factor

- Cylindrical

- Prismatic

- Pouch

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America