Repositioning and Offloading Devices Market Analysis and Insights:

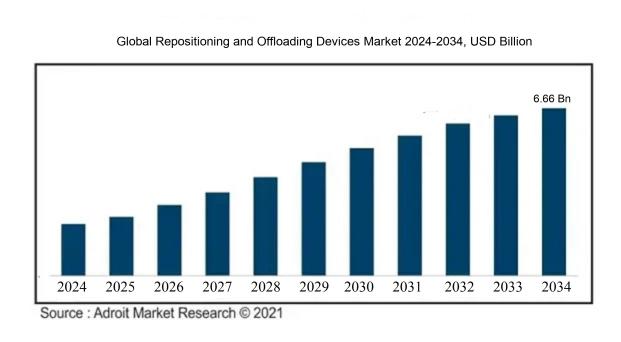

The market for repositioning and offloading devices is expected to reach around USD 6.66 billion by 2034, having grown from USD 4.21 billion in 2024 to USD 4.48 billion in 2025. Between 2024 and 2034, the market is growing at a compound annual growth rate (CAGR) of 6.83%.

The market for repositioning and offloading devices is significantly influenced by the growing prevalence of pressure ulcers and ened awareness surrounding patient safety and comfort in medical environments. Changes in demographics, particularly the aging population and an increase in chronic illness cases, contribute to the demand for sophisticated medical devices designed to prevent skin damage. Furthermore, innovations in device engineering, including the use of advanced materials and pressure-relieving technologies, improve both the functionality and ease of use of these products. Regulatory measures aimed at mitigating hospital-acquired conditions encourage healthcare facilities to invest in tools that enhance quality care. Increased financial support for healthcare services and a transition toward value-based care models further drive the acceptance of repositioning and offloading devices. The mounting focus on training healthcare professionals in effective repositioning methods also bolsters market expansion by enhancing patient outcomes and lowering overall healthcare expenditures.

Repositioning and Offloading Devices Market Definition

Repositioning instruments are engineered to facilitate the adjustment of a patient's posture, thereby preventing the development of pressure ulcers and improving overall comfort. Offloading supports are tailored apparatuses that alleviate pressure from targeted regions of the body, which is particularly crucial for those with restricted mobility or a ened risk of skin deterioration.

Repositioning and offloading devices are essential in the prevention of pressure ulcers and the improvement of patient comfort, especially for those with restricted mobility. These tools distribute pressure evenly across the skin, thereby reducing the likelihood of tissue damage from sustained pressure on bony areas. Moreover, they enhance circulation, maintain skin health, and contribute to comprehensive patient care. By managing pressure effectively, healthcare professionals can enhance patient outcomes, lower complication rates, and decrease the healthcare expenses linked with treating pressure-related injuries. Therefore, incorporating these devices into clinical practice is vital for safeguarding the health and welfare of at-risk patient groups.

Repositioning and Offloading Devices Market Segmental Analysis:

Insights On Product Type

Removable Knee-High Offloading Devices

Removable Knee-High Offloading Devices are expected to dominate the Global Repositioning and Offloading Devices Market due to their versatility and increased patient comfort. These devices allow caregivers to easily adjust and remove them as needed for patient assessments, hygiene, and rehabilitation exercises. The higher adaptability to various medical needs and conditions, along with growing awareness about pressure ulcer prevention and patient care, bolsters their demand in hospitals and home care settings. Moreover, advancements in materials and design have enhanced their effectiveness, contributing to their dominance in this competitive market landscape.

Nonremovable Knee-High Offloading Devices

Nonremovable Knee-High Offloading Devices focus on providing consistent and stable support, primarily for patients with severe conditions or those who cannot bear weight on their legs. Their fixed nature is beneficial for long-term treatment plans, where continuous pressure relief is paramount. These devices are crucial in clinical settings where patients require strict adherence to offloading protocols. However, their limited flexibility in patient handling can affect their market share, as adaptability becomes increasingly important for effective patient management.

Air-Assisted Lateral Transfer Systems

Air-Assisted Lateral Transfer Systems enhance the safety and comfort of transferring patients in healthcare environments. By utilizing air cushions, these devices minimize friction and reduce the risk of injury to both patients and caregivers during transfers. Although they provide significant advantages regarding ease of movement and reduced manual handling injury risks, their adoption rate is somewhat tempered by higher costs and the need for training healthcare staff. The increasing focus on patient safety and comfort may boost their usage but will still maintain them as a secondary choice compared to more easily adaptable solutions.

Replacement Sliding Sheets

Replacement Sliding Sheets are crucial for reducing friction during patient transfers and repositioning, ensuring safer and more comfortable movement in various care settings. Their utility is essential for both patients and healthcare workers, but their reliance on manual labor can be a limiting factor in some settings. While they provide a cost-effective solution for managing patient mobility, the growing trend toward automated and more advanced options may challenge their market presence. The demand is likely to stabilize as they continue to play a supportive role in patient handling.

Wheelchairs

Wheelchairs serve a fundamental role within the broad category of patient mobility solutions, allowing significant independence and functionality for users. In terms of repositioning and offloading, wheelchairs contribute to patient care but are less specialized for pressure relief compared to dedicated offloading devices. Their primary function is mobility rather than offloading, which can dilute their expected market presence in the repositioning. Despite the importance of wheelchairs in enabling movement, healthcare providers may favor more targeted solutions specifically designed for pressure ulcer prevention and skin protection.

Insights On Application

Surgery

The Surgery application is anticipated to dominate the Global Repositioning and Offloading Devices Market. This surge in dominance is primarily driven by the increasing number of surgical procedures worldwide. As hospital visits rise due to chronic conditions requiring surgical interventions, the demand for efficient repositioning and offloading devices is amplified to enhance patient outcomes and recovery. Additionally, advancements in surgical technology and techniques create a broader requirement for specialized devices that promote safety and effectiveness during surgical operations. The mounting focus on postoperative care and patient comfort further solidifies the importance of this in a rapidly evolving healthcare landscape.

Diagnostics

In the Diagnostics application, the focus is primarily on enhancing the accuracy and efficiency of diagnostic procedures. As the healthcare industry evolves, there is an increasing need for devices that can assist in the repositioning of patients for imaging and examination purposes. However, this is currently experiencing slower growth compared to the Surgical due to the relatively passive nature of diagnostic procedures. Despite this, advancements in diagnostic technology, like imaging methods and patient monitoring systems, could potentially boost the interest in repositioning and offloading devices in this area.

Offloading

The Offloading category plays a crucial role in reducing pressure on specific body parts for patients with certain medical conditions, particularly those related to wound care and rehabilitation. The ongoing efforts to prevent pressure ulcers and other complications in bed-ridden patients have highlighted the need for specialized devices that can offload pressure effectively. Though this category holds significant importance in patient care, it tends to be overshadowed by the urgent and dynamic requirements presented by surgical applications. Continuous research and development efforts, however, may result in increased adoption within this field, as healthcare providers recognize its potential in enhancing patient quality of life.

Insights On End User

Hospitals

The hospitals is expected to dominate the Global Repositioning and Offloading Devices Market due to the increasing prevalence of conditions requiring surgical interventions, which leads to a higher incidence of pressure ulcers among patients. Hospitals often have a high turnover of patients, necessitating the continuous use of repositioning and offloading devices to prevent complications and enhance recovery. Moreover, advancements in medical technology have resulted in sophisticated devices tailored for hospital environments, promoting better patient outcomes and reducing healthcare costs. As such, healthcare providers are increasingly investing in these devices to improve care standards within their establishments.

Ambulatory Care

Ambulatory care settings are seeing a growing utilization of repositioning and offloading devices, primarily due to the rising number of outpatient procedures and the need for effective post-operative care. Patients receiving treatment in these facilities often have mobility challenges, making the use of such devices essential to prevent pressure injuries. Additionally, the shift towards outpatient care models demands that healthcare providers implement efficient strategies to ensure patient safety and comfort during recovery. This trend is likely to bolster the use of repositioning equipment in these environments.

Home Care Setting

In home care settings, the use of repositioning and offloading devices is becoming increasingly important as more patients choose to receive care at home. This is driven by an aging population and a growing preference for personalized care, where caregivers can utilize these devices to help manage patients who have limited mobility. Moreover, as technology advances and becomes more accessible, patients and caregivers can benefit from enhanced support to minimize the risk of pressure ulcers at home. However, these devices require more education for users, which can limit their growth compared to hospitals.

Nursing Homes

Nursing homes are experiencing a steady demand for repositioning and offloading devices, primarily due to the high incidence of pressure ulcers among residents who often have limited mobility. The need for effective preventive measures in long-term care facilities is critical, as the elderly population is particularly vulnerable to skin injuries. While nursing homes are incorporating these devices to enhance resident care, the budget constraints often hinder the acquisition of advanced technology. Furthermore, the level of training of staff in utilizing these devices can impact their efficiency in preventing injuries, affecting the overall growth in this sector.

Insights On Method of Operation

Electric

Electric devices are expected to dominate the Global Repositioning and Offloading Devices Market due to their advanced features, ease of use, and growing demand for automation in healthcare settings. Healthcare professionals increasingly prefer electric devices because they offer precise control, improved safety, and reduced physical strain for both patients and staff. The integration of technology in modern healthcare is driving this trend, as electric devices are often equipped with smart features for monitoring and adjustments. As hospitals and care facilities continue to prioritize efficiency and patient comfort, electric repositioning and offloading devices stand out as the optimal solution, positioning them as leaders in the market.

Manual

Manual devices are often favored for their simplicity and cost-effectiveness in various healthcare environments. While they require more physical involvement from caregivers, they can sometimes offer greater control in delicate repositioning situations. These devices do not rely on electrical components, making them suitable for use in settings where power supply might be an issue. Additionally, manual devices are often more affordable for smaller healthcare facilities or home care situations, enabling broader access to essential equipment.

Hybrid

Hybrid devices, which combine features of both manual and electric systems, serve a niche market with specific needs. They offer flexibility, accommodating various patient conditions and caregiver preferences. However, the complexity of these devices can make them less appealing compared to fully electric options, which boast superior functionality and ease of use. Despite this, hybrid devices can be a practical choice in scenarios where both manual operation and electrical assistance are beneficial, thereby catering to unique requirements across different healthcare environments.

Global Repositioning and Offloading Devices Market Regional Insights:

North America

North America is expected to dominate the Global Repositioning and Offloading Devices market due to its advanced healthcare infrastructure, substantial investment in medical technology, and a growing aging population that requires increased mobility assistance. The presence of leading manufacturers and a high rate of adoption of innovative medical devices significantly contribute to the region's market leadership. Furthermore, stringent regulatory frameworks ensure the quality and safety of such devices, thereby boosting consumer confidence. The synergy between healthcare providers, researchers, and technology developers enhances product development, making North America a focal point for the repositioning and offloading devices market.

Latin America

Latin America’s market for repositioning and offloading devices is gradually expanding but faces challenges such as economic variability and inconsistent healthcare funding. However, nations like Brazil and Mexico are witnessing increased health awareness and investment in healthcare upgrades, which helps in pushing the demand for these devices. The growing elderly population in this region is likely to drive the market forward, creating opportunities for manufacturers.

Asia Pacific

The Asia Pacific region shows promising growth potential in the Global Repositioning and Offloading Devices market. Countries like China and India are experiencing rapid improvements in healthcare systems, alongside a surge in population aging. Increased disposable income and a rising focus on healthcare spending support demand for advanced medical equipment. Moreover, governments are investing in healthcare reforms, which will likely boost the demand for repositioning and offloading devices.

Europe

Europe is a significant player in the Global Repositioning and Offloading Devices market, thanks to a well-established healthcare system and stringent regulations focused on patient safety. The aging population in countries like Germany, Italy, and the UK is driving the demand for mobility aids and devices. Furthermore, the implementation of innovative technologies and a high level of healthcare expenditure provide a solid foundation for market growth, making it a key region in this industry.

Middle East & Africa

The Middle East & Africa region has a developing market for repositioning and offloading devices, with potential for future growth. While healthcare infrastructure is improving, challenges such as political instability and limited access to healthcare services may hinder immediate progress. Nevertheless, increasing investments in healthcare from both public and private sectors, particularly in nations like the UAE and South Africa, are expected to boost the adoption of advanced medical devices in the coming years.

Repositioning and Offloading Devices Competitive Landscape:

Major contributors to the Global Repositioning and Offloading Devices market are pivotal in fostering innovation and the advancement of cutting-edge medical solutions, prioritizing the safety and comfort of patients. They significantly impact market expansion by forming strategic alliances, improving distribution networks, and raising awareness of their offerings among healthcare practitioners.

Prominent participants in the Repositioning and Offloading Devices sector encompass Hill-Rom Holdings, Inc., Invacare Corporation, Arjo Huntleigh, Stryker Corporation, Medtronic plc, Getinge AB, Guldmann A/S, The Transparent Company, Wissner-Bosserhoff GmbH, and Blue Chip Medical Products, Inc. Furthermore, companies such as Drive DeVilbiss Healthcare, Joerns Healthcare, Inc., Spectrum Medical, and Brownmed, Inc. significantly impact this industry. Other noteworthy entities include Safe Patient Handling Systems, Inc., Tunstall Healthcare Group, Proactive Medical, and Stryker's Bed and Mobility division. These organizations are celebrated for their advancements and contributions in creating effective devices aimed at repositioning and offloading for enhanced patient care.

Global Repositioning and Offloading Devices COVID-19 Impact and Market Status:

The Covid-19 pandemic greatly intensified the need for repositioning and offloading devices, as healthcare systems adjusted to ened patient requirements and implemented safety measures, highlighting the crucial role of preventing pressure injuries in critical care environments.

The COVID-19 pandemic has profoundly affected the market for repositioning and offloading devices, mainly by escalating the demand for sophisticated healthcare measures aimed at preventing pressure ulcers in hospitalized individuals. The rise in COVID-19 cases resulted in a higher patient influx in healthcare settings, highlighting the necessity for efficient patient care approaches, such as utilizing repositioning devices to address issues related to extended immobility. Furthermore, the surge in telehealth services and remote patient monitoring has spurred innovation within the industry, encouraging manufacturers to create more flexible and hygienic solutions. Nonetheless, early in the pandemic, supply chain challenges posed obstacles to manufacturing and distribution processes. As healthcare systems transition into a post-pandemic phase, a focus on enhancing patient safety and comfort is expected to drive the market forward, presenting growth opportunities amidst an ongoing emphasis on pressure injury prevention. Ultimately, the pandemic has acted as a catalyst for advancements in patient care technologies, significantly altering the market landscape for repositioning and offloading devices.

Latest Trends and Innovation in The Global Repositioning and Offloading Devices Market:

- In March 2023, Medtronic announced the acquisition of Mazor Robotics to enhance its surgical technologies, focusing on improving precision in repositioning devices used during surgical procedures.

- In January 2023, Boston Scientific launched the EXALT Model B single-use duodenoscope, which provides a solution for gastrointestinal procedures while emphasizing safety and ease of repositioning in comparison to traditional reusable devices.

- In July 2022, Sterigenics International LLC expanded its offloading technology offerings by acquiring the advanced sterilization business of Johnson & Johnson, improving its capabilities in sterilizing medical devices and enhancing supply chain efficiency.

- In February 2022, Stryker partnered with OrthoSensor to integrate sensor technology into its joint replacement devices, allowing for better monitoring and repositioning during surgeries and optimizing patient outcomes.

- In November 2021, Zimmer Biomet announced an investment in the startup company Olatec Therapeutics, which is developing novel offloading technologies for diabetic foot ulcers and non-healing wounds, aiming to revolutionize care in this.

- In April 2021, AbbVie completed the acquisition of Allergan, which included Allergan's innovative repositioning devices for aesthetic and reconstructive surgery, expanding AbbVie's footprint in the surgical device market.

- In September 2020, Smith & Nephew launched the Dyonics Ultra 4K, a new visualization system designed for orthopedic surgeries, enabling improved clarity and precision during repositioning procedures.

- In December 2020, Teleflex Incorporated acquired AEON Clarity, a company specializing in innovative offloading and tissue preservation technologies, enhancing Teleflex's portfolio in wound care devices.

Repositioning and Offloading Devices Market Growth Factors:

The Repositioning and Offloading Devices Market is being driven by several key factors, such as the growing incidence of pressure sores, ened awareness regarding patient safety, and innovations in medical technology.

The market for repositioning and offloading devices is witnessing notable growth driven by multiple factors. A notable increase in pressure ulcer occurrences, particularly among elderly individuals and those with mobility challenges, is significantly raising the demand for effective offloading solutions. Technological advancements are contributing to the emergence of innovative products that improve patient comfort and outcomes, thereby fostering greater market adoption. Healthcare providers are placing a stronger emphasis on patient safety and proactive care, leading to increased investments in high-quality repositioning devices. Concurrently, there is a ened awareness regarding pressure ulcer prevention among healthcare professionals and families, further fueling market growth. Supportive government initiatives and regulatory measures aimed at enhancing healthcare quality standards play a crucial role in the expansion of this industry. The rise in both hospital admissions and outpatient procedures associated with chronic conditions necessitates efficient patient management solutions, factually boosting the demand for such devices. Additionally, the transition towards value-based healthcare models prioritizes cost-effective solutions that mitigate complications, placing increased focus on repositioning and offloading technologies. Ultimately, a confluence of demographic shifts, technological innovation, and a stronger commitment to patient well-being is propelling the vigorous growth of the repositioning and offloading devices market.

Repositioning and Offloading Devices Market Restaining Factors:

Significant hurdles in the market for repositioning and offloading devices involve a lack of awareness among healthcare professionals and the substantial expenses linked to the implementation of advanced technologies.

The market for repositioning and offloading devices encounters numerous challenges that could impede its expansion. A primary concern is the substantial financial investment required for sophisticated medical technologies, which can restrict availability, particularly in economically constrained areas. Moreover, a deficiency in education and training among healthcare professionals about the effective utilization of these tools may result in their inadequate application. The market is also affected by rigorous regulatory requirements and varying standards across regions, which can obstruct the introduction of new products and inhibit innovation. Additionally, the adherence to conventional methods and a reluctance to embrace change among certain healthcare practitioners might delay the integration of these advanced technologies. Budget reductions within the healthcare industry could further exacerbate funding difficulties for acquiring such devices, likely resulting in decreased sales. Nevertheless, as awareness regarding patient safety and the quality of healthcare grows, coupled with technological advancements making these devices more cost-effective and efficient, the outlook for the repositioning and offloading devices market seems favorable, suggesting potential for significant growth and broader acceptance in the coming years.

Key Segments of the Repositioning and Offloading Devices Market

By Product Type

- Nonremovable Knee-High Offloading Devices

- Removable Knee-High Offloading Devices

- Air-Assisted Lateral Transfer Systems

- Replacement Sliding Sheets

- Wheelchairs

By Application

- Surgery

- Diagnostics

By End User

- Hospitals

- Ambulatory Care

- Home Care Setting

- Nursing Homes

By Method of Operation

- Manual

- Electric

- Hybrid

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America