Market Analysis and Insights:

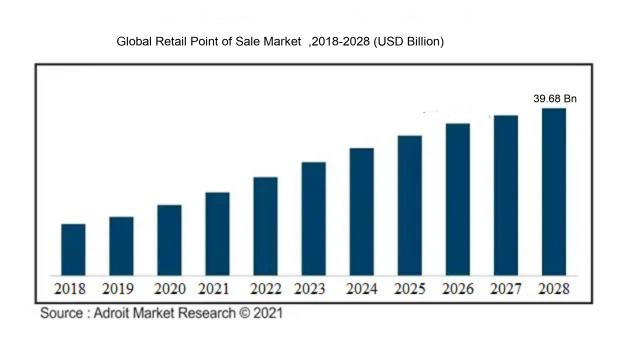

The market for Global Retail Point of Sale was estimated to be worth USD 14.92 billion in 2020, and from 2020 to 2028, it is anticipated to grow at a CAGR of 12.27%, with an expected value of USD 39.68 billion in 2028.

The retail point of sale (POS) industry experiences influence from various factors. Primarily, the surge in using advanced technologies like cloud-based POS systems and mobile POS devices plays a significant role in driving market growth. These innovative solutions come with improved features, such as inventory management, customer relationship management, and real-time analytics, thereby facilitating efficient operations and enhancing customer satisfaction. Moreover, the increasing need for data-driven insights in the retail sector is propelling the adoption of POS systems that offer valuable business intelligence. Retailers are utilizing this information to make strategic decisions, optimize inventory, and analyze customer shopping behaviors for tailored offerings. The proliferation of e-commerce platforms and omnichannel retail strategies is further fueling the demand for integrated POS systems capable of managing both online and offline sales channels seamlessly. Additionally, there is a growing emphasis on improving customer experiences through secure and swift transactions, personalized promotions, and loyalty programs, which is driving market expansion. Lastly, the strict regulations and compliance standards related to data security and payment processing are pushing for the implementation of robust POS systems to ensure compliance and safeguard customer data. In essence, the retail POS market growth is powered by advancements in technology, data-driven insights, omnichannel retail strategies, customer experience enhancement, and adherence to regulatory standards.

Retail Point of Sale Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2028 |

| Study Period | 2018-2028 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2028 | USD 39.68 billion |

| Growth Rate | CAGR of 12.27% during 2020-2028 |

| Segment Covered | By Product, By Component, By End User, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Oracle Corporation, SAP SE, Verifone Systems, Inc., Toshiba Corporation, Ingenico Group, NCR Corporation, Shopify, Inc., PAX Technology Limited, Square, Inc., and Cisco Systems, Inc. |

Market Definition

The retail point of sale (POS) sector encompasses the innovative systems, equipment, and software solutions utilized by retailers to conduct sales transactions and oversee inventory. This sector incorporates various devices and software intended to enhance the purchasing process for both consumers and businesses, thereby enhancing efficiency and precision in retail management. The retail point of sale (POS) sector is a critical component of the retail industry, enabling businesses to effectively process transactions, manage inventory, and enhance customer interactions.

Advancements in technology have transformed the POS market, offering sophisticated features like real-time data tracking, integrated payment solutions, and seamless integration with various business systems. This evolution allows retailers to streamline their operations, elevate customer experiences, and make data-driven decisions for business growth. As e-commerce and omni-channel retailing continue to expand, a robust and interconnected POS system has become indispensable for success. Ultimately, the retail POS market holds significant importance in empowering businesses to optimize processes, boost efficiency, and adapt to the changing dynamics of the modern retail landscape.

Key Market Segmentation:

Insights On Key Product

Mobile

The mobile is expected to dominate the Global Retail Point of Sale Market. With the growing adoption of smartphones and tablets, the demand for mobile point-of-sale systems has witnessed a significant increase. Mobile solutions offer flexibility and mobility to retailers, allowing them to engage with customers and complete transactions anywhere within the store. The convenience and real-time data accessibility provided by mobile point-of-sale systems have made them extremely popular among retailers. Furthermore, the integration of advanced technologies such as NFC and biometrics has further enhanced the capabilities of mobile POS systems, making them a preferred choice for retailers across various industries.

Fixed

Although the mobile is projected to dominate, the fixed of the Global Retail Point of Sale Market still maintains its relevance and popularity. Fixed point-of-sale systems are widely used by retailers in traditional brick-and-mortar stores. These systems consist of hardware components such as cash registers, barcode scanners, and receipt printers, combined with software solutions to process transactions and manage inventory. While the demand for mobile POS systems is on the rise, many retailers, especially those with larger stores or complex operations, still rely on fixed systems due to their robustness, scalability, and established infrastructure. Fixed POS systems offer stability and reliability, making them suitable for high-volume transactions and integration with other retail management systems.

Insights On Key Component

Software

Based on my knowledge and research, the Software is expected to dominate the Global Retail Point of Sale Market market. This is due to the increasing demand for advanced software solutions that can streamline operations, enhance customer experience, and improve inventory management in retail businesses. With the growth of e-commerce and omnichannel retailing, retailers require software that can integrate with multiple sales channels, provide real-time data analytics, and support features such as loyalty programs and mobile payments. As a result, software providers are continually innovating and offering comprehensive point-of-sale solutions to cater to these evolving needs. The software is projected to experience substantial growth as retailers invest in modernizing their point-of-sale infrastructure to stay competitive in the market.

Hardware

While the Software is expected to dominate the Global Retail Point of Sale Market market, the Hardware also holds significant importance. Hardware components such as cash registers, barcode scanners, receipt printers, and touch screen displays are crucial elements of a retail point-of-sale system. Despite the growth of cloud-based and mobile point-of-sale solutions, many retailers still rely on traditional hardware devices for their physical store locations. However, the hardware is expected to experience slower growth compared to software and services as the focus shifts towards integrated software solutions that can be run on various hardware platforms.

Services

The Services plays a vital role in supporting the implementation, customization, and maintenance of retail point-of-sale systems. Service providers offer installation, training, technical support, and consulting services to retailers to ensure smooth operations and maximize the benefits of their point-of-sale solutions. Although essential, the Services is expected to have a smaller market share compared to software and hardware. This is because many software vendors now provide comprehensive packages that include both software and service components, minimizing the need for separate service providers. Nonetheless, the demand for specialized services tailored to specific retail requirements, such as integration with existing systems or advanced analytics, is expected to drive growth within this .

Insights On Key End User

Supermarkets/Hypermarkets

The Supermarkets/Hypermarkets is expected to dominate the Global Retail Point of Sale Market. Supermarkets and hypermarkets are large retail stores that offer a wide variety of products and attract a large number of customers.

They typically have multiple checkout counters and require an efficient and reliable point of sale system to handle the high volume of transactions. With the growth of organized retail and the increasing preference for one-stop shopping experiences, supermarkets and hypermarkets are likely to continue dominating the market. These establishments have the resources to invest in advanced POS technologies to enhance customer experience and streamline their operations. Therefore, the Supermarkets/Hypermarkets is expected to dominate the Global Retail Point of Sale Market.

Grocery Stores

Grocery stores are a major player in the retail point of sale sector, even though they are not anticipated to dominate it. Compared to supermarkets, grocery stores typically have smaller store sizes and serve customers' daily requirements. Grocery stores need dependable and effective point of sale systems to optimize their operations, even though their transaction volume may not be as great as that of supermarkets. The implementation of modern point-of-sale (POS) systems is imperative for grocery stores due to the significance of precise inventory control and expedited checkout operations. Grocery stores hold a substantial share in the global retail point of sale sector, although not being as prevalent as supermarkets.

Specialty Stores

Specialty stores cater to a specific niche or target audience, offering unique and often high-end products. While the number of specialty stores may be limited compared to supermarkets and grocery stores, they create a distinguished shopping experience for customers. Due to the specialized nature of their products, specialty stores often have higher average transaction values. Therefore, the point of sale systems used in specialty stores must not only facilitate efficient checkout processes but also support inventory management and customer relationship management. Although not dominating the market, specialty stores hold their place as an important in the Global Retail Point of Sale Market.

Convenience Stores

Convenience stores are small-sized retail establishments known for their extended operating hours and easy accessibility. While they may not have a wide range of products like supermarkets, they serve the immediate needs of consumers, such as snacks, beverages, and essential items. With the growing demand for convenience and on-the-go purchases, convenience stores continue to thrive. However, due to their smaller size and limited inventory, the transaction volume at convenience stores is generally lower compared to larger retail formats. As a result, the market share of point of sale solutions in convenience stores may be relatively smaller compared to supermarkets and grocery stores.

Gas Stations

Gas stations provide fuel and often offer additional services like convenience stores or car washes. While the primary focus of gas stations is fuel sales, they also generate revenue through in-store purchases. However, the transaction volume at gas stations, a from fuel transactions, is typically lower compared to other retail formats. Point of sale systems in gas stations mainly facilitate fuel dispensing and payment processing, with limited inventory management requirements. Therefore, gas stations may not dominate the Global Retail Point of Sale Market but still play a significant role in the industry.

Discount Stores

Discount stores, also known as dollar stores or discount retailers, offer a wide range of products at a discounted price. They attract price-conscious consumers looking for value deals. Although the transaction volume and average transaction value at discount stores may not be as high as supermarkets or specialty stores, they still contribute to the Global Retail Point of Sale Market. The emphasis on cost-effective solutions in discount stores may drive them to adopt cost-efficient point of sale systems that prioritize affordability while catering to essential retail functions.

Other End Users

The "Other End Users" category encompasses various retail establishments that may not fit into the previously mentioned s. This category includes retail businesses such as clothing stores, electronics stores, home improvement stores, and more. Every retail business has unique requirements, and the choice of point of sale systems will depend on factors like industry specialization, target audience, and business size. While these end users collectively contribute to the Global Retail Point of Sale Market, they are not expected to dominate the market individually.

Others

The "Others" category refers to additional end users in the retail industry that are not specified in the given choices. As a catch-all category, it may include emerging or niche retail formats that have distinct requirements and characteristics. The significance and dominance of this category will depend on the specific types of retail businesses included, making it difficult to determine its expected influence on the Global Retail Point of Sale Market without further information.

Insights on Regional Analysis:

Asia Pacific

Asia Pacific is expected to dominate the Global Retail Point of Sale Market market. This region boasts a fast-growing retail industry, fueled by emerging economies such as China and India. The increasing adoption of technology and digitalization in the retail sector, along with the growth of e-commerce, has created a favorable environment for the expansion of the retail point of sale market in Asia Pacific. Additionally, the rising disposable income and changing consumer preferences in this region are driving the demand for efficient and convenient payment solutions, further contributing to the growth of the retail point of sale market.

North America

North America, although not the dominating region, is also a significant player in the Global Retail Point of Sale Market market. The region has a mature and well-established retail sector, supported by high consumer spending and advanced infrastructure. With the presence of major retail giants and a tech-savvy population, North America has been quick to adopt innovative point of sale solutions. The region's focus on enhancing customer experience and streamlining operations through advanced retail technology positively impacts the growth of the retail point of sale market in North America.

Europe

Europe, similar to North America, has a developed retail industry and plays a significant role in the Global Retail Point of Sale Market market. The region's strong economy, high internet penetration, and willingness to adopt new technologies drive the demand for efficient point of sale solutions. European retailers are increasingly implementing cloud-based and mobile point of sale systems to enhance customer experience and automate processes. Additionally, the stringent regulations related to data security and GDPR compliance in Europe have led retailers to invest in secure and compliant retail point of sale solutions.

Latin America

Latin America is a region on the rise in terms of its contribution to the Global Retail Point of Sale Market market. Factors such as urbanization, a growing middle class, and increasing internet penetration are driving the expansion of the retail sector in this region. As Latin American retailers shift towards modernizing their operations and offering seamless customer experiences, the demand for technologically advanced point of sale solutions is increasing. However, various challenges, including economic instability and concerns over data security, continue to impact the growth of the retail point of sale market in Latin America.

Middle East & Africa

Although still relatively small compared to other regions, the Middle East & Africa region is witnessing significant growth in the retail point of sale market. The increasing consumer spending power, rising urbanization, and governments' initiatives towards digital transformation are driving the adoption of retail technology solutions in this region. As retailers strive to enhance customer experiences and improve operational efficiency, the demand for reliable and efficient point of sale systems is increasing. However, factors such as economic volatility, limited technology infrastructure, and cultural barriers present challenges to the growth of the retail point of sale market in the Middle East & Africa.

Company Profiles:

Prominent entities within the international retail point of sale sector significantly contribute to delivering pioneering and resilient POS offerings that enhance customer satisfaction and optimize retail processes on a global scale. These entities prioritize intensive research and innovation to maintain their competitiveness within the industry. Prominent entities within the Retail Point of Sale Market are Oracle Corporation, SAP SE, Verifone Systems, Inc., Toshiba Corporation, Ingenico Group, NCR Corporation, Shopify, Inc., PAX Technology Limited, Square, Inc., and Cisco Systems, Inc.

COVID-19 Impact and Market Status:

The global retail point of sale market has experienced a downturn as a consequence of the Covid-19 pandemic, mainly driven by the shuttering of retail establishments and a decrease in consumer expenditures. The retail point of sale market has undergone significant changes due to the impact of the COVID-19 pandemic.

Global lockdowns and social distancing measures led to the closure or limited operation of retail stores, resulting in reduced consumer traffic. This compelled retailers to explore new avenues for sales and customer service, leading to a notable increase in the adoption of contactless payment methods and online e-commerce platforms. Cloud-based and mobile point of sale (POS) systems became more sought after as retailers aimed to streamline order processing, inventory management, and customer interaction tools. Additionally, retailers placed a strong emphasis on safety by integrating touchless payment options and self-service checkouts in their POS systems. Following the relaxation of restrictions, retail outlets gradually reopened, with a continued focus on social distancing and hygiene measures driving the demand for advanced POS technologies. Despite posing challenges, the pandemic also accelerated the digital transformation of the retail industry, prompting retailers to invest in cutting-edge solutions that facilitate seamless and secure transactions for their customers.

Latest Trends and Innovation:

- In April 2021, Square, a leading digital payment solutions provider, announced the acquisition of Tidal, a music streaming platform.

- In January 2021, Lightspeed POS, a cloud-based POS system provider, acquired ShopKeep, a leading POS software provider for small businesses.

- In December 2020, PayPal Holdings Inc. acquired Curv, a digital asset security company, to enhance its offerings in the cryptocurrency space.

- In September 2020, Vend, a cloud-based POS and retail management platform, announced a strategic collaboration with BigCommerce, a leading e-commerce platform.

- In August 2020, Intuit, the company behind QuickBooks, acquired TradeGecko, a cloud-based inventory and order management platform, to strengthen its position in the retail industry.

- In July 2020, Lightspeed POS completed the acquisition of Upserve, a restaurant management platform, to further expand its offerings in the hospitality sector.

- In June 2020, Shopify, a leading e-commerce platform, announced the acquisition of 6 River Systems, a fulfillment solutions provider, to enhance its capabilities in warehouse automation.

- In April 2020, Adobe Systems Incorporated acquired Workfront, a work management platform, to enhance its collaboration and productivity solutions for marketing teams.

- In March 2020, HP Inc. introduced the HP Engage One Pro, an all-in-one point of sale (POS) system with enhanced security and performance features.

- In February 2020, NCR Corporation, a leading provider of POS solutions, announced the acquisition of D3 Technology, a software company specializing in digital banking solutions.

Significant Growth Factors:

The Retail Point of Sale Market is experiencing significant growth due to the rising utilization of digital payment solutions and the increasing need for sophisticated inventory and customer management systems.

The Retail Point of Sale (POS) industry has experienced substantial growth recently as a result of a variety of significant factors. One key driver is the widespread adoption of cloud-based POS systems, which have expanded the market by offering improved flexibility, scalability, and cost-efficiency. These systems enable retailers to efficiently manage sales and inventory across multiple locations. Furthermore, the demand for convenient and user-friendly payment processing solutions has led to an increase in the use of mobile POS systems. These systems allow retailers to accept various payment methods, including contactless payments.

The trend towards omnichannel retailing has also played a significant role in driving the adoption of integrated POS systems that seamlessly bridge online and offline sales channels. This integration provides customers with a consistent and personalized shopping experience. Additionally, the shift towards digitalization and the growing emphasis on data-driven decision-making have driven the adoption of POS systems with advanced analytics capabilities.These systems provide retailers with valuable insights into customer behavior, inventory management, and sales performance.

The rise of e-commerce platforms and the need for efficient order fulfillment and inventory management solutions have further fueled the demand for POS systems with robust inventory management features. As a result, the retail POS market is expected to continue growing in the foreseeable future, fueled by the increasing demand for integrated, cloud-based, and analytics-driven solutions that empower retailers to streamline operations, enhance customer experiences, and drive sales growth.

Restraining Factors:

Several significant constraints affecting the Retail Point of Sale Market are the substantial expenses associated with implementation and the increasing inclination towards e-commerce.

The Retail Point of Sale (POS) Market has experienced notable growth in recent times, although there are specific limiting factors impeding its advancement. Initially, the substantial upfront expenses associated with implementing a POS system may discourage small retailers with constrained financial means. The costs related to procuring hardware, software, and other supplementary tools can present a hurdle for small enterprises, limiting their capacity to integrate this technology.

Moreover, the lack of technical know-how and training among staff members can also serve as an impediment. The shift to a new POS system necessitates adequate training to ensure smooth operations and optimal utilization, yet numerous retailers lack the requisite expertise and understanding.

Additionally, apprehensions regarding data security and privacy present another obstacle for the retail POS market. Retailers must safeguard customer data, payment credentials, and sensitive business details from security breaches and cyber threats. Achieving this demands investments in robust security protocols, which can strain some businesses financially. Nevertheless, despite these challenges, the outlook for the retail POS market is positive. Advancements in technology, such as cloud-based POS systems and mobile payment solutions, are streamlining the implementation and management of POS systems by enhancing efficiency and affordability. Furthermore, the escalating demand for personalized and seamless shopping experiences is propelling the adoption of POS systems, opening avenues for retailers to augment the customer journey and optimize operational effectiveness. As awareness regarding the benefits of POS systems expands, it is anticipated that more retailers, including small and medium-sized enterprises, will surmount these barriers and welcome this technology, thereby catalyzing growth and innovation in the retail sector.

Key Segments of the Retail Point of Sale Market

Product Overview

• Fixed Point of Sale

• Mobile Point of Sale

Component Overview

• Hardware

• Software

• Services

End User Overview

• Supermarkets/Hypermarkets

• Grocery Stores

• Specialty Stores

• Convenience Stores

• Gas Stations

• Discount Stores

• Other End Users

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America