Market Analysis and Insights:

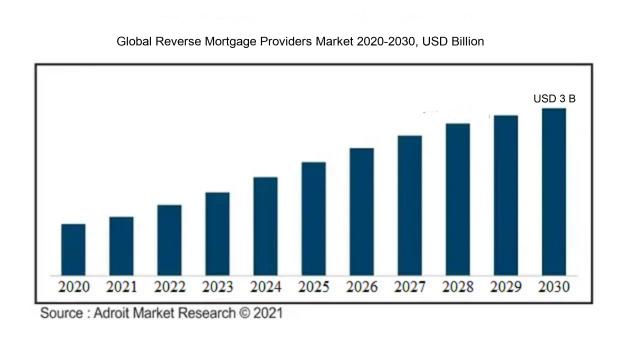

The market for Global Reverse Mortgage Providers was estimated to be worth USD 1.8 billion in 2024, and from 2024 to 2030, it is anticipated to grow at a CAGR of 5.5%, with an expected value of USD 3 billion in 2030.

The Reverse Mortgage Providers Market is significantly influenced by several pivotal factors, notably the increasing senior population, ened awareness surrounding retirement financial strategies, and the growing appreciation of home equity. With the baby boomer generation entering retirement, there is an escalating demand for financial alternatives that enable older adults to tap into their home equity without the necessity of selling their properties. Moreover, educational campaigns that elucidate the advantages and flexibility of reverse mortgages are fostering market expansion, as consumers gain a better understanding of how these financial products can enhance retirement income. Favorable economic conditions, such as persistently low interest rates and rising property values, further boost the appeal of reverse mortgages, allowing homeowners to benefit from considerable equity. In addition, the development of new regulatory standards and product innovations is anticipated to solidify and broaden the market, rendering reverse mortgages a more accessible option for many older homeowners aiming for financial security in their retirement years.

Reverse Mortgage Providers Market Scope :

| Metrics | Details |

| Base Year | 2024 |

| Historic Data | 2020-2023 |

| Forecast Period | 2024-2030 |

| Study Period | 2023-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | USD 3 billion |

| Growth Rate | CAGR of 5.5% during 2024-2030 |

| Segment Covered | By Type, By Application, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | AAG (American Advisors Group), C2 Financial Corporation, and Reverse Mortgage Funding LLC, along with OneMain Financial, Finance of America Reverse, and Liberty Home Equity Solutions. |

Market Definition

Reverse mortgage lenders are financial entities that provide loans enabling homeowners, primarily those in their senior years, to transform a portion of their home equity into liquid assets, without the obligation of making monthly mortgage repayments. The repayment of the loan occurs when the homeowner sells the house, relocates, or deceases.

Providers of reverse mortgages play an essential role for individuals aged 62 and above, presenting a financial option that transforms home equity into liquid assets without necessitating monthly mortgage payments. This arrangement can greatly bolster the financial security of retirees, allowing them to address living expenses, medical bills, or home renovations while still residing in their properties. Through customized guidance and a range of loan offerings, these providers assist clients in understanding the intricacies of reverse mortgages, ensuring that their choices are well-informed and consistent with their long-term financial aspirations. Furthermore, reverse mortgages can alleviate financial burdens and enhance the quality of life for older adults, positioning these providers as a crucial component in retirement strategy planning.

Key Market Segmentation:

Insights On Key Type

Home Equity Conversion Mortgages (HECMs)

Home Equity Conversion Mortgages (HECMs) are expected to dominate the Global Reverse Mortgage Providers market due to their federally insured status and growing popularity among senior homeowners. This type of reverse mortgage provides significant financial flexibility, as it allows individuals aged 62 and older to convert a portion of their home equity into cash without needing to sell the property. The increasing aging population and rising housing equity are key drivers, with HECMs offering borrowers a safe and reliable means to access funds for medical expenses, home renovations, or other needs. The familiarity of HECMs with lenders and consumers further cements their leading position in the market.

Single-purpose Reverse Mortgages

Single-purpose reverse mortgages are designed for specific needs, such as home repairs or property taxes. Typically offered by state and local government agencies, they are often more affordable than other types because they usually feature lower fees and limited usage. However, despite their cost-effectiveness, they lack the flexibility and broader appeal of HECMs, hampering their market dominance. The limited scope of these loans restricts their attractiveness to a wider audience, resulting in a smaller share of the overall reverse mortgage market. This makes them a less preferred option for consumers looking for financial solutions.

Proprietary Reverse Mortgages

Proprietary reverse mortgages cater to affluent individuals who own high-value homes. Unlike HECMs, they are private loans and are not federally insured, which can introduce more risk to borrowers. The primary advantage of proprietary loans lies in their higher borrowing limits, allowing homeowners with significant equity more access to cash. However, these products are less commonly known and may only appeal to a specific niche market. Additionally, the lack of regulatory oversight may deter potential borrowers who seek security in their financial decisions, giving disadvantage to this type of loan in comparison to HECMs.

Insights On Key Application

Income Supplement

Income Supplement is expected to dominate the Global Reverse Mortgage Providers Market due to the growing necessity among retirees to secure an additional income stream in order to meet their living costs and maintain their lifestyle. As people live longer, there is increasing pressure on fixed retirement savings and pensions, making reverse mortgages an attractive option for those seeking financial stability in their later years. The appeal of converting home equity into cash flow without the obligation to make monthly payments positions this application as the most sought-after among homeowners considering reverse mortgages. Additionally, the trend of aging populations globally reinforces this advantage further.

Debt

The debt category continues to be a significant player in the reverse mortgage market. Homeowners often leverage reverse mortgages to pay off existing debts, such as credit cards and personal loans. This strategy allows them to alleviate financial burdens and avoid potential credit damage while also keeping their financial standing intact. With the rising costs of living and economic uncertainty, more individuals are opting to use reverse mortgages to manage and reduce their outstanding financial obligations effectively.

Health Care Related

Health care-related expenses are another critical area where reverse mortgages play a vital role. Many retirees are faced with unexpected medical costs, which can quickly deplete their savings. By tapping into home equity, these individuals can better manage their health care bills, whether it’s for long-term care services or unexpected medical emergencies. As life expectancy increases, so does the need for reliable funding sources to cover health-related expenditures, making this option increasingly relevant.

Renovations

Renovations hold a unique position within the reverse mortgage market, as many homeowners use these financial tools to finance home improvements. Aging properties often require updates to maintain safety and comfort, and reverse mortgages make it easier for seniors to invest in necessary renovations without the immediate financial strain of traditional loans. This approach not only enhances their living conditions but can also improve the home's value, making it a strategic use of their home equity.

Living Expenses

Living expenses are another important application area for reverse mortgages. Seniors often find themselves facing challenges in covering daily expenses, including groceries, utilities, and rising costs of living. Many view reverse mortgages as a way to supplement their income, ensuring a better quality of life. By converting home equity into funds for daily necessities, they can mitigate financial stress and focus more on enjoying their retirement years rather than worrying about finances.

Insights on Regional Analysis:

North America

North America is expected to dominate the Global Reverse Mortgage Providers market due to its advanced financial services infrastructure, high level of consumer awareness, and a significant aging population. The United States, in particular, leads in offering reverse mortgage products, driven by government policies and financial institutions that promote their uptake among retirees seeking to tap into their home equity for additional income. The presence of established players and a well-regulated market lends stability and growth potential, making North America the foremost region in this sector.

Latin America

Latin America is gradually emerging in the reverse mortgage market, driven by an increasing aging population and a growing interest in retirement planning. However, the region is still in the early stages of adoption, with limited product offerings and lower awareness among consumers. The market potential exists, particularly in wealthier countries like Brazil and Chile, but regulatory frameworks need development and education initiatives are essential to stimulate growth.

Asia Pacific

In Asia Pacific, the reverse mortgage market is witnessing slow but steady growth as countries such as Australia and Japan begin to realize the benefits of these financial products. The aging demographic is a significant driver, and cultural shifts towards asset utilization are beginning to take shape. However, concerns regarding eligibility, financial literacy, and the stigma associated with reverse mortgages still hamper wider acceptance across the region.

Europe

Europe's reverse mortgage market remains fragmented, with several countries implementing different regulatory frameworks and market conditions. While the UK, Germany, and the Netherlands show some promise, the overall uptake is significantly lower compared to North America. Cultural disparities around homeownership and financial products play a key role in the slow growth of reverse mortgages, leading to considerable market variance across the continent.

Middle East & Africa

The Middle East & Africa region has an extremely nascent reverse mortgage market, driven mainly by cultural perceptions about debt and home equity. With a relatively younger demographic and less focus on retirement planning, the concept of reverse mortgages is not widely recognized. There is potential for growth, particularly in more developed markets like South Africa, but for now, the region remains largely untapped in the reverse mortgage sector.

Company Profiles:

Prominent entities within the global reverse mortgage market comprise banks and specialized mortgage firms that deliver customized lending solutions for older adults, enabling them to leverage their home equity while adhering to regulatory requirements. These organizations focus on innovating products, educating clients, and managing risks, all of which contribute to market expansion and bolster consumer confidence.

Prominent entities in the Reverse Mortgage Providers sector encompass AAG (American Advisors Group), C2 Financial Corporation, and Reverse Mortgage Funding LLC, along with OneMain Financial, Finance of America Reverse, and Liberty Home Equity Solutions. Additionally, Homepoint and Longbridge Financial play significant roles in this arena. Other noteworthy firms include Mutual of Omaha Mortgage, All Reverse Mortgage Company, Trust Reverse Mortgage, and Equitable Mortgage. The competitive landscape is further shaped by players such as Watermark Home Loans, Seniors First, and Modern Mortgage Solutions.

COVID-19 Impact and Market Status:

The Covid-19 pandemic greatly impacted the Global Reverse Mortgage Providers market by hastening the shift towards digital solutions and transforming consumer attitudes towards remote services and financial security alternatives for older adults.

The COVID-19 pandemic has profoundly affected the market for reverse mortgage providers by shifting consumer habits and altering market conditions. As anxiety surged during this period, a growing number of older homeowners began considering reverse mortgages as a viable financial safety measure, enabling them to unlock their home equity to manage living costs or settle debts. This spike in interest led lenders to modify their services and enhance the application process, frequently integrating digital solutions to support remote communications. Nevertheless, the economic decline and escalating property values raised flags regarding equity and repayment complications, resulting in more stringent lending standards and ened assessments of borrower eligibility. Furthermore, the pandemic underscored the necessity for education and transparency within the reverse mortgage sector, as many prospective clients sought trustworthy guidance to understand these financial products. In summary, the market encountered both new opportunities and challenges, urging providers to reassess their strategies to effectively cater to a changing customer base.

Latest Trends and Innovation:

- In June 2023, AAG (American Advisors Group) announced a partnership with the fintech company ReverseVision to enhance their technology offerings and streamline the reverse mortgage application process with improved digital tools.

- In April 2022, Finance of America Reverse (FAR) completed its acquisition of the reverse mortgage assets of Home Point Financial, expanding its market reach and strengthening its product lineup.

- In January 2023, Reverse Mortgage Funding (RMF) launched a new proprietary reverse mortgage product called the EquityEdge, aimed at providing greater flexibility and features for borrowers, thereby enhancing their competitive positioning in the market.

- In March 2021, the Federal Housing Administration (FHA) introduced new guidelines for reverse mortgages, allowing lenders like AAG and RMF to offer more compliant and consumer-friendly products, which subsequently led to a spike in market activity.

- In October 2022, HUD (Department of Housing and Urban Development) finalized its plans to expand access to reverse mortgages, which was positively received by companies like FAR and RMF, who prepared to offer new programs aligning with the updated regulatory landscape.

- In September 2023, Mutual of Omaha Reverse Mortgage announced the launch of an innovative online education platform designed to help potential borrowers understand reverse mortgage options, aiming to improve consumer awareness and engagement in the market.

- In February 2022, Wells Fargo announced it would exit the reverse mortgage business entirely, impacting the competitive landscape and allowing other providers like AAG and RMF to capture a larger market share.

Significant Growth Factors:

The expansion of the reverse mortgage provider sector is fueled by a maturing demographic, a surge in home equity, and a ened understanding of financial alternatives available to retirees.

The market for reverse mortgage providers is witnessing remarkable expansion, influenced by several critical factors. Primarily, the increasing number of elderly individuals worldwide, particularly from the baby boomer cohort, is driving the demand for financial solutions that support retirement funding. Reverse mortgages present an advantageous option for converting home equity into cash that can help meet these financial needs. Additionally, as property values continue to rise, homeowners have the opportunity to access larger loan amounts, enhancing the allure of reverse mortgages.

Moreover, the growing awareness and education surrounding reverse mortgages play a crucial role in this growth. Financial institutions and housing counselors are actively working to correct misunderstandings about these products, which facilitates greater accessibility for potential borrowers. Further, the current low-interest rate environment makes reverse mortgages more appealing, enabling consumers to obtain more favorable loan conditions.

Government initiatives that promote home equity conversion and establish consumer protection guidelines are also contributing positively to market dynamics by boosting borrower confidence. Finally, advancements in technology within the mortgage industry are simplifying the processes of application and approval, helping consumers navigate the complexities linked to reverse mortgages with greater ease. Collectively, these elements are shaping a thriving market that meets the financial needs of an older population.

Restraining Factors:

Significant impediments within the reverse mortgage provider sector consist of ambiguous regulatory frameworks and the possibility of variable interest rates, both of which can influence consumer trust and their readiness to participate in these financial offerings.

The market for reverse mortgage providers faces various constraints that impede its potential for growth. A significant challenge arises from ened examination by regulatory agencies, resulting in rigorous compliance mandates that complicate processing and diminish provider adaptability. Furthermore, a general lack of consumer understanding regarding reverse mortgages and their advantages contributes to reluctance among homeowners, especially older adults who represent the main target audience. This unfamiliarity can lead to misunderstandings about the terms and consequences of such financial products, ultimately discouraging prospective clients.

Financial institutions also contend with the effects of varying interest rates and changing economic circumstances, which can affect their lending abilities and the overall stability of the market. In addition, competition from other financial options, like home equity lines of credit, may redirect potential clients away from reverse mortgages. On the technological side, some providers are slow to embrace digital platforms for customer interaction, which can hinder their reach and operational efficiency.

Nevertheless, the market holds potential, particularly as the aging population increasingly seeks financial avenues aligned with their retirement needs. As awareness and education about reverse mortgages improve, along with advancements in service offerings, providers in this sector may uncover new avenues for growth and enhance their standing within the financial ecosystem.

Key Segments of the Reverse Mortgage Providers Market

By Type

• Home Equity Conversion Mortgages (HECMs)

• Single-purpose Reverse Mortgages

• Proprietary Reverse Mortgages

By Application

• Debt

• Health Care Related

• Renovations

• Income Supplement

• Living Expenses

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America