The global ride-sharing market was valued at USD 43.24 billion in 2017 and is anticipated to grow at a faster pace due to the increasing population and growing concern for the environment. Further to reduce traffic congestion and associated air pollution have expected to drive the market in the coming future. However, at present rapid income growth in the middle class has restrained the growth of the ride-sharing market.

The global market for the Ride Sharing is anticipated to develop at a compound annual growth rate (CAGR) of 16.7% throughout the course of the forecast, to reach US$ 344.4 bn by 2026.

.jpg)

However, increasing penetration of smart electronic devices, such as tablets, smartphones, and laptops is estimated to driving the market growth. In the ride-sharing business model, smart electronic devices are considered as the most significant platforms on which the ride sharing apps are installed.

Further, the fast uptake of smartphones and the internet around the world have opened possibilities for ride-sharing in many regions. The various security features offered such as route tracking, license plate, name and number of the driver and pas records are available to the customers before the driver arrives. Moreover, car owners are also inclined to use the ride share occasionally, for example when going out for a party. These features have encouraged to drive the global ride-sharing market share.

Key company profile in the Global Ride Sharing Market report ANI Technologies Pvt. Ltd., INTEL, BLABLACAR, TOMTOM International BV, Denso Corporation, APTIV, WAYMO, General Motors, Ford Motor Company, IBM International, CABIFY, CAR2GO, DAIMLER Uber Technology Inc., Haxi, Ola, Lyft, Didi Chuxing , Grab, Go Jerk, Easy task, Hitch-a-Ride, and Yandex Taxi.

Ride Sharing Market Scope

| Metrics | Details |

| Base Year | 2021 |

| Historic Data | 2016-2017 |

| Forecast Period | 2021-2026 |

| Study Period | 2016-2026 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2026 | US$ 344.4 bn |

| Growth Rate | CAGR of 16.7% during 2016-2026 |

| Segment Covered | by application, By Membership type, By Service, By Vehicle Type, By Method, by Capacity, By Material Type, By End User, Regions |

| Regions Covered | North America, Europe, Asia Pacific, Middle East and Africa, South America |

| Key Players Profiled | ANI Technologies Pvt. Ltd., INTEL, BLABLACAR, TOMTOM International BV, Denso Corporation, APTIV, WAYMO, General Motors, Ford Motor Company, IBM International, CABIFY, CAR2GO, DAIMLER |

Key segments of the Ride Sharing Market

By Application (USD Billion)

- Andriod

- IOS

- Others

By Membership Type, (USD Billion)

- Fixed Ridesharing

- Corporate Ridesharing

- and Dynamic Ridesharing

By Service, (USD Billion)

- app-based

- web-based

- web

- app-based

By Vehicle Type, (USD Billion)

- Electric Vehicle Mobility

- CNG/LPG Vehicle

- ICE Vehicle Mobility Micro-mobility

Region Overview, (USD Billion)

- North America

- United States of America

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- the Netherlands

- Poland

- Russia

- The United Kingdom

- Rest of Europe

- Asia-Pacific

- China

- India

- Indonesia

- South Korea

- Rest of Asia-Pacific

- South America

- Argentina

- Brazil

- Peru

- Uruguay

- Rest of South America

Frequently Asked Questions (FAQ) :

Ride sharing is a two-sided market which is dependent on demand and supply of customers and cars respectively. On the demand side, passengers download more than one car-hailing apps such as Uber and Ola and use them to compare availability and prices. Similarly, drivers could sign up to more than one platform that depends on various factors such as the probability of picking up passengers and financial incentives.

The growing demand for the global ride-sharing market has accelerated the production of cars with flexible interiors such as relaxing and fun. Moreover, the consumer can take benefits of such cars as its interior offer higher levels of convenience which is cheaper to buy and maintain. In January 2016, General Motors made a $500 million investment in Lyft, and also launched its car rental and sharing service named Maven. While Swedish firm Volvo has a partnership with Uber to provide its XC90 SUV model for autonomous testing.

Another valuable contribution of global ridesharing market is towards the environment, where there is a reduction in vehicles circulation per day. This will result in an estimated minimization of annual CO2 emissions and parking space. In 2017, in Myanmar, ride sharing resulted in a reduction of CO2 emission by 423 million kg, which is the same amount of emission as compared to 160,000 tons of coal. The vehicle circulation reduction will also contribute to a decrease in demand for parking spaces for private vehicles. This freed up space can accommodate additional 230,000 trees in Yangon, to make the city greener and rich in vegetation.

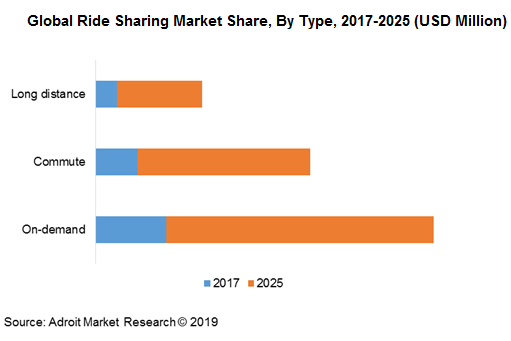

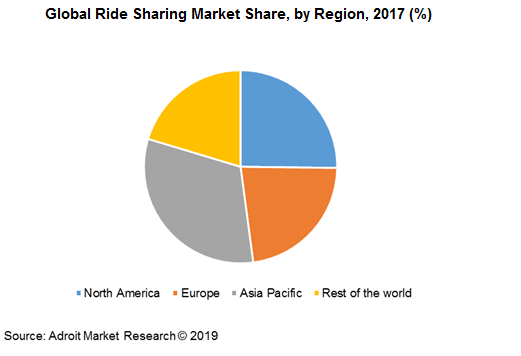

Based on the type of global ride-sharing market, on-demand is expected to dominate the market whereas commute is projected to have the highest growth rate at 19.3% CAGR in the forecast period. Asia-Pacific is leading the ride-sharing market with surged adoption of on-demand rides due to growing population and rising traffic congestion. Moreover, the long distance commute segment is anticipated to witness potential growth over the forecast period. This type of commute is at a growing stage and gaining acceptance amid the extended adoption of various ride-sharing platforms by end users. The adoption of long-distance commute type is estimated to account potential growth according to the user’s connectivity through various popular platforms.

The Asia Pacific dominated the global ride-sharing market in 2018. Ridesharing service has also attracted private car owners to join and gain from it financially in this region. In Yangon, nearly 1 out of every 4 of private car owners tends to be a part of a ride-sharing service.

In North America, U.S. is the leading country constituting around 82.4% of the ride-sharing market. Moreover, U.S. government is also taking an initiative to help the companies to grow in this region and also taking measures for the safety of riders. For example, in July 2018, the California Public Utilities Commission (CPUC), regulated ridesharing rules for companies like Uber and Lyft. The regulation includes driver background checks, insurance requirements, and drug tests.

At the momentum of the ride-sharing market, there are two major global companies which include Uber and Lyft. However, regional companies like Ola, Didi Chuxing, and Grab has a strong market presence in the ridesharing market. Hence, giving tough competition to global players. The competitive landscape of the global ride-sharing market is consolidated in 2017 as Uber held the major of ride-sharing market with the presence in 65 countries and over 600 cities worldwide.