Robotaxi Market Analysis and Insights:

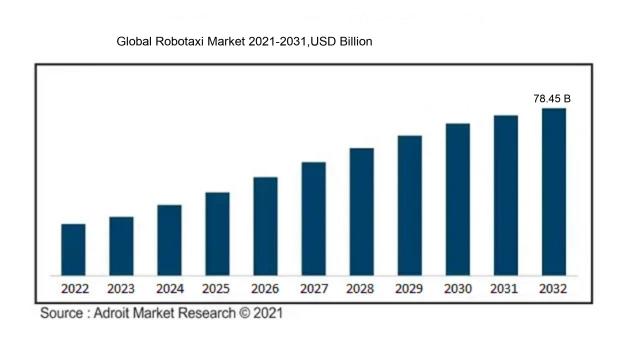

In 2023, the size of the worldwide Robotaxi market was US$ 487.7 million. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 75% from 2024 to 2032, reaching US$ 78.45 billion.

The Robotaxi sector is significantly influenced by advancements in autonomous vehicle technologies, particularly in areas such as artificial intelligence, sensor enhancements, and advanced mapping techniques. The trend of urbanization, coupled with a growing desire for efficient and affordable transportation options, is fueling demand as consumers increasingly opt for alternatives to conventional car ownership. Furthermore, rising environmental concerns and a drive towards sustainable transport solutions are spurring investments in electric and self-driving vehicles, which are becoming more attractive in urban areas. Evolving regulatory landscapes are also playing a crucial role in enabling the integration of autonomous vehicles, promoting public confidence and safety. Additionally, the post-pandemic emphasis on shared mobility options has intensified interest in robotaxi services, which provide a safe and convenient means of travel. Collectively, these dynamics cultivate a favorable landscape for the development of the Robotaxi sector, offering substantial opportunities for innovation and growth in the near future.

Robotaxi Market Definition

The robotaxi industry involves self-driving vehicles that provide passenger transportation without any human operators. This field focuses on the creation, implementation, and operation of autonomous cars within ride-hailing services.

The Robotaxi sector signifies a paradigm shift in city transportation, presenting considerable advantages including improved safety, alleviated traffic congestion, and diminished emissions. Through the adoption of self-driving vehicle technology, this industry is poised to deliver effective transit options that cater to increasing environmental awareness and urbanization dynamics. Additionally, the market presents considerable economic opportunities, with forecasts indicating notable expansion fueled by consumer preferences for convenience and affordability. As legislative frameworks develop and technology progresses, Robotaxis may become integral to redefining transportation frameworks, highlighting the importance for participants in automotive, technology, and urban planning fields to participate in this burgeoning market.

Robotaxi Market Segmental Analysis:

Insights On Key Vehicle Type

Cars

The Cars category is expected to dominate the Global Robotaxi Market. This is primarily due to the increasing consumer preference for personal mobility and convenience. Cars offer a familiar and comfortable experience for passengers, which aligns with the desire for a personalized travel experience. They also have a well-established infrastructure for both charging and maintenance, making them an attractive choice for companies looking to implement robotaxi services. Additionally, advancements in autonomous driving technology specifically tailored for cars have accelerated their deployment in urban settings. This growth is further fueled by urbanization and rising concerns over ride-sharing convenience, resulting in a higher demand for automated car services.

Shuttle/Van

The Shuttle/Van category is characterized by potential, especially in controlled environments like airports, campuses, and urban centers. These vehicles are designed to carry multiple passengers simultaneously, making them efficient for short-distance travel. They serve well in settings where high passenger volumes are present, pointing to their future role in urban transportation. While they may not dominate the market like cars, their utility in specific contexts can support an effective deployment of robotaxi services, contributing to integrated transport solutions where convenience in group travel can be maximized.

Insights On Key Level of Autonomy

Level 5

The Global Robotaxi Market is expected to be dominated by Level 5 autonomy vehicles. This level signifies full automation, allowing vehicles to operate without any human intervention, which aligns with consumer demand for safety, convenience, and efficiency. As technology continues to advance, the development and deployment of fully autonomous vehicles will likely become commercially viable, capturing the interest and investment from manufacturers and consumers alike. The shift towards Level 5 is fueled by major players in the auto industry and tech companies, all of whom are racing to achieve this technological milestone. The potential for an entirely driverless experience is very appealing, leading to its expected dominance in the market.

Level 4

Level 4 autonomy vehicles are designed to operate without human intervention in specific environments, such as urban areas or dedicated pathways. While they are advanced compared to lower levels of autonomy, they still require conditions that enable their functionality. This is pivotal in the transitional phase towards fully autonomous systems, as it allows for testing and real-world application while providing increased safety and efficiency compared to human-driven vehicles. However, the market for Level 4 is expected to be constrained by its limitations in various environments, reducing its potential share compared to Level 5.

Insights On Key Propulsion Type

Electric Cell

Electric cell technology is expected to dominate the Global Robotaxi Market due to its efficiency, scalability, and environmental benefits. As cities worldwide push towards reducing greenhouse gas emissions, electric vehicles are becoming a key part of that transition. Major automotive manufacturers are investing heavily in research and development to enhance battery life and performance, making electric cells a preferable choice for robotaxis. Additionally, the infrastructure for electric charging points is expanding rapidly, which further supports the adoption of electric cell-powered vehicles. This combination of technological advancement, governmental support for EVs, and growing consumer acceptance positions electric cell technology as the leading propulsion type in the robotaxi sector.

Fuel Cell

Fuel cell technology is another important player in the transportation landscape, particularly for applications requiring long-range travel and quick refueling times. Fuel cells convert hydrogen into electricity through a chemical reaction, producing water as the only byproduct. This zero-emission characteristic makes them an attractive alternative for robotaxis in urban environments. However, the current limitations in hydrogen infrastructure and storage hydrant availability hinder widespread adoption compared to electric cells. Nevertheless, advancements are being made to improve efficiencies and develop the necessary refueling network, which could potentially increase the role of fuel cells in the robotaxi market.

Car Rental

The car rental model for robotaxis offers flexibility and a variety of options for consumers who may not want to invest in full ownership of a vehicle. By leveraging existing rental infrastructures, businesses can deploy robotaxis in high-demand areas while managing costs effectively. This model allows for an immediate response to market needs, especially during peak hours or special events. However, challenges include maintaining vehicle availability and condition, as well as integrating technology seamlessly with existing car rental systems. Although it shines in specific scenarios, its overall impact in the broader robotaxi market remains constrained.

Station Based

In the station-based model, robotaxis operate from designated hubs or stations where passengers can easily access vehicles. This approach may provide better control over fleets and facilitate organized pickup and drop-off processes. Furthermore, having a central station can enable coordinated maintenance and charging, ensuring vehicles are ready for deployment. However, the model's reliance on physical locations can limit operational flexibility and scalability in fast-moving urban environments. Station-based systems could be suitable in specific contexts, but they may not reach the level of efficiency and adaptability offered by electric cell vehicles in the evolving robotaxi landscape.

Insights On Key Component type

Lidar

Lidar is expected to dominate the Global Robotaxi Market due to its advanced capabilities in providing accurate distance measurements and detailed environmental mapping. It utilizes laser beams to generate 3D maps of the surrounding environment, which is crucial for safe navigation and obstacle detection. As robotaxis aim to achieve autonomous driving levels, the precision that lidar offers becomes essential for ensuring safety and efficiency. Moreover, with advancements in lidar technology leading to reduced costs and improved performance, its adoption rate is projected to accelerate, further solidifying its leading position in the market.

Camera

Cameras play a significant role in the functioning of robotaxis but serve a different purpose compared to lidar. They are mainly used for object recognition, traffic sign detection, and lane-keeping assistance. By capturing high-definition images and processing them through advanced computer vision algorithms, cameras can contribute crucial data for autonomous driving systems. However, their reliance on visible light can be a limitation under poor lighting conditions, making them less robust than lidar for comprehensive environment mapping.

Radar

Radar technology is primarily utilized for detecting the speed and distance of objects nearby. It operates effectively in varying weather conditions, including rain and fog, providing reliable data for collision avoidance systems in robotaxis. While radar offers valuable information for object tracking and can complement other sensor technologies in creating a multi-layered perception system, it lacks the detail required for precise environmental mapping and obstacle recognition, which limits its stand-alone effectiveness in fully autonomous scenarios.

Ultrasonic Sensors

Ultrasonic sensors are excellent for close-range object detection, such as parking assistance and low-speed maneuvers. By emitting ultrasonic waves and measuring the time taken for the echoes to return, these sensors can provide accurate distance measurements to nearby objects. However, their limited range and lower accuracy compared to lidar and cameras make them more suited for specific applications rather than serving as primary sensors in the robotaxi architecture. Thus, they are usually integrated into the overall sensing system but do not play a dominant role.

Insights On Key Application type

Goods transportation

Goods transportation is expected to dominate the market since it is an important application area within the robotaxi market, characterized by the need for efficient logistics and last-mile delivery solutions. As e-commerce continues to expand, the demand for autonomous delivery vehicles has grown remarkably. Companies are exploring autonomous options to reduce transportation costs and improve delivery speed. However, while this receives interest, it faces regulatory challenges and infrastructural limitations, which can hinder rapid adoption. Overall, goods transportation remains relevant but is not expected to be the leading application type in the robotaxi market.

Passenger transportation

In the context of the robotaxi market, passenger transportation has emerged as a focal point driven by consumer preferences. The proliferation of ride-hailing apps and the quest for seamless, on-demand travel options have generated significant interest in this. Companies are investing heavily in autonomous vehicle technology to enhance ride safety and comfort. The focus on passenger-centric features, such as user interfaces and on-the-go connectivity, also contributes to the favorable outlook for this application type. Despite its challenges, passenger transportation is poised for sustained growth due to its alignment with urban mobility trends and consumer needs.

Global Robotaxi Market Regional Insights:

North America

North America is expected to dominate the Global Robotaxi Market due to its rapid advancements in technology, robust investment in autonomous vehicle research, and favorable regulatory environment. The region, particularly the United States, boasts an established automotive industry and significant partnerships between tech giants and automotive manufacturers. Furthermore, cities like San Francisco and Los Angeles are pioneering real-world trials of robotaxi services, allowing for quick adaptation and consumer familiarity. The high level of urbanization and customer acceptance of shared mobility services in North America also significantly drive the growth of the robotaxi market, making it the most promising region for this innovative transportation solution.

Latin America

Latin America, while still developing its robotaxi infrastructure, exhibits potential due to growing urbanization and an increasing demand for mobility solutions. However, various challenges like economic instability and variable regulatory frameworks may impede rapid growth. Countries like Brazil and Mexico are showing interest in smart transportation initiatives, but significant investment and technological advancements are needed to establish a competitive robotaxi market. The region is currently at a nascent stage and is likely to follow the lead of more advanced regions like North America and Europe.

Asia Pacific

Asia Pacific holds a substantial share of the robotaxi market thanks to the presence of tech-savvy consumers and a supportive environment for innovation. Countries such as China and Japan are making strides with autonomous vehicle technology and have governments backing such initiatives. However, the region faces challenges with infrastructure, regulation, and public acceptance. While competition among local companies is also intense, the potential for rapid growth owing to urbanization and a relatively high population density indicates that Asia Pacific can play a significant role in the evolution of robotaxi services.

Europe

Europe is poised to be a significant player in the robotaxi market, driven by regulatory support for sustainable transportation and technological innovation. Countries such as Germany and the United Kingdom are advancing their autonomous vehicle programs and testing frameworks. However, varying regulatory standards across different countries can create complexities for uniform growth in the robotaxi sector. The market stands to benefit from partnerships between automotive giants and tech firms, yet the pace may not match that of North America due to regulatory hurdles and consumer acceptance challenges.

Middle East & Africa

The Middle East & Africa region is currently lagging behind in the robotaxi market but shows promise due to increasing urbanization and infrastructure development. Certain countries, particularly in the Middle East, are experimenting with autonomous transport solutions backed by government initiatives. The potential for robotaxis exists, yet the market faces challenges like high initial investments, varying levels of technological infrastructure, and regulatory uncertainties. As the region continues to grow economically, advancements in the robotaxi industry may follow, but significant hurdles still need to be overcome before it can compete with more established markets.

Robotaxi Market Competitive Landscape:

Prominent stakeholders in the worldwide robotaxi sector, including tech innovators, car manufacturers, and ride-hailing services, work together to advance autonomous vehicle technology, elevate safety protocols, and broaden service availability. Their collaborative efforts and financial commitments play a vital role in influencing regulatory policies and fostering greater acceptance of robotaxi offerings among consumers.

The principal participants in the Robotaxi industry consist of Waymo, Cruise (a division of General Motors), Aurora Innovation, Argo AI (previously associated with Ford and Volkswagen), Baidu, Zoox (owned by Amazon), Mobileye (a subsidiary of Intel), Nissan, Aptiv, Pony.ai, DiDi Chuxing, Tesla, Lyft, Yandex, and Motional (a collaborative venture between Aptiv and Lyft).

Global Robotaxi Market COVID-19 Impact and Market Status:

The Covid-19 pandemic significantly expedited the evolution and acceptance of robotaxi services, driven by a ened desire for contactless transportation options, which underscored the necessity for automation in city transportation systems.

The COVID-19 pandemic had a profound effect on the robotaxi industry, affecting technological progress and altering consumer attitudes. At the onset, the sector experienced setbacks in trials and rollouts due to lockdown measures and health-related apprehensions, which hindered the pace of development. Conversely, the pandemic sparked a surge in interest for contactless transportation alternatives, increasing the demand for self-driving vehicles. With a decrease in public transport use driven by safety worries, consumers became more receptive to different mobility options. Furthermore, investments in autonomous technologies persisted as businesses acknowledged the necessity for innovation in transportation solutions. As recovery from the pandemic continues, there is a renewed emphasis on implementing safety protocols to bolster public confidence in robotaxi services. In response to ened priorities on health and sanitation, companies are evolving their offerings to align with changing consumer expectations. While the pandemic initially posed challenges, its long-term repercussions may ultimately stimulate growth in the robotaxi sector as society embraces new modes of transportation.

Latest Trends and Innovation in The Global Robotaxi Market :

- In December 2022, Waymo expanded its operations by launching robotaxi services in San Francisco, enhancing its network in urban areas and offering fare-based rides to customers after previously providing free rides during testing phases.

- In August 2023, Cruise announced it had secured additional funding from Microsoft as part of a strategic partnership, aimed at accelerating the development of its autonomous driving technology and expanding its robotaxi fleet.

- In September 2023, Tesla revealed its Full Self-Driving (FSD) version 11.3, significantly improving the capabilities of its Autopilot system, which is a crucial step towards rolling out fully autonomous robotaxis.

- In July 2023, Zoox, owned by Amazon, unveiled its fully autonomous vehicle designed specifically for ridesharing, featuring a bi-directional design and no driver's seat, which aims to redefine urban mobility.

- In November 2022, Aurora Innovation acquired the robotaxi division of the self-driving startup, Uber ATG, consolidating its position in the autonomous vehicle market and paving the way for the launch of its robotaxi service.

- In March 2023, Baidu launched its fully autonomous robotaxi service, Apollo Go, in Beijing, marking a significant growth in the availability of self-driving taxis in China and covering an extensive service area.

- In October 2022, Motional, a joint venture between Hyundai and Aptiv, commenced its fully driverless robotaxi service in Las Vegas, enhancing its position in the North American market with plans for further expansions.

- In January 2023, Nvidia and Aurora announced a partnership to integrate Nvidia's AI technology into Aurora's robotaxi platform, bolstering its autonomous driving capabilities and improving safety and efficiency.

Robotaxi Market Growth Factors:

The Robotaxi market is being propelled by several key elements, including progress in autonomous vehicle technology, growing public acceptance of ride-sharing options, and favorable regulatory environments.

The Robotaxi sector is witnessing substantial expansion fueled by several pivotal elements. Primarily, improvements in artificial intelligence and machine learning are significantly enhancing the operational efficiency and safety of self-driving vehicles. Additionally, a rising preference for convenient, on-demand transport options is encouraging urban dwellers to explore shared mobility choices, with Robotaxis providing an economical substitute to conventional taxi services. Furthermore, government efforts and financial resources directed towards smart city developments are facilitating the inclusion of autonomous vehicles within urban transportation networks. Additionally, a growing awareness of environmental issues is prompting consumers to search for eco-friendly ride-hailing solutions, which Robotaxis can offer, especially in conjunction with electric vehicle technology that minimizes emissions. Technological advancements in sensors and mapping systems are also bolstering the navigation and safety of autonomous vehicles, thereby enhancing public trust. Lastly, collaborations between technology firms and automotive producers are expediting the rollout and advancement of Robotaxi services, further aiding market growth. Together, these elements are setting the stage for significant growth in the Robotaxi market in the years ahead, in line with global movements toward increased automation and sustainable transport solutions.

Robotaxi Market Restaining Factors:

The primary obstacles hindering the Robotaxi industry encompass regulatory complexities, apprehensions surrounding safety, and elevated operational expenses.

The Robotaxi industry encounters various limiting factors that may hinder its growth potential. One of the main challenges is the ongoing regulatory issues, as numerous governments are still in the process of formulating comprehensive laws that balance public safety with the encouragement of innovation. Furthermore, public perception and trust in self-driving vehicles pose considerable obstacles; incidents involving autonomous technology have intensified doubts among prospective passengers. The significant financial investment required for the development and deployment of sophisticated sensor technologies and artificial intelligence can also discourage funding, consequently slowing innovation in the field. Additionally, the intricate technical requirements needed to navigate urban settings complicate widespread adoption. Concerns regarding cybersecurity and the risk of hacking can further contribute to user anxiety. Moreover, the necessary infrastructure to facilitate Robotaxi services, including specialized lanes and charging facilities, is still in early development phases in various regions. Despite these challenges, continuous technological progress, ongoing investments from major automotive companies, and an increasing emphasis on sustainability are poised to help the Robotaxi market surmount these barriers, ultimately transforming urban mobility.

Key Segments of the Robotaxi Market

By Vehicle Type:

Cars

Shuttle/Van

By Level of Autonomy:

- Level 4,

- Level 5

By Propulsion Type:

- Electric cell

- Fuel cell

- Car rental

- Station based

By Component Type:

- Camera

- Lidar

- Radar

- Ultrasonic Sensors

By Application Type:

- Goods transportation

- Passenger transportation

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America