Market Analysis and Insights:

The market for Robot Software was estimated to be worth USD 9.5 billion in 2023, and from 2023 to 2033, it is anticipated to grow at a CAGR of 26.4%, with an expected value of USD 69 billion in 2033.

.jpg)

The Robot Software Market is fundamentally shaped by several crucial elements, notably the progress in artificial intelligence (AI) and machine learning, which significantly boost the capabilities and efficiency of robots. There is a growing need for automation in diverse sectors, including manufacturing, logistics, healthcare, and retail, which propels market expansion as organizations aim to enhance productivity and lower operational expenses. Additionally, the convergence of the Internet of Things (IoT) allows for more intelligent robotic systems that can interact and cooperate seamlessly in various industrial settings. Continuous investments in research and development pave the way for innovative software solutions that improve both robot functionality and user experience. The emergence of service robots and autonomous systems in both individual and commercial contexts is also a critical factor, as companies acknowledge the ability of robots to mitigate labor shortages and enhance service delivery. Collectively, these aspects create a vibrant environment for growth and transformation within the Robot Software Market.

Robot Software Market Scope :

| Metrics | Details |

| Base Year | 2024 |

| Historic Data | 2020-2023 |

| Forecast Period | 2023-2033 |

| Study Period | 2022-2033 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2033 | USD 69 billion |

| Growth Rate | CAGR of 26.4% during 2023-2033 |

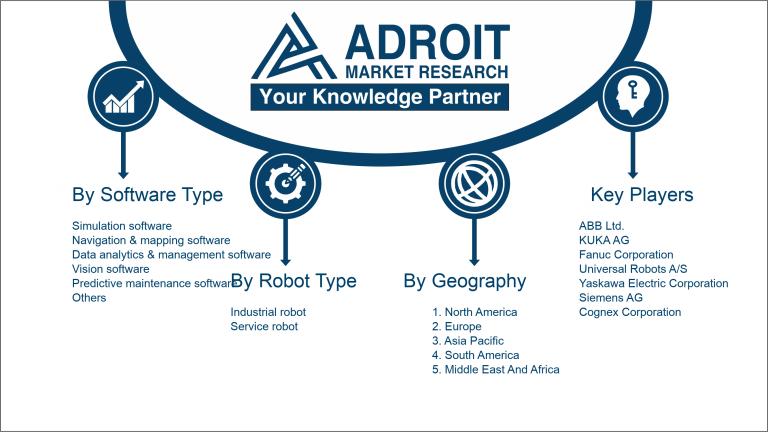

| Segment Covered | By Software Type, By Robot Type, By Deployment Mode, By Enterprise Size, By End-use Industry, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | ABB Ltd., KUKA AG, Fanuc Corporation, Universal Robots A/S, Yaskawa Electric Corporation, Siemens AG, Cognex Corporation, Blue Prism Group plc, Automation Anywhere, UiPath, NVIDIA Corporation, Teradyne Inc., Google LLC, Amazon Robotics, and Microsoft Corporation. |

Market Definition

Robot software encompasses the tailored programs and algorithms that empower robots to execute functions either independently or with some degree of human oversight. This software amalgamates diverse elements, including sensory processing, decision-making capabilities, and control mechanisms, to enable effective engagement with their surroundings.

Robot software plays a pivotal role as the cognitive framework behind robotic systems, empowering automation across numerous sectors. By incorporating sophisticated algorithms and machine learning features, this software allows for various functions, including perception, decision-making, and control, thus enabling robots to work efficiently and adjust to ever-changing surroundings. Its significance is evident in boosting productivity, lowering operational expenses, and improving safety in dangerous settings. With more industries embracing robotic technologies in areas like manufacturing, logistics, and healthcare, the function of robot software is essential for the effective and innovative performance of these systems, leading to a transformative impact on business operations and their relationship with technology.

Key Market Segmentation:

Insights On Key Software Type

Data analytics & management software

Data analytics & management software is expected to dominate the Global Robot Software Market due to its critical role in optimizing robotic operations and enhancing decision-making processes. As industries increasingly adopt automation, the need for analytical insights derived from massive datasets generated by robots becomes paramount. This software helps in understanding real-time performance, predicting failures, and improving overall system efficiencies. Moreover, with the rise of artificial intelligence and machine learning technologies, data analytics tools are vital for learning from past activities, adapting to new environments, and facilitating smarter robotic behaviors. Consequently, this is poised to show substantial growth and market leadership.

Simulation software

Simulation software serves an essential function by allowing engineers and developers to test and validate robotic systems in virtual environments before deployment. This capability minimizes risks and reduces costs associated with physical prototyping. The increasing complexity of robotic applications requires sophisticated modeling techniques, driving demand for simulation software in various industries, from manufacturing to healthcare. Its ability to simulate diverse environmental conditions enables organizations to ensure that their robotic systems are capable of operating effectively and safely, propelling its continued relevance and growth in the market.

Navigation & mapping software

Navigation & mapping software plays a fundamental role in enhancing the autonomy of robots, especially in sectors such as logistics and delivery. By enabling robots to perceive their surroundings and navigate through complex environments, this software is vital for operational efficiency. As industries migrate towards autonomous solutions, the demand for advanced navigation tools that offer real-time mapping and obstacle avoidance is expected to grow. This aspect makes navigation & mapping software a critical component in the evolution of robotic systems, although it may not currently lead the market.

Vision software

Vision software is increasingly important for robotic functionality, as it allows machines to interpret visual data and make informed decisions. This technology supports applications in manufacturing, security, and healthcare, where visual recognition and analysis enhance operational capabilities. The growing integration of machine vision in automated inspections and quality control processes signifies its rising importance. Although it supports many advanced robotic applications by providing real-time analysis and monitoring, its share in the overall market does not compare to that of data analytics software, which offers broader applications.

Predictive maintenance software

Predictive maintenance software is critical for prolonging the lifespan of robotic systems and optimizing their performance. By utilizing data from sensors and historical operational metrics, this software can forecast maintenance needs, preventing unexpected downtimes and enhancing efficiency. Industries seeking to minimize operational costs while maximizing productivity find great value in implementing predictive maintenance solutions. While essential, the current emphasis placed on analytics capabilities in transforming operational data into actionable insights allows other types of software, particularly data analytics and management software, to take precedence in market growth.

Others

The Others category encompasses various niche software solutions that contribute to specific robotic functionalities, such as safety monitoring, human-robot interaction interfaces, and specialized control systems. Although these applications play significant roles in targeted areas, they lack the broader applicability and impact seen in dominant categories like data analytics and management software. As technological trends evolve, these specialized solutions may gain more recognition, but currently, they remain overshadowed by more prominent software types driving the robotic software market's overall growth.

Insights On Key Robot Type

Service Robot

The service robot category is expected to dominate the Global Robot Software Market due to its rapid integration into various sectors, including healthcare, hospitality, and logistics. The growing demand for automation in daily operations, coupled with advancements in artificial intelligence and machine learning, has greatly increased the capabilities and functionalities of service robots. As businesses increasingly recognize the value of enhancing customer experiences and operational efficiency through automated solutions, the investment in service robot software is surging. This traction is further propelled by societal shifts towards tech-driven support systems, reflecting changing consumer behavior and ened expectations for service delivery.

Industrial Robot

The industrial robot remains a significant player in the Global Robot Software Market, primarily driven by their extensive application across manufacturing industries. With factories increasingly adopting automation technologies to boost productivity and reduce operational costs, the demand for software that enhances the functionality of industrial robots continues to grow. These robots typically require specialized software to perform tasks such as assembly, welding, and material handling, necessitating ongoing development and innovation. Moreover, the importance of flexibility in manufacturing processes and the rise of Industry 4.0 contribute to the sustained relevance of industrial robots, even as the service robot expands.

Insights On Key Deployment Mode

Cloud-based

The Cloud-based deployment mode is anticipated to dominate the Global Robot Software Market due to its scalability, flexibility, and cost-effectiveness. As industries continue to embrace automation and seek ways to enhance operational efficiencies, cloud solutions offer easy access to robotic software without the need for heavy infrastructure investments. Additionally, cloud-based systems enable real-time updates, improved collaboration, and seamless integration with various IoT devices, making it the preferred choice for businesses looking to stay competitive in today’s fast-paced environment. Furthermore, the ongoing shift towards remote monitoring and management in industrial automation further supports the growth of Cloud-based robot software solutions.

On-premises

Despite the growing popularity of cloud solutions, the On-premises deployment method still holds significant appeal for certain organizations, particularly those in regulated industries. Companies that handle sensitive data or require strict control over their IT infrastructure tend to favor on-premises systems. This method allows for comprehensive data security and compliance with industry regulations, which is critical in sectors like healthcare and finance. Additionally, businesses with existing investments in local infrastructure may also see on-premises solutions as a way to leverage their current assets while maintaining control over their robotic systems.

Insights On Key Enterprise Size

Small & Medium Enterprises (SME)

Small and medium-sized enterprises (SMEs) are projected to lead the global robot software market, driven by their growing use of automation to boost efficiency and reduce costs. Unlike larger companies, SMEs are typically more flexible and open to innovation, making it easier for them to adopt advanced robotic solutions that fit their unique requirements, such as improving inventory management, customer service, and production workflows, without the high expenses often associated with bigger firms. Additionally, government incentives and funding aimed at SMEs promote investment in new technologies, facilitating their adoption of robot software and reinforcing their leadership in the market.

Large Enterprises

Large enterprises are characterized by significant resources and established infrastructure, allowing them to invest heavily in advanced robot software solutions. However, the decision-making process can be lengthy due to internal protocols and the complexity of operations. While they often have the budget to integrate cutting-edge technologies, the slower pace of implementation results in a reduced share of the market compared to SMEs. Large companies may focus more on existing systems rather than rapidly adopting new innovations, leading to a potential lag in capturing new market dynamics and trends.

Insights On Key End-use Industry

Manufacturing

Manufacturing is expected to dominate the Global Robot Software Market as a result of extensive automation implementation. The industry is increasingly using robotics to increase production efficiency, lower operational costs, and improve product quality. With the rise of Industry 4.0, businesses are incorporating IoT and AI capabilities into their manufacturing processes, necessitating advanced robotics software solutions. These solutions enable real-time monitoring, predictive maintenance, and seamless machine communication, all of which help to streamline manufacturing operations. Furthermore, the ongoing trend towards customised products necessitates the use of robotics to meet diverse consumer demands, which will help this sector grow in the software market.

Automotive

The automotive industry is witnessing a surge in automation with a focus on improving production line efficiency and enhancing vehicle safety. Robotics play a critical role in assembling, painting, and testing vehicles, making this sector a significant consumer of robot software. As electric and autonomous vehicles gain traction, the demand for sophisticated software to manage complex robotic systems will continue to rise. Furthermore, competitive pressures to innovate and adapt to consumer preferences further propel robotics integration in automotive manufacturing.

Healthcare

In healthcare, robotics is revolutionizing how medical procedures are performed. Surgical robots enhance precision and reduce recovery times, contributing to better patient outcomes. Software for robotics in healthcare is also critical for managing complex tasks such as robotic-assisted surgeries, patient monitoring, and logistics automation in hospitals. The growing need for efficient healthcare delivery, particularly highlighted during the pandemic, is driving investments in robotic technologies and their associated software.

Transportation & Logistics

The transportation and logistics sector is increasingly adopting robotics to streamline operations and enhance supply chain efficiency. Automated guided vehicles (AGVs) and drones are transforming how goods are moved and delivered. The reliance on software for route optimization, inventory management, and real-time tracking is crucial to maximizing efficiency in this industry. As e-commerce continues to expand, companies are looking to robotics technology to meet increasing delivery demands and improve warehouse operations.

BFSI

In the Banking, Financial Services, and Insurance (BFSI) sector, robotic process automation (RPA) is being employed to automate repetitive tasks such as data entry and transaction processing. While not as prominent as other areas, the need for efficiency and compliance in financial operations is driving the adoption of robotic software solutions. As financial institutions look to improve customer service through chatbots and automated help systems, the integration of robotics is expected to grow in importance.

Retail & E-commerce

The retail and e-commerce industries are leveraging robotics to enhance customer service and improve inventory management. Automated checkout systems and robots for restocking shelves are increasingly prevalent in brick-and-mortar stores. In e-commerce, fulfillment centers use robotic software to streamline order processing and reduce delivery times. The growing emphasis on efficiency and enhanced shopping experiences is making robotics a key component of retail operations, leading to increased software demand.

Others

The Others category encompasses a diverse range of industries and applications, from agriculture to entertainment. Robotics technology is becoming increasingly valuable in different arenas, adapting to specific needs such as crop management in agriculture or automated content creation in media. While not as dominant as the aforementioned sectors, these applications still contribute to the global robot software market's growth by introducing niche solutions that cater to unique industry challenges. The continuous advancement in technology allows these varied industries to explore robotics for optimization and innovation.

Insights on Regional Analysis:

Asia Pacific

Asia Pacific is expected to dominate the Global Robot Software market due to several compelling factors. Firstly, this region has been at the forefront of technological advancements, particularly in automation and robotics, driven by countries such as Japan, China, and South Korea. These nations have a strong industrial base and are aggressively investing in research and development within the robotics sector. Additionally, the growing demand for automation across various industries, including manufacturing and logistics, is propelling the adoption of robot software solutions. The increasing focus on AI integration and smart manufacturing initiatives in this region further underscores its leading position in the global market.

North America

North America is a significant player in the Global Robot Software market, characterized by a robust technology ecosystem. The region boasts a plethora of key companies and startups that focus heavily on innovation in robotics. The United States, in particular, leads in the development of advanced robotics technologies, with a strong emphasis on applications in industries such as healthcare, defense, and manufacturing. The increasing investment in smart home technologies and autonomous vehicles further supports growth in this , making North America a vital region in the global landscape.

Europe

Europe has established itself as a prominent region in the Global Robot Software market, with a strong commitment to automation and regulatory support that encourages innovation. Countries like Germany and Sweden are leading the charge, particularly in industrial robotics and the integration of robot software in manufacturing processes. The European Union's focus on Industry 4.0 initiatives, alongside a sustainability agenda, has stimulated demand for efficient robotic solutions. Furthermore, collaboration between academia and industry in this region fosters research that enhances robot software capabilities.

Latin America

Latin America, while not as dominant as Asia Pacific or North America, is witnessing gradual growth in the Global Robot Software market. Economic development and the push for automation in industries such as agriculture and mining are catalyzing interest in robotic solutions. However, challenges such as economic instability and varying levels of technological adoption across countries complicate the market landscape. Despite these hurdles, there is a budding interest in leveraging automated solutions to increase productivity, suggesting potential for future growth in this region.

Middle East & Africa

The Middle East & Africa region is currently at an emerging stage in the Global Robot Software market. Investment in robotics is relatively low compared to other regions, and the market is characterized by a nascent industrial base. However, countries in the Gulf Cooperation Council (GCC), such as the UAE and Saudi Arabia, are increasingly embracing technological advancements as part of their diversification strategies away from oil dependency. While challenges remain in terms of infrastructure and investment, the region’s focus on innovation presents opportunities for the growth of robot software solutions in the coming years.

Company Profiles:

Prominent contributors to the Global Robot Software sector, encompassing developers of operating systems, programming frameworks, and application software, are pivotal in fostering innovation and competitive edge. Their efforts facilitate advanced automation, boost operational efficiency, and promote integration across multiple industries, ultimately influencing the evolution of robotics technology.

Prominent participants in the Robot Software Market encompass companies such as ABB Ltd., KUKA AG, Fanuc Corporation, Universal Robots A/S, Yaskawa Electric Corporation, Siemens AG, Cognex Corporation, Blue Prism Group plc, Automation Anywhere, UiPath, NVIDIA Corporation, Teradyne Inc., Google LLC, Amazon Robotics, and Microsoft Corporation. Moreover, other noteworthy contributors to the market include Mitsubishi Electric Corporation, Rockwell Automation, iRobot Corporation, Boston Dynamics, and Rethink Robotics.

COVID-19 Impact and Market Status:

The Covid-19 pandemic significantly increased the demand for automation and robotics software, as businesses aimed to improve operational efficiency and lessen their dependence on human labor in response to disruptions in the workforce.

The COVID-19 pandemic has had a profound impact on the market for robotic software, rapidly increasing the demand for automation in numerous industries. In the face of labor shortages and disruptions in supply chains, organizations increasingly turned to robotic solutions to maintain operational efficiency and continuity. The healthcare industry experienced a particularly notable rise in the use of robotic technologies for applications in telemedicine, sanitation, and logistics, driving significant advancements in the capabilities of robotic software. Moreover, the pandemic accelerated investment in remote monitoring and control technologies, further propelling the evolution of AI-enhanced robotic systems. Nonetheless, challenges such as delays in supply chains and rising operational costs presented short-term hurdles. Together, these dynamics have initiated a period of transformation in the market, encouraging innovation and influencing future trends toward more advanced and adaptable robotic systems across a variety of sectors.

Latest Trends and Innovation:

- In March 2023, Amazon announced the acquisition of iRobot, the company behind the Roomba vacuum, for approximately $1.7 billion, expanding Amazon's capabilities in home robotics and smart home technology.

- In January 2023, UiPath introduced its latest automation software release, enhancing its platform with new machine learning capabilities that allow for more intelligent automation processes aimed at enterprise customers.

- In April 2023, ABB launched its new collaborative robot, the YuMi, with advanced software features that facilitate easier integration into various manufacturing environments, enabling users to reduce downtime and improve productivity.

- In August 2023, Blue Prism launched a series of integrations with Microsoft Azure to enhance its robotic process automation (RPA) offerings, allowing businesses to leverage Azure's cloud capabilities for more scalable automation solutions.

- In June 2023, Boston Dynamics unveiled a new software update for its Spot robot, introducing improved navigation and mapping features which enhance its operational flexibility in complex environments, particularly for industrial applications.

- In September 2023, NVIDIA partnered with Omron to create AI-driven solutions for robotic automation in manufacturing, leveraging NVIDIA's deep learning technology to improve the capabilities of Omron's autonomous mobile robots.

- In May 2023, SoftBank Robotics revealed advancements in its Pepper platform, incorporating more natural human-robot interaction features powered by advanced AI algorithms, aimed at enhancing customer engagement in retail environments.

- In February 2023, Siemens announced the integration of its robotic software with Siemens Xcelerator, a digital enterprise suite designed to optimize product lifecycle management through advanced automation technologies.

- In July 2023, Cognex Corporation expanded its vision software capabilities, enhancing the functionality of its machine vision systems for robotics applications aimed at improving accuracy and efficiency in industrial automation.

Significant Growth Factors:

The market for robotic software is witnessing expansion, spurred by progress in artificial intelligence, a surge in automation within various sectors, and a growing need for streamlined operational solutions.

The robot software industry is witnessing robust expansion, fueled by various influential elements. To begin with, the progress in artificial intelligence and machine learning is significantly enhancing the functionality and performance of robotic systems, which encourages their broader implementation across different fields. The escalating need for automation, particularly in manufacturing and logistics sectors such as automotive and e-commerce, is a major driver as companies aim to boost efficiency and lower labor expenses. Furthermore, the proliferation of the Internet of Things (IoT) is enabling a greater degree of connectivity in robotic applications, which allows for real-time data processing and enhanced operational effectiveness.

The healthcare industry plays a pivotal role as well, utilizing robotic software for surgical procedures, patient support, and rehabilitation, thereby broadening the market’s scope. Additionally, growing investments in research and innovation, along with governmental efforts to promote automation and robotics, are further advancing market dynamics. The emphasis on smart manufacturing and the Fourth Industrial Revolution (Industry 4.0) is also catalyzing the integration of robotic technologies to refine production methodologies. Taken together, these dynamics are crafting a promising environment for the robot software market, setting the stage for ongoing growth in the upcoming years.

Restraining Factors:

Significant challenges in the Robot Software Market consist of elevated development expenses, inadequate interoperability, and regulatory barriers that hinder broad acceptance.

The Robot Software Market encounters numerous factors that may impede its growth potential. Foremost among these is the substantial initial capital investment needed for the implementation of advanced robotic software, which can discourage small and medium-sized enterprises from participating in the market. Moreover, the intricate process of integrating robotic software with pre-existing systems presents obstacles and often necessitates specialized expertise that might be scarce. Furthermore, apprehensions surrounding cybersecurity act as a barrier to widespread adoption, as companies remain cautious about the risks linked to incorporating robotic systems within their networks. Regulatory challenges and compliance protocols can also delay implementation, especially in sectors like healthcare and manufacturing, where safety standards are critical. Additionally, the rapid evolution of technology can swiftly make current solutions outdated, causing reluctance among potential investors. Nevertheless, the market stands at a pivotal moment, propelled by ongoing innovations and a growing acceptance of automation across diverse industries. As businesses begin to appreciate the long-standing advantages of robotic solutions in improving efficiency and lowering operational expenses, the market is set for significant expansion, presenting chances to surmount existing challenges and forge a future in which robotic software is integral to operational strategies.

Key Segments of the Robot Software Market

By Software Type

• Simulation software

• Navigation & mapping software

• Data analytics & management software

• Vision software

• Predictive maintenance software

• Others

By Robot Type

• Industrial robot

• Service robot

By Deployment Mode

• On-premises

• Cloud-based

By Enterprise Size

• Large enterprise

• Small & Medium Enterprises (SME)

By End-use Industry

• Manufacturing

• Automotive

• Healthcare

• Transportation & logistics

• BFSI

• Retail & e-commerce

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America