Market Analysis and Insights:

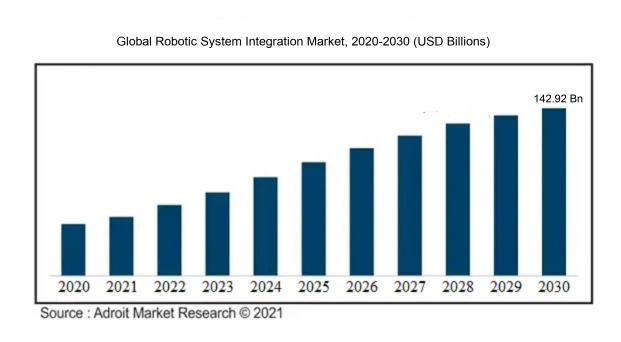

The market for Global Robotic System Integration was estimated to be worth USD 73.82 billion in 2023, and from 2024 to 2030, it is anticipated to grow at a CAGR of 9.57%, with an expected value of USD 142.92 billion in 2030.

The driving forces behind the Robotic System Integration sector lie in the swift technological advancements, a rise in automation needs across diverse industries, and a push for efficient and cost-effective solutions. Integrating robotic systems empowers businesses to boost operational efficiency, elevate productivity, and curtail labor expenses. Furthermore, the incorporation of Industrial Internet of Things (IIoT) and artificial intelligence (AI) into robotics systems integration is actively contributing to market expansion. The surge in collaborative robots, or cobots, is also playing a pivotal role in pushing the demand for robotic system integration as these robots are designed to work alongside humans, thereby enhancing safety and adaptability in industrial settings. Additionally, the flourishing e-commerce landscape, especially within the logistics and warehousing realm, is generating substantial opportunities for robotic system integration. The escalating emphasis on precision and quality control, particularly in sectors like automotive and electronics manufacturing, is further propelling the need for robotic system integration solutions.

Robotic System Integration Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2018-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | USD 142.92 billion |

| Growth Rate | CAGR of 9.57% during 2024-2030 |

| Segment Covered | By Type, By Application, By Region . |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | ABB Ltd., FANUC Corporation, Yaskawa Electric Corporation, Kuka AG, Kawasaki Heavy Industries Ltd., Mitsubishi Electric Corporation, Toshiba Machine Co. Ltd., Denso Corporation, Nachi-Fujikoshi Corp, and Comau S.p.A. |

Market Definition

The concept of robotic system integration involves the synergistic amalgamation and coordination of diverse robotic elements, encompassing both hardware and software, to establish a sophisticated and proficient robotic system tailored to a particular purpose or operation. This extensive integration process encompasses the intricate tasks of system design, programming, and enhancement to guarantee the smooth and effective interplay and cooperation among the varied robotic components.

Integration of robotic systems holds significant importance for various reasons. Primarily, it enables companies to enhance their manufacturing workflows by automating repetitive tasks and boosting production efficiency. Consequently, this results in decreased operational expenses and quicker product delivery times. Moreover, the incorporation of robotics improves worker safety by taking over hazardous or strenuous tasks, thereby reducing the likelihood of accidents. Additionally, it enhances product quality and uniformity by eliminating human errors and inconsistencies typically associated with manual production processes. Furthermore, robotic systems have the capability to gather and analyze precise real-time data, offering valuable insights for optimizing overall operations. By integrating different robotic technologies seamlessly, companies can advance automation and enhance manufacturing flexibility. In conclusion, the integration of robotic systems provides a wide array of advantages that enhance productivity, safety, quality, and adaptability in the manufacturing sector.

Key Market Segmentation:

Insights On Key Type

Service

The Service type is expected to dominate the Global Robotic System Integration Market. As companies increasingly adopt robotic systems, the demand for professional services such as system integration, installation, maintenance, and support is on the rise. Service providers play a crucial role in ensuring the seamless integration and functionality of robotic systems within various industries. They provide expertise, consultation, and specialized skill sets to address the specific needs and requirements of businesses. With the growing complexity of robotic systems, companies rely heavily on service providers to optimize system performance, enhance efficiency, and maximize return on investment. Therefore, the Service part is expected to dominate the Global Robotic System Integration Market.

Hardware

The Hardware type, although not expected to dominate the Global Robotic System Integration Market, remains a significant component of the industry. Hardware includes physical components such as robotic arms, sensors, controllers, and other mechanical elements required for the integration of robotic systems. While the demand for hardware is directly influenced by the adoption of robotic systems, it is dependent on the availability of software and services for its optimal functioning. As such, the Hardware part complements the dominant Service part by providing the necessary tools and equipment for integrating robotic systems.

Software

Similarly, the Software type, although not expected to dominate the Global Robotic System Integration Market, plays a crucial role in enabling the functionality and coordination of robotic systems. Software encompasses programming, algorithms, and control systems that govern the operations of the robots. It enables tasks such as motion planning, path optimization, and real-time monitoring. While the demand for software is driven by the need for intelligent and autonomous robotic systems, it relies on hardware and services for its effective implementation. The Software part works in conjunction with the dominant Service part to provide integrated and efficient robotic systems to various industries.

Insights On Key Application

Automotive

The Automotive application is expected to dominate the Global Robotic System Integration Market. The automotive industry has been a major adopter of robotic systems for various applications such as welding, material handling, and painting. The increasing demand for automation in this sector, driven by the need for improved productivity, quality, and safety, has led to a significant growth in the use of robotic system integration. Moreover, advancements in robotic technology and the integration of artificial intelligence have further accelerated the adoption of robotic systems in the automotive industry. Therefore, the Automotive part is expected to dominate the Global Robotic System Integration Market.

Electrical and Electronics

The Electrical and Electronics application is a significant component of the Global Robotic System Integration Market. The growing complexity and miniaturization of electronic components have created a need for precise and efficient assembly processes. Robotic system integration provides the required accuracy, speed, and flexibility for handling and assembling electronic components. Additionally, the demand for automation in the electrical and electronics industry is fueled by factors such as cost reduction, streamlined production, and improved quality control. Hence, the Electrical and Electronics part holds a substantial share in the Global Robotic System Integration Market.

Metal Industry

The Metal Industry application plays a vital role in the Global Robotic System Integration Market. Robotic system integration offers numerous advantages in metalworking applications such as welding, material handling, cutting, and polishing. The ability of robots to perform repetitive tasks with high precision and speed makes them well-suited for metalworking processes. Furthermore, robotic systems enhance workplace safety by reducing human involvement in hazardous tasks. The Metal Industry part is expected to continue dominating the Global Robotic System Integration Market due to the increasing adoption of automation in metalworking processes.

Chemical

The Chemical application is a notable constituent of the Global Robotic System Integration Market. Robotic systems find significant applications in the chemical industry, such as material handling, packaging, and quality control. The use of robots enables efficient and accurate handling of hazardous chemicals, reducing risks to human workers. Automation in the chemical sector helps improve productivity, minimize errors, and enhance overall process efficiency. Hence, the Chemical part holds a considerable share in the Global Robotic System Integration Market.

Rubber and Plastic

The Rubber and Plastic application is an integral part of the Global Robotic System Integration Market. Robotic system integration offers advantages in the rubber and plastic industry by enabling precise and efficient handling, assembly, and packaging of products. The demand for automation in this sector is driven by the need for improved productivity, consistency in product quality, and cost reduction. Furthermore, robotic systems enhance workplace safety by reducing human exposure to hazardous materials. Consequently, the Rubber and Plastic part holds a significant share in the Global Robotic System Integration Market.

Food, Beverages, and Pharmaceuticals

The Food, Beverages, and Pharmaceuticals application play a crucial role in the Global Robotic System Integration Market. Robotic systems offer benefits in these industries by improving efficiency, hygiene, and product quality. In the food and beverages sector, robots are used for tasks such as packaging, palletizing, and sorting, enabling faster and more accurate processing. In the pharmaceutical industry, robotic system integration aids in precise dispensing, labeling, and packaging of medications, ensuring compliance with regulatory standards. The increasing focus on automation and stringent quality control measures in these industries contribute to the dominance of the Food, Beverages, and Pharmaceuticals part in the Global Robotic System Integration Market.

Others

While the Automotive application is expected to dominate the Global Robotic System Integration Market, the Others category includes various sectors that also contribute to the overall market. These may include industries such as aerospace, defense, logistics, agriculture, and more. The diverse applications of robotic system integration in these industries offer unique opportunities for automation and enhanced productivity. Although the "Others" part may not have the same level of dominance as the Automotive part, it still constitutes a significant portion of the Global Robotic System Integration Market.

Insights on Regional Analysis:

Asia Pacific

Asia Pacific is expected to dominate the Global Robotic System Integration market. This region has witnessed significant growth in the adoption of robotic systems across various industries, including automotive, electronics, and manufacturing. The robust industrialization and rapid technological advancements in countries like China, Japan, and South Korea have driven the demand for robotic system integration services. Moreover, the increasing focus on automation and efficiency in manufacturing processes, combined with favorable government initiatives, has further boosted the market growth in this region. With a high rate of industrialization and the presence of major market players, Asia Pacific is well-positioned to dominate the Global Robotic System Integration market.

North America

North America is one of the key markets for robotic system integration. The region has a well-established industrial sector, particularly in countries like the United States and Canada. The increasing adoption of automation and advancements in robotics technology are driving the demand for robotic system integration services in this region. Additionally, the presence of major players in the robotics industry and the focus on research and development activities contribute to the market growth. However, while North America remains a significant market for robotic system integration, it is expected to be overshadowed by the Asia Pacific region in terms of dominance in the Global Robotic System Integration market.

Europe

Europe is another important region in the Global Robotic System Integration market. The region has a strong manufacturing base and is home to several leading automotive and industrial equipment manufacturers. The increasing adoption of automation and robotics across various industries, including automotive, electronics, and pharmaceuticals, has fueled the demand for robotic system integration services. Moreover, the presence of favorable government regulations and initiatives, such as Industry 4.0, has further accelerated the market growth in Europe. However, despite its strong position in the market, Europe is expected to be outpaced by the Asia Pacific region in terms of dominance in the Global Robotic System Integration market.

Latin America

Latin America is an emerging market for robotic system integration. The region has witnessed steady growth in industrialization and a rising demand for automation and robotics solutions. Countries like Brazil and Mexico are witnessing increasing investments in the manufacturing sector, which is driving the adoption of robotic system integration services. Moreover, the growing focus on improving productivity and operational efficiency is expected to fuel the market growth in this region. However, Latin America is not expected to dominate the Global Robotic System Integration market and will likely hold a smaller market share compared to regions like Asia Pacific and Europe.

Middle East & Africa

The Middle East & Africa region is also experiencing growth in the adoption of robotic system integration solutions. The region has a diverse industrial landscape, with sectors like oil and gas, automotive, and manufacturing driving the demand for automation and robotics. Moreover, the increasing investments in infrastructure development and the focus on enhancing operational efficiency are expected to boost the market growth in this region. However, despite these positive factors, the Middle East & Africa is not projected to dominate the Global Robotic System Integration market, with Asia Pacific anticipated to hold the dominant position.

Company Profiles:

The primary participants in the international robotic system integration sector play a pivotal role in creating, innovating, and executing holistic robotic solutions tailored to diverse industries, improving operational effectiveness and diminishing workforce expenditures. Furthermore, they deliver comprehensive technical assistance, upkeep, and instructional resources to guarantee peak functionality and client contentment.

Prominent companies in the field of Robotic System Integration encompass ABB Ltd., FANUC Corporation, Yaskawa Electric Corporation, Kuka AG, Kawasaki Heavy Industries Ltd., Mitsubishi Electric Corporation, Toshiba Machine Co. Ltd., Denso Corporation, Nachi-Fujikoshi Corp, and Comau S.p.A. Engaged in the evolution, production, and integration of robotic technologies across diverse sectors, these organizations maintain a robust global footprint and deliver a diverse array of robotic solutions covering industrial robots, collaborative robots, and autonomous mobile robots.

Dedicated to continuous innovation and advancement, these industry leaders strive to improve the efficacy, capabilities, and safety features of their robotic offerings. Furthermore, they actively engage in forging strategic alliances, consolidations, and acquisitions to broaden their market presence and retain a competitive edge within the Robotic System Integration sector.

COVID-19 Impact and Market Status:

The global market for robotic system integration has faced substantial challenges due to the Covid-19 pandemic, with supply chain disruptions and impediments to industry growth.

The global economy has experienced a significant influence from the COVID-19 pandemic, notably impacting the robotic system integration sector. While the future repercussions remain uncertain, there have been varying outcomes for the market. Positively, there has been an increased demand for automation and robotic systems as organizations strive to reduce human interaction and mitigate the risks associated with virus spread. This surge in demand has particularly been noted in sectors such as healthcare, logistics, and manufacturing. Conversely, the pandemic has disrupted supply chains and led to delays in the implementation of robotic systems. Numerous businesses have encountered challenges in acquiring essential components and executing their automation strategies due to restrictions imposed during lockdowns and limitations on travel. Additionally, the economic downturn and financial constraints have restricted investments in robotic system integration for many companies. In essence, the COVID-19 impact on the robotic system integration industry has presented a combination of opportunities and obstacles, with the future outlook contingent on the pandemic's duration and severity.

Latest Trends and Innovation:

- In January 2021, ABB announced the acquisition of ASTI Mobile Robotics Group, a leading global autonomous mobile robot (AMR) manufacturer.

- In March 2021, Universal Robots unveiled its new cobot application builder, offering a user-friendly interface for the seamless integration of robotic systems.

- In May 2021, KUKA Robotics launched the KR IONTEC, a new generation of industrial robots designed for high-speed, flexible automation in various industries.

- In June 2021, FANUC Corporation partnered with Rockwell Automation to collaborate on next-generation industrial automation systems and solutions.

- In July 2021, Yaskawa Electric Corporation acquired The Switch, a Finnish supplier of electric drive train technology and integrated power solutions.

- In September 2021, Mitsubishi Electric Corporation introduced its RV-8CRL industrial robot designed for pick-and-place applications in the electronics manufacturing industry.

- In November 2021, Kawasaki Heavy Industries, Ltd. expanded its portfolio with the launch of its new RS007N and RS007L collaborative robots.

- In December 2021, Omron Corporation developed an integrated solution combining its robotic automation technology with artificial intelligence, enhancing the efficiency of warehouse operations.

Significant Growth Factors:

The expansion of the robotic system integration sector can be linked to various factors, including a rising need for automation, continuous progress in robotics technology, and the necessity for streamlined and economical operations across diverse industries.

The growth of the Robotic System Integration Market in recent years can be attributed to various significant factors. The demand for automation in industries has notably increased, prompting the integration of robotic systems.

Companies are turning to robotics to boost production efficiency, cut labor costs, and enhance product quality. Progress in artificial intelligence and machine learning has empowered robots to execute more intricate tasks, making them smarter and more adaptable, thus promoting their integration across different sectors. The rise of the Internet of Things (IoT) and Industry 4.0 has facilitated seamless communication and data sharing between robots and other systems, resulting in enhanced overall system performance. The availability of flexible and collaborative robotic systems has simplified the adoption of automation solutions, even among small and medium-sized enterprises. With new applications emerging in logistics, healthcare, and agriculture, the market for robotic system integration continues to expand.

Furthermore, increased investments in robotics research and development by both public and private sectors have stimulated innovation and technological progress, attracting more companies to invest in robotic systems. Collectively, these factors, coupled with ongoing technological advancements, are anticipated to propel further growth in the robotic system integration market in the coming years.

Restraining Factors:

A key hindrance to the expansion of the Robotic System Integration Market is the scarcity of advanced technical knowledge required for the effective deployment and supervision of intricate robotic systems.

The market for integrating robotic systems is poised for substantial growth in the future due to the rising trend of automation adoption in various industries.

However, obstacles exist that could hinder market expansion. A significant hurdle is the considerable initial investment needed to incorporate robotic systems into current operations, which may be prohibitive for small and medium-sized enterprises with limited financial capabilities. Furthermore, the intricate nature of integration and the requirement for skilled technicians to operate these systems present challenges for businesses. Some industries, notably those in traditional sectors, may also have limited awareness and acceptance of the advantages of robot integration, potentially slowing market growth. Concerns around job displacement and employee resistance to automation could further dampen demand for robotic system integration. Despite these challenges, the market has immense growth potential. Technological advancements, including collaborative robots and artificial intelligence, are simplifying and streamlining the integration process. As companies increasingly prioritize enhancing productivity, minimizing errors, and boosting operational efficiency, the adoption of robotic systems is on the rise. With industries recognizing the benefits these systems bring, the market is well-positioned for expansion, paving the way for new opportunities and developments in robotic system integration.

Key Segments of the Robotic System Integration Market

Type Overview

• Hardware

• Software

• Services

Application Overview

• Automotive

• Electrical and Electronics

• Metal Industry

• Chemical

• Rubber and Plastic

• Food, Beverages, and Pharmaceuticals

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America