Market Analysis and Insights:

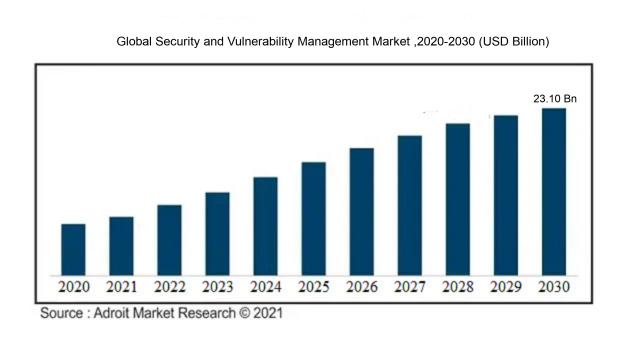

The market for Global Security and Vulnerability Management was estimated to be worth USD 13.94 billion in 2022, and from 2023 to 2030, it is anticipated to grow at a CAGR of 6.73%, with an expected value of USD 23.10 billion in 2030.

The market for Security and Vulnerability Management is influenced by various factors. The escalating volume and sophistication of cyber threats and attacks are driving the need for robust security solutions. As businesses embrace digital transformation, the risks of vulnerabilities and security breaches increase, necessitating comprehensive security measures. Additionally, strict government regulations and industry standards are compelling organizations to allocate resources towards security and vulnerability management solutions to adhere to compliance requirements.

The proliferation of cloud computing, IoT, and BYOD practices is also widening the attack surface, underscoring the importance of proactive vulnerability management across diverse devices and networks. Moreover, the surge in data breaches and incidents of identity theft is ening the focus on enhancing security measures, prompting organizations to invest in advanced security technologies and services. Lastly, the growing demand for real-time threat intelligence and analytics is driving the expansion of the Security and Vulnerability Management market, as businesses aim to swiftly and effectively detect and respond to potential threats.

Security and Vulnerability Management Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2018-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | USD 23.10 billion |

| Growth Rate | CAGR of 6.73% during 2023-2030 |

| Segment Covered | By component, By target, By organization size , By deployment mode, By vertical, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | AG, Delphi Technologies, Denso Corporation, Robert Bosch GmbH, Hitachi Automotive Systems Ltd., Magneti Marelli S.p.A, Keihin Corporation, Stanadyne LLC, Woodward Inc., and Carter Fuel Systems LLC. |

Market Definition

Security and vulnerability management encompasses the systematic identification and mitigation of potential risks and vulnerabilities within an organization's systems and infrastructure with the goal of safeguarding sensitive information and valuable assets. This process entails the proactive implementation of measures like frequent scanning, patching, and monitoring to fortify defenses against potential security threats.

In today's era of digital advancement, the importance of security and vulnerability management cannot be overstated in light of the escalating volume of cyber threats and attacks. This process encompasses the identification, evaluation, and mitigation of vulnerabilities and risks present in an organization's information technology systems and networks. Through the deployment of robust security protocols, businesses can thwart unauthorized access, data breaches, and the associated financial repercussions. Moreover, security and vulnerability management aids in ensuring adherence to pertinent industry regulations and standards, thereby protecting critical data and upholding customer confidence. Proactive risk management enables organizations to outmaneuver cybercriminals, fortify their standing, and mitigate the potential for operational interruptions. By investing in comprehensive security strategies and regularly updating them, businesses can preemptively detect and resolve vulnerabilities, thereby diminishing the likelihood and severity of security incidents.

Key Market Segmentation:

Insights On Key component

Software

The software is expected to dominate the Global Security and Vulnerability Management Market. This is primarily due to the increasing adoption of security and vulnerability management software solutions by organizations to protect their sensitive information and digital assets. With the growing number of cyber threats and data breaches, companies are prioritizing the implementation of robust software solutions to detect, assess, and mitigate vulnerabilities in their systems. Additionally, advancements in technology, such as artificial intelligence and machine learning, are enhancing the capabilities of security software, further driving its dominance in the market.

Services

services also play a crucial role in the Global Security and Vulnerability Management Market. Security and vulnerability management services encompass a range of offerings, including consulting, implementation, and managed security services. These services enable organizations to leverage the expertise of security professionals and enhance their overall security posture. Although the software is expected to dominate, the services is equally important as it complements the software solutions and provides valuable support in terms of implementation, customization, and ongoing management of security systems. Organizations often rely on a combination of software and services to effectively manage their security and vulnerability needs.

Insights On Key target

Content Management Systems Vulnerabilities

Content Management Systems Vulnerabilities is expected to dominate the Global Security and Vulnerability Management Market. Content Management Systems (CMS) are widely used by organizations to create, manage, and publish digital content. These systems are often targeted by hackers due to their popularity and the potential for exploiting vulnerabilities within them. With the increasing number of websites and online platforms powered by CMS, the demand for security and vulnerability management solutions specifically catering to CMS vulnerabilities is expected to grow significantly.

IoT Vulnerabilities

IoT Vulnerabilities is one more noticeable within the By target category. IoT devices are becoming increasingly prevalent in both consumer and industrial applications, offering convenience and efficiency. However, these devices are also prone to vulnerabilities that can be exploited by malicious actors. While IoT vulnerabilities pose significant security risks, they are not expected to dominate the Global Security and Vulnerability Management Market as compared to Content Management Systems Vulnerabilities. This is due to the specific nature of the CMS vulnerabilities being more widely applicable across various industries and organizations.

API Vulnerabilities

API Vulnerabilities is yet one more noticeable within the By target category. APIs (Application Programming Interfaces) play a vital role in modern software development, enabling communication between different applications and systems. However, vulnerabilities in these APIs can expose sensitive data and pose security risks. While API vulnerabilities are a significant concern, they are not expected to dominate the Global Security and Vulnerability Management Market. This is primarily because CMS vulnerabilities and IoT vulnerabilities have a broader reach and impact.

Other Target Vulnerabilities

Other Target Vulnerabilities encompasses vulnerabilities that do not fall within the specific categories of CMS, IoT, or APIs. It may include vulnerabilities in other types of software, hardware, systems, or infrastructure. While these vulnerabilities should not be disregarded, they are not expected to dominate the Global Security and Vulnerability Management Market. The dominance is likely to be seen in the s of Content Management Systems Vulnerabilities due to the widespread use of CMS and the critical need for securing them alongside the rising threat landscape.

Insights On Key deployment mode

Cloud

The cloud deployment mode is expected to dominate the Global Security and Vulnerability Management Market. Cloud-based solutions offer numerous advantages over on-premises deployments, such as scalability, flexibility, and reduced infrastructure costs. With the increasing adoption of cloud technologies and the growing need for efficient security management solutions, organizations are opting for cloud-based security and vulnerability management systems. The cloud deployment model allows for easy accessibility, real-time threat monitoring, and seamless updates, thereby enhancing overall security posture. Additionally, cloud-based solutions enable organizations to quickly adapt and respond to evolving security threats, making them a preferred choice in the market.

On-Premises

While the cloud deployment mode is expected to dominate the market, the on-premises continues to hold a significant share. Some organizations, icularly those dealing with sensitive data or regulatory compliance requirements, prefer to have direct control over their security infrastructure. On-premises solutions offer enhanced data privacy and security as organizations can maintain complete control over their security systems. Additionally, certain industries or countries may have specific regulations that necessitate keeping data within their physical boundaries. Hence, despite the growing popularity of cloud-based solutions, there is still a substantial demand for on-premises security and vulnerability management systems among specific organizations.

Insights On Key organization size

Large Enterprises

Based on the available data and market research, Large Enterprises is expected to dominate the Global Security and Vulnerability Management Market. Large enterprises typically have more resources and a greater need for robust security and vulnerability management solutions. They often face higher risks due to their size, complexity, and larger customer base. With their extensive budgets, they can invest in comprehensive security solutions and employ dedicated teams to manage their vulnerabilities effectively.

Furthermore, large enterprises are often subject to more stringent regulatory requirements, which drive the demand for advanced security measures. This combination of factors positions large enterprises as the dominating in the Global Security and Vulnerability Management Market.

SMEs

While Large Enterprises are expected to dominate the Global Security and Vulnerability Management Market, SMEs also play a significant role in this market. Small and Medium Enterprises (SMEs) constitute a substantial portion of the business landscape, and their security needs should not be overlooked.

Although SMEs may have fewer resources compared to large enterprises, they still face cybersecurity threats and vulnerabilities that need to be addressed.

The increasing awareness of the importance of cybersecurity and the growing number of cyberattacks targeting smaller businesses have compelled SMEs to invest in security solutions. As a result, the demand for security and vulnerability management solutions specifically tailored for SMEs is on the rise. While they may not dominate the market, SMEs represent an essential in the Global Security and Vulnerability Management Market.

Insights On Key vertical

IT and ITeS

The IT and ITeS is expected to dominate the Global Security and Vulnerability Management Market. With the increasing reliance on technology and the growing number of cyber threats, IT and ITeS companies are investing heavily in security and vulnerability management solutions. These organizations handle large volumes of sensitive data and are therefore more susceptible to security breaches. As a result, they prioritize the implementation of robust security measures to protect their networks, systems, and customer information.

Furthermore, the rapid digital transformation across industries is driving the demand for security and vulnerability management solutions in the IT and ITeS sector. Thus, the IT and ITeS is projected to dominate the market.

BFSI

The BFSI holds significant potential in the Global Security and Vulnerability Management Market. Banking, financial services, and insurance companies operate in a highly regulated environment and handle substantial financial data. This makes them attractive targets for cybercriminals. Hence, BFSI organizations have a strong focus on protecting their systems, networks, and customer data. The adoption of security and vulnerability management solutions is crucial for the BFSI sector to mitigate risks and maintain the trust of their customers. While the BFSI is poised for growth, it is expected to be slightly overshadowed by the dominance of the IT and ITeS sector.

Healthcare

The healthcare is also expected to witness significant growth in the Global Security and Vulnerability Management Market. Healthcare organizations hold vast amounts of sensitive patient data, including personal and medical records. The increasing digitization of healthcare systems and the rise in cyber threats necessitate robust security measures. Protecting patient confidentiality and ensuring the integrity of medical systems are crucial in safeguarding the healthcare sector. As a result, the demand for security and vulnerability management solutions in the healthcare is expected to rise.

Retail

While the retail is not expected to dominate the Global Security and Vulnerability Management Market, it plays a significant role in driving the adoption of security solutions. Retail organizations handle customer payment information, personal data, and operate a large number of online platforms.

With the rise in e-commerce and the increasing number of cyberattacks targeting retail organizations, the need for security and vulnerability management solutions is evident. As the retail industry continues to evolve and expand its digital presence, the implementation of robust security measures becomes imperative to protect customer data and maintain brand reputation.

Manufacturing

The manufacturing is another important player in the Global Security and Vulnerability Management Market. As manufacturing companies adopt Industry 4.0 technologies and connect their operations to the Internet of Things (IoT) networks, their vulnerability to cyber threats increases. Protecting manufacturing systems, intellectual property, and ensuring operational continuity are critical for the sector. Therefore, the demand for security and vulnerability management solutions in the manufacturing is expected to grow.

Energy and Utility

The energy and utility sector also holds potential in the Global Security and Vulnerability Management Market. With the increasing interconnectivity of energy grids, the digitization of utility infrastructure, and the shift toward renewable energy, the sector faces cyber risks. Malicious actors targeting the energy and utility sector can disrupt critical services, compromise infrastructure, or steal sensitive information. Therefore, security and vulnerability management solutions are essential for protecting these critical assets and maintaining reliable and secure energy systems.

Other

The "Other" encompasses industries not explicitly mentioned in the given options. While it is difficult to predict the specific dominance of this as it encompasses various industries, it is crucial to acknowledge that all industries, to some extent, need security and vulnerability management solutions. Every organization, regardless of its vertical, faces digital threats, making it essential to invest in cybersecurity measures. Therefore, the demand for security and vulnerability management solutions across other industry verticals is expected to contribute to the overall growth of the market.

Insights on Regional Analysis:

North America

North America is expected to dominate the global security and vulnerability management market. This can be attributed to the strong presence of major market players in the region, as well as the high adoption of advanced technologies and the increasing focus on cybersecurity. Moreover, the presence of stringent government regulations and standards regarding data protection and privacy further drives the demand for security and vulnerability management solutions in North America. The region also has a high IT spending capacity and a well-established infrastructure, which enables organizations to invest in robust security measures. Overall, with its technological advancements, strict regulations, and strong market players, North America is poised to maintain its dominance in the global security and vulnerability management market.

Latin America

Latin America is a growing market in the global security and vulnerability management landscape. The region is witnessing an increased focus on cybersecurity due to rising cyber threats and instances of major data breaches. Additionally, the growing adoption of cloud-based services and digital transformation initiatives in Latin American countries is driving the demand for security and vulnerability management solutions. The presence of government regulations and initiatives to enhance cybersecurity practices further supports the market growth in the region. While Latin America is still emerging as a key player in the global market, it is experiencing steady growth and is expected to continue expanding its market share in the coming years.

Asia Pacific

Asia Pacific is another region that is experiencing significant growth in the security and vulnerability management market. The region is home to several emerging economies, such as China and India, which are witnessing rapid digitization and industrialization. The increasing adoption of internet-connected devices, cloud computing, and mobile technologies in the region has led to a higher risk of cyber threats and vulnerabilities. As a result, organizations in Asia Pacific are investing in security solutions to protect their digital assets and ensure data privacy. Furthermore, the growing awareness of cybersecurity and government initiatives to strengthen cybersecurity infrastructure contribute to the market's growth in the region. Asia Pacific is poised to become a dominant player in the global security and vulnerability management market in the future.

Europe

Europe is a mature market for security and vulnerability management solutions. The region has stringent data protection regulations, such as the General Data Protection Regulation (GDPR), which mandate organizations to adopt robust security measures and regularly assess and manage vulnerabilities. The increasing sophistication of cyber threats and the rising number of data breaches have further fueled the demand for security and vulnerability management solutions in Europe. Moreover, the presence of major market players and high technology adoption rates contribute to the region's dominance in the market. While Europe may not have the highest market share compared to North America or Asia Pacific, it remains a significant player in the global security and vulnerability management market.

Middle East & Africa

The Middle East & Africa region is experiencing rapid growth in the security and vulnerability management market. The increasing digitization initiatives and high internet penetration rates in countries like the United Arab Emirates and South Africa are driving the demand for security solutions. Additionally, the region's expanding e-commerce sector and growing investments in critical infrastructure projects necessitate effective security and vulnerability management. Cybersecurity regulations and government initiatives to strengthen cybersecurity further boost the market growth in the Middle East & Africa region. Although still developing, the region holds significant potential and is expected to expand its market share in the global security and vulnerability management market.

Company Profiles:

Prominent entities within the Global Security and Vulnerability Management sector are instrumental in delivering cutting-edge technologies and strategies for the detection, control, and reduction of security threats and susceptibilities. Through a commitment to ongoing innovation, these entities safeguard business operations and shield confidential information within diverse sectors.

Prominent participants in the Security and Vulnerability Management Market encompass IBM Corporation, Qualys Inc., Hewlett Packard Enterprise Development LP, McAfee LLC, Symantec Corporation, Rapid7 Inc., Tenable Network Security Inc., Micro Focus International plc, Cisco Systems Inc., and Trustwave Holdings Inc. These industry leaders offer advanced security solutions and cutting-edge vulnerability management platforms. Their diverse portfolio includes services such as vulnerability assessment, patch management, threat intelligence, risk management, and compliance management. Leveraging their widespread global reach and substantial customer base, these top contenders prioritize innovation to maintain a competitive edge in the market and tackle the increasing security complexities encountered by organizations spanning various sectors.

COVID-19 Impact and Market Status:

The influence of the Covid-19 pandemic on the worldwide security and vulnerability management sector has resulted in a surge in the need for cybersecurity solutions. The shift to remote work and advancements in digital technologies have introduced fresh vulnerabilities, prompting ened demand for enhanced security measures.

The Security and Vulnerability Management market has undergone a significant transformation as a consequence of the COVID-19 pandemic. The escalation of remote work practices and the integration of digital technologies have created a pressing necessity for robust security mechanisms to safeguard critical information and thwart cyber dangers. Enterprises are progressively channeling resources into security solutions to fortify the integrity of their networks, devices, and cloud-based platforms.

The transition to remote work has amplified the likelihood of vulnerabilities and potential breaches, attributable to employees utilizing personal gadgets and unsecured networks to access corporate data. Consequently, organizations are placing an increased emphasis on security and vulnerability management, investing in innovative threat detection and response strategies. Additionally, the pandemic has revealed the frailties within supply chains, necessitating the implementation of ened security protocols in this domain. As businesses and industries pivot towards prioritizing cybersecurity, the Security and Vulnerability Management market is poised to witness substantial growth in the ensuing years.

Latest Trends and Innovation:

- In May 2021, Qualys, a leading provider of cloud-based security and compliance solutions, announced the acquisition of Software-as-a-Service (SaaS) continuous testing provider, Swarm64. This acquisition aims to enhance Qualys' capabilities in vulnerability management and is expected to provide customers with a comprehensive solution for securing their IT infrastructure.

- Also in May 2021, Rapid7, a provider of security analytics and automation solutions, announced the acquisition of IntSights, a cyber threat intelligence company. This acquisition enables Rapid7 to offer enhanced global threat intelligence capabilities, providing customers with a more comprehensive understanding of potential cyber threats.

- In February 2021, Tenable, a cybersecurity company, introduced Tenable Lumin, a cloud-based platform for measuring and managing cyber risk across the organization. Tenable Lumin allows organizations to gain actionable insights and prioritize vulnerabilities based on their potential impact, enabling better decision-making in vulnerability management.

- In January 2021, Cisco announced the acquisition of Slido, an audience interaction platform. While Slido is not directly related to security and vulnerability management, this move showcases Cisco's continuous efforts to enhance its collaboration and communication tools, which play a crucial role in incident response and security management.

- During the RSA Conference in May 2021, Microsoft unveiled Azure Sentinel, a cloud-native security information and event management (SIEM) solution. This addition to Microsoft's security portfolio aims to provide customers with a comprehensive view of their security environment and enable better detection and response to security incidents.

- In September 2020, IBM introduced its Cloud Pak for Security platform, a containerized software platform that integrates security technology from multiple vendors. This platform enables organizations to unify their security data, gain better visibility into security threats, and streamline their security operations.

- In August 2020, Splunk, a data analytics and security company, announced the acquisition of TruSTAR, a threat intelligence platform. This acquisition enhances Splunk's capabilities in threat intelligence management and allows organizations to centralize and automate their threat intelligence processes.

- Also in August 2020, Palo Alto Networks announced the acquisition of Crypsis Group, a leading incident response, risk management, and digital forensics services provider. This acquisition strengthens Palo Alto Networks' incident response capabilities, offering customers a comprehensive cybersecurity solution.

Significant Growth Factors:

The expansion of the Security and Vulnerability Management market is being fueled by the escalation of online risks and the growing utilization of cloud-centric solutions.

The Security and Vulnerability Management (SVM) market is experiencing notable growth driven by various crucial factors.

The escalating frequency and sophistication of cyberattacks underscore the significance of strong security measures, thereby increasing the need for SVM solutions. Organizations in diverse sectors are realizing the importance of evaluating their vulnerability levels and actively mitigating potential risks in response to the evolving threat landscape. The surge in cloud computing and Internet of Things (IoT) adoption has broadened the attack surface, intensifying market expansion. Businesses are becoming more cognizant of the financial and reputational impacts of security breaches, leading to investments in SVM solutions for efficient vulnerability detection, prioritization, and remediation. Additionally, stringent regulatory mandates like the General Data Protection Regulation (GDPR) and the Payment Card Industry Data Security Standard (PCI DSS) are compelling organizations to implement robust SVM practices. The incorporation of cutting-edge technologies such as artificial intelligence (AI) and machine learning (ML) into SVM solutions enables real-time threat identification and resolution. Moreover, the growing emphasis on continuous monitoring and proactive risk management approaches further boosts the demand for SVM solutions, collectively driving the growth of the Security and Vulnerability Management market.

Restraining Factors:

The Security and Vulnerability Management Market faces a considerable challenge due to the intricate and ever-changing landscape of cyber threats.

The Security and Vulnerability Management market encounters various factors that could potentially impede its growth trajectory. Firstly, the intricacy of managing multiple security solutions and integrating them into existing systems presents a daunting task for organizations, resulting in a slower adoption rate. Furthermore, the escalating frequency and complexity of cyber-attacks present significant challenges for security and vulnerability management providers. As threat actors continually refine their tactics, the market must evolve by creating advanced solutions, a process that can be time-consuming and resource-intensive. Additionally, financial constraints may present a formidable hurdle for organizations seeking to invest in robust security and vulnerability management solutions. Some enterprises may prioritize alternative IT expenditures over security, thereby constraining the market's potential.

Finally, data privacy regulations and compliance mandates create further obstacles to market expansion, as organizations must align their security approaches with legal frameworks and industry standards, adding intricacy and costs to implementation. Despite these obstacles, the Security and Vulnerability Management market harbors vast potential. The escalating awareness of cyber threats and data breaches has led to increased investments in security solutions. Furthermore, advancements in technologies like artificial intelligence and machine learning are enhancing the efficacy and efficiency of security and vulnerability management solutions. Moreover, the mounting focus on data protection and privacy is compelling organizations to invest in robust security frameworks. Given the appropriate strategies and relentless innovation, the market can surmount these inhibiting factors and prosper in the upcoming years

Key Segments of the Security and Vulnerability Management Market

Component Overview

• Software

• Services

Target Overview

• Content Management Systems Vulnerabilities

• IoT Vulnerabilities

• API Vulnerabilities

• Other Target Vulnerabilities

Deployment Mode Overview

• Cloud

• On-Premises

Organization Size Overview

• Large Enterprises

• SMEs

Vertical Overview

• IT and ITeS

• BFSI

• Healthcare

• Retail

• Manufacturing

• Energy and Utility

• Other

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America