The global market size for seed treatment stood at USD 4.66 billion in 2018. Seed treatment is the application of chemical treatment for effective crop cultivation, in the form of insecticides, fertilizers, etc. This treatment protect seeds from several soil-borne and seed-borne infections and extreme environmental conditions. Providing seed treatment to the germinating crops improves the crop yield along and results in the harvesting of disease free healthy crops.

Growth of the seed treatment market is supported by several factors such as rising population which has augmented the demand for agriculture produce.

At a compound annual growth rate (CAGR) of 12.62%, the global seed treatment market is anticipated to increase from $ 11.32 billion in 2022 to $ 26.01 billion by 2029.

.jpg)

Furthermore, reduction of arable land across the globe has increased the pressure of higher crop yields from limited resources. Thus, farmers around the globe are rapidly adopting seed treatment methods as an essential part of agricultural practices. Therefore, seed treatment is a viable process to increase the crop yield along with producing healthy crops. However, environmental concerns regarding toxicity of these chemical treatments is projected to impede the market growth over the forecast period.

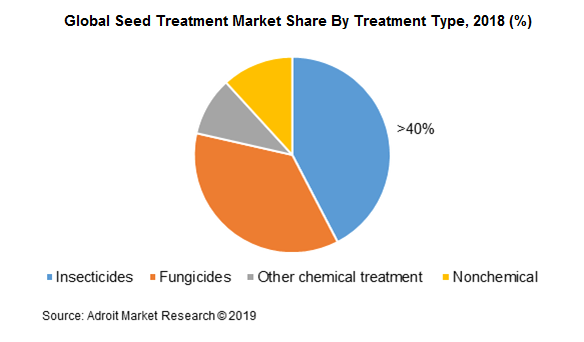

Seed treatment is conducted in four phases namely protection, disinfection, enhancing and eradication, during the crop cultivation process. The global seed treatment market is categorized on the basis of crop type and seed treatment type. On the basis of crop type, corn/maize was the topmost category to use seed treatment in 2018. Corn is one of the most consumed agriculture product across the globe, which is highly used in several cuisines. Corn accounted for nearly one-third of the market share in the global seed treatment market, whereas canola and cotton are projected to witness the highest growth for seed treatment products by 2025. On the basis of treatment type, insecticides dominated the seed treatment demand with ~42% of market share in 2018. As most of the crop diseases are caused due to insects and fungal bugs, insecticides and fungicides are the most used treatment types in the seed treatment industry.

Nature of the global seed treatment industry is concentrated, with tier-1 players accounting for more than half of the global market share. Key players in the global seed treatment market are BASF SE, DuPont de Nemours and Company, Syngenta AG, Chemtura Corporation, Valent U.S.A. Corporation, BrettYoung Limited, Sumitomo Chemical Company, Advanced Biological Marketing. Merger & acquisition is the major strategy adopted by the players in order to gain easy access to the market. Expansion is also among the key strategy adopted in order to expand the customer base. In August 2018, BASF SE acquired the crop science business among other related assets from Bayer AG. This acquisition is expected to strengthen BASF’s position in the nematicide seed treatment, seed protection and non-selective herbicide sectors in the future.

Seed Treatment Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2029 |

| Study Period | 2018-2029 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2029 | $ 26.01 billion |

| Growth Rate | CAGR of 12.62 % during 2019-2029 |

| Segment Covered | By Product Type, by Crop Type, By Application Method, By Application Time, Regions |

| Regions Covered | North America, Europe, Asia Pacific, Middle East and Africa, South America |

| Key Players Profiled | Seed Film Coating, Matte Finish, Shine, Sparkle, Seed Encrusting, Seed Pelleting |

Segment overview of Global Seed Treatment Market

Crop type Overview (USD Billion)

- Corn/Maize

- Soybean

- Wheat

- Canola

- Cotton

- Others

- Treatment type Overview, (USD Billion)

- Insecticides

- Fungicides

- Nonchemical

- Other chemical treatment

- Regional Overview, (USD Billion)

- North America

- U.S.

- Canada

- Europe

- France

- Germany

- Spain

- Rest of Europe

- Asia Pacific

- India

- Japan

- China

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- UAE

- South Africa

- Rest of Middle East and Africa

- North America

- The report has company profiles of major players in the market

- BASF SE

- Bayer Cropscience

- DuPont de Nemours and Company

- Chemtura Corporation

- Syngenta AG

- Valent U.S.A. Corporation

- Sumitomo Chemical Company

- BrettYoung Limited

- Advanced Biological Marketing

- Others

Frequently Asked Questions (FAQ) :

The global seed treatment market depicts high concentration with presence of large players that have captured a significant market share over the recent years. Global players such as BASF SE and DuPont are actively spending in the seed treatment segment to maintain its customer base along with expanding their product offerings across the globe.

Given below are some of the recent developments witnessed by the seed treatment sector:-

- On May 2019, BASF SE collaborated with Rothamsted Research in order to further develop their research in sustainable agriculture, by increasingly focusing on soil management. With this, the company aims to invest in research & development in order to upgrade their current offerings as well as expand their product offerings for a wide range of crops.

- In February 2019, the company gained approval of one of its fungicide chemical Revysol® in the European region. Revysol® is the first approved Isopropanol-Azole ingredient which has gained government consent for agricultural purposes. The product launch is expected to be around late 2019 to early 2020. With this, the company is aiming at optimizing its strategy of offering innovative products.

- In December 2018, BASF announced the expansion of its existing product portfolio of soyabean seed treatment. The company launched Vault IP Plus and Obvius Plus fungicide treatment product lines. Vault IP seed treatment is the only combined inoculant that contains two active biological ingredients for improving the protection and reducing fungicidal activity.

- In August 2018, BASF SE announced acquisition of assets and certain business segments from Bayer AG, which prominently includes its seed treatment operations. With this acquisition, the company aims to strengthen its crop protection, digital farming and biotecnology business. The acquisition also led to company’s venture in new business areas into nematicide seed treatment and non-selective herbicides.

Over the past few years, global companies such as BASF SE are proactively venturing into expanding their existing product portfolio, as there has been growing demand for specific seed treatment products which also comply with the existing government regulations. Acquisition of its major competitor, Bayer CropScience AG has led to further consolidation in the market. As a consequence, BASF SE has expanded its presence across the supply chain, thus intensifying market competition for the regional and local players.

The global seed treatment market is categorized on the basis of crop type and treatment type. By crop type, the market is segmented into soybean, wheat, corn / maize, cotton, and canola among others. By treatment type, the market is divided into fungicides, insecticides, non-chemical, and other chemical treatments.

Corn crop type emerged as the biggest segment in global seed treatment market. Globally, the seed treatment market for corn cultivation was valued at USD 1.58 billion in 2018. Corn is among the highest produced crops globally as it is a prominent ingredient used in several food products and biofuel applications. In North America and Latin America, corn is one of the staple food product and hence is one of the most cultivated crops type by the farmers since many decades. Farmers in these regions are increasingly adopting seed treatment in order to protect their yield. According to CropLife America (CLA), in 2011, of the total corn seeds planted, more than 90% of the seeds have received seed treatment. The considerable adoption rate in developed regions has supported the firm growth of the seed treatment market in the past decade.

In terms of treatment, Insecticides dominated the seed treatment market. The segment alone accounted for more than one-third of the market share in 2018. With the advancement in the seed treatment formulations, many new products and active substrates have been introduced recently, which has given insecticides a gainful traction in the global market. Systematic targeting of the actives into the plants will only attack the pests and insects without hampering the crop yield and quality. This targeted approach has proven beneficial as predatory insects remain intact, thereby reducing the environmental harm coupled with prevention of any damage to the ecosystem. Overall, the insecticide seed treatment market is projected to be surpass USD 3.90 billion by 2025.

Regional analysis of the global seed treatment market is divided into North America, Latin America, Europe, Asia Pacific and the Middle East & Africa.

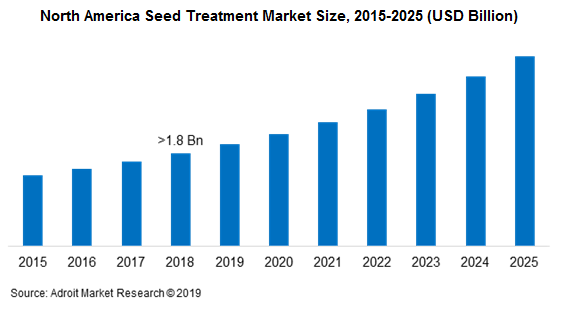

North America emerged as the biggest market in the global seed treatment market and is further projected to dominate the demand side over the forecast period. The market was valued at >USD 1.8 billion in 2018. This high demand is attributed to the factor that the region is the largest producer of corn and soy crops in the world, which requires the treatment, owing to its high vulnerability of getting infected. Ease of availability of active ingredients is also a factor that is considered to augment the demand for seed treatment in the region. Furthermore, as the farmers in the region tend to be more educated towards advanced farming techniques, the farmers are adopting new methods such as precision farming along with implementing new machinery. Along with ease of access, high purchasing power of the farmers is also a key factor to supplement the demand for seed treatment chemicals over the forecast period. Overall, North America is a well-established market and as the demand for these crops is growing steadily, the sector is projected to perform well over the years ahead.

After North America, Europe closely followed by Latin America stood as the key region to drive the seed treatment market demand. Asia Pacific is regarded as the key growth segment of the seed treatment market in the coming years. China and India are among the most populous countries in the world, together accounting for approximately 36% of the world population. Therefore, the demand for higher agricultural output from the limited availability of land assets has led to the adoption of seed treatment chemicals. As the purchasing power of end-users along with government support are on rise, the sales of seed treatment products are likely to propel over the forecast period.