Sensors Market Analysis and Insights:

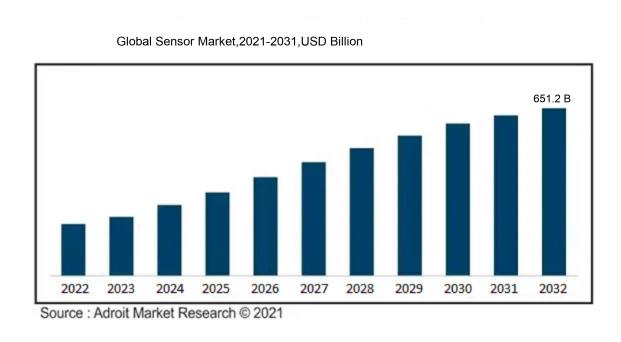

In 2023, the size of the worldwide Sensors market was US$ 252.3 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 17.29 % from 2024 to 2032, reaching US$ 651.2 billion.

The Sensors industry is significantly influenced by progress in technology, rising automation needs across multiple sectors, and the widespread integration of the Internet of Things (IoT). The increasing prevalence of smart devices, coupled with a ened focus on energy efficiency, necessitates the use of advanced Sensors for peak functionality. Moreover, the automotive industry's drive for improved safety features and the development of self-driving vehicles are accelerating the adoption of Sensors technologies. In the healthcare domain, the rise of wearable devices and systems for remote patient monitoring is contributing to market expansion. Environmental issues and regulatory frameworks advocating for sustainable practices are encouraging businesses to invest in Sensors technologies for enhanced resource management. Additionally, innovations in microelectromechanical systems (MEMS) and Sensors integration are enhancing performance, lowering costs, and broadening application scopes, which together amplify the attractiveness of the market. Collectively, these elements cultivate an energetic environment that promotes ongoing innovation and investment within the Sensors sector.

Sensors Market Definition

A Sensors is an instrument designed to identify and quantify various physical characteristics, including temperature, luminosity, or movement, and transforms this data into signals suitable for analysis or subsequent action.

Sensors are vital components of contemporary technology, allowing for the identification and quantification of various physical phenomena like temperature, pressure, humidity, and movement. They transform these measurements into signals that can be analyzed and utilized, promoting automation and data gathering in numerous sectors. In the healthcare field, Sensors are used to track vital signs, improving patient care and medical interventions. In the realm of environmental monitoring, they assist in assessing pollution levels and factors related to climate change. Furthermore, Sensors are essential in smart devices, automotive technologies, and industrial processes, enhancing efficiency and safety, thus becoming essential in our interconnected society.

Sensors Market Segmental Analysis:

Insights On Type

Image Sensors

Image Sensors are a critical component in various applications such as smartphones, cameras, and surveillance systems and are anticipated to dominate the Global Sensors Market. The demand for high-resolution imaging in both consumer electronics and industrial applications is increasing significantly. Emerging technologies such as augmented reality and automated driving are projected to further bolster the market for image Sensors. The ongoing trend towards AI integration in imaging technologies is likely to drive both advancements and adoption rates, solidifying image Sensors’ position within the industry.

BioSensors

BioSensors are growing rapidly primarily due to their increasing applications in healthcare, environmental monitoring, and food safety. Driven by technological advancements and growing awareness regarding health and wellness, the demand for precise and reliable monitoring equipment is surging. Furthermore, the global trend toward personalized medicine is propelling the development and implementation of bioSensors in point-of-care diagnostics, allowing for rapid and accurate health assessments. This momentum is expected to maintain bioSensors in a leading position within the overall market.

Optical Sensors

Optical Sensors play a pivotal role in various industries, including consumer electronics, automotive, and aerospace. Advancements in technology have led to increased miniaturization and enhanced sensitivity, which are appealing characteristics for manufacturers. The growth of connected devices adopting optical technology, along with the increasing demand for automation and energy efficiency, is further driving the market for optical Sensors.

Motion Sensors

Motion Sensors are widely used in security systems, smart home devices, and industrial applications. As more consumers seek intuitive, responsive homes, the integration of motion Sensors into smart technology is becoming more common. Additionally, the rise in demand for wearable technology, which often incorporates motion-sensing capabilities, is boosting the sector's importance.

Pressure Sensors

Pressure Sensors are vital across a range of industries, including automotive, aerospace, and healthcare. Their ability to monitor and control processes is essential for operational efficiency and safety in various applications. The growing emphasis on predictive maintenance in industrial settings is also driving demand, as pressure Sensors provide critical data to avert system failures and enhance performance.

Temperature Sensors

Temperature Sensors are crucial in sectors like food and beverage, healthcare, and HVAC systems. The growing focus on energy efficiency and environmental regulations is motivating industries to adopt temperature Sensors for better process control. With advancements in wireless communication and IoT technology, temperature Sensors are becoming integral to smart monitoring systems, allowing for real-time data collection and analysis, thus driving market growth.

Humidity Sensors

Humidity Sensors are fundamental in environments where moisture control is essential, such as HVAC systems, agricultural applications, and food storage. Their role in maintaining optimal humidity levels ensures product quality and energy efficiency. Advances in technology, including the development of compact and cost-effective Sensors, are expected to contribute further to their market penetration and application versatility.

Radar Sensors

Radar Sensors are increasingly utilized in automotive applications, particularly in advanced driver-assistance systems (ADAS). Their ability to detect objects and measure distances accurately is crucial for improving safety standards in vehicles. The shift toward more intelligent transportation systems is propelling the demand for radar technology in both commercial and personal vehicles. Moreover, the defense sector's reliance on radar Sensors for surveillance and reconnaissance adds to their market significance as technology continues to evolve and expand in capabilities.

Touch Sensors

Touch Sensors are an integral component in the consumer electronics market, revolutionizing user interaction with devices. Their applications range from smartphones and tablets to kiosks and home appliances. The demand for interfaces that offer intuitive control over devices is driving the growth of touch Sensors. The increasing trend toward automation and the proliferation of smart devices are fostering advancements in touch technology, including multi-touch capabilities and enhanced responsiveness.

Others

The category of others includes a diverse range of Sensors not specifically defined above, such as ultrasonic Sensors, gas Sensors, and accelerometers. Each of these Sensors caters to niche markets and applications, contributing to various industrial, environmental, and consumer needs. While they may not dominate the market, their significance cannot be overlooked as they fill specific roles in technology solutions. As industries evolve and adopt new technologies, this category is expected to evolve with unique applications, driving specialized growth across sectors.

Insights On Component

Microcontrollers

Microcontrollers are vital components in Sensors systems, providing the necessary processing power to interpret data from Sensors and are expected to dominate the Global Sensors Market. Their versatility allows them to be integrated into various products, contributing to the explosion of smart technologies across different sectors, but they are overshadowed by the communication capabilities offered by transceivers.

Transceivers

Transceivers are growing due to their crucial role in wireless communication and data transmission. As the Internet of Things (IoT) continues to expand, the need for efficient communication between Sensors and devices has escalated. Transceivers allow Sensors to communicate data effectively and reliably, which is vital in various applications, including smart homes, industrial automation, and healthcare monitoring. Their ability to facilitate seamless connectivity while ensuring low power consumption positions them as a component, particularly as industries increasingly prioritize efficiency and automation in Sensors systems.

Amplifiers

Amplifiers serve an important purpose in the Sensors ecosystem by enhancing weak signals so that they can be accurately processed and analyzed. They are crucial in applications where Sensors signals must be increased to meet the necessary thresholds for further processing. In industries such as medical devices and environmental monitoring, amplifiers ensure data accuracy and reliability. While they play an integral role in improving Sensors performance, their market impact is limited when compared to the critical communication function fulfilled by transceivers in a fully connected environment.

ADC & DAC

Analog-to-Digital Converters (ADC) and Digital-to-Analog Converters (DAC) are critical in enabling Sensors to interface with digital systems by converting signals into a suitable format. They are paramount in processes where Sensors collect analog signals, like temperature or pressure readings, and need to transmit this data digitally. Despite their importance in signal translation, they do not offer the same breadth of application as transceivers, which not only access these converted signals but also facilitate their transmission across networks, making ADC and DAC less dominant in comparison to the communication aspects of Sensors components.

Insights On Technology

CMOS

CMOS (Complementary Metal-Oxide-Semiconductor) technology is expected to dominate the global Sensors market due to its widespread applicability and cost-effectiveness. CMOS Sensors are integrated circuits that offer high functionality and low power consumption, making them highly desirable for a range of applications, from consumer electronics to automotive and industrial sectors. Their capacity for miniaturization allows for compact designs, which are increasingly demanded in modern devices. Furthermore, CMOS technology supports high-resolution imaging, enhancing the quality of data generated by Sensors, thus driving adoption among manufacturers and consumers alike. As a cost-efficient, scalable solution, CMOS is set to lead the market.

MEMS

MEMS (Micro-Electro-Mechanical Systems) Sensors are gaining traction in the market due to their unique advantages of miniaturization and enhanced sensing capabilities. These devices can integrate mechanical and electrical functions on a single chip, allowing for sophisticated measurements across various applications, including automotive, medical, and consumer electronics. MEMS technology enables functionalities such as motion detection and pressure sensing, which are critical in smart devices and IoT applications. Their ability to operate in diverse conditions and cost-effective production methods further contribute to their growth potential, although they remain slightly behind CMOS in sheer market dominance.

NEMS

NEMS (Nano-Electro-Mechanical Systems) represent a cutting-edge technology in the Sensors market with their design at the nanoscale, offering extremely high sensitivity and precision in sensing applications. While NEMS is currently more specialized and less prevalent than MEMS and CMOS, its market potential is significant within sectors requiring highly sensitive devices, such as healthcare and environmental monitoring. The innovation in NEMS allows for the development of Sensors that can detect minimal physical changes, thereby paving the way for advancements in biosensing and molecular detection. However, the niche nature and higher costs of NEMS technology limit its broader application compared to MEMS and CMOS options.

Insights On Vertical

Automotive

The automotive sector is expected to dominate the global Sensors market. This is primarily due to the growing demands for advanced driver assistance systems (ADAS), electric vehicles (EVs), and autonomous driving technologies. With increasing focus on safety, emission control, and connectivity features within vehicles, the integration of various Sensors such as LIDAR, radar, and camera systems is essential. Moreover, the ongoing regulatory requirements enforcing stricter safety measures further fuel the demand for Sensors in vehicles. As the automotive landscape continues to evolve with innovations and technological advancements, the reliance on Sensors will undoubtedly intensify, making this sector the leader in Sensors application.

Consumer Electronics

The consumer electronics industry holds a significant position in the Sensors market, mainly driven by the demand for smart devices. Features such as motion detection, touch sensitivity, and environmental sensing in gadgets like smartphones, smartwatches, and home automation systems necessitate the integration of various Sensors technologies. The advent of the Internet of Things (IoT) has revolutionized how consumers interact with their devices, increasing the need for advanced Sensors to enhance user experience and device functionality. As consumer technology continues to advance, the necessity for innovative Sensors will remain, ensuring the industry retains a crucial role.

Industrial IT & Telecom

The industrial IT and telecom sector is progressively expanding its footprint in the Sensors market due to the escalating demand for automation and remote monitoring solutions. As industries strive for higher productivity and efficiency, the deployment of Sensors in applications like predictive maintenance and process optimization is becoming commonplace. Furthermore, the rise of smart factories and Industry 4.0 initiatives necessitates robust Sensors integration to facilitate data collection and analysis. With increasing investments in telecommunications infrastructure and IoT technology, this is anticipated to experience notable growth, emphasizing the critical role of Sensors.

Healthcare

In the healthcare sector, the demand for Sensors is surging due to their essential role in medical diagnostics and monitoring. With advancements in wearable technology, Sensors are being integrated into devices for continuous patient monitoring, which is particularly critical in managing chronic conditions. The rise in telehealth services and home healthcare solutions is also propelling Sensors technology adoption for real-time health data collection. Furthermore, regulatory support and increasing health awareness among individuals enhance the relevance of Sensors in personalized medicine. As healthcare continues to evolve with technology-backed solutions, the application of Sensors will further penetrate the market.

Aerospace & Defense

The aerospace and defense sector utilizes Sensors extensively for navigation, surveillance, and communication systems. The need for high-precision Sensors that can perform reliably under various environmental conditions is paramount in this domain. Advancements in aircraft technology, including unmanned aerial vehicles (UAVs) and space exploration, demand innovative Sensors solutions to improve safety and operational efficiency. Furthermore, increased defense budgets across nations to enhance surveillance capabilities are driving the incorporation of advanced Sensors technologies. As global geopolitical tensions rise, the relevance of Sensors in aerospace and defense applications will continue to be vital, marking this as a participant in the overall Sensors landscape.

Others

The 'Others' category encompasses various niche markets where Sensors implementation is growing. This includes sectors such as agricultural technology, environmental monitoring, and smart buildings. The rising demand for precision agriculture, driven by the need for improved yield and resource management, highlights the growing relevance of Sensors in monitoring soil moisture, weather conditions, and crop health. Additionally, environmental regulations are fostering the need for Sensors that can measure air and water quality. As societal focus shifts towards sustainability and efficiency, innovative Sensors solutions in these 'other' applications are expected to gain momentum, thus enhancing their contribution to the Sensors market.

Global Sensors Market Regional Insights:

Asia Pacific

The Asia Pacific region is expected to dominate the global Sensors market due to its rapid industrialization, technological advancements, and increasing demand for smart technologies. Countries like China, Japan, and India are pushing forward with significant investments in automation, automotive, consumer electronics, and industrial IoT, propelling the growth of Sensors applications. Furthermore, the growing adoption of smart cities and initiatives related to environmental monitoring are amplifying the need for Sensors. The region benefits from a robust manufacturing base, favorable government policies, and a large population driving consumer electronics demand, solidifying its leadership in the global Sensors market.

North America

North America holds a significant position in the global Sensors market, mainly due to its strong presence of technological giants and advanced research capabilities. The United States, in particular, leads in innovation and adoption of new technologies such as automotive Sensors and IoT applications. The region also invests heavily in defense, healthcare, and aerospace, which are critical sectors driving Sensors demand. Moreover, the growing focus on environmental sustainability and energy efficiency is further boosting Sensors usage, contributing to the region's substantial market share.

Europe

Europe occupies a notable position in the Sensors market, primarily characterized by its stringent regulatory frameworks and emphasis on innovation in technology. The European Union's commitment to sustainability and renewable energy is resulting in increased demand for environmental Sensors and energy efficiency solutions. Countries like Germany and Sweden are at the forefront of industries utilizing advanced Sensors for automation and smart manufacturing. Additionally, significant investments in the automotive sector, particularly with electric and autonomous vehicles, will continue to enhance Europe’s role in the global Sensors landscape.

Latin America

Latin America has a growing market for Sensors, driven by sectors like agriculture, energy, and mining. The region is increasingly recognizing the importance of modern technology in enhancing productivity and efficiency. Countries such as Brazil and Mexico are investing in smart agriculture and energy solutions, which are helping to drive Sensors adoption. However, challenges related to economic stability and infrastructure remain, potentially slowing the overall growth of the Sensors market in this region. Nevertheless, the increasing trend toward digital transformation is likely to provide opportunities for future growth.

Middle East & Africa

The Middle East & Africa region is slowly emerging in the global Sensors market, fueled by investments in infrastructure and technology. Countries like the UAE and South Africa are making strides in sectors such as oil and gas, agriculture, and smart cities where Sensors technology is becoming essential. However, the market here is still developing compared to other regions, with limited adoption of advanced Sensors technologies. Investments in improving technology infrastructure and regional economic stability will be critical for the growth of the Sensors market in these regions, making it a potential for future expansion but currently lagging behind others.

Sensors Market Competitive Landscape:

Prominent entities in the worldwide Sensors industry, encompassing major producers and technology firms, propel innovation and market expansion via the creation of cutting-edge Sensors technologies and collaborative alliances. Their efforts influence industry standards, improve product functionalities, and broaden applications across diverse fields, including automotive and healthcare.

Prominent companies in the Sensors industry comprise Honeywell International Inc., Texas Instruments Incorporated, Siemens AG, Bosch Sensorstec GmbH, Analog Devices, Inc., STMicroelectronics N.V., NXP Semiconductors, Infineon Technologies AG, Omron Corporation, TE Connectivity Ltd., 3M Company, Emerson Electric Co., Microchip Technology Inc., Robert Bosch GmbH, and Renesas Electronics Corporation.

Global Sensors Market COVID-19 Impact and Market Status:

The Covid-19 pandemic has significantly expedited the expansion of the international Sensors market by increasing the need for touchless technologies and improved health monitoring systems.

The COVID-19 pandemic has profoundly affected the Sensors industry, creating both hurdles and avenues for growth across different fields. Initially, the disruption of supply chains and manufacturing processes led to significant shortages and delays, particularly in sectors dependent on semiconductors and electronic parts. Nevertheless, this crisis hastened the integration of Sensors in essential domains like healthcare, where there was a notable rise in the demand for temperature, respiratory, and bioSensors for monitoring and diagnosing COVID-19. Furthermore, the pandemic instigated an increased emphasis on automation, intelligent technologies, and remote monitoring solutions in both industrial and consumer sectors, aiming to minimize physical contact. This shift fueled advancements in the Internet of Things (IoT) and smart home markets. Consequently, although certain parts of the Sensors market encountered temporary challenges, others witnessed remarkable growth, underscoring a transition towards a more interconnected and health-oriented landscape that may shape future Sensors developments.

Latest Trends and Innovation in The Global Sensors Market:

- In October 2023, STMicroelectronics announced the acquisition of the Sensors business from the French company, Ams AG, enhancing ST's portfolio in environmental and automotive Sensors technologies.

- In September 2023, Bosch Sensorstec unveiled its BHI260AP, an advanced inertial measurement unit, which incorporates artificial intelligence for improved motion sensing capabilities in consumer electronics.

- In August 2023, TE Connectivity launched the LUXEON 3030 2D high-power LED, which features innovative Sensors integration designed for smart lighting applications in the Internet of Things (IoT) ecosystem.

- In July 2023, Qualcomm introduced the QCC517x platform, which integrates a high-performance audio Sensors that enables voice recognition and environmental sound awareness in wireless audio devices.

- In June 2023, Honeywell completed its acquisition of Intellihot, a leader in innovative water heating solutions, enabling Honeywell to enhance its smart building technologies with advanced Sensors integration.

- In May 2023, NXP Semiconductors announced a partnership with Amazon, integrating NXP's NFC and secure element capabilities into Amazon's Alexa for enhanced smart home control and security features.

- In April 2023, Analog Devices released the ADPD188GG, a highly integrated optical Sensors designed for health and fitness monitoring applications, providing advanced functions like pulse oximetry and heart rate detection.

- In March 2023, Infineon Technologies announced its acquisition of Wolfspeed's silicon carbide business, a strategic move aimed at strengthening its position in automotive power electronics and Sensors applications.

- In February 2023, Siemens introduced the Sitrans LUT400 series, a new radar level Sensors aimed at the food and beverage industry, featuring improved accuracy and reliability in challenging environments.

- In January 2023, Texas Instruments launched the AFE7950, a highly integrated RF Sensors designed for high-frequency applications, known for its low power consumption and precision performance.

Sensors Market Growth Factors:

The expansion of the Sensors market is fueled by the escalating need for automation, progress in Internet of Things (IoT) innovations, and a growing prevalence of smart devices across diverse sectors.

The Sensors market is experiencing remarkable expansion due to a multitude of interconnected trends and technological innovations. One of the primary drivers is the growing prevalence of the Internet of Things (IoT), which ens the necessity for Sensors essential for system connectivity and monitoring across various sectors. Furthermore, the escalating emphasis on automation and intelligent technologies within industries like manufacturing, healthcare, and transportation significantly boosts Sensors deployment. The increasing production of electric and hybrid vehicles also contributes to this growth, as these vehicles depend on sophisticated Sensors for various functionalities, including safety and performance monitoring.

In addition, the rising public consciousness regarding environmental concerns has spurred the creation of Sensors aimed at energy management and pollution tracking, thereby facilitating market growth. The advent of wearable technology and smart home devices has additionally generated new demand, underlining the importance of compact and efficient Sensors designs. Technological advancements in Sensors, notably Micro-Electro-Mechanical Systems (MEMS) and nanotechnology, improve their capabilities and foster innovative applications. Lastly, government efforts promoting the development of smart cities and sustainable initiatives are further amplifying Sensors demand, positioning the market for ongoing expansion in the foreseeable future.

Sensors Market Restaining Factors:

The Sensors market faces several significant obstacles, including elevated production expenses, intricate technological demands, and the swift evolution of technology, which contributes to a faster rate of obsolescence.

The Sensors industry encounters a range of challenges that could hinder its expansion and innovative progress. Among the primary obstacles is the elevated cost of production, which can restrict access to cutting-edge Sensors for smaller enterprises and startups. The intricate nature of Sensors technology may also result in difficulties regarding integration and compatibility with pre-existing systems, which can deter adoption, particularly in established sectors. Furthermore, apprehensions about data security and privacy present significant obstacles, as increased connectivity ens the potential for cyber threats, resulting in regulatory scrutiny and consumer reluctance. Additionally, the swift rate of technological development demands ongoing investment in research and development, exerting financial pressure on businesses. Environmental regulations may impose restrictions on certain materials utilized in Sensors fabrication, complicating matters further. Nevertheless, the market is projected to flourish in the years to come, fueled by a rising demand for automation, smart devices, and the Internet of Things. As new innovations surface and technologies advance, the industry is anticipated to surmount these challenges, ultimately enhancing efficiency and improving the quality of life through diverse Sensors applications across multiple sectors.

Segments of the Sensors Market

By Type

- Image Sensors

- Optical Sensors

- BioSensors

- Motion Sensors

- Pressure Sensors

- Temperature Sensors

- Humidity Sensors

- Radar Sensors

- Touch Sensors

- Others

By Component

- Microcontrollers

- Transceivers

- Amplifiers

- ADC & DAC

By Technology

- MEMS

- CMOS

- NEMS

By Vertical

- Consumer Electronics

- Automotive

- Industrial IT & Telecom

- Healthcare

- Aerospace & Defense

- Others

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America