Servo Motors Market Analysis and Insights:

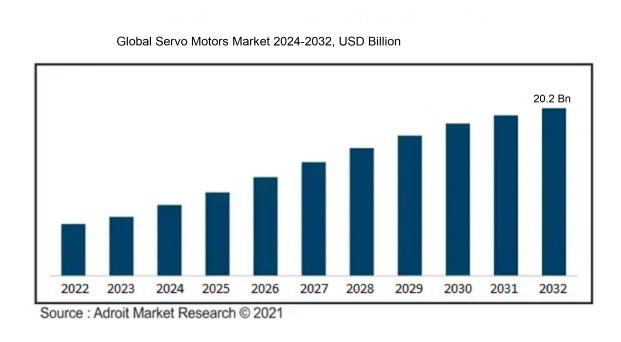

At a remarkable compound annual growth rate (CAGR) of 6.4%, the worldwide servo motors market is expected to rise significantly, from USD 12.3 billion in 2023 to a predicted USD 20.2 billion by 2032.

The growing need for automation in a wide range of industries, including robotics, automotive, and manufacturing, has a big impact on the servo motor industry. As organizations seek to enhance their operational efficiency and precision, the use of servo motors—renowned for their accuracy and quick response—has become increasingly prevalent. Furthermore, the market is growing as a result of Industry 4.0 and the integration of cutting-edge technologies like the Internet of Things (IoT), as servo motors are essential to automated solutions and intelligent machinery. The escalating demand in electric vehicles and renewable energy sectors also contributes to this growth, given their necessity for advanced control systems. In addition, continuous advancements in technology, including the creation of compact and energy-saving servo motors, are driving market expansion by improving performance and lowering operational expenses. When combined, these factors provide a solid basis for the market expansion for servo motors.

Servo Motors Market Definition

Servo motors are advanced electric drive systems engineered for the meticulous regulation of angle or linear displacement, speed, and acceleration. These devices usually integrate feedback mechanisms to guarantee precise motion and positioning across a wide range of applications.

Servo motors are essential components in contemporary automation and robotics, attributed to their exceptional precision and control features. Engineered for precise positioning, speed regulation, and torque output, they are particularly suited for tasks that demand meticulous movements, such as in robotic arms, CNC machinery, and medical equipment. Their operation within closed-loop systems allows for immediate feedback and modifications, which ensures peak performance. Furthermore, servo motors accommodate a range of control techniques, incorporating both analog and digital signals, which broadens their applicability across various sectors. As technological advancements progress, the significance of servo motors is increasingly recognized, fueling innovations in automation and precision engineering.

Servo Motors Market Segmental Analysis:

Insights On Type

AC Servo Motors

AC Servo Motors are expected to dominate the Global Servo Motors Market due to their superior efficiency, precise control, and enhanced performance in different applications. Their capability to provide high torque at various speeds makes them highly suitable for robotics, CNC machinery, and automation systems. With the rising demand for energy-efficient solutions and the increase in automation processes across industries like manufacturing, automotive, and aerospace, AC Servo Motors are becoming the go-to choice. Furthermore, technological developments have produced strong and small AC servo motors, increasing their use in a wide range of industrial applications.

DC Servo Motors

DC Servo Motors hold a significant position in the market, primarily in applications where speed control and quick response are critical. They are commonly used in low-power applications such as hardcover binding machines, conveyors, and tiny robots. The ease of control with a simple voltage change makes DC Servo Motors favorable for tasks requiring specific speed and position adjustments. Despite being overshadowed by AC models, the demand for DC Servo Motors continues to persist, especially in niche areas and older systems that still rely on this technology, ensuring their relevance in the market.

Insights On Voltage Range

Low Voltage

The Low Voltage is expected to dominate the Global Servo Motors Market due to its widespread application across various industries such as manufacturing, robotics, and automotive. Low voltage servo motors are highly efficient and versatile, enabling precise control over motion and speed. Their ability to operate effectively in compact systems while delivering significant torque and speed makes them a preferred choice for many applications. Low voltage servo motor use is also accelerated by the growing trend toward automation and the growing need for energy-efficient solutions. These factors collectively contribute to maintaining a strong market presence for Low Voltage servo motors.

Medium Voltage

The Medium Voltage category, while not as dominant as Low Voltage, still plays a critical role in specific industrial applications. These motors are typically employed in larger machinery and systems where higher power levels are necessary. Industries like oil and gas, mining, and large manufacturing setups often leverage medium voltage servo motors for their ability to handle higher loads and deliver efficient performance. As automation advances and industries seek to increase operational efficiency, the medium voltage range remains an essential part of the servo motor market, catering to specialized applications.

High Voltage

The High Voltage is primarily focused on applications requiring significant power outputs, such as in heavy industries and large-scale operations. These motors are suitable for driving heavy machinery, turbines, and pumps. However, the market for high voltage servo motors is comparatively smaller due to the niche applications and the complexity of installation and operation. As industries continue to emphasize energy efficiency and compact design, the high voltage category is likely to see limited growth, primarily serving specific high-demand sectors rather than experiencing broad market expansion.

Insights On Application

Industrial Machinery

Because of the growing need for automation in manufacturing processes, the global servo motors market is anticipated to be dominated by industrial machinery. Servo motors are being used by industries more and more to improve production line accuracy and efficiency. One major element propelling this expansion is the rise of smart factories and Industry 4.0 efforts. Servo motors offer superior control and responsiveness, making them preferable for applications such as CNC machines and robotic arms. The rising need for improved performance and reduced operational costs in manufacturing will further strengthen the position of industrial machinery in the servo motors market.

Automotive

The automotive industry is another critical area for the application of servo motors, especially with the ongoing trend of electrification and automation in vehicles. Automotive manufacturers utilize servo motors for precise control in assembly lines, enhancing productivity and ensuring quality. Moreover, advanced driver-assistance systems (ADAS) and autonomous vehicles are further pushing the demand for servo motors, as they are integral to the functioning of electric steering systems, braking, and other precision applications. As the automotive sector continues to innovate, the reliance on servo motors is anticipated to significantly grow.

Electronics

In the electronics industry, servo motors play a vital role in the manufacturing processes of various electronic devices, including computers, smartphones, and other consumer gadgets. They are utilized for precision movements in assembly equipment, which is essential for achieving high-quality production standards. Additionally, the rising trend of miniaturization in electronic components requires highly accurate motion control, further boosting the demand for servo motors. As technology evolves and the demand for electronics increases, this sector is expected to maintain a strong presence in the servo motors market.

Aerospace & Defense

The aerospace and defense sector is known for its strict requirements for reliability and performance, making servo motors a critical component in numerous applications. These motors are utilized in flight control systems, robotic applications, and manufacturing processes for aerospace components, where precision and redundancy are paramount. As countries increase their defense budgets and invest in advanced technologies, the need for reliable motion control in aerospace and defense applications will promote steady growth for servo motors within this.

Healthcare

In the healthcare sector, servo motors are used in various medical devices and equipment, such as surgical robots, imaging systems, and patient care devices. The growing trend towards minimally invasive surgeries and robotic-assisted procedures is driving demand for high-precision servo motors that contribute to enhanced accuracy and reduced recovery times for patients. Furthermore, advancements in telemedicine and remote healthcare technologies highlight the growing reliance on sophisticated equipment, ensuring that servo motors continue to have a substantial presence in the healthcare application landscape.

Others

The "Others" category includes a range of uses for servo motors, such as printing, textiles, and packaging. Servo motors are valued in these sectors for their capacity to improve product quality and offer accurate motion control. The use of servo motors in these many applications is anticipated to increase as production processes change with an emphasis on efficiency and automation. This may not dominate the overall market but is nonetheless significant in contributing to the versatility and applicability of servo motors in numerous sectors.

Insights On End-User

Robotics

Among the various categories of end-users in the global servo motors market, robotics is anticipated to dominate the landscape. The increasing adoption of automation across industries is a significant driver, as robotics enhances precision, efficiency, and productivity in manufacturing processes. Moreover, advancements in artificial intelligence and the expansion of the Internet of Things (IoT) are leading to more sophisticated robotic applications. These trends are fostering a robust demand for servo motors, which are crucial for providing high-performance control in various robotic systems. Consequently, the synergy of innovation in robotics and increased investments are solidifying its position as the leading user of servo motors.

Manufacturing

Manufacturing is a vital category in the global servo motors market due to its extensive use in automated assembly lines, CNC machines, and process control systems. The ongoing trend of digital transformation within this sector emphasizes the need for precise and efficient machinery, directly benefiting the demand for servo motors. As manufacturers seek to improve operational efficiencies and reduce waste, the is experiencing steady growth. Furthermore, the rise in smart factories is propelling investments in advanced manufacturing technologies, enhancing the relevance of servo motors in various applications.

Packaging

The packaging industry also plays a significant role in the global servo motors market. The demand for high-speed, accurate packaging processes is increasing due to consumer preferences for convenience and sustainability. Servo motors are crucial in packaging machinery, enabling dynamic changes in speed and position for various packaging formats. Enhanced performance and precision lead to reduced material wastage and improved production timelines. As the packaging sector continues to innovate and adopt automation technologies, the need for servo motors in this industry is projected to contribute positively to its growth, albeit at a slower pace compared to robotics.

Others

The "Others" category represents an array of industries utilizing servo motors, including aerospace, automotive, and healthcare. Although this might not exhibit the same level of growth as robotics or manufacturing, it is essential to note that niche applications in specialized fields hold significant potential. For instance, in the aerospace sector, servo motors offer critical functions for flight control surfaces, while in healthcare, they enhance the precision of surgical robots. The diversification across multiple industries, while varied in growth rates, showcases the versatility and importance of servo motors in applications beyond traditional manufacturing, leading to a consistent demand within this category.

Global Servo Motors Market Regional Insights:

Asia Pacific

The Asia Pacific region is expected to dominate the Global Servo Motors market due to several key factors. This region is witnessing rapid industrialization and urbanization, which increases demand for automation and advanced manufacturing technologies. Countries like China, Japan, and India are at the forefront of adopting servo motors in various applications ranging from robotics to automotive manufacturing. Additionally, the presence of major manufacturers and suppliers in the region contributes significantly to market growth, as companies invest in research and development to innovate and improve servo motor technologies. The increasing focus on renewable energy, coupled with smart manufacturing and Industry 4.0 initiatives, further solidifies Asia Pacific’s position as the leading market for servo motors.

North America

In North America, the servo motors market is driven by advancements in technology and a high degree of automation across multiple industries. The region is home to many leading manufacturers and has strong infrastructure for research and development. The automotive, electronics, and aerospace sectors are significant users of servo motors, prompting continuous innovation and growth. However, the market's growth is tempered by competition from Asia Pacific manufacturers who can offer lower costs, making North America a steady but secondary market.

Europe

Europe ranks prominently in the servo motors market due to its robust manufacturing sector and emphasis on automation and efficiency. Countries like Germany, Italy, and the UK are leading in the adoption of Industry 4.0 practices, directly correlating to increased usage of servo motors. The region focuses on energy efficiency, contributing to a growing demand for smart and sustainable manufacturing solutions. However, regulatory challenges and stringent safety standards can impede market growth in some areas, making Europe competitive but not dominant.

Latin America

The Latin American servo motors market is emerging but remains significantly behind the leading regions. The growth is primarily driven by the increasing industrial base and modernization of manufacturing processes. Countries such as Brazil and Mexico are showing potential for market expansion due to foreign investments and economic development initiatives. Still, the region faces challenges such as economic instability and logistics issues, which can slow down the overall adoption of servo motor technologies.

Middle East & Africa

In the Middle East & Africa, the servo motors market is gradually developing, propelled by ongoing investment in infrastructure and industrial projects. Countries like the UAE and South Africa are focusing on diversifying their economies away from oil dependency, leading to investments in automation and manufacturing. However, political instability and economic challenges hinder faster market growth. The potential exists, but currently, this region is not close to dominating the global servo motors market like Asia Pacific.

Servo Motors Competitive Landscape:

Prominent participants in the worldwide servo motors sector, encompassing producers, vendors, and distributors, propel innovation and foster competition by creating cutting-edge technologies and offering customized solutions for a range of applications. Their collaborative alliances and financial investments contribute to market expansion and boost operational efficiency across different industries.

Prominent entities within the servo motors industry encompass Siemens AG, Mitsubishi Electric Corporation, Rockwell Automation, Inc., Schneider Electric SE, ABB Ltd., Yaskawa Electric Corporation, Emerson Electric Co., FAULHABER Group, NSK Ltd., Parker Hannifin Corporation, Oriental Motor Co., Ltd., Kollmorgen Corporation, Fanuc Corporation, Bosch Rexroth AG, and SANYO DENKI CO., LTD.

Global Servo Motors COVID-19 Impact and Market Status:

The Covid-19 pandemic caused significant interruptions in supply chains and manufacturing processes, resulting in a short-term decrease in the worldwide market for servo motors. Simultaneously, it hastened the integration of automation across diverse sectors.

The COVID-19 pandemic exerted a profound influence on the servo motors sector, chiefly by disrupting supply chains and hindering manufacturing operations. The implementation of lockdowns and social distancing protocols resulted in the temporary closure of factories, especially in manufacturing-dependent regions, which diminished production capabilities. Additionally, economic uncertainties led to a decrease in demand from various industries, including automotive and consumer electronics, further constraining market expansion.

Conversely, the crisis prompted a rapid shift towards automation and robotics as organizations aimed to increase operational efficiency and lower their dependence on human labor amid health concerns. This transformation generated new prospects for the servo motors market, particularly in fields like automation, robotics, and advanced manufacturing solutions. As economies began to stabilize, a resurgence in the demand for servo motors emerged, fueled by an increased emphasis on automation and innovations in technology. In summary, while the pandemic presented significant obstacles, it also fostered opportunities for evolution and progress within the industry.

Latest Trends and Innovation in The Global Servo Motors Market:

- In July 2023, Siemens acquired the industrial automation company, Webdyn, enhancing its portfolio in IoT-enabled servo motors and drive systems, furthering its commitment to smart manufacturing solutions.

- In April 2023, Mitsubishi Electric announced the launch of its latest series of servo motors, the MELSERVO-J5, which features advanced AI and machine learning capabilities to optimize performance and energy efficiency in automation processes.

- In March 2023, Yaskawa Electric Corporation introduced a new line of Sigma-7 servo motors that offer unprecedented precision and speed, improving overall productivity in robotics and CNC machinery.

- In January 2023, Panasonic announced a strategic partnership with ABB to develop next-generation servo motor technologies focused on sustainable energy solutions, aiming to reduce carbon emissions in manufacturing.

- In October 2022, Rockwell Automation acquired AVATA, a consulting firm specializing in digital transformation, which includes innovations in industrial automation and servo motor applications to enhance operational efficiency.

- In September 2022, Schneider Electric expanded its EcoStruxure Automation platform to include enhanced predictive maintenance features for servo motors, allowing for better real-time monitoring and reducing downtime.

- In August 2022, Kollmorgen launched its new suite of robotic servo motors designed specifically for collaborative robots (cobots), enhancing their safety and performance metrics in manufacturing environments.

- In June 2022, Fanuc Corporation announced the integration of its servo motors with advanced AI capabilities, capable of predictive analytics to streamline manufacturing processes and improve machine learning accuracy.

- In February 2022, Bosch Rexroth introduced the IndraDyn S series of servo motors, featuring a compact design and higher torque density, targeting the growing demand for space-saving automation solutions.

- In December 2021, National Instruments collaborated with several leading universities to research next-generation servo motor applications in robotic systems, focusing on enhanced agility and responsiveness in automated processes.

Servo Motors Market Growth Factors:

The expansion of the servo motor market is fueled by innovations in automation technology, a ened demand for precision in engineering, and the growing integration of robotics across various sectors.

The market for servo motors is experiencing remarkable growth fueled by several pivotal factors. Primarily, the escalating need for automation in diverse sectors such as manufacturing, automotive, and robotics highlights the significance of accurate motion control, which, in turn, drives the adoption of servo motors. Additionally, technological advancements—especially the incorporation of the Internet of Things (IoT) and artificial intelligence—are improving the efficiency and performance of these systems, making them increasingly attractive to manufacturers focused on enhancing productivity.

Moreover, the rising preference for energy-efficient technologies bolsters the market, as servo motors offer greater energy savings in comparison to conventional motors. The burgeoning renewable energy sector, especially in wind and solar technologies, further stimulates demand, given that servo motors play a vital role in optimizing processes for energy conversion.

Investment in research and development is also on the rise, leading to innovations in servo motor drivetrains that broaden their capabilities and applications. Furthermore, the growing focus on miniaturization and compact design in consumer electronics and medical devices reinforces the ongoing demand for high-performance servo motors. As industries continue to prioritize automation and precision engineering, the servo motors market is set for significant growth in the years ahead.

Servo Motors Market Restaining Factors:

Significant limiting factors impacting the servo motor market encompass elevated initial expenses and the intricate nature of their installation and upkeep.

The Servo Motors Market encounters multiple obstacles that impede its expansion. One notable challenge is the substantial upfront investment needed for sophisticated technological components, which can deter small and medium enterprises from entering this space. Additionally, the intricate nature of servo motor systems necessitates expertise for proper installation and configuration, leading to ened training expenses and operational difficulties. Rapid advancements in technology may contribute to the obsolescence of current systems, causing manufacturers to hesitate in committing to new servo motor innovations. The presence of alternative motion control technologies, like stepper motors, which are generally more cost-effective and simpler to implement, adds competitive strain to the servo motor sector. Moreover, disruptions in the supply chain, highlighted by recent global incidents, can impede timely manufacturing and delivery processes, ultimately impacting project schedules. Nevertheless, the rising demand for automation across diverse industries, along with the evolution of smart technologies and increased investment in robotics, offers an optimistic perspective for the servo motors market. With industries actively seeking efficiency improvements and continuing to innovate, the future for servo motors looks promising, fostering enhanced performance and broader adoption.

Key Segments of the Servo Motors Market

By Type

• AC Servo Motors

• DC Servo Motors

By Voltage Range

• Low Voltage

• Medium Voltage

• High Voltage

By Application

• Automotive

• Electronics

• Industrial Machinery

• Aerospace & Defense

• Healthcare

• Others

By End-User

• Manufacturing

• Robotics

• Packaging

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America