Market Analysis and Insights:

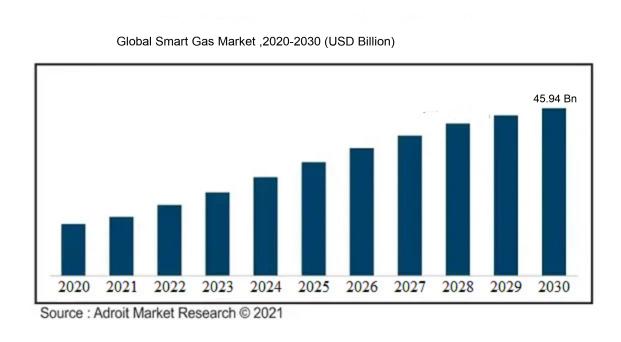

The market for Smart Gas was estimated to be worth USD 15.64 billion in 2022, and from 2023 to 2030, it is anticipated to grow at a CAGR of 17.34%, with an expected value of USD 45.94 billion in 2030.

The smart gas market is being primarily driven by several key factors. One significant factor is the global demand for energy solutions that are both efficient and sustainable, which is spurring the growth of smart gas technologies. Concerns regarding greenhouse gas emissions and the imperative to decrease carbon footprint have propelled the adoption of cutting-edge innovations like smart gas meters, enabling precise consumption monitoring and enhanced demand management. Moreover, the implementation of smart grid systems and the evolution of IoT technology have streamlined the incorporation of smart gas solutions, further accelerating market expansion.

Additionally, governments and regulatory bodies worldwide are incentivizing and endorsing the utilization of smart gas systems through supportive policies, creating a conducive market landscape. Furthermore, the surge in urbanization and industrial development in emerging economies has led to an escalated demand for gas infrastructure, consequently stimulating the uptake of smart gas solutions. In essence, the overarching drivers propelling the smart gas market include the escalating need for energy efficiency, environmental conscientiousness, and operational efficacy enhancement.

Smart Gas Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2018-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | USD 45.94 billion |

| Growth Rate | CAGR of 17.34% during 2023-2030 |

| Segment Covered | By Technology , By Type, By Component , By End user, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Honeywell International Inc., ABB Ltd., Sensus (Xylem Inc.), Itron Inc., Schneider Electric SE, Badger Meter Inc., Landis+Gyr (Toshiba Corporation), Siemens AG, Master Meter Inc., and Aclara Technologies LLC. |

Market Definition

Intelligent gas pertains to the utilization of cutting-edge technology and Internet of Things (IoT) applications within the natural gas sector, facilitating remote supervision and management of gas pipelines and associated infrastructure to enhance operational efficiency and safety. This involves the integration of sensors, communication systems, and data analysis to enhance gas distribution and utilization. Intelligent gas technology stands as a crucial asset in contemporary society for various compelling reasons. Its foremost benefit lies in facilitating the efficient and precise monitoring of gas consumption, thus minimizing unnecessary waste and advocating for energy preservation. Moreover, this technology offers the capability of swiftly identifying gas leaks and potential safety risks in real-time, thereby safeguarding lives and avert accidents.

Additionally, smart gas systems yield invaluable insights through data analysis, which can be leveraged to streamline supply chain operations and enhance distribution networks, ultimately leading to cost efficiencies for all stakeholders involved. Furthermore, the seamless integration of smart gas technology with other cutting-edge devices and systems enables automated processes and remote access, thereby augmenting user convenience and adaptability. The advent of smart gas technology holds immense potential for transforming the gas sector by boosting efficiency, improving safety standards, and fostering economic advantages.

Key Market Segmentation:

Insights On Key Technology

Advanced Metering Infrastructure (AMI)

Advanced Metering Infrastructure (AMI) is expected to dominate the Global Smart Gas Market. AMI technology enables real-time data collection and communication between utility companies and gas meters. This allows for more accurate and timely meter readings, improved monitoring of gas consumption patterns, and enhanced billing and operational efficiency. The integration of AMI technology also enables remote control and management of gas networks, helping to optimize distribution and reduce maintenance costs. With its advanced capabilities and benefits, AMI is poised to revolutionize the gas industry and drive the growth of the Global Smart Gas Market. (108 words) Automated Meter Reading (AMR) Automated Meter Reading (AMR) is another important part within the By Technology category of the Global Smart Gas Market. AMR technology allows for remote reading of gas meters, eliminating the need for manual meter reading. This technology automates the process of collecting gas consumption data, providing more accurate billing and reducing human errors. Although AMR offers advantages in terms of efficiency and cost-saving, it is expected to have less dominance compared to the AMI technology. While the AMR will continue to play a significant role in the Smart Gas Market, the advanced capabilities of AMI are likely to overshadow AMR in terms of market dominance. (109 words)

Insights On Key Type

Smart Ultrasonic Gas Meter

The Smart Ultrasonic Gas Meter is expected to dominate the Global Smart Gas Market. Ultrasonic gas meters are widely used for accurate measurement of gas flow with high-precision technology. These meters utilize ultrasonic sound waves to measure gas flow, providing improved accuracy, reliability, and efficiency compared to traditional diaphragm gas meters. The growing demand for smart meters that offer advanced features such as remote monitoring, data analytics, and real-time data transmission is driving the adoption of smart ultrasonic gas meters. Additionally, the need for accurate and efficient gas measurement in sectors such as residential, commercial, and industrial is propelling the market growth of smart ultrasonic gas meters. With their superior attributes and increasing applications, smart ultrasonic gas meters are poised to dominate the global smart gas market.

Smart Diaphragm Gas Meter

Smart Diaphragm Gas Meter also holds significant market share. Diaphragm gas meters have been widely employed for gas measurement due to their cost-effectiveness and simplicity. Although they may not offer the same level of accuracy and advanced features as smart ultrasonic gas meters, they are still preferred in certain applications, especially in residential areas. The low-cost advantage and ease of installation make smart diaphragm gas meters an attractive choice for small-scale users with basic gas measurement requirements. While the market share of smart diaphragm gas meters may be lower compared to smart ultrasonic gas meters, they still play a commendable role in the global smart gas market, serving specific s and catering to different customer needs.

Insights On Key Component

Hardware

Hardware is expected to dominate the Global Smart Gas Market. Hardware components play a crucial role in the infrastructure and implementation of smart gas systems. These components include sensors, meters, communication devices, and control units that enable the monitoring, measurement, and transmission of gas consumption data. With the growing demand for efficient and reliable gas management solutions, the Hardware is anticipated to witness significant growth. It forms the foundation of smart gas systems, enabling accurate data collection and analysis, and facilitating effective gas usage management.

Software

While the Hardware is expected to dominate the Global Smart Gas Market, the Software also holds significant importance. Software applications play a vital role in data processing, analytics, and control systems within smart gas solutions. These applications enable the integration of data from various hardware components, perform real-time monitoring and analysis, and provide insights for effective gas management. The Software supports the optimization of gas usage, remote monitoring and control, leak detection, billing, and customer engagement. Although it may not dominate the market as much as the Hardware , the Software complements the hardware infrastructure and enhances the overall efficiency and effectiveness of smart gas systems.

Insights On Key End user

Residential

The Residential is expected to dominate the Global Smart Gas Market. This is primarily driven by the increasing adoption of smart gas solutions in residential households. With the rising demand for energy-efficient and sustainable solutions, residential consumers are embracing smart gas technologies to monitor and optimize gas usage in their homes. These solutions offer benefits such as real-time consumption data, remote control and monitoring capabilities, and improved safety features. Additionally, initiatives promoting smart homes and the integration of smart gas systems with other home automation technologies further contribute to the growth of this .

Commercial

The Commercial of the Global Smart Gas Market is expected to witness significant growth. Commercial establishments, including office spaces, retail stores, and hotels, are increasingly embracing smart gas solutions to enhance energy efficiency, reduce costs, and comply with sustainability regulations. Smart gas technologies offer features like automatic meter reading, leak detection, and demand-side management, which enable businesses to streamline gas consumption and optimize their operations. Moreover, the integration of smart gas systems with building management systems and other smart building technologies provides comprehensive energy management solutions for commercial entities.

Industrial

Although the Residential is expected to dominate the Global Smart Gas Market, the Industrial also plays a crucial role in its growth. Industries such as manufacturing, oil and gas, and chemicals have a substantial gas consumption demand. Smart gas technologies empower these industries to monitor gas usage, identify leakages, and enhance safety measures. By leveraging real-time data and analytics, industrial players can optimize their gas consumption, reduce operational costs, and comply with environmental regulations. Therefore, the Industrial is expected to witness substantial growth, albeit not as dominant as the Residential , in the Global Smart Gas Market.

Insights on Regional Analysis:

Based on my research and analysis, the region that is expected to dominate the global Smart Gas market is North America. This is due to several factors such as the rapid adoption of smart gas technology in countries like the United States and Canada, the presence of advanced infrastructure and communication networks, and the increasing focus on improving energy efficiency and reducing carbon emissions. Additionally, North America is home to several key players in the smart gas industry, which further strengthens its position as the dominant region in the global market.

Europe:

Europe is another significant market for smart gas solutions. The region has been at the forefront of adopting advanced technologies and implementing smart grid systems, making it a promising market for smart gas technologies as well. Factors such as strict environmental regulations, government initiatives to reduce carbon emissions, and the presence of established energy infrastructure contribute to the growth of the smart gas market in Europe. Although Europe is a strong contender, it is expected to fall slightly behind North America in terms of dominating the global market.

Asia Pacific:

The Asia Pacific region showcases immense potential for the smart gas market. Rapid urbanization, industrialization, and the increasing demand for energy in countries like China and India are driving the adoption of smart gas technologies in the region. Moreover, government initiatives promoting sustainable energy and the need for efficient management of gas resources fuel the growth of the smart gas market in the Asia Pacific. While the market is expanding rapidly, it is expected to require more time to surpass the dominance of North America in the global market.

Latin America:

Latin America is also witnessing significant growth in the smart gas market. Increased investments in natural gas infrastructure and the adoption of advanced technologies in countries like Brazil and Argentina are driving the market growth. The region's rich natural gas reserves and focus on reducing energy losses contribute to the adoption of smart gas solutions. However, Latin America still has some catching up to do in terms of dominating the global smart gas market, as it faces challenges related to infrastructure development and economic constraints.

Middle East & Africa:

The Middle East & Africa region has immense potential for the smart gas market due to the presence of significant natural gas reserves. However, factors such as political instability, limited infrastructure development, and lower energy demand compared to other regions pose challenges in the adoption of smart gas technologies. Although the region is expected to experience growth in the smart gas sector, it currently trails behind North America, Europe, Asia Pacific, and Latin America in terms of dominating the global market.

Company Profiles:

Prominent participants in the worldwide Smart Gas industry significantly contribute to fostering innovation and technological progress within the sector. Through the provision of smart gas products and services aimed at enhancing efficiency, bolstering safety measures, and minimizing waste, these industry leaders engage in competition by offering state-of-the-art technologies, broadening their global presence, and establishing strategic collaborations to attain a competitive advantage in the industry.

Prominent contributors to the smart gas industry are Honeywell International Inc., ABB Ltd., Sensus (Xylem Inc.), Itron Inc., Schneider Electric SE, Badger Meter Inc., Landis+Gyr (Toshiba Corporation), Siemens AG, Master Meter Inc., and Aclara Technologies LLC. These organizations play a vital role in advancing the smart gas sector with their wide array of offerings including gas meters, communication modules, data management systems, and analytical platforms. Targeting various consumer s like residential, commercial, and industrial, they provide solutions for effective gas monitoring, billing, and remote supervision. Through continuous innovation, product diversification, research investments, and strategic nerships, these industry leaders continuously drive the expansion and improvement of the smart gas market.

COVID-19 Impact and Market Status:

The worldwide intelligent gas sector has experienced the effects of the Covid-19 pandemic, resulting in a reduction in consumption as a consequence of economic instability and supply chain disruptions.

The global smart gas market has been significantly affected by the ongoing COVID-19 pandemic, mirroring the challenges faced by various industries worldwide. The pandemic-induced economic slowdown and disruptions in the global supply chain have resulted in a decreased demand for smart gas solutions. Government-imposed lockdowns and travel restrictions have impeded the installation and upkeep of smart gas systems, causing project delays and revenue declines. Moreover, the economic uncertainties triggered by the pandemic have compelled budget cuts and diminished investments in infrastructure and emerging technologies, thereby hindering the market's expansion. Nevertheless, with the gradual relaxation of lockdown restrictions and the revival of economic activities globally, there is expected to be a resurgence in the demand for smart gas technologies. The market is forecasted to rebound as there is an increasing emphasis on energy efficiency, sustainability, and the adoption of smart solutions to curtail operational costs within the gas industry in the post-pandemic landscape.

Latest Trends and Innovation:

- In July 2021, Itron, a technology and services company, announced its agreement to acquire Silver Spring Networks, a networking solutions provider for the energy industry.

- In January 2021, Honeywell, a multinational conglomerate, introduced a new smart gas meter solution, the Elster® 1700 Series Meter, designed to enhance accuracy and enable remote monitoring and management capabilities.

- In December 2020, Xylem, a water technology company, completed its acquisition of Sensus, a provider of smart meters, communication systems, and software for the utility industry.

- In October 2020, Itron nered with Landis+Gyr, a global provider of energy management solutions, to integrate Itron's gas measurement solutions with Landis+Gyr's AMI platform, enabling advanced analytics and improved operational efficiency.

- In August 2020, Dominion Energy, a power and energy company, entered into a nership with Uplight, a software platform provider, to develop a demand-side management program using smart gas meter data.

- In June 2020, Aclara, a provider of smart infrastructure solutions, launched its next-generation residential and commercial gas meters, featuring advanced communication capabilities and accuracy enhancements.

- In May 2020, Badger Meter, a flow measurement and control technology company, announced its acquisition of s::can GmbH, a water quality monitoring solutions provider, to expand its smart water and gas meter offerings.

- In February 2020, Itron launched its updated gas metering solutions portfolio, including advanced measurement technologies, communication modules, and software applications, to enable smarter gas distribution networks.

Significant Growth Factors:

The Smart Gas Market's expansion is driven by the rising need for effective energy management solutions and the uptake of sophisticated metering infrastructures to enhance monitoring and oversight capabilities.

The global market for smart gas is poised for significant expansion in the upcoming years driven by a multitude of factors. A notable catalyst of this growth is the surging demand for effective energy management solutions. Smart gas technologies empower utility companies to monitor and administer gas distribution networks in real time, optimizing energy usage and reducing waste. Additionally, the escalating emphasis on environmental sustainability and the imperative to curb greenhouse gas emissions are propelling the uptake of smart gas solutions. These innovative technologies facilitate automated meter reading, detection of leaks, and remote monitoring, enabling swift identification and resolution of gas leakage incidents. Furthermore, the integration of sophisticated analytics and Internet of Things (IoT) technologies within the smart gas sector is further bolstering market expansion. By leveraging these advancements, utilities can remotely monitor gas consumption trends, anticipate peak demand periods, and optimize supply operations accordingly. Moreover, government initiatives aimed at promoting the adoption of smart grid systems and smart city infrastructure are also driving the advancement of the smart gas market. Despite the potential hindrances posed by factors like high initial implementation costs and concerns surrounding data security and privacy, ongoing technological progress and the increasing acceptance of smart grid solutions are expected to sustain the steady growth of the smart gas market in the foreseeable future.

Restraining Factors:

Constraints on the Smart Gas Market stem from the restricted access to infrastructure and the substantial expenses associated with implementation.

The Smart Gas Market is poised for substantial growth in the forthcoming years; however, several factors may impede this progress. A notable obstacle is the significant upfront investment essential for implementing smart gas meters and related infrastructure, icularly burdensome for smaller gas utilities. Moreover, a scarcity of skilled labor and technical know-how, especially prevalent in developing regions, could hinder the effective deployment and upkeep of smart gas systems.

Concerns surrounding data security and privacy may also discourage consumers from embracing smart gas solutions due to their sensitive information being collected and transmitted. Furthermore, the complex and varying regulatory landscapes across different regions and countries could restrict the market's growth potential. The outbreak of the COVID-19 pandemic has also disrupted the supply chain and installation processes of smart gas solutions, temporarily hampering market expansion. Despite these hurdles, the smart gas market is anticipated to demonstrate favorable growth in the long run. The escalating adoption of smart city initiatives, coupled with a growing emphasis on energy efficiency and sustainability, is fueling the demand for smart gas solutions.

Additionally, technological advancements such as the Internet of Things (IoT) and artificial intelligence are enhancing the functionality of smart gas systems, addressing some existing limitations. As governments and energy providers intensify efforts to reduce greenhouse gas emissions and enhance energy management, the demand for smart gas solutions is forecasted to soar, creating promising prospects for market participants in the future.

Key Segments of the Smart Gas Market

Technology Overview

• Automated Meter Reading (AMR)

• Advanced Metering Infrastructure (AMI)

Type Overview

• Smart Ultrasonic Gas Meter

• Smart Diaphragm Gas Meter

Component Overview

• Hardware

• Software

End-User Overview

• Residential

• Commercial

• Industrial

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America