Smart Harvest Market Analysis and Insights:

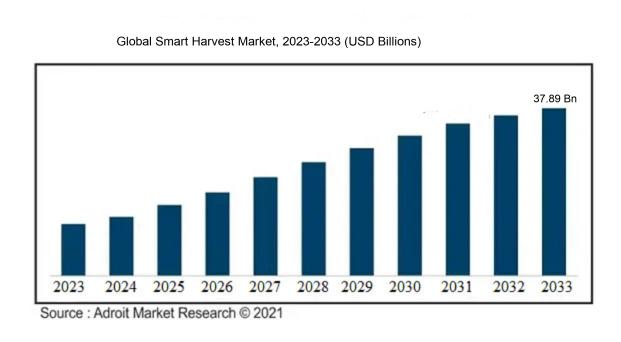

The market for Smart Harvest was estimated to be worth USD 12.73 billion in 2023, and from 2023 to 2033, it is anticipated to grow at a CAGR of 10.79%, with an expected value of USD 37.89 billion in 2033.

The rise in global population and the subsequent surge in food demand are compelling farmers to embrace smart harvest techniques to enhance productivity and efficiency. Additionally, the increasing adoption of precision agriculture, which utilizes technology to optimize farming processes, is fueling the need for smart harvest solutions. The desire to minimize labor costs, enhance yield quality, and reduce post-harvest losses is further propelling market growth. The integration of automation and robotics in agriculture is also accelerating the uptake of smart harvest technologies. Moreover, government initiatives supporting smart agriculture practices are incentivizing farmers to integrate these solutions. Increased awareness of the advantages of smart harvest, like reduced environmental impact and better resource management, is positively influencing the market. Overall, these factors are anticipated to drive the Global Smart Harvest Market's expansion in the foreseeable future.

Smart Harvest Market Definition

Global Smart Harvest involves leveraging sophisticated technologies like robotics and sensors to maximize productivity and effectiveness across the global agricultural industry. This entails merging automation and data analysis to simplify farming operations and ultimately boost crop production.

The significance of global smart harvest lies in its capacity to transform agricultural methods, enhance productivity, and boost crop yields. Cutting-edge technologies like robotics, artificial intelligence, and remote sensing empower farmers to automate operations, monitor plant wellness, and enhance the efficiency of resource allocation. This results in decreased reliance on manual labor, decreased ecological footprint, and ened profitability. Furthermore, smart harvesting systems offer greater precision and accuracy, leading to reduced wastage and ensuring top-notch agricultural output. Given the current obstacles of climate change, population expansion, and food security, smart harvest emerges as a vital factor in supporting sustainable and robust agricultural techniques worldwide.

Smart Harvest Market Segmental Analysis:

Insights On Key Component

Harvesting Robots

Harvesting Robots are expected to dominate the Global Smart Harvest Market. These robots are designed specifically for agricultural harvesting tasks, and their use in smart harvesting systems offers several advantages. Harvesting robots are equipped with advanced technologies such as computer vision, machine learning, and robotic arms to identify and pick ripe crops accurately. They can significantly enhance efficiency, reduce labor costs, and minimize human errors in harvesting operations. The growing demand for high-quality and fresh produce, coupled with the increasing need to optimize productivity, is driving the adoption of harvesting robots in the agricultural sector. Additionally, the ability of these robots to work autonomously, even in challenging terrain or adverse weather conditions, further contributes to their dominance in the global smart harvest market.

Automation & Control Systems

Automation & Control Systems play a vital role in enabling smart harvesting processes. These systems are responsible for managing and controlling various components of the smart harvest system, such as robotics, imaging systems, and sensors. While they are integral to the functioning of smart harvesting, automation and control systems are not expected to dominate the global smart harvest market on their own. They act as the backbone, providing the necessary infrastructure and coordination for other components to operate efficiently. With their ability to streamline operations, ensure seamless integration, and optimize resource utilization, automation and control systems significantly contribute to the overall effectiveness of smart harvesting systems.

Imaging Systems

Imaging Systems form a crucial sector of the Global Smart Harvest Market by providing valuable data and insights for crop monitoring and analysis. These systems, including cameras and drones, capture images of the crops, enabling farmers to assess crop health, identify disease or pest infestations, and make informed decisions for improved crop management. While imaging systems are an essential component in smart harvesting, they are not expected to dominate the market independently. Their primary purpose is to support other components such as harvesting robots, sensors, and software by providing real-time data and visual information for efficient decision-making.

Sensors

Sensors play a vital role in collecting real-time data from the field, ensuring precise crop monitoring and analysis. These sensors detect parameters such as soil moisture, temperature, humidity, and plant health indicators, providing valuable insights to farmers. While sensors are integral to the functioning of smart harvesting systems, they are not anticipated to dominate the global smart harvest market solely. Rather, sensors work in conjunction with other components such as automation systems, harvesting robots, imaging systems, and software to optimize agricultural operations and improve overall efficiency.

Software

Software acts as the brain behind smart harvesting systems, enabling effective data analysis, decision-making, and control. Smart harvesting software facilitates crop monitoring, data integration, automation, and predictive analytics. It plays a crucial role in optimizing resource allocation, scheduling, and overall operational efficiency. While software is an essential component in smart harvesting, it is not projected to dominate the market independently. Software works hand in hand with other components such as harvesting robots, imaging systems, sensors, and automation and control systems to ensure seamless integration and enable comprehensive smart harvest solutions.

Insights On Key Crop Type

Fruits

Fruits are expected to dominate the Global Smart Harvest Market. The fruit part holds significant potential due to the increasing demand for automated harvesting solutions in the fruit industry. Smart harvesting technologies offer benefits such as increased efficiency, yield optimization, reduced labor costs, and enhanced quality control. Moreover, the perishable nature of fruits requires timely and accurate harvesting, making smart harvest solutions crucial in ensuring optimal harvest timing. With the growing emphasis on sustainable and precision agriculture practices, the adoption of smart harvest technologies in the fruit sector is projected to witness substantial growth.

Vegetables

While fruits are expected to dominate the Global Smart Harvest Market, the vegetable part also holds considerable potential. As the demand for fresh and high-quality vegetables rises, farmers are increasingly seeking methods to automate and optimize their harvesting processes. Smart harvest technologies provide solutions for efficient and precise vegetable harvesting, including crop sensing, robotic picking, and automated sorting. These technologies offer advantages such as increased productivity, reduced post-harvest losses, and improved resource management. Therefore, the vegetable part is anticipated to experience significant growth as more farmers adopt smart harvesting techniques to meet the rising demand for vegetables worldwide.

Insights On Key Site of Operation

Greenhouse

The sector that is expected to dominate the Smart Harvest Market is the Greenhouse. With the rising demand for controlled environment agriculture, the use of greenhouses has become increasingly popular. Greenhouses offer the advantage of providing a protected and optimized environment for plants, allowing for year-round cultivation and improved crop quality. This part is driven by the need for sustainable farming practices, higher productivity, and efficient resource utilization. Furthermore, advancements in greenhouse technologies such as automation, artificial intelligence, and IoT integration are further enhancing the growth of this part.

Indoor

The Indoor site, while not dominating the Smart Harvest Market, still holds significant potential. Indoor farming involves cultivating crops in a completely controlled environment, usually in buildings or warehouses. This part addresses challenges related to limited land availability, adverse weather conditions, and urbanization. Indoor farming offers advantages such as higher crop yield, reduced water usage, and the ability to grow crops in urban areas. However, the higher initial investment costs and energy consumption limit its widespread adoption. Despite this, the Indoor part is witnessing growth due to innovations in vertical farming, hydroponics, and aeroponics, making it a viable option for certain crops and regions.

On-field

The On-field site, although not expected to dominate the Global Smart Harvest Market, continues to play a crucial role in traditional agriculture practices. This part refers to the conventional method of crop cultivation in open fields. While it involves more reliance on natural conditions and manual labor, on-field farming still holds a significant share in the agricultural industry. Many factors such as the lower cost of implementation, access to natural sunlight, and vast land availability contribute to the continued relevance of on-field farming. However, challenges related to climate change, pest control, and limited productivity growth are driving the industry to explore smart harvest technologies and practices. Although on-field farming is not the dominant part, it remains an integral part of the overall market.

Global Smart Harvest Market Regional Insights:

Asia Pacific

Asia Pacific is expected to dominate the global smart harvest market. This region is home to some of the largest agricultural economies, such as China and India, which have a high demand for advanced farming technologies. Additionally, the increasing population and rising disposable income levels in countries like China and India have led to a greater need for efficient farming techniques to sustain food production. The governments in these countries are also promoting the adoption of smart farming practices, further driving the growth of the smart harvest market in the region. Furthermore, advancements in precision agriculture and automation technologies in Asia Pacific are enabling farmers to enhance their crop yield and reduce labor costs, making smart harvest systems increasingly attractive. With these factors in mind, Asia Pacific is poised to dominate the global smart harvest market.

North America

North America is a significant market for smart harvest solutions. The region has a highly developed agricultural industry with a strong emphasis on technological advancement and innovation. The adoption of smart farming techniques, including smart harvest systems, is high among North American farmers, owing to factors such as the need for increased productivity, reducing labor costs, and preserving environmental resources. Moreover, the presence of major market players and research institutions focused on agricultural technology in countries like the United States and Canada further contributes to the growth of the smart harvest market in North America. While North America is expected to have considerable growth in the smart harvest market, it may not surpass Asia Pacific in terms of dominance.

Europe

Europe is another important region in the global smart harvest market. The region has a well-established agricultural sector and a high demand for advanced farming practices to ensure sustainable food production. European countries, such as Germany, France, and the Netherlands, are renowned for their advanced farming technologies and precision agriculture methods. Furthermore, the European Union has implemented several policies and programs to promote sustainable agriculture and encourage the adoption of smart farming solutions. The presence of innovative startups and collaborative efforts between industry players and research institutions also contribute to the growth of the smart harvest market in Europe. However, while Europe is expected to show significant growth, it may not dominate the global smart harvest market compared to Asia Pacific.

Latin America

Latin America is an emerging market for smart harvest solutions. The region has vast agricultural land, and countries like Brazil and Argentina are major agricultural producers. The adoption of smart farming practices, including smart harvest systems, in Latin America is driven by factors such as the need to improve productivity, reduce labor costs, and mitigate the impacts of climate change. Moreover, the implementation of government initiatives to modernize agriculture and increasing investments in agri-tech startups contribute to the growth of the smart harvest market in the region. However, Latin America may not dominate the global smart harvest market as it faces challenges related to limited infrastructure in rural areas and the need for greater awareness and education about the benefits of smart farming technologies.

Middle East & Africa

The Middle East & Africa region is also gaining traction in the smart harvest market, albeit at a slower pace compared to other regions. The region faces challenges such as limited water resources, harsh climatic conditions, and limited arable land. However, countries like Israel and South Africa are leading the way in adopting smart farming technologies to overcome these challenges and improve agricultural productivity. The use of precision agriculture techniques, such as drip irrigation and sensor-based monitoring systems, is helping optimize crop yields and reduce water consumption in arid regions. While the Middle East & Africa region shows potential for growth in the smart harvest market, it may not dominate the global market due to its unique challenges and lower adoption rates compared to other regions.

Global Smart Harvest Market Competitive Landscape:

Prominent figures within the worldwide Smart Harvest industry engage in the creation and production of cutting-edge agricultural innovations and equipment designed to automate the harvesting procedure and enhance crop output. Their focus lies in bolstering sustainable farming methods and maximizing yields. Additionally, these entities offer intelligent technologies like sensors, artificial intelligence, and data analytics for monitoring and evaluating crop development, aiming to minimize manual labor and enhance operational efficiency across the agricultural domain.

Leading companies in the global smart harvest industry encompass Robert Bosch GmbH, Deere & Company, Trimble Inc., AGCO Corporation, AgJunction Inc., Teejet Technologies, Lely Holding S.a.r.l., Harvest Automation, Inc., GEA Group AG, BouMatic, Ploeger Oxbo Group, and AVL Motion B.V. These entities are actively engaged in the advancement and implementation of smart harvesting solutions, notably harvesting robots, self-directed vehicles, and precision farming technologies. By persistently fostering innovation, they strive to augment crop productivity, curtail labor expenditures, and refine overall operational efficiency within the agricultural sphere. Furthermore, these key players prioritize strategic partnerships, alliances, and acquisitions to extend their clientele, fortify market presence, and attain a competitive advantage in the worldwide smart harvest domain. Cumulatively, these enterprises significantly propel the progression and maturation of smart harvest technologies on a global scale.

Global Smart Harvest Market COVID-19 Impact and Market Status:

The global Smart Harvest market has been profoundly influenced by the Covid-19 pandemic, resulting in supply chain interruptions, decreased technology investments, and a redirection of attention towards crucial food production activities.

The global smart harvest market has been significantly affected by the emergence of the COVID-19 pandemic. Measures implemented by governments worldwide to mitigate the spread of the virus, such as lockdowns and social distancing protocols, have disrupted the supply chain and production of smart harvest technologies. The closure of manufacturing plants, travel restrictions, and a scarcity of labor have led to setbacks in the advancement and dissemination of smart harvest solutions. Furthermore, the financial uncertainties brought about by the pandemic have dampened consumer spending power and fostered cautious consumer behavior, impacting the demand for smart harvest technologies negatively. Nevertheless, the necessity for sustainable and effective agricultural methods to ensure food security has underscored the significance of smart harvest practices. This has opened avenues for industry participants to innovate and offer cutting-edge solutions that enhance agricultural efficiency and productivity. With the global economy slowly rebounding, it is anticipated that the smart harvest market will witness a gradual resurgence, buoyed by the increasing integration of technology and the ened emphasis on sustainable agricultural practices.

Smart Harvest Market Latest Trends & Innovations:

- In October 2020, Deere & Company, an American agriculture machinery manufacturer, announced the acquisition of Bear Flag Robotics, a California-based autonomous driving technology company, to enhance its capabilities in autonomous machines and smart farming.

- In June 2021, Trimble Inc., a US-based GPS technology and precision agriculture solutions provider, introduced its next-generation GFX-350™ display and NAV-500™ guidance controller, providing advanced features to improve efficiency and productivity in smart harvesting.

- In March 2020, Agco Corporation, a worldwide manufacturer and distributor of agricultural equipment, completed the acquisition of 151 Research, a Texas-based technology company, to incorporate its latest innovations into Agco's precision planting and smart farming solutions.

- In January 2021, Kubota Corporation, a Japanese tractor and heavy equipment manufacturer, signed a Memorandum of Understanding with Microsoft to collaborate on the development of innovative smart farming solutions leveraging artificial intelligence and Internet of Things (IoT) technologies.

- In November 2020, AGCO Corporation entered into a strategic partnership with Solinftec, a leading provider of smart agriculture solutions, to integrate Solinftec's advanced analytics and digital platforms into AGCO's machinery and equipment, enabling improved crop productivity and operational efficiency.

- In September 2021, Trimble Inc. expanded its precision agriculture solutions portfolio by acquiring Rhonda Software, a Ukraine-based company specializing in real-time monitoring and data analytics for agricultural machinery, further enhancing Trimble's smart harvest offerings.

- In December 2020, Claas, a global agricultural machinery manufacturer based in Germany, partnered with the German Aerospace Center (DLR) to develop autonomous harvesting robots, aiming to revolutionize the way crops are harvested in the future by leveraging cutting-edge technologies.

- In July 2021, Deere & Company announced the acquisition of Unimil, a Brazil-based company specializing in the production of sugarcane harvesting equipment, enabling Deere to strengthen its presence and offerings in the sugarcane harvesting market.

- In February 2021, Kubota Corporation unveiled its autonomous concept tractor, X-tractor, at the Future Farming Dialogue 2021 event. The X-tractor showcases Kubota's commitment to harnessing autonomous and smart technologies for the future of agricultural harvesting.

- In August 2020, AGCO Corporation launched its new IDEALDrive™ system, an autonomous, joystick-operated grain harvester, which integrates GPS technology and machine learning algorithms to enhance harvesting efficiency and accuracy, resulting in increased productivity.

Smart Harvest Market Growth Factors:

The expansion catalysts propelling the worldwide Smart Harvest Market encompass the rising call for precision agriculture, integration of cutting-edge technologies into farming methodologies, and the necessity for enhanced effectiveness and output in the agricultural domain.

The global smart harvest market is on the brink of substantial expansion in the forthcoming years, driven by several pivotal factors. Primary among these is the increasing embrace of cutting-edge agricultural technologies, which is significantly boosting growth. With the world's population on the rise and the imperative to enhance food production becoming more pressing, farmers are increasingly turning to smart harvest solutions to enhance operational efficiency and crop yield. Moreover, the imperative of optimizing labor resources is propelling the demand for smart harvest technologies. These innovative solutions are instrumental in curbing manual labor requirements, thereby addressing the prevalent issue of labor shortages in the agricultural sector. Further bolstering market demand is the burgeoning emphasis on precision agriculture, which is driving the adoption of smart harvest systems. Leveraging sensors, drones, and data analytics in smart harvesting empowers farmers to closely monitor crop health, optimize resource allocation, and make well-informed decisions. Additionally, growing awareness regarding the advantages of smart harvest technologies, such as reduced post-harvest losses and improved product quality, is serving as a catalyst for market expansion. Government initiatives and subsidies aimed at promoting the adoption of smart agricultural practices are also poised to propel market growth in the foreseeable future. Lastly, the increasing integration of artificial intelligence (AI) and the Internet of Things (IoT) in agriculture is opening up lucrative opportunities for smart harvest technologies. In summary, the global smart harvest market is anticipated to witness notable growth due to the uptake of advanced agricultural technologies, the imperative for labor optimization, the focus on precision agriculture, increased awareness of benefits, government backing, and the integration of AI and IoT in the agricultural domain.

Smart Harvest Market Restraining Factors:

The global smart harvest market faces growth constraints due to the insufficient recognition and implementation of advanced agricultural technologies in various regions.

The growth and advancement of the Global Smart Harvest Market are impeded by various constraints. One significant hurdle is the substantial initial investment necessary for the integration of smart harvesting technologies, which serves as a deterrent for numerous farmers, particularly those operating on a small scale and lacking the financial means to embrace such innovations. Moreover, a lack of awareness and expertise concerning smart harvesting techniques acts as a barrier to their widespread acceptance. Farmers might be reluctant to deviate from conventional methods and may not fully grasp the advantages offered by smart harvesting practices. The dependence on internet connectivity and sophisticated sensors also presents a challenge in regions with limited or unreliable network access, potentially limiting the implementation of smart harvesting systems in remote or underdeveloped locales. Additionally, apprehensions regarding data security and privacy pose potential obstacles to the uptake of smart harvesting technologies, as farmers are concerned about the risks associated with data breaches and unauthorized access to their confidential data. Despite these challenges, the Global Smart Harvest Market shows promise for growth. With ongoing technological enhancements and governmental support for smart agriculture initiatives, it is possible to surmount these barriers. The long-term benefits associated with smart harvesting, such as enhanced crop yields, increased resource efficiency, and reduced labor demands, present compelling advantages that can incentivize the adoption of these technologies. Through effective awareness campaigns, educational programs, and supportive measures, the Smart Harvest Market can address these constraints and pave the way for a more sustainable and productive future in agriculture.

Key Segments of the Smart Harvest Market

Component Overview

• Harvesting Robots

• Automation & Control Systems

• Imaging Systems

• Sensors

• Software

Crop Type Overview

• Fruits

• Vegetables

Site of Operation Overview

• Indoor

• On-field

• Greenhouse

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America