Market Analysis and Insights:

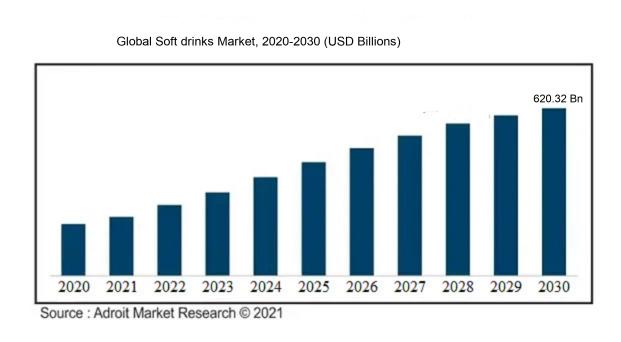

The market for soft drinks was estimated to be worth USD 412.2 billion in 2021, and from 2022 to 2031, it is anticipated to grow at a CAGR of 5.17%, with an expected value of USD 620.32 billion in 2030.

The soft drinks industry's growth and popularity are fueled by multiple factors. Changes in consumer lifestyles and rising disposable incomes have elevated the demand for convenient beverages, positioning soft drinks as a preferred option. The vast array of flavors and choices caters to diverse consumer tastes, amplifying market appeal. Major industry players' extensive marketing and promotional efforts have cultivated brand recognition and consumer loyalty. The burgeoning emphasis on health and wellness has spurred interest in healthier and functional soft drinks, featuring attributes like low sugar content and natural ingredients. The convenience of packaged soft drinks, facilitated by the proliferation of e-commerce platforms, has broadened consumer accessibility. Additionally, the global expansion of fast-food outlets and quick-service restaurants has bolstered soft drink demand as popular beverage options. These collective elements synergize to propel the continuous advancement of the soft drinks sector.

Soft drinks Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2018-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | USD 620.32 billion |

| Growth Rate | CAGR of 5.17% during 2021-2030 |

| Segment Covered | By Product , By Packaging, By Flavour, By Distribution Channel, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Coca-Cola Company, PepsiCo Inc., Keurig Dr Pepper Inc., Suntory Beverage & Food Ltd., Nestlé S.A., Danone S.A., Red Bull GmbH, Monster Beverage Corporation, The Hershey Company, and Britvic plc. |

Market Definition

Carbonated beverages, also referred to as soft drinks, are effervescent beverages that do not contain alcohol. They are composed of carbonated water, a variety of flavors, and sweetening agents, offering a lively and tasty drinking sensation. Soft drinks are enjoyed for their hydrating qualities or as a fundamental ingredient in cocktails.

Carbonated beverages play a significant role for various reasons. They offer hydration and assist in satisfying thirst, particularly in warm climates or post-exercise. Furthermore, they present a diverse array of flavors and types to suit different preferences. Moreover, these beverages contribute to social enjoyment and can enhance social interactions, such as gatherings or celebrations. They are also easily accessible and widely available, catering to a broad audience. However, it is crucial to consume carbonated beverages in moderation due to their high sugar content, which can pose health risks when consumed excessively. In summary, carbonated beverages offer a pleasurable and invigorating drink choice but maintaining a balanced and controlled intake is vital for optimal well-being.

Key Market Segmentation:

Insights On Key Product

Carbonated

Carbonated soft drinks are expected to dominate the global soft drinks market. This part includes popular beverages such as cola, lemon-lime sodas, and other carbonated drinks. Carbonated soft drinks have been a long-standing favorite among consumers worldwide, with their fizzy and refreshing taste. They have a wide range of flavors and are often associated with fun and socializing. Their popularity is bolstered by the strong presence of major global brands and extensive marketing campaigns. Despite growing concerns about the health implications of high sugar content, carbonated soft drinks continue to hold a significant market share due to their established consumer base and brand loyalty.

Non-carbonated

Non-carbonated soft drinks represent another important product within the global soft drinks market. This category encompasses beverages like ready-to-drink tea, coffee-based drinks, energy drinks, and sports drinks. Non-carbonated drinks cater to consumers seeking alternative options, often offering functional benefits or unique flavor profiles. The non-carbonated part has experienced steady growth in recent years, driven by increasing health consciousness and the demand for healthier beverage alternatives. While not expected to dominate the market, non-carbonated soft drinks are likely to continue gaining market share as consumers diversify their beverage choices.

Bottled Water

Bottled water is another product that has witnessed significant growth and is expected to maintain a strong position in the global soft drinks market. With increasing concerns about tap water quality and the growing focus on hydration, consumers are turning to bottled water as a safe and convenient option. This part includes both still and sparkling bottled water, catering to different preferences. Bottled water's popularity also extends to the on-the-go lifestyle, where it provides a portable and accessible source of hydration. As a result, bottled water is expected to remain a dominant force within the soft drinks market.

Juice Drink

The Juice drink product faces strong competition but remains a popular choice among consumers. Juice drinks offer a combination of fruit juice and other ingredients such as sweeteners or preservatives. With a variety of flavors available, juice drinks appeal to those seeking a refreshing and fruity taste experience. However, they face challenges from other beverage options such as carbonated drinks, functional drinks, and even fresh fruit juices. While not expected to dominate the market, juice drinks will continue to find their place as a favored choice among certain consumer s.

Functional Drink

Functional drinks are gaining momentum in the global soft drinks market due to their targeted health benefits. This part includes beverages enhanced with additional ingredients like vitamins, minerals, herbs, or functional ingredients such as probiotics. Consumers are increasingly seeking beverages that support their specific health needs or offer functional advantages. Functional drinks cater to this demand, providing options like sports recovery drinks, enhanced waters, and gut health beverages. Although not expected to dominate the market, the functional drink part is likely to experience continued growth as more consumers prioritize their health and seek out functional beverages.

Others

The Others category encompasses a diverse range of soft drinks that do not fall under other specific categories. This includes specialty drinks like herbal teas, kombucha, sparkling fruit juices, and other niche products. While these beverages may have dedicated consumer bases, they are unlikely to dominate the global soft drinks market due to their specialized nature. However, there may be pockets of growth and demand for these unique offerings as consumers seek out new taste experiences and differentiated beverage options.

Insights On Key Packaging

Bottles

Bottles are expected to dominate the global soft drinks market. Bottled beverages, especially carbonated soft drinks, have been popular among consumers due to their convenience, portability, and wide availability. Bottles provide a convenient way for consumers to enjoy their favorite soft drinks on the go, whether at home, in restaurants, or during outdoor activities. Additionally, bottles offer a longer shelf life compared to other packaging options, ensuring that the beverages reach consumers in a fresh and desirable state. As a result of these factors, the bottled part is likely to hold the largest market share in the global soft drinks market.

Canned

Although bottles are expected to dominate the global soft drinks market, canned beverages also hold a significant share. Canned soft drinks offer certain advantages such as being lightweight, easy to stack and store, and less prone to breakage. Cans are particularly popular in certain contexts, such as at sporting events, concerts, or vending machines, where they are often the preferred choice due to their convenience. While bottles may have a wider reach, the canned part has its own loyal customer base and continues to maintain a substantial market presence.

Soda Fountain

While bottles and cans are expected to dominate the global soft drinks market, the soda fountain plays a vital role in the foodservice industry. Soda fountains are commonly found in restaurants, fast-food chains, and food courts, offering self-service options to consumers. Although this part may not have a significant market share compared to bottles and cans in the overall soft drinks market, it is an essential part of the industry's ecosystem. Soda fountains offer a customizable experience as consumers can mix and match flavors, leading to unique drink combinations. Additionally, soda fountains attract consumers who prefer freshly mixed beverages and the opportunity to experiment with different flavors.

Insights On Key Flavour

Cola

Cola is expected to dominate the Global Soft Drinks Market. Cola-flavored soft drinks have long been a popular choice among consumers and have a strong presence in the global market. With iconic brands such as Coca-Cola and Pepsi leading the way, Cola has established itself as a timeless and universally recognized flavor. Its rich and distinct taste, combined with effective marketing strategies by major players in the industry, have solidified Cola as a dominant part in the Global Soft Drinks Market.

Citrus

Citrus is a significant flavour in the Global Soft Drinks Market, but it is not expected to dominate. Citrus-flavored soft drinks, including options like orange, lemon, and lime, have a loyal consumer base and offer a refreshing and tangy taste. However, compared to Cola, Citrus does not enjoy the same level of widespread popularity and recognition. While there are successful Citrus-flavored brands in the market, they often cater to specific regional or niche markets rather than dominating the global stage.

Others

The Others category in terms of flavor is unlikely to dominate the Global Soft Drinks Market. This category encompasses a wide range of flavors, from fruit punch to root beer to ginger ale. While there are certainly niche markets and devoted fans of these alternative flavors, they lack the universal appeal and established market dominance of Cola. Despite their unique and sometimes innovative taste profiles, the "Others" part typically resides in the shadow of Cola and Citrus in terms of market share and overall consumer preference.

Insights On Key Distribution Channel

Convenience Stores & Gas Stations

Convenience Stores & Gas Stations are expected to dominate the Global Soft drinks market. Convenience stores and gas stations have become popular and convenient destinations for consumers to purchase soft drinks. These establishments offer a wide range of soft drink options and are easily accessible to consumers, making them a convenient choice for on-the-go purchases. Additionally, convenience stores and gas stations often have extended operating hours, allowing consumers to satisfy their soft drink cravings at any time. The convenience factor, combined with the wide availability of soft drinks, makes this part the dominant player in the Global Soft drinks market.

Hypermarkets

Hypermarkets are large-scale retail establishments that combine a supermarket and a department store. They offer a wide range of products, including soft drinks, under one roof. Hypermarkets are popular among consumers due to their one-stop shopping experience, competitive pricing, and wide variety of products. The global soft drinks market is expected to grow at a significant rate in the coming years, with hypermarkets playing a crucial role in this growth. The convenience and variety offered by hypermarkets make them an attractive distribution channel for soft drink manufacturers. The market for soft drinks is segmented based on product, packaging, distribution channel, and region.

Supermarkets & Mass Merchandisers

Supermarkets and mass merchandisers are retail establishments that offer a wide range of products, including soft drinks. Supermarkets are typically smaller than hypermarkets but still offer a wide variety of products. Mass merchandisers, on the other hand, offer a limited range of products but in large quantities. Both supermarkets and mass merchandisers are popular distribution channels for soft drinks due to their convenience and wide variety of products. The global soft drinks market is expected to grow significantly in the coming years, with supermarkets and mass merchandisers playing a crucial role in this growth. The market for soft drinks is segmented based on product, packaging, distribution channel, and region.

Food Service Outlets

Food service outlets also hold a considerable share in the Global Soft drinks market. This part includes various establishments like restaurants, cafes, and fast-food chains that serve soft drinks as part of their beverage menu. With the growing trend of dining out and the popularity of fast-food chains, consumers frequently opt for soft drinks to accompany their meals. Moreover, many food service outlets offer free refills or bottomless soft drinks, further enticing consumers to choose soft drinks over other beverage options. The presence of soft drinks in food service outlets contributes to the overall dominance of this part in the Global Soft drinks market.

Online Stores & D2C

Online stores and direct-to-consumer (D2C) channels are gaining traction in the Global Soft drinks market. As e-commerce continues to grow, consumers are increasingly turning to online platforms to purchase their favorite soft drinks. The convenience of online shopping, combined with the availability of a wide range of soft drink options, attracts consumers who prefer to have their purchases delivered to their doorstep. Additionally, some soft drink manufacturers have embraced the D2C model, allowing them to forge direct connections with consumers and offer personalized products and experiences. While this part is not expected to dominate the Global Soft drinks market, it is anticipated to experience significant growth in the coming years.

Others

The "Others" comprises smaller, niche distribution channels that may include specialty stores, vending machines, and local neighborhood stores. While these distribution channels cater to specific consumer preferences or local markets, they do not hold a significant share in the overall Global Soft drinks market. The dominance of larger distribution channels mentioned earlier, such as convenience stores, supermarkets, and food service outlets, overshadows the contribution of these smaller channels. Nonetheless, these smaller distribution channels play a crucial role in catering to niche consumer demands and providing localized accessibility to soft drinks.

Insights on Regional Analysis:

Asia Pacific

Asia Pacific is expected to dominate the global soft drinks market. This region has a large and growing population, coupled with increasing urbanization and rising disposable incomes. These factors have led to a high demand for soft drinks in countries like China, India, and Indonesia. Additionally, a shift in consumer preferences towards healthier and functional beverages has also contributed to the growth of the soft drinks market in this region. The presence of major players, such as Coca-Cola and PepsiCo, who have been rapidly expanding their operations in Asia Pacific, further strengthens the dominance of this region in the global soft drinks market.

North America

North America is a significant player in the global soft drinks market. The region boasts a mature market with well-established drink brands and a high per capita consumption of soft drinks. However, the market in North America has been experiencing a slowdown due to growing health concerns related to the high sugar content in carbonated soft drinks. Consumers are shifting towards healthier alternatives like natural and functional beverages. Nevertheless, North America remains a dominant market for soft drinks, and innovative product offerings and strategic marketing campaigns by manufacturers are expected to help maintain its position in the global market.

Europe

Europe is another important market for soft drinks. The region has a well-developed infrastructure and a high level of disposable income, allowing for greater consumer spending on beverages. However, similar to North America, Europe has been witnessing a shift in consumer preferences towards healthier options, leading to a decline in carbonated soft drinks consumption. The market is responding to this change by introducing a variety of low or no-sugar alternatives, as well as functional beverages. While the soft drinks market in Europe may not dominate the global market, it continues to be an influential player due to its large consumer base and the presence of established brands.

Latin America

Latin America is a growing market for soft drinks. The region has a large and young population, rapid urbanization, and improving economic conditions, which have contributed to the increased consumption of soft drinks. Traditional favorites such as carbonated soft drinks, as well as fruit juices and other packaged beverages, are popular in Latin America. However, there has been a growing concern about the health effects of sugary drinks, leading to a shift towards healthier alternatives. Despite this, Latin America continues to be an important region for soft drink manufacturers due to its sizeable market and growth potential.

Middle East & Africa

The Middle East & Africa region is witnessing steady growth in the soft drinks market. Factors such as a growing population, increasing urbanization, and rising disposable incomes are driving the demand for soft drinks in this region. In addition to carbonated soft drinks, there is a growing preference for non-carbonated beverages such as bottled water, juices, and ready-to-drink teas and coffees. However, challenges such as water scarcity and the prevalence of stringent regulations on the sale and consumption of alcoholic beverages in some countries impact the growth of the soft drinks market in this region. While the Middle East & Africa may not dominate the global soft drinks market, it presents significant opportunities for expansion and investment for companies in the industry.

Company Profiles:

Major participants in the worldwide carbonated beverages sector, including The Coca-Cola Company and PepsiCo, exert significant influence over the field through their robust brand recognition and expansive international distribution systems, persistently unveiling novel offerings to cater to customer preferences.

Major key players in the carbonated beverage industry include The Coca-Cola Company, PepsiCo Inc., Keurig Dr Pepper Inc., Suntory Beverage & Food Ltd., Nestlé S.A., Danone S.A., Red Bull GmbH, Monster Beverage Corporation, The Hershey Company, and Britvic plc.

COVID-19 Impact and Market Status:

The global soft drinks market has experienced a notable downturn in sales as a result of the Covid-19 pandemic, attributed to disruptions in supply chains and decreased consumer expenditure.

The soft drinks market has undergone significant changes due to the impact of the COVID-19 pandemic. The implementation of lockdown measures and social distancing guidelines has led to the closure of various establishments such as restaurants, cafes, and bars, resulting in a noticeable decrease in soft drink consumption within the on-trade sector. With people spending more time at home, there has been a decline in the demand for soft drinks, causing a dip in sales and revenue for industry players. Moreover, the pandemic-induced disruptions in global supply chains have led to logistical hurdles and shortages of packaging materials, further hindering the production and distribution of soft drinks.

Despite these challenges, a shift in consumer preferences has emerged, with a greater emphasis on health and wellness driving an increased interest in healthier and functional beverage options. In response to this trend, soft drink manufacturers have introduced new products featuring reduced sugar content and natural ingredients. The surge in e-commerce platforms has also played a vital role in supporting the industry, as more consumers have turned to online channels for their soft drink purchases. In essence, while the pandemic has posed obstacles for the soft drinks market, it has also spurred innovation and adaptation within the industry, presenting new avenues for growth and development.

Latest Trends and Innovation:

- In September 2020, Coca-Cola announced the acquisition of the remaining stake in Coca-Cola Beverages Africa, becoming the sole owner of the company.

- In August 2020, PepsiCo entered into an agreement to acquire Rockstar Energy Beverages, expanding its energy drinks portfolio.

- In June 2020, Keurig Dr Pepper launched the Dr Pepper Zero Sugar, a new line extension offering a zero-sugar alternative to the classic Dr Pepper.

- In May 2020, Monster Beverage Corporation announced a strategic partnership with Coca-Cola, through which Coca-Cola would acquire a stake in the company and become the preferred distribution partner for Monster's energy drinks.

- In April 2020, PepsiCo launched MTN DEW Zero Sugar, an updated version of their popular Mountain Dew soda with no added sugars.

- In February 2020, Coca-Cola introduced the first-ever paper bottle prototype for its mineral water brand, AdeZ, as part of their sustainability efforts.

- In January 2020, Keurig Dr Pepper launched the Snapple Straight Up Tea line, expanding its ready-to-drink tea offerings.

- In November 2019, The Coca-Cola Company acquired China's leading soy milk brand, Xiamen Culiangwang Beverage Technology Co., Ltd., strengthening their presence in the Chinese market.

- In October 2019, PepsiCo acquired South Africa's Pioneer Foods, expanding its presence in the African market and diversifying its product portfolio.

- In September 2019, Keurig Dr Pepper announced a $220 million investment in their manufacturing facility in Allentown, PA, to support the production of their beverages.

Significant Growth Factors:

The soft drinks market is experiencing growth due to the rise in disposable income and shifting consumer trends favoring healthier beverage choices.

The soft drinks industry has seen remarkable growth recently, propelled by various key factors. A significant driver is the evolving consumer tastes and the increasing preference for healthier beverage choices. As consumers become more health-conscious, there is a rising demand for low-sugar, natural, and functional drinks like flavored water, herbal teas, and organic juices. This shift has prompted the development of innovative and healthier soft drink options, contributing to market expansion.Moreover, the growing middle-class population in emerging markets has resulted in higher disposable incomes and greater purchasing power, leading to increased consumption of soft drinks. The easy accessibility of soft drinks in different packaging formats, such as cans, bottles, and pouches, has also played a role in driving market growth.

Additionally, the aggressive marketing strategies employed by major players, including celebrity endorsements, social media campaigns, and product diversification, have been effective in shaping consumer preferences and driving sales. The rising popularity of ready-to-drink beverages and the development of modern retail infrastructure like supermarkets and convenience stores have further fueled the growth of the soft drinks market.

Restraining Factors:

Heightened awareness about personal well-being and escalating apprehensions regarding the elevated sugar levels found in carbonated beverages have surfaced as notable impediments for the industry.

The soft drinks industry is confronting a myriad of challenges. Primarily, the ened health consciousness among consumers has resulted in a decrease in the consumption of sugary drinks. Due to increased awareness regarding the adverse effects of excessive sugar consumption, people are increasingly turning to healthier options like bottled water and fruit juices. In addition, the surging popularity of functional beverages, such as sports and energy drinks, has intensified competition and restricted the growth prospects of traditional soft drinks. Furthermore, the implementation of stringent regulations and taxes on sugary beverages by governments globally has added further strain on the sector. These measures are aimed at combating rising obesity rates and promoting healthier living. Moreover, the soft drinks market has been affected by the global economic slowdown and fluctuations in currency exchange rates, as consumers may cut back on spending for non-essential products. Lastly, concerns about the environmental impact of producing and disposing of plastic bottles have prompted consumers to seek more sustainable alternatives, such as reusable bottles. While these challenges pose significant obstacles for the soft drinks industry, companies have the opportunity to adapt to evolving consumer preferences and enhance their product offerings. By introducing new flavors, healthier formulations, and sustainable packaging solutions, the sector can rebuild consumer confidence and foster growth in the coming years.

Key Segments of the Soft Drinks Market

Product Overview

• Carbonated Soft Drinks

• Non-carbonated Soft Drinks

• Bottled Water

• Juice Drinks

• Functional Drinks

• Others

Packaging Overview

• Bottles

• Canned

• Soda Fountain

Flavour Overview

• Cola

• Citrus

• Others

Distribution Channel Overview

• Hypermarkets

• Supermarkets & Mass Merchandisers

• Convenience Stores & Gas Stations

• Food Service Outlets

• Online Stores & D2C

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America