Market Analysis and Insights:

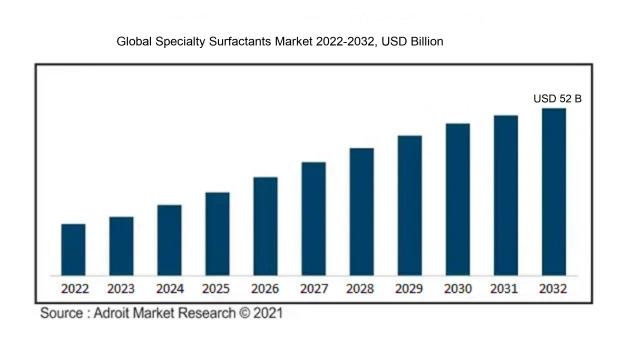

The market for Specialty Surfactants was estimated to be worth USD 34 billion in 2023, and from 2023 to 2032, it is anticipated to grow at a CAGR of 5%, with an expected value of USD 52 billion in 2032.

The Specialty Surfactants Market is fundamentally influenced by a surge in demand across multiple sectors, such as personal care, home care, and industrial uses. A ened consumer focus on environmental sustainability is driving a transition towards biodegradable and eco-friendly surfactants, encouraging manufacturers to create innovative and greener solutions. Moreover, the escalating need for high-performance surfactants in the cosmetics and toiletries s, spurred by consumer preferences for premium and multifunctional offerings, plays a significant role in the market's expansion. The growth of various end-use industries, including oil and gas, textiles, and agriculture, further amplifies the requirement for specialized surfactants. Additionally, advancements in technology and supportive regulations aimed at facilitating the development of safer and more effective surfactant options are crucial in influencing market trends. In summary, the convergence of sustainability initiatives, shifting consumer behavior, and a broadened scope of applications drives the growth of the Specialty Surfactants Market.

Specialty Surfactants Market Scope :

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2020-2023 |

| Forecast Period | 2023-2032 |

| Study Period | 2022-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 52 billion |

| Growth Rate | CAGR of 5% during 2023-2032 |

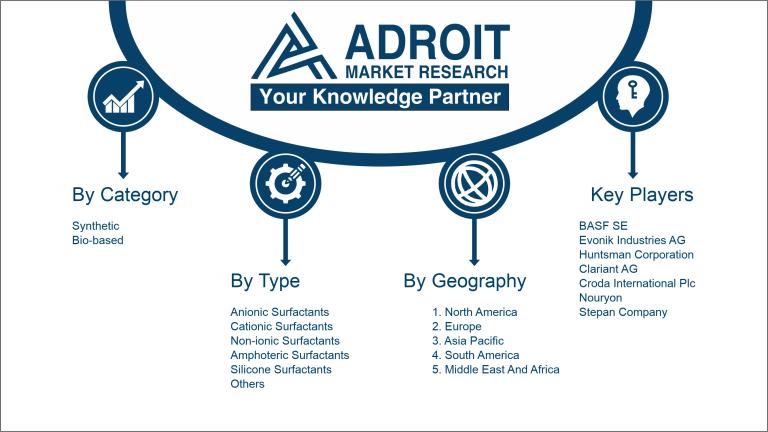

| Segment Covered | By Category, By Type, By Process, By Application, By End Use, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | BASF SE, Evonik Industries AG, Huntsman Corporation, Clariant AG, Croda International Plc, Nouryon, Stepan Company, Dow Inc., Solvay SA, Ashland Global Holdings Inc., AkzoNobel N.V., Galaxy Surfactants Ltd., and Mitsubishi Chemical Corporation. |

Market Definition

Specialty surfactants are tailored surface-active compounds developed for particular uses, including personal care products, industrial cleaning solutions, and agricultural applications. These agents exhibit distinct characteristics that improve efficacy in their formulations, focusing on specialized functions such as emulsification, wetting, and foaming.

Specialty surfactants are vital in multiple sectors, attributed to their distinctive chemical characteristics that optimize formulation performance. They reduce surface tension, enhance wetting properties, and promote effective emulsification, making them indispensable in a wide array of products, including personal care items, cosmetics, household cleaning agents, and industrial solutions. Their capability to deliver enhanced stability and effectiveness enables the creation of products that address consumer needs for both efficiency and sustainability. Moreover, specialty surfactants often aid in the development of environmentally friendly formulations, responding to increasing ecological awareness and fostering innovation and competitive edge in the industry.

Key Market Segmentation:

Insights On Key Category

Bio-based

The Bio-based category is expected to dominate the Global Specialty Surfactants Market due to increasing consumer demand for environmentally friendly and sustainable products. With growing awareness regarding the environmental impacts of synthetic surfactants, brands are shifting towards bio-based solutions that align with sustainability goals. Regulatory support aimed at promoting eco-friendly products, along with a significant rise in applications across personal care, home care, and industrial sectors, further propels the favor towards Bio-based surfactants. This momentum reflects a broader market trend prioritizing natural ingredients, which resonates well with consumer values and drives innovations in product development.

Synthetic

The Synthetic category remains significant within the Global Specialty Surfactants Market, primarily due to its established performance and cost-effectiveness in a variety of applications. Synthetic surfactants offer superior performance characteristics compared to their bio-based counterparts, including enhanced foaming properties, stability, and versatility in formulation. Industries such as automotive, textiles, and agriculture extensively utilize these products for their reliability and proven efficacy. While the trend shifts towards sustainable options, synthetic surfactants continue to be the foundation of many formulations, leveraging existing infrastructure for mass production and established supply chains to meet ongoing market demand.

Insights On Key Type

Non-ionic Surfactants

Non-ionic surfactants are expected to dominate the Global Specialty Surfactants Market due to their versatility, compatibility with various formulations, and mildness, making them particularly suitable for personal care, industrial, and household applications. Their usage in diverse applications allows them to cater to a broad spectrum of customer needs, especially in cosmetics and cleaning products. The trend toward eco-friendly and bio-based formulations is also propelling the growth of non-ionic surfactants. Consequently, their effectiveness in stabilizing emulsions and foams while being less sensitive to water hardness elevates them above other types in market share, reflecting increased consumer preference for sustainable and multifunctional products.

Anionic Surfactants

Anionic surfactants play a significant role in the Global Specialty Surfactants Market, primarily due to their excellent cleaning and detergent properties. Commonly found in personal care and household cleaning products, these compounds generate a rich lather, making them a preferred choice for consumers looking for effective cleaning solutions. Their cost-effectiveness and efficiency in breaking down grease and oils also contribute to their widespread use. Beyond household applications, anionic surfactants are utilized in various industrial goods, signaling a stable demand that fosters their presence in the market.

Cationic Surfactants

Cationic surfactants are well-regarded for their antimicrobial properties and are extensively used in hair care products, such as conditioners and formulations targeting infection control in personal care items. Their ability to act as fabric softeners also proves instrumental in the textile and laundry s. Although their market share is smaller compared to non-ionic and anionic variants, cationic surfactants exhibit growth potential driven by increasing consumer awareness about hygiene and hair care. Their specialized functions cater to niche markets, enhancing their importance within the broader specialty surfactants landscape.

Amphoteric Surfactants

Amphoteric surfactants are characterized by their unique dual-charge properties, which allow them to function as either cationic or anionic molecules depending on the pH of their environment. This versatility makes them particularly appealing for cosmetic applications, such as shampoos and body washes, where mildness and safety are crucial. The growing trend towards gentle formulations in personal care products is driving further interest in amphoteric surfactants. Their stable foam and thickening properties also augment their usability across multiple industries, ensuring they retain a place in the competitive surfactant market.

Silicone Surfactants

Silicone surfactants are known for their exceptional wetting and spreading capabilities, which enhance formulations in various cosmetic and industrial products. They provide superior benefits in terms of stability and conditioning, especially in hair care items and skin creams. The increasing preference for premium cosmetic products with improved sensory attributes drives the demand for silicone surfactants. Additionally, their application in agriculture for pesticide formulations for improved efficacy is expanding their market reach further, making them an integral choice for manufacturers seeking high-performance specialty surfactants.

Others

The "Others" category encompasses a variety of specialty surfactants, which may include biodegradable options or innovations tailored for specific industrial processes. Although this lacks the volume of leading categories, it demonstrates potential growth due to rising environmental concerns and regulatory pressure. Emerging trends toward sustainable chemicals and biobased surfactants are propelling manufacturers to invest in novel formulations beyond conventional products. As industries seek solutions that align with ecological mandates, this category, while smaller, reflects a transformative approach within the global specialty surfactant marketplace, suggesting a promising future ahead.

Insights On Key Process

Sulfonation / Sulfation

Sulfonation / sulfation is anticipated to be the leading process in the Global Specialty Surfactants Market due to its widespread applicability across various industries, including personal care, household cleaning, and industrial applications. This method is known for producing highly effective and versatile surfactants such as alkylbenzene sulfonates and sulfate esters, which are prized for their exceptional cleaning and emulsifying properties. As consumer demand for high-performance, environmentally friendly products continues to grow, manufacturers are increasingly favoring sulfonation/sulfation processes. Moreover, advancements in technology and an emphasis on sustainable practices are reinforcing sulfonation/sulfation's position as the preferred choice in the production of specialty surfactants.

Esterification

Esterification, though less dominant than sulfonation/sulfation, plays a significant role in the production of specialty surfactants. This process typically leads to the creation of non-ionic surfactants that are exceptionally gentle on skin and effective in various formulations, making them ideal for use in personal care products. The increasing demand for eco-friendly formulations and mild cleansing agents is driving interest in esterification processes. As bio-based and renewable feedstocks gain traction and regulations on harsh chemicals tighten, the esterification method is expected to see a steady rise in usage, catering to consumer preferences for milder products without compromising on effectiveness.

Amination

Amination is another important method in the production of specialty surfactants, though it does not hold the top position in market share. The process typically involves the reaction of amines with fatty acids or alcohols, resulting in a variety of amine-based surfactants. These surfactants are particularly valued for their ability to enhance foaming properties and stabilize emulsions in numerous applications, such as industrial cleaning and personal care products. The growing market demand for multifunctional products that can perform various tasks while being environmentally friendly is likely to boost the uptake of amination processes as manufacturers seek to innovate their product offerings.

Others

The "others" category encompasses diverse processes that may not fit neatly into sulfonation/sulfation, esterification, or amination. These can include methods such as etherification or alkoxylation, which produce distinct surfactants with unique benefits. While this category is not the leading one in terms of market presence, it does offer specialized solutions catering to niche markets, which can be advantageous for specific applications. The versatility and customization enabled by these alternative processes will likely see a steady user base, albeit with less emphasis in the general market, as companies strive to meet particular industry requirements and consumer needs.

Insights On Key Application

Emulsifiers

Emulsifiers are expected to dominate the Global Specialty Surfactants Market due to their crucial role in stabilizing mixtures of water and oils across various industries, including food, pharmaceuticals, and personal care. The increasing demand for convenience foods and cosmetics that require stable emulsions is driving the growth of this application. Emulsifiers improve the texture, stability, and shelf life of products, making them essential in modern formulations. They also facilitate the creation of low-fat and reduced-calorie products, aligning with consumer preferences for healthier options. With innovations and advancements in emulsifier chemistry, their functionality continues to expand, further cementing their leading position in the market.

Wetting Agents

Wetting agents play a vital role in enhancing the spreading and penetration of liquids in various applications, particularly in agrochemicals and paints. Their ability to improve surface adhesion ensures optimal performance in these sectors, driving their growth. As environmental regulations promote less harmful and more efficient formulations, the demand for innovative wetting agents in industries such as coatings and cleaning products is expected to rise, complementing their use in sustainable practices.

Dispersants

Dispersants are crucial in many applications for maintaining stable suspensions, particularly in coatings, inks, and agriculture. They ensure uniform distribution of solid particles in liquids, which enhances product performance and appearance. As industries move towards higher-quality standards and better product performance, the need for effective dispersants is likely to see substantial growth. Innovations in this area, focusing on eco-friendly formulations, will also contribute to their rising prominence.

Foaming Agents

Foaming agents are significant in applications such as personal care, household products, and food processing. They contribute to the formation and stabilization of foams, improving the sensory experience in cosmetics and enhancing the performance of cleaning products. The ongoing trend towards environmentally friendly products is pushing the market toward natural foaming agents, which are gaining traction. This shift is expected to boost demand and sustainable foaming solutions in various industries.

Stabilizers

Stabilizers are essential for maintaining the consistency and stability of emulsions and colloidal systems across a wide range of products. Their importance in the formulation of food, pharmaceuticals, and personal care products ensures that they play a crucial role in product quality and performance. With increasing consumer awareness regarding the safety and efficacy of additives, there is a growing trend towards natural stabilizers. This shift aligns with industry innovations, promoting sustainability and driving demand in the stabilizer market.

Lubricants

Lubricants are vital in various industries to reduce friction and wear between surfaces, enhancing machinery efficiency, particularly in automotive and industrial applications. With advancements in technology, there is a growing need for specialty lubricants that offer improved performance capabilities. Furthermore, the increasing focus on energy efficiency and equipment longevity drives the demand for high-quality lubricants, which encapsulate biodegradable and eco-friendly options, thus promoting sustainable business practices.

Biocides

Biocides are crucial for preventing microbial contamination in numerous applications, especially in paints, coatings, and personal care products. As industries face increasing pressure to maintain product safety and extend shelf life, the demand for effective biocides is on the rise. Furthermore, emerging regulatory standards favoring non-toxic alternatives are propelling the market towards the development of sustainable biocide options. This trend is indicative of evolving consumer expectations regarding product safety and environmental impact.

Corrosion Inhibitors

Corrosion inhibitors are critical in protecting metal surfaces across industries such as automotive, manufacturing, and oil & gas. They play a key role in extending the service life of equipment and structures by preventing degradation caused by corrosive agents. As industrial applications become increasingly sophisticated, the need for advanced corrosion protection solutions remains strong. Innovations, particularly in green chemistry, are leading to the development of more effective and environmentally friendly corrosion inhibitors, further solidifying their market position.

Others

In the Global Specialty Surfactants Market, additional applications extend beyond typical categories, offering diverse industrial uses. For instance, surfactants are crucial in oil recovery, aiding in oil extraction by reducing surface tension in petroleum reservoirs. In textile manufacturing, they serve as antistatic agents and leveling agents to improve fabric quality. In the agricultural sector, surfactants enhance pesticide efficiency by improving spread and penetration on plant surfaces. Additionally, they play a role in personal care and cosmetics by creating stable emulsions, improving product texture, and enhancing cleansing efficiency.

Insights On Key End-use

Personal Care

The Personal Care is expected to dominate the Global Specialty Surfactants Market due to the rising consumer demand for specialized and formulation-specific products that enhance the texture, cleansing ability, and foaming properties in personal care items. The growing awareness regarding personal grooming and hygiene, coupled with the trend of natural and organic ingredients in cosmetics, has propelled this market forward. Brands are increasingly focusing on incorporating specialty surfactants to create products that cater to specific skin types and are more functional, thereby driving innovation and growth in this category.

Homecare

The Homecare sector is also significant in the Global Specialty Surfactants Market. With increasing urbanization and changing lifestyles, there is a rising demand for effective cleaning products that deliver better performance in terms of stain removal and surface cleaning. Homecare items like detergents and floor cleaners are incorporating specialized surfactants to improve cleansing capability, enhance product stability, and provide a pleasing sensory experience for consumers. Thus, this area continues to be a critical market contributor as manufacturers seek to meet evolving consumer needs.

Automotive

In the Automotive arena, specialty surfactants play a vital role in producing cleaning and maintenance products like car wash soaps, waxes, and industrial cleaners. The demand for high-performance products that facilitate easy application and provide superior cleaning efficiency has boosted the use of specialty surfactants in this area. As the automotive industry focuses on innovation and improved consumer satisfaction, this remains crucial for product development.

Industrial

The Industrial reflects immense potential for specialty surfactants, primarily for their applications in emulsification, wetting, and dispersion in processes like manufacturing and construction. Industries require robust formulations that can withstand various operational conditions, leading to increased investment in innovative surfactant solutions. With the growth of industrial production globally, this market is characterized by ongoing developments to ensure both performance and sustainability.

Food & Beverages

In the Food & Beverages sector, the use of specialty surfactants is becoming more prevalent as manufacturers strive to improve product texture, shelf life, and overall quality. These surfactants assist in emulsification and stabilization of food products, enhancing their appeal to consumers. The growing emphasis on clean-label products has prompted a rise in the demand for safe and effective surfactants that contribute to better nutritional values, attracting attention within this market.

Oil & Gas

The Oil & Gas industry utilizes specialty surfactants primarily for applications in drilling fluids, enhanced oil recovery, and cleaning agents for equipment. The increasing focus on efficiency and the need for environmentally friendly solutions is driving the demand for innovative surfactant technologies. As the industry looks to optimize production and minimize environmental impact, this area continues to explore opportunities for specialized formulations.

Agriculture

In Agriculture, specialty surfactants are utilized in agrochemical formulations to improve the efficacy of pesticides and herbicides. These surfactants promote better adhesion and coverage, leading to improved crop protection. With the agricultural sector pushing towards sustainable practices and increased yield, the need for more effective surfactant solutions that can enhance the performance of agricultural chemicals is critical to this market's growth trajectory.

Textile

The Textile industry uses specialty surfactants in processes such as dyeing, finishing, and cleaning of fabrics. Their ability to improve wetting and dye dispersion makes them essential in manufacturing quality textile products. With a rising demand for high-performance textiles and sustainable practices, innovations in surfactant technologies are significant, allowing manufacturers to enhance product performance while meeting environmental standards.

Paints & Coatings

In the Paints & Coatings domain, specialty surfactants play a crucial role in improving the stability and performance of coatings. They help with pigment dispersion and enhance the application properties of paints, providing better flow and leveling. As architectural and industrial sectors continue to expand, the demand for high-quality paints and coatings drives the need for advanced surfactant solutions that meet performance and environmental considerations in this market.

Others

Beyond major industries, specialty surfactants have applications in various other sectors. In healthcare, they support pharmaceutical formulations and medical cleaning agents. Construction benefits from surfactants in concrete additives, enhancing durability and workability. Mining operations utilize surfactants in ore processing, reducing energy and water use. Electronics manufacturing employs them in cleaning and etching processes to ensure precision. Water treatment plants use specialty surfactants to manage water quality and reduce impurities. These diverse applications underscore the adaptability of specialty surfactants across specialized industries needing tailored solutions.

Insights on Regional Analysis:

Asia Pacific

The Asia Pacific region is anticipated to dominate the Global Specialty Surfactants market due to a robust growth trajectory driven by increasing demand across various end-use industries, including personal care, household care, and industrial applications. The region benefits from a combination of rapid urbanization, a growing middle-class population, and ened consumer awareness regarding product efficacy. Countries like China and India have developed significant manufacturing capabilities and are becoming crucial hubs for surfactant production. As environmental regulations become stricter, the industry is also shifting towards greener surfactant solutions, which further propels innovation and investment in the region. The adaptability of local players and an expanding consumer base will likely cement the dominance of Asia Pacific in the specialty surfactants sector.

North America

North America holds a significant position in the Global Specialty Surfactants market, characterized by its advanced technology and high standards in product quality. The region's robust demand for eco-friendly and innovative surfactants has been driven by substantial investments in research and development. Key players in the personal care and home care industries are focusing on sustainable formulations, which fuels growth. However, increasing competition and the shifting manufacturing landscape may pose challenges. Nevertheless, the North American market is expected to continue a steady growth trajectory due to continuous product innovation and industrial demand.

Europe

Europe remains a potentially strong market for specialty surfactants, with a rich heritage in chemical manufacturing and a stringent regulatory environment that pushes for high-quality products. Leading nations like Germany, France, and the UK are investing in sustainable surfactant technologies that align with the European Green Deal goals. The demand for specialty surfactants in personal care and cleaning products is still robust, driven by consumer preferences for organic and natural ingredients. However, economic uncertainties and supply chain constraints could inhibit some growth opportunities in the short term.

Latin America

Latin America is gradually emerging in the specialty surfactants market but faces hurdles such as economic volatility and infrastructure challenges. Despite this, the demand for surfactants in the personal care and household s is increasing, as consumers become more aware of product performance. Major countries like Brazil and Argentina show growing interest in sustainable solutions, spurring local companies to innovate. The region is experiencing a shift towards bio-based surfactants, which may open new avenues for market growth. However, overall dominance in the specialty surfactants landscape appears limited compared to other regions.

Middle East & Africa

The Middle East & Africa is a developing market for specialty surfactants, influenced primarily by the growing personal care and industrial sectors. Countries rich in resources, like Saudi Arabia and the UAE, are investing in chemical manufacturing capabilities, creating a niche for regional players. However, the market is challenged by socio-economic factors, limited consumer awareness, and regulatory complexities. Despite potential growth driven by urbanization and an expanding middle class, the region is not projected to dominate the global specialty surfactants market in the foreseeable future, making its influence relatively modest compared to Asia Pacific and North America.

Company Profiles:

Prominent stakeholders in the worldwide specialty surfactants sector play a crucial role in fostering innovation and managing supply chains, thus facilitating progress in formulation techniques and sustainability initiatives. They engage in cross-industry partnerships to address changing consumer preferences and adhere to regulatory requirements, all while improving product efficacy.

Prominent participants in the Specialty Surfactants Market encompass BASF SE, Evonik Industries AG, Huntsman Corporation, Clariant AG, Croda International Plc, Nouryon, Stepan Company, Dow Inc., Solvay SA, Ashland Global Holdings Inc., AkzoNobel N.V., Galaxy Surfactants Ltd., and Mitsubishi Chemical Corporation.

COVID-19 Impact and Market Status:

The Covid-19 pandemic has profoundly impacted the Global Specialty Surfactants market, resulting in alterations to supply chains, a surge in demand for cleaning products, and transformations in consumer habits.

The COVID-19 pandemic had a profound effect on the market for specialty surfactants, primarily due to disruptions in supply chains and evolving demand patterns across various sectors. In the early stages of the pandemic, lockdown measures resulted in a reduction of production capabilities and operational halts, leading to a scarcity of raw materials. Conversely, the ened emphasis on cleanliness and sanitation during this period triggered a surge in demand for surfactants utilized in cleaning solutions, disinfectants, and personal care products. This change gave rise to a temporary market uplift, especially within the realms of household and industrial cleaning applications. As economies started to rebound, the market encountered challenges in aligning with shifting consumer preferences and sustainability demands, which increasingly favored environmentally friendly products. Ultimately, while the pandemic presented immediate obstacles, it also revealed new avenues for growth in the specialty surfactants sector, driving companies to innovate and broaden their product ranges to address the evolving requirements in a post-pandemic environment.

Latest Trends and Innovation:

- In November 2021, BASF announced the acquisition of the technology and assets of the Dutch company, Cognis, expanding its specialty surfactants portfolio to enhance its capabilities in sustainable formulations for personal care applications.

- In July 2022, Clariant launched its new line of eco-friendly surfactants named "Plantasens," aimed at meeting the growing demand for natural ingredients in the cosmetic and personal care industry.

- In March 2023, Evonik Industries AG completed the acquisition of the surfactants manufacturer, J.R. Simplot Company, allowing Evonik to bolster its capabilities in biobased specialty surfactants aimed at agricultural applications.

- In April 2023, Stepan Company announced its partnership with an unnamed biotechnology firm to co-develop a new line of bio-based surfactants to cater to the changing preferences towards sustainable surfactants in home and personal care products.

- In September 2023, Solvay SA introduced its new line of biodegradable surfactants for the industrial market, following a significant investment in R&D to enhance their sustainability credentials and meet regulatory demands.

- In August 2023, Croda International Plc expanded its surfactant manufacturing facility in South Carolina, USA, to increase production capacity of specialty surfactants for the North American market.

Significant Growth Factors:

The expansion of the Specialty Surfactants Market is propelled by a surge in demand across various sectors including personal care, home care items, and industrial applications, in conjunction with a growing awareness of environmentally sustainable formulations.

The Specialty Surfactants Market is witnessing notable growth due to several influential factors. Primarily, there is a growing consumer preference for biodegradable and environmentally friendly products, which is boosting the use of natural surfactants. This trend is evident as consumers increasingly prioritize sustainable alternatives. Furthermore, the burgeoning industries of cosmetics, personal care, and household goods are further augmenting the demand for specialty surfactants, which improve product functionality and attractiveness. The progression of sectors such as pharmaceuticals, textiles, and agriculture is also propelling market growth, as these fields increasingly utilize surfactants for diverse functions including cleaning, emulsifying, and foaming agents.

In addition, advancements in surfactant formulation technology are fostering the creation of cutting-edge solutions that meet specific customer requirements, enhancing both effectiveness and efficiency. Regulatory efforts aimed at minimizing the environmental footprint of chemical substances are motivating manufacturers to shift their focus toward more sustainable surfactant products. Moreover, the ened awareness of hygiene and cleanliness, particularly in light of global health challenges, is further boosting the demand for specialty surfactants in cleaning and disinfecting applications. Together, these dynamics are fostering a strong upward trajectory for the Specialty Surfactants Market, indicating a potential for sustained growth in the years ahead.

Restraining Factors:

The specialty surfactants market is hindered by several critical challenges, notably strict environmental regulations and variable costs of raw materials.

The market for specialty surfactants is confronted with various challenges that could impede its expansion. One significant issue is the volatility of raw material prices, which can directly influence production costs and, in turn, create fluctuations in pricing strategies and profit margins. Additionally, strict environmental regulations governing the manufacture and application of surfactants may restrict the availability of specific materials, leading manufacturers to incur extra compliance expenses. The rising consumer demand for eco-friendly and biodegradable options poses an obstacle for conventional surfactants, necessitating considerable investments in research and development to adapt existing products. Moreover, competition from alternative solutions, such as enzyme-based cleaning agents or products that utilize fewer surfactants, further limits the market’s potential. Geopolitical instability and trade barriers can disrupt global supply chains, affecting the distribution of specialty surfactants. However, amidst these hurdles, the market is anticipated to witness favorable growth due to an increasing inclination toward sustainable products and advancements in formulation technologies. This emphasis on sustainability opens avenues for companies to stand out, innovate, and venture into new markets, ultimately fostering growth in the specialty surfactants industry.

Key Segments of the Specialty Surfactants Market

By Category:

- Synthetic

- Bio-based

By Type:

- Anionic Surfactants

- Cationic Surfactants

- Non-ionic Surfactants

- Amphoteric Surfactants

- Silicone Surfactants

- Others

By Process:

- Sulfonation / Sulfation

- Esterification

- Amination

- Others

By Application:

- Wetting Agents

- Emulsifiers

- Dispersants

- Foaming Agents

- Stabilizers

- Lubricants

- Biocides

- Corrosion Inhibitors

- Others

By End-use:

- Homecare

- Personal Care

- Automotive

- Industrial

- Food & Beverages

- Oil & Gas

- Agriculture

- Textile

- Paints & Coatings

- Others

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America