Market Analysis and Insights:

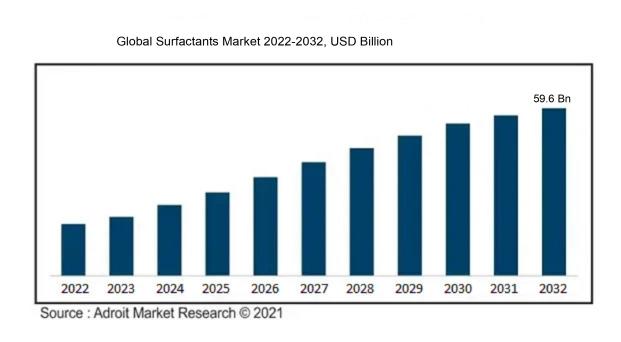

In 2022, the valuation of the surfactant market was recorded at USD 37.71 billion. It is projected to expand at a compound annual growth rate (CAGR) of 4.71% over the next decade, reaching USD 59.6 billion by 2032.

Various driving forces are behind the increasing size of the surfactants market. Increased consumer spending and population growth are significantly boosting the use of daily personal care products such as shampoos, soaps, and detergents, contributing to market growth. Expansion in sectors such as industrial manufacturing is also creating a ened need for surfactants in applications including textiles, paints, food processing, and the oil and gas sector. The push towards sustainability has led to the rise of surfactants derived from renewable sources, which supports market growth alongside a stronger consumer preference for environmentally friendly products. Furthermore, economic growth in emerging markets like India, China, and Brazil has amplified consumer purchasing power, which in turn drives greater demand for surfactants.

Surfactants Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 59.6 billion |

| Growth Rate | CAGR of 4.71% during 2023-2032 |

| Segment Covered | By Substrate ,By Type ,By Application ,By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | BASF SE, The Dow Chemical Company, Huntsman Corporation, Solvay SA, Evonik Industries AG, Akzo Nobel N.V., Clariant AG, Kao Corporation, Stepan Company, and Croda International Plc. |

Market Definition

Surfactants, due to their ability to reduce surface tension, enable effective mixing of oil and water, making them indispensable in various consumer and industrial products. These chemical compounds help lower the interface tension between substances, facilitating essential processes such as emulsification and mixing.

Known for their ability to reduce liquid surface tension, surfactants, or surface-active agents, are vital for the efficacy of numerous products including detergents, shampoos, and soaps. Their role extends to facilitating the dispersion of materials, assisting in the removal of dirt, oils, and stains. In the industrial context, surfactants are used to stabilize mixtures of liquids and enhance the performance of pesticides in agriculture, aid in drug delivery within pharmaceuticals, and improve oil recovery in the petroleum sector. Additionally, their surface-altering capabilities make them useful in fabric softeners and anti-static sprays, proving essential for a variety of cleaning and industrial processes.

Key Market Segmentation:

Insights On Key Substrate

Synthetic Surfactants

The dominance of synthetic surfactants in the global market is anticipated to continue, driven by their broad applicability across diverse sectors such as personal care, household maintenance, and industrial processes. Their effectiveness is enhanced by qualities like high foam production, superior cleaning strength, and stability, with ongoing technological innovations producing more efficient and environmentally friendly synthetic surfactant options.

Bio-Based Surfactants

Bio-based surfactants are gaining significant traction in the global surfactants market. With increasing concerns regarding environmental sustainability and the shift towards bio-based products, bio-based surfactants offer a more eco-friendly alternative to their synthetic counterparts. These surfactants are derived from renewable feedstocks such as vegetable oils and sugars, making them biodegradable and non-toxic. The growing demand for sustainable products across various industries, including personal care and cleaning, is expected to drive the market growth of bio-based surfactants.

Chemically Synthesized Surfactants

Chemically synthesized surfactants hold a significant share in the global surfactants market. These surfactants are produced by modifying natural raw materials through chemical processes to enhance their performance properties. They offer a wide range of applications in industries such as paints and coatings, textiles, and agrochemicals. The versatility and cost-effectiveness of chemically synthesized surfactants contribute to their substantial market presence.

Biosurfactants

Biosurfactants, although in a nascent stage, are showing potential growth in the global surfactants market. These surfactants are produced by microorganisms through fermentation processes and offer unique properties such as high biodegradability and low toxicity. The demand for biosurfactants is driven by the increasing focus on sustainable solutions and the need for environmentally friendly alternatives. However, their higher production costs and limited availability compared to synthetic and bio-based surfactants remain a challenge for wider market adoption.

Insights On Key Type

Anionic Surfactants:

Anionic surfactants are poised to maintain their leading position in the global surfactants market. Their prevalence is supported by their extensive application in sectors such as personal care, household maintenance, and industrial processes, where they are prized for their foaming, cleansing, and wetting properties. Cost-effectiveness also plays a crucial role in their widespread use.

Non-ionic Surfactants:

Non-ionic surfactants are an essential part within the global surfactants market. These surfactants are characterized by their lack of an electrically charged group, resulting in enhanced compatibility with different pH levels and stability in harsh conditions. Non-ionic surfactants find applications in the manufacturing of detergents, paints, textiles, and several other industries that require superior emulsifying and dispersing properties.

Cationic Surfactants:

Cationic surfactants constitute a significant part in the global surfactants market. These surfactants possess a positively charged group, enabling them to provide excellent conditioning and antimicrobial properties. Cationic surfactants are extensively utilized in the personal care industry for producing hair conditioners, fabric softeners, and specialized cleansers. Their distinctive characteristics make them an indispensable component in numerous cosmetic and home care products.

Amphoteric Surfactants:

Amphoteric surfactants play a crucial role and hold a notable share in the global surfactants market. These surfactants possess both positively and negatively charged groups, enabling them to exhibit versatility and compatibility with a wide range of formulations. Amphoteric surfactants are highly used in personal care products, such as shampoos, shower gels, and baby care items, due to their mildness and gentle cleansing properties. Their ability to reduce irritation and enhance foam stability makes them a preferred choice in the cosmetics and toiletries industry.

Insights On Key Application

Personal Care

The personal care segment is projected to lead in the surfactants market due to increasing demands for products like shampoos and facial cleansers, which rely on surfactants for enhanced stability and cleansing efficacy. Moreover, growing consumer awareness regarding hygiene and grooming continues to propel the demand for surfactants in personal care applications.

Home Care

The home care part is another significant in the global surfactants market. Surfactants play a vital role in the formulation of household cleaning products, including detergents, dishwashing liquids, fabric softeners, and surface cleaners. With the increasing focus on cleanliness and sanitation, particularly in urban areas, the demand for surfactants in the home care industry is anticipated to witness steady growth.

Industrial & Institutional Cleaning

The industrial & institutional cleaning part also holds a notable share in the global surfactants market. Surfactants find extensive use in commercial and industrial cleaning applications, such as in manufacturing facilities, hospitals, restaurants, hotels, and offices. The ability of surfactants to lower the surface tension of liquids and facilitate the removal of dirt, grease, and stains makes them essential ingredients in industrial and institutional cleaning products.

Textile

The textile part is significant in the surfactants market as well. Surfactants are employed in textile processing for functions like wetting, emulsification, dispersing, and levelling. They enhance the dyeing process, improve fabric quality, and provide desired effects such as softness and antistatic properties. The growing textile industry, particularly in emerging economies, is driving the demand for surfactants in this part.

Elastomers & Plastics

The elastomers & plastics part is another noteworthy constituent of the surfactants market. Surfactants are used as additives in the manufacturing of rubber and plastic products to improve their processing, dispersion, and performance characteristics. The increasing demand for rubber and plastic materials across various end-use industries, such as automotive, construction, and packaging, is driving the demand for surfactants in this part.

Oilfield Chemicals

The oilfield chemicals part holds a significant share in the surfactants market. Surfactants are utilized in the oil and gas industry for applications such as drilling, production, and enhanced oil recovery. They aid in reducing interfacial tension, improving displacing efficiency, and enhancing oil recovery rates. The growth of the oil and gas sector is expected to drive the demand for surfactants in this part.

Agrochemicals

The agrochemicals part is another important component of the surfactants market. Surfactants are incorporated into agricultural formulations, such as herbicides, insecticides, and fungicides, to enhance their efficacy and adhesion to plant surfaces. The increasing population and the need for higher agricultural productivity are expected to drive the demand for surfactants in the agrochemicals part.

Food & Beverage

The food & beverage part also holds a significant share in the surfactants market. Surfactants are used in various food applications such as emulsifiers, solubilizers, and dispersants. They help in improving the texture, stability, and sensory attributes of food products. The growing demand for processed and convenience food products is expected to drive the demand for surfactants in this part.

Others

The remaining parts in the global surfactants market, classified as Others, encompass various niche applications such as personal hygiene products, cosmetics, paints and coatings, and construction chemicals. While these parts may not individually dominate the market, they contribute to the overall growth and diversification of surfactant applications.

Insights on Regional Analysis:

Asia Pacific

Anticipated to lead the global surfactants market, the Asia Pacific region benefits from the strong market presence of countries such as China, Japan, and India. The region's expanding population, rapid urban development, and rising incomes are boosting consumption of household and personal care products, further stimulating the demand for surfactants. Additionally, the growth in industrial sectors like textiles and oil & gas supports the increased use of surfactants.

Europe

Europe represents a significant market for surfactants. The region has a well-established chemical industry and is home to major manufacturers, such as Germany and the Netherlands. The increasing demand for bio-based and specialty surfactants, especially in the personal care and healthcare sectors, drives the growth in Europe. Moreover, stringent regulations regarding environmental sustainability and product safety are also pushing for the adoption of eco-friendly surfactants in the region.

North America

North America is a mature market for surfactants due to its established industrial sectors. The region has a strong demand for surfactants in industries such as personal care, home care, and agriculture. However, the market growth is relatively slower compared to other regions due to market saturation and increasing concerns over the environmental impact of synthetic surfactants. Nonetheless, the demand for specialty surfactants, particularly in the oil and gas sector, offers growth opportunities in the region.

Latin America

Latin America presents potential growth opportunities for the surfactants market. The region has a growing population and increasing urbanization, which drive the demand for personal care and home care products. Additionally, the agricultural sector relies heavily on surfactants for crop protection and enhancing the efficacy of agrochemicals. The market growth in Latin America is also attributed to rising disposable income, changing lifestyle patterns, and the expansion of various end-use industries.

Middle East & Africa

The Middle East & Africa region is witnessing moderate growth in the surfactants market. The region's developing economies, such as Saudi Arabia and South Africa, are contributing to the demand for surfactants. The region's growing construction and infrastructure sectors create a demand for surfactants in applications such as paints, coatings, and concrete additives. However, factors like political instability, volatile oil prices, and limited market opportunities hinder the market growth to some extent in this region.

Company Profiles:

Leading companies within the global surfactants market play a crucial role in producing and distributing these essential chemicals across various sectors, including personal care, household, and industrial applications. Their activities significantly influence market dynamics, meeting consumer demands and driving innovation in surfactant products.

Key industry players in the surfactants market include BASF SE, The Dow Chemical Company, Huntsman Corporation, Solvay SA, Evonik Industries AG, Akzo Nobel N.V., Clariant AG, Kao Corporation, Stepan Company, and Croda International Plc. These firms are deeply involved in the production and distribution of surfactants worldwide, continually advancing their offerings through research and development. Their market presence is also strengthened through strategic mergers, acquisitions, and partnerships, enhancing their competitive edge.

COVID-19 Impact and Market Status:

The global surfactants market has been greatly influenced by the Covid-19 pandemic, resulting in disruptions to supply chains, decreased demand from end-use sectors, and a noticeable change in consumer preferences towards products related to hygiene and disinfection.

The surfactants market experienced significant disruptions due to the global COVID-19 pandemic, which led to widespread lockdowns and a subsequent impact on manufacturing and supply chains. The restrictions affected the availability of crucial raw materials and disrupted international trade, causing a slowdown in the surfactants industry, particularly impacting sectors like automotive and construction.

Latest Trends and Innovation:

- In October 2020, Clariant AG, a Swiss multinational specialty chemicals company, launched GlucoTain® Sense, a sustainable surfactant range designed for personal care products.

- In February 2021, BASF SE, a German multinational chemical company, introduced a new plant-based surfactant called Dehyton® AO 45.

- In March 2021, Croda International plc, a British speciality chemicals company, completed the acquisition of Avanti Polar Lipids, Inc., a leading supplier of research phospholipids, surfactants, and antibodies.

- In April 2021, Solvay SA, a Belgian chemical company, announced its partnership with Henkel AG & Co. KGaA to develop renewable surfactants for household and commercial cleaning applications.

- In May 2021, Stepan Company, a major global manufacturer of specialty and intermediate chemicals, acquired the surfactant business from Clariant AG.

- In June 2021, Evonik Industries AG, a German specialty chemicals company, developed a novel algal-based natural surfactant with improved sustainability attributes.

- In July 2021, Lubrizol Corporation, a specialty chemical company, introduced a new polymeric surfactant called Carbopol® SMART 7-529 polymer, designed for a range of skincare and haircare applications.

Significant Growth Factors:

Factors driving the expansion of the surfactants industry encompass a rising need from diverse sectors like personal care, cleaning products, and the oil & gas sector, along with a growing recognition among consumers about the advantages of surfactants in these specific areas.

Looking ahead, the surfactants market is set to experience robust growth. This growth is driven by increasing demands across various sectors, including personal care and pharmaceuticals, where surfactants improve process efficiencies by reducing surface tension. The surge in consumer interest in hygiene and eco-friendly products, along with technological advancements and the introduction of innovative, sustainable surfactant solutions, are expected to further boost market growth.

Restraining Factors:

The increasing desire for environmentally sustainable options presents a significant obstacle to the expansion of the surfactants industry.

The advancement of the surfactants market faces several challenges, including stringent environmental regulations and the high cost of raw materials derived from petroleum. Market growth is further hindered by the need for products that meet specific performance standards without compromising sustainability. Despite these challenges, the market is poised for growth, driven by technological advancements and increased demand from urbanization and industrial expansion, which offer new opportunities for market expansion.

Key Segments of the Surfactants Market

Substrate Overview :

- Synthetic Surfactants

- Bio-Based Surfactants

- Chemically Synthesized Surfactants

- Biosurfactants

Type Overview :

- Anionic Surfactants

- Non-ionic Surfactants

- Cationic Surfactants

- Amphoteric Surfactants

Application Overview :

- Home Care

- Personal Care

- Industrial & Institutional Cleaning

- Textile

- Elastomers & Plastics

- Oilfield Chemicals

- Agrochemicals

- Food & Beverage

- Others

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- UK

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America