Market Analysis and Insights:

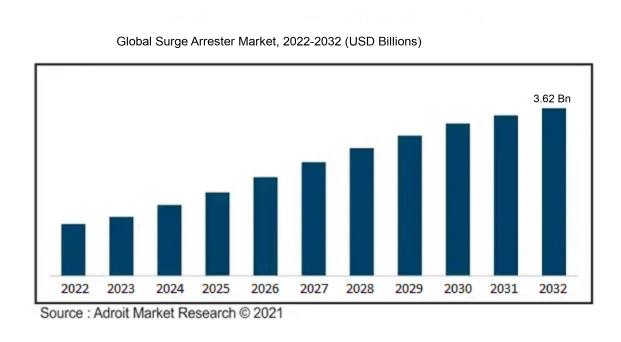

The market for Surge Arrester was estimated to be worth USD 700 million in 2023, and from 2024 to 2032, it is anticipated to grow at a CAGR of 4.87%, with an expected value of USD 3.62 billion in 2032.

The surge arrester market is being propelled by various significant factors. Primarily, the increasing emphasis on enhancing power quality and preventing harm to electrical devices is spurring the surge in demand for surge arresters. This is especially critical in sectors such as manufacturing, telecommunications, and healthcare, where any interruption in power supply can result in serious consequences. Moreover, the growing investment in smart grid and renewable energy source development is driving the necessity for surge protection tools. With the growing complexity of these grids, the risk of power surges and voltage fluctuations escalates, highlighting the crucial role of surge arresters in safeguarding the infrastructure. Additionally, the rising consumer awareness regarding the importance of surge protection is fostering market expansion. As more electronic devices and household appliances are being used, households are becoming more conscious of protecting their equipment against power surges. Lastly, the enforcement of strict regulations and safety standards by governmental and regulatory bodies worldwide is further fostering the demand for surge arresters. These standards are designed to guarantee the safety of electrical systems and equipment, thereby stimulating the market for surge protection devices.

Surge Arrester Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 3.62 billion |

| Growth Rate | CAGR of 4.87% during 2024-2032 |

| Segment Covered | By Type, By End-User, By Application, By Voltage, By Class, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | ABB Ltd., Eaton Corporation, Siemens AG, Schneider Electric SE, Hubbell Power Systems Inc., CG Power and Industrial Solutions Limited, Mitsubishi Electric Corporation, Toshiba Corporation, TE Connectivity Ltd., |

Market Definition

A surge arrester serves as a safeguard mechanism that is crafted to redirect surplus voltage and current away from electrical systems, shielding them from potential harm induced by sudden increases in voltage. It functions as a protective barrier against transient voltage occurrences, like lightning strikes or power surges, by dispersing the excess energy and upholding the operational stability of the electrical grid.

A surge arrester serves as a crucial safeguard for electrical equipment, shielding it from sudden increases in voltage known as spikes or surges. These occurrences can result from various factors such as lightning strikes, fluctuations in the power grid, or malfunctions in the equipment itself. Sensitive electronic devices like computers, televisions, and appliances are at risk of enduring permanent harm due to such surges. By functioning as a shield, the surge arrester redirects any surplus voltage away from the equipment, thereby preventing it from reaching damaging levels. This protective mechanism guarantees the operational safety and durability of the connected devices, thereby diminishing the chances of fire outbreaks, equipment failures, and the need for costly repairs or replacements. Absence of a surge arrester leaves the equipment exposed to voltage spikes, potentially causing substantial financial setbacks and safety risks. Consequently, the implementation of surge arresters holds immense significance in securing electrical equipment and sustaining optimal performance across a variety of personal, commercial, and industrial environments.

Key Market Segmentation:

Insights On Key Type

Polymeric

Polymeric is expected to dominate the Global Surge Arrester Market. Polymeric surge arresters are widely used due to their superior performance and advantages over porcelain surge arresters. They offer higher energy absorption capability, improved pollution performance, and enhanced insulation properties. The demand for polymeric surge arresters is increasing in various industry sectors such as power transmission and distribution, renewable energy, and industrial applications. They are more reliable and have a longer lifespan compared to porcelain surge arresters. Additionally, polymeric surge arresters are lightweight and compact, making them easier to install and maintain. These factors contribute to the dominance of the polymeric part in the Global Surge Arrester Market.

Porcelain

Porcelain surge arresters, although not expected to dominate the Global Surge Arrester Market, still hold a significant share due to their long-standing presence and usage in the industry. Porcelain surge arresters have been traditionally used in power systems for decades and are known for their durability and high voltage capabilities. They are suitable for outdoor applications and offer excellent mechanical strength and vibration resistance. However, the main disadvantage of porcelain surge arresters is their vulnerability to pollution, which can affect their performance and increase the risk of flashovers. As a result, their usage is gradually being replaced by polymeric surge arresters, which offer better pollution performance and other advantages. Nonetheless, porcelain surge arresters continue to find application in specific industries and regions as a reliable surge protection solution.

Insights On Key End-User

Utilities

The Utilities end-user is expected to dominate the Global Surge Arrester Market. Utilities, including power generation, transmission, and distribution companies, have a substantial need for surge arresters to protect their infrastructure from voltage surges and ensure uninterrupted power supply. With the increasing demand for energy and the expansion of utility networks, the adoption of surge arresters is anticipated to grow significantly in this part. Moreover, government regulations and initiatives promoting the use of renewable energy sources are likely to drive the demand for surge arresters in the Utilities sector.

Industries

In the Global Surge Arrester Market, the Industries end-user is expected to see considerable growth and demand for surge arresters. Industries encompass a broad range of sectors, such as manufacturing, mining, oil and gas, and chemical plants, which are prone to voltage surges caused by various operational processes and equipment. The need for surge protection in industrial settings is crucial to ensure the safety and reliability of equipment, thereby reducing downtime and minimizing potential losses. As industrial activities continue to expand globally, the demand for surge arresters in the Industries part is anticipated to witness notable growth.

Transportation

The Transportation part is also likely to contribute significantly to the Global Surge Arrester Market, although it may not dominate compared to the Utilities part. The transportation sector encompasses railways, road transportation, and airports, where surge arresters are used to protect critical signaling systems, communication networks, and infrastructure from voltage surges. As transportation infrastructure continues to evolve and incorporate advanced technologies, the demand for surge arresters in this part is expected to increase. Moreover, the growing emphasis on smart transportation systems and electrification of transportation modes will further drive the adoption of surge arresters in the Transportation sector.

Insights On Key Application

AIS

The AIS (Air Insulated Substation) application is expected to dominate the Global Surge Arrester Market. AIS is widely used for medium voltage substations and provides robust protection against lightning strikes and switching surges. It is a mature technology that offers reliability, cost-effectiveness, and ease of maintenance. As the demand for electricity continues to rise, the need for AIS surge arresters is expected to increase, thus driving the dominance of the AIS part in the Global Surge Arrester Market.

GIS

Although the AIS application is expected to dominate the Global Surge Arrester Market, the GIS (Gas Insulated Substation) application also holds significant potential. GIS substations are compact, require a smaller land footprint, and offer enhanced safety due to the enclosed design. These advantages make GIS surge arresters suitable for applications in urban and densely populated areas where space is limited. Additionally, the increasing focus on renewable energy sources is driving the adoption of GIS substations, further contributing to the growth of the GIS surge arrester part in the Global Surge Arrester Market.

Insights On Key Voltage

High

The High voltage sector is expected to dominate the Global Surge Arrester Market. This can be attributed to several factors. Firstly, the increasing demand for electricity, particularly in developing regions, has led to the expansion of power transmission and distribution networks. High voltage surge arresters are crucial in protecting these networks from voltage surges and ensuring reliable power supply. Secondly, the implementation of renewable energy projects, such as wind and solar farms, often requires high voltage surge protection to safeguard equipment and prevent damage. Lastly, industries such as oil and gas, petrochemicals, and manufacturing rely on high voltage systems, necessitating the use of surge arresters for equipment protection. Considering these factors, the High voltage part is expected to dominate the Global Surge Arrester Market.

Medium

Although the High voltage sector is expected to dominate the Global Surge Arrester Market, the Medium voltage sector also holds significant potential. Medium voltage systems are commonly used in urban power distribution networks, commercial buildings, and large industrial facilities. With urbanization and industrialization on the rise, the demand for reliable power supply in these areas is increasing. Surge arresters are essential in protecting medium voltage equipment and infrastructure from voltage surges. Additionally, the growth of the construction sector and infrastructure development projects further drives the demand for medium voltage surge arresters. While the Medium voltage part may not surpass the dominance of the High voltage part, it is expected to have a substantial market share.

Low

The Low voltage sector is not expected to dominate the Global Surge Arrester Market. While low voltage systems are prevalent in residential, commercial, and small-scale industrial applications, they generally do not require surge arresters as extensively as higher voltage systems. Low voltage devices and appliances are typically protected through the use of transient voltage surge suppressors (TVSS) or surge protectors, which are different from surge arresters. These devices are more commonly found in power strips or integrated into electrical outlets. As a result, the demand for low voltage surge arresters is relatively lower compared to the high and medium voltage parts in the market.

Insights On Key Class

Station

The Station class is expected to dominate the Global Surge Arrester Market. This can be attributed to the increasing demand for surge arresters in high voltage transmission lines and power substations. Station class surge arresters are designed to handle high energy levels and provide reliable protection against voltage spikes, ensuring the safety and functionality of critical infrastructure. With the growing focus on improving grid reliability and reducing electrical downtime, the demand for station class surge arresters is anticipated to rise significantly in the coming years. Additionally, the need for advanced surge protection devices in developing countries that are expanding their power transmission networks is further expected to drive the market dominance of the Station part.

Intermediate

The Intermediate sector of the Class category is also expected to play a significant role in the Global Surge Arrester Market. These surge arresters are primarily used in intermediate voltage applications, such as distribution networks and industrial facilities. With the increasing adoption of renewable energy sources and the growing need for reliable power distribution systems, the demand for intermediate class surge arresters is projected to witness steady growth. Moreover, the rapid industrialization and urbanization in emerging economies are driving the expansion of distribution networks, further fueling the demand for intermediate class surge arresters.

Distribution

The Distribution sector of the Class category may not dominate the Global Surge Arrester Market, but it still holds a significant share of the market. Distribution class surge arresters are typically utilized in low voltage applications, such as residential areas, commercial buildings, and small-scale industries. While the demand for distribution class surge arresters is expected to remain steady, it may not experience as significant growth as the Station and Intermediate parts due to the limited voltage capacity and use cases. Nonetheless, the increasing awareness about electrical safety and the need for surge protection in diverse end-use sectors will continue to contribute to the demand for distribution class surge arresters.

Insights on Regional Analysis:

Asia Pacific

Asia Pacific is expected to dominate the Global Surge Arrester market. The region is witnessing rapid urbanization and industrialization, leading to increased investments in power infrastructure. Countries like China and India are major contributors to the surge arrester market in this region. Additionally, the rising demand for electricity and the need to modernize existing power grids are driving the adoption of surge arresters. The presence of several key market players and favorable government initiatives to enhance power system reliability further contribute to the dominance of Asia Pacific in the global surge arrester market.

North America

North America is expected to experience substantial growth in the surge arrester market. The region is characterized by developed power infrastructure and high awareness about the need for reliable power supply. The aging power grid infrastructure in the United States and Canada is a key factor driving the demand for surge arresters. Moreover, the growing adoption of renewable energy sources, such as solar and wind, is increasing the need for surge protection devices. The presence of leading market players and technological advancements in the region also contribute to the growth of the surge arrester market in North America.

Europe

Europe is also expected to witness significant growth in the surge arrester market. The region has a mature power infrastructure and has been actively investing in grid modernization and renewable energy integration. The increasing adoption of electric vehicles and the expansion of smart grids further drive the demand for surge arresters in Europe. Additionally, stringent government regulations regarding power quality and safety standards boost the market growth. The presence of key market players and the focus on sustainable energy solutions further contribute to the growth of the surge arrester market in Europe.

Middle East & Africa

The Middle East & Africa region is experiencing rapid urbanization and industrialization, leading to increased investments in power infrastructure. The expansion of oil and gas industries and the development of smart cities drive the demand for surge arresters in this region. Moreover, the growing need for reliable power supply and the increasing adoption of renewable energy sources propel the market growth. However, the market in this region is relatively smaller compared to other regions, and the presence of local manufacturers creates a highly competitive market environment.

Latin America

Latin America is expected to witness steady growth in the surge arrester market. The region is characterized by ongoing infrastructure development and a growing demand for electricity. The expansion of renewable energy sources, such as solar and wind, and the need to improve power grid reliability contribute to the demand for surge arresters. Additionally, the presence of key market players and the implementation of government initiatives to enhance power infrastructure further fuel the market growth in Latin America. However, economic and political uncertainties in some countries may hinder market growth to some extent.

Company Profiles:

Prominent participants in the worldwide surge arrester sector play a significant role in delivering dependable and effective surge protection solutions to safeguard electrical systems. Leveraging their technical knowledge and diverse product portfolios, they pioneer innovations and propel market expansion to meet the rising worldwide need for surge protection devices.

Prominent companies such as ABB Ltd., Eaton Corporation, Siemens AG, Schneider Electric SE, Hubbell Power Systems Inc., CG Power and Industrial Solutions Limited, Mitsubishi Electric Corporation, Toshiba Corporation, TE Connectivity Ltd., and Raycap Corporation are key players in the surge arrester market. These industry leaders are instrumental in delivering cutting-edge and dependable solutions to safeguard electrical systems and devices against voltage surges. Global leaders like ABB Ltd., Eaton Corporation, and Siemens AG stand out for their extensive product offerings tailored to diverse customer requirements. Moreover, Schneider Electric SE, Hubbell Power Systems Inc., CG Power and Industrial Solutions Limited, Mitsubishi Electric Corporation, Toshiba Corporation, TE Connectivity Ltd., and Raycap Corporation are also notable contributors to the market with their inventive surge protection technologies.

COVID-19 Impact and Market Status:

The global surge arrester demand has markedly decreased as a consequence of the Covid-19 pandemic, attributable to interrupted manufacturing processes and the deferral of electrical infrastructure undertakings.

The surge arrester market has experienced a notable impact as a result of the COVID-19 pandemic. This impact is expected to lead to a decrease in growth rates within the market due to the widespread economic slowdown triggered by the pandemic. Disruptions within global supply chains, the temporary closure of manufacturing facilities, and constraints on international trade have all contributed to hindrances in the production and distribution of surge arresters. Consequently, reduced industrial and commercial activities during lockdown periods have led to diminished demand for surge arresters across various sectors including construction, oil and gas, and electronics.

Nonetheless, as economies gradually reopen and industries recommence operations, the surge arrester market is projected to recover. The increased emphasis on energy efficiency, incorporation of renewable energy sources, and advancements in digitalization are expected to drive a resurgence in demand for surge arresters in the future. Sectors such as renewable energy, smart grids, and telecommunications are anticipated to offer growth opportunities for the surge arrester market as they continue to thrive despite the challenges posed by the pandemic. Furthermore, initiatives aimed at expanding electricity infrastructure and investments in power transmission and distribution systems are likely to propel the surge arrester market in the long run. Despite the setbacks faced currently, it is anticipated that the surge arrester market will rebound as global economies endeavor to recover from the impacts of the COVID-19 pandemic.

Latest Trends and Innovation:

- In June 2019, ABB Ltd. announced the acquisition of GE Industrial Solutions, a leading global provider of electrical products, systems, and services.

- In February 2021, Siemens AG completed the acquisition of C&S Electric, an Indian company specializing in low-voltage switchgear and power distribution solutions.

- In January 2020, Eaton Corporation plc introduced its new UltraSIL polymer housed surge arresters, providing enhanced protection against electrical surges in multiple applications.

- In October 2020, Schneider Electric SE announced the launch of its new Surge arrester - Vigi SsL product line, designed for residential, commercial, and industrial applications.

- In November 2019, Emerson Electric Co. introduced the 160kV surge arrester, expanding its comprehensive surge protection portfolio for utility and industrial applications.

- In September 2020, Mitsubishi Electric Corporation launched its new SiC-MOSFET with integrated surge protection diode on a single chip, offering improved reliability and performance.

Significant Growth Factors:

The surge arrester market is experiencing growth due to escalating requirements for dependable power transmission systems, alongside increasing investments in grid infrastructure enhancement.

The surge arrester market is poised for substantial expansion in the upcoming years driven by various pivotal factors. The surge can largely be attributed to the escalating electricity demand and the consequent expansion of the power industry. The swift pace of urban and industrial development worldwide is ening the requirement for stable and uninterrupted power supply, thereby boosting the necessity for surge arresters. Additionally, the increasing recognition of electrical safety significance and safeguarding sensitive electronic devices against power fluctuations are influencing market growth positively. Surge arresters play a crucial role in shielding electrical equipment from transient voltage surges, thus ensuring user safety. Moreover, the incorporation of state-of-the-art technologies in surge arresters including metal oxide varistors and gas discharge tubes is set to propel market expansion.

These technologies offer enhanced protective features and superior performance in contrast to conventional surge arresters. Furthermore, the rise in investments in renewable energy sources like solar and wind power is anticipated to surge the demand for surge arresters for safeguarding the electrical infrastructure linked with these energy systems. Altogether, the surge arrester market is projected to witness substantial growth owing to the escalating electricity demand, growing awareness about electrical safety, and technological advancements integrated into surge arresters.

Restraining Factors:

Factors such as the high costs associated with installation and maintenance, as well as the entrenched market presence of current industry leaders, constrain the growth potential of the Surge Arrester Market.

The surge arrester market presents a promising landscape for growth, although it faces various constraints. A notable challenge is the high cost associated with surge arresters, which could impede their adoption, particularly in emerging markets and industries with financial limitations.

Furthermore, a lack of awareness among end-users regarding the significance of surge protection and the potential damages from power surges may impede market expansion. Additionally, the market is hindered by the short lifespan of surge arresters, necessitating regular maintenance and replacement. The absence of strict regulations mandating the use of surge arresters in specific industries further constrains market development. Moreover, the global supply chain disruption resulting from the COVID-19 pandemic has caused a shortage of essential raw materials for manufacturing surge arresters, further hampering market growth. Nevertheless, despite these obstacles, the surge arrester market is poised for significant growth. The increasing integration of renewable energy sources and the growing emphasis on grid reliability are expected to drive the demand for surge arresters. Technological advancements in surge arrester design, including the creation of more compact and efficient models, present opportunities for market players to address challenges and enhance their market presence. Additionally, the ongoing investments in the construction sector and the continuous expansion of smart grid infrastructure on a global scale offer a positive long-term outlook for the surge arrester market.

Key Segments of the Surge Arrester Market

Type Overview

• Polymeric Surge Arrester

• Porcelain Surge Arrester

End-User Overview

• Utilities

• Industries

• Transportation

Application Overview

• AIS (Air Insulated Substations)

• GIS (Gas Insulated Substations)

Voltage Overview

• Low Voltage

• Medium Voltage

• High Voltage

Class Overview

• Distribution Class

• Intermediate Class

• Station Class

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America