Market Analysis and Insights:

The market for Global Telecom Towers was estimated to be worth USD 55.08 billion in 2023, and from 2023 to 2031, it is anticipated to grow at a CAGR of 10.41%, with an expected value of USD 110.11 billion in 2031.

.jpg)

The telecom towers industry is being primarily fueled by a variety of factors, including the growing need for consistent and dependable communication services, the rapid expansion of the telecommunications sector, and the imperative to extend network coverage to remote regions. Furthermore, the increasing popularity of smartphones and other wireless devices has resulted in a significant uptick in mobile data usage, necessitating the installation of more telecom towers to accommodate the ened demand. The introduction of 5G networks, characterized by their high speeds and minimal latency, is also contributing to the demand for telecom towers required to support the infrastructure for this advanced technology. Government efforts aimed at enhancing connectivity in rural and underserved areas, as well as investments in smart city initiatives, are further bolstering the telecom towers market. Nonetheless, obstacles such as the high costs associated with maintenance, concerns regarding environmental impact, and regulatory constraints relating to tower placement could impede the expansion of the market.

Telecom Towers Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2031 |

| Study Period | 2018-2031 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2031 | USD 110.11 billion |

| Growth Rate | CAGR of 10.41% during 2023-2031 |

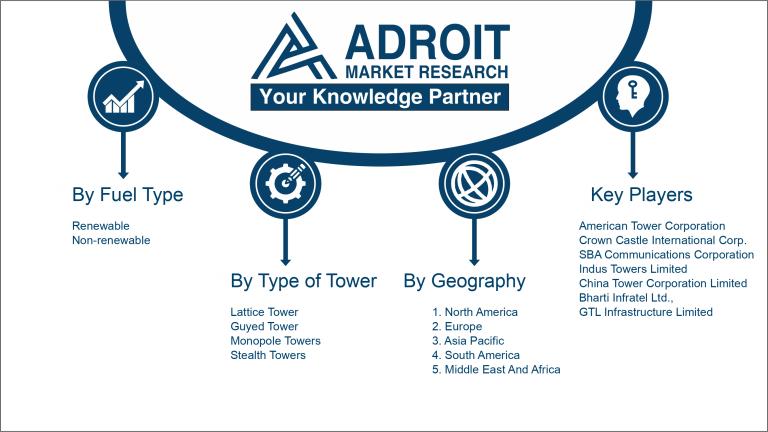

| Segment Covered | By Fuel Type ,By Type of Tower,By Installation ,By Ownership,By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | American Tower Corporation, Crown Castle International Corp., SBA Communications Corporation, Indus Towers Limited, China Tower Corporation Limited, Bharti Infratel Ltd., AT&T Tower Acquisition LLC, GTL Infrastructure Limited, Helios Tower Africa, and T-Mobile Towers LLC. |

Market Definition

Telecommunication towers represent elevated constructions utilized for positioning telecommunication apparatus, antennas, and supplementary communication tools to enable the conveyance of wireless signals supporting mobile devices, internet access, and additional communication amenities. These towers serve as vital infrastructure to enhance and fortify telecommunication systems.

Telecommunications structures, known as telecom towers, are integral components of modern communication systems. These tall constructions, outfitted with antennas, serve the vital function of enabling wireless communications by transmitting and receiving signals that link mobile devices with the central network. Acting as a crucial interface between end-users and telecommunication service providers, these towers guarantee seamless transmission of voice, data, and internet services. Due to their strategic placement, telecom towers are indispensable for ensuring broad geographic coverage, facilitating mobile connectivity across diverse urban and remote regions. Moreover, they play a pivotal role in fostering dependable communication networks, promoting connectivity, and facilitating the implementation of cutting-edge technologies like 5G, which necessitate high-density tower installations for optimal functionality. By significantly contributing to economic development, societal progress, and enhanced quality of life, these towers serve as enablers of information access, business sustainability, and interpersonal connections over vast distances. Therefore, telecom towers emerge as critical elements for establishing and sustaining efficient communication infrastructures requisite for the digital era.

Key Market Segmentation:

Insights On Key Fuel Type

Renewable:

The Renewable Fuel Type is expected to dominate the global Telecom Towers market. This is primarily due to the increasing focus on sustainability and the need to reduce carbon emissions. The deployment of renewable fuel-powered towers, such as solar and wind-powered towers, allows telecom companies to meet their energy demands while minimizing their environmental impact. The renewable fuel type offers long-term cost savings, reliable and clean power generation, making it the preferred choice for telecom tower installations.

Non-renewable:

While the renewable fuel type dominates the market, the Non-renewable Fuel Type, specifically diesel, still has a significant presence in the global Telecom Towers market. Diesel-powered towers are widely used in remote areas without access to reliable electricity grids or renewable energy sources. These towers provide a reliable power supply and have a long-established infrastructure, making them suitable for deployment in challenging environments. However, the increasing focus on sustainability and the environmental concerns associated with diesel emissions are expected to gradually decrease the market share of this part in the future.

Insights On Key Type of Tower

Monopole Towers

Monopole Towers are expected to dominate the global telecom towers market. These towers offer several advantages such as ease of installation, compact structure, and aesthetic appeal. The increasing demand for seamless network connectivity, especially in urban areas, is driving the growth of this part. Monopole towers provide space for multiple telecom operators and allow for efficient signal transmission. Moreover, advancements in technology and the need for 5G network infrastructure are further fueling the demand for monopole towers.

Lattice Tower

Lattice towers, though not dominating the market, hold a significant share. These towers provide high structural stability and are suitable for locations prone to high wind speeds. The lattice tower part is witnessing steady growth owing to its suitability for rural areas and cost-effectiveness. However, the dominance of monopole towers in terms of features and aesthetics limits the growth potential of this part.

Guyed Tower

Guyed towers also have a notable presence in the global telecom towers market. These towers utilize guy wires for stability and offer cost advantages over other types of towers, making them suitable for applications with constrained budgets. However, factors such as complex installation procedures and the need for large land area for anchorage restrict the dominant potential of the guyed tower part.

Stealth Towers

The stealth tower part caters to the increasing demand for aesthetically pleasing towers that blend with the surrounding environment. These towers are disguised as trees, flagpoles, or other structures to minimize visual impact. While the demand for stealth towers is rising due to strict regulations and aesthetic preferences in certain areas, their market share remains smaller than other parts.

Insights On Key Installation

Ground-based installations are expected to dominate the Global Telecom Towers market. This is primarily due to their higher stability and ability to support larger infrastructure. Ground-based installations provide better accessibility for maintenance and facilitate easier equipment upgrades, making them the preferred choice for telecom operators looking for long-term solutions.

Rooftop installations, on the other hand, offer advantages such as lower deployment costs and the ability to utilize existing infrastructure. While they may be more suitable for urban areas or locations with limited land availability, they face challenges related to weight restrictions, site access limitations, and aesthetic considerations. Despite these constraints, rooftop installations are still expected to hold a significant share in the market, especially in densely populated urban environments.

Insights On Key Ownership

Private-owned

Private-owned telecom towers are expected to dominate the global telecom towers market. This is due to the increasing trend of outsourcing tower infrastructure to specialized companies, allowing telecom operators to focus on their core business activities. Private-owned towers provide cost-effective solutions, better management capabilities, and flexibility for operators, resulting in their growing popularity. Furthermore, private-owned towers attract investments from various stakeholders and enable operators to expand their network coverage efficiently.

Operator-owned

Operator-owned telecom towers remain a significant part in the global market. Traditional telecom operators have historically owned and operated their tower infrastructure. While the dominance of this part is diminishing, it still holds a substantial market share due to established infrastructure networks and the reluctance of some operators to outsource tower operations.

Joint Venture

Joint venture telecom towers involve partnerships between different entities, typically combining the resources and capabilities of telecom operators with tower companies. This part provides opportunities for operators to reduce costs, share risks, and leverage expertise from industry specialists. While joint ventures offer benefits, they are not expected to dominate the market as they often involve specific projects or limited cooperation between parties.

MNO Captive

Mobile Network Operator (MNO) captive towers refer to towers that are exclusively owned and operated by a particular telecom operator. MNO captive towers are often seen in areas where competition among operators is limited or where an operator aims to maintain complete control over their network infrastructure. However, this part is not expected to dominate the global telecom towers market as the industry trends towards open access and shared infrastructure models.

Insights on Regional Analysis:

North America

North America is expected to dominate the global telecom towers market. This can be attributed to the high adoption of advanced technologies and the presence of prominent telecom service providers in the region. Additionally, the increasing demand for high-speed internet connectivity and the rapid growth of wireless communication networks further contribute to the dominance of North America in the market.

Latin America

In Latin America, the telecom towers market is witnessing significant growth. This can be attributed to the increasing investments in the development of telecom infrastructure and the rising penetration of mobile devices in the region. Furthermore, the growing demand for internet services and the government initiatives promoting the expansion of telecommunication networks fuel the growth of the telecom towers market in Latin America.

Asia Pacific

The telecom towers market in Asia Pacific is experiencing rapid expansion. The region is witnessing a substantial increase in the adoption of wireless communication technologies and the penetration of smartphones. The rising demand for seamless network connectivity, especially in densely populated countries such as China and India, is driving the growth of the telecom towers market in Asia Pacific.

Europe

Europe is also witnessing growth in its telecom towers market. Factors such as the increasing demand for high-speed internet services, the advancement of 5G technology, and government initiatives for the development of telecom infrastructure contribute to the market's growth in Europe. Additionally, the presence of major telecom equipment manufacturers and service providers in the region further boosts the expansion of the telecom towers market in Europe.

Middle East & Africa

The Middle East & Africa region is experiencing significant growth in its telecom towers market. This can be attributed to the increasing investments in the development of telecommunication infrastructure and the rising demand for mobile communication services in the region. Moreover, the adoption of advanced technologies like 4G and 5G, coupled with government initiatives promoting digital transformation, accelerates the expansion of the telecom towers market in the Middle East & Africa.

Company Profiles:

Prominent figures within the worldwide Telecom Towers industry significantly contribute to the advancement, management, and upkeep of communication networks, facilitating the effective global exchange of information. Their duties encompass overseeing the erection of telecom towers and offering dependable solutions to telecommunication firms to guarantee uninterrupted connectivity for various enterprises and people.

Prominent entities immersed in the Telecom Towers Market encompass American Tower Corporation, Crown Castle International Corp., SBA Communications Corporation, Indus Towers Limited, China Tower Corporation Limited, Bharti Infratel Ltd., AT&T Tower Acquisition LLC, GTL Infrastructure Limited, Helios Tower Africa, and T-Mobile Towers LLC. These organizations serve as pivotal figures within the telecom tower domain, offering communication infrastructure solutions on a global scale. Through their expansive array of telecom towers, they facilitate the seamless transmission of wireless signals, thereby ensuring uninterrupted connectivity and network coverage for mobile operators and various other telecom service providers.

These leading entities play an integral role in fostering the expansion of the telecommunications sector by furnishing the indispensable infrastructure required for the proliferation of mobile networks and the implementation of cutting-edge technologies like 5G.

COVID-19 Impact and Market Status:

The global telecom towers market has been notably affected by the Covid-19 pandemic, causing disruptions in supply chains and postponing infrastructure deployment initiatives.

The global telecom towers market has experienced a profound transformation due to the impact of the COVID-19 pandemic. Government-mandated lockdowns and restrictions have driven a surge in demand for telecom services such as internet and mobile connectivity on a worldwide scale.

Consequently, the telecom towers market has witnessed significant growth to meet the escalating requirements for data consumption among individuals and businesses. Nevertheless, the industry has faced obstacles amidst the pandemic, ranging from disruptions in the supply chain and delays in tower installations to a decrease in workforce availability. Furthermore, the economic downturn resulting from the pandemic has caused a reduction in investments, impacting the financial support for new network implementations. Despite these challenges, there is optimism for a gradual recovery in the market as countries ease restrictions and anticipate the forthcoming demand for improved connectivity. Telecom tower companies are projected to navigate the transition by introducing safety protocols and investing in advanced technologies like 5G to address the evolving needs of consumers.

Latest Trends and Innovation:

- March 2021: American Tower Corporation announced the acquisition of InSite Wireless Group, LLC, enabling the company to expand its portfolio of tower assets.

- April 2021: Indus Towers and Bharti Infratel completed their merger, creating the largest tower infrastructure company in India, renamed Indus Towers Limited.

- May 2021: Cellnex Telecom acquired Polkomtel Infrastruktura, expanding its presence in Poland's telecom tower market.

- June 2021: Crown Castle International Corp. acquired Landmark Dividend LLC, strengthening its position as one of the largest owners and operators of shared communications infrastructure in the United States.

- July 2021: China Tower Corporation and China Broadcasting Network Corporation signed a strategic cooperation framework agreement to deepen their collaboration in the construction, operation, and maintenance of communications infrastructure in China.

- August 2021: SBA Communications Corporation acquired a portfolio of communication sites from Trilogy International Partners LLC in Bolivia, enhancing its tower assets in the Latin American market.

- September 2021: American Tower Corporation announced the acquisition of MTN's telecom towers in South Africa, Uganda, and Ghana, further expanding its presence in these African markets.

- October 2021: Cellnex Telecom acquired Hutchison Europe's Passive Telecoms Infrastructure (PTI) business, enhancing its presence in the UK and Ireland.

- November 2021: Bharti Airtel completed the divestment of its 800 towers in Kenya and Tanzania to Helios Towers, enabling the company to optimize its tower portfolio in Africa.

- December 2021: American Tower Corporation and AT&T signed a long-term agreement for the lease and deployment of AT&T's fiber infrastructure on American Tower's communication sites.

Significant Growth Factors

:The expansion drivers of the Telecommunication Towers Industry encompass a ened need for enhanced network connectivity, a surge in mobile data consumption, and swift innovations in wireless communication technologies.

The Telecom Towers Market is experiencing notable growth driven by various key factors. The increasing number of mobile subscriptions and the growing demand for wireless communication services have led to the expansion of telecom networks, thereby increasing the requirement for telecom towers. Moreover, the rising adoption of smartphones and the surge in data consumption across different sectors like e-commerce, healthcare, and banking have further elevated the demand for telecom infrastructure. Additionally, the global move towards 5G technology and the escalating deployment of IoT devices have necessitated the installation of more telecom towers to support improved network connectivity and ensure seamless communication. Urbanization and population growth in emerging economies such as India and China have also contributed to increased telecom penetration and the need for expanded network coverage, driving market growth.

Furthermore, favourable government policies aimed at promoting digitalization and connectivity have played a role in expanding the telecom towers market. The introduction of innovative solutions like green towers and shared telecom infrastructure has not only addressed environmental concerns but also enhanced cost-efficiency, fostering market growth. Collectively, these significant growth drivers indicate a promising future for the telecom towers market, offering ample opportunities for industry players to capitalize on.

Restraining Factors:

The restricted access to appropriate land for the installation of telecommunication towers presents a notable challenge to the expansion of the industry.

The market for telecom towers has experienced notable growth in recent years due to the rising need for enhanced connectivity and the rapid expansion of the telecommunications industry. However, there are various factors that could hinder the market's progress. One key challenge is the substantial capital investment and ongoing operational costs required for setting up telecom towers, which can limit market players' ability to expand infrastructure.

Moreover, government regulations concerning tower installation and radiation emissions add complexity to the market landscape, leading to delays and increased expenses. Additionally, limited availability of suitable sites for tower placements in densely populated urban areas often results in inadequate coverage and weak signal quality. The rise of alternative communication technologies like satellite-based connectivity and non-tower solutions poses a threat to the telecom tower market's advancement. The COVID-19 pandemic has further impacted the market by disrupting supply chains, causing installation delays, and weakening overall market momentum.

Despite these challenges, the telecom towers market presents promising growth opportunities. Increasing demands for reliable connectivity, advancements in 5G technology, and the expansion of IoT applications are expected to be key drivers of market growth in the foreseeable future.

Collaboration among industry players and government efforts to reduce regulatory hurdles could potentially accelerate market growth, ensuring a positive outlook for the telecom tower sector.

Key Segments of the Telecom Towers Market

Fuel Type Overview

- Renewable

- Non-renewable

Type of Tower Overview

- Lattice Tower

- Guyed Tower

- Monopole Towers

- Stealth Towers

Installation Overview

- Rooftop Installation

- Ground-based Installation

Ownership Overview

- Operator-owned

- Joint Venture-owned

- Private-owned

- MNO Captive-owned

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America