Tourist Bus Market Analysis and Insights:

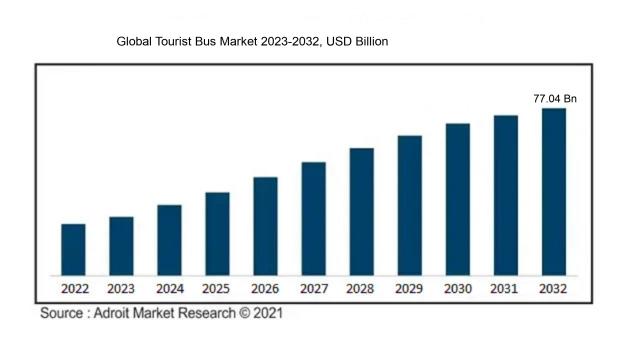

The market for tourist buses was estimated to be worth USD 36.93 billion in 2022. According to projections, the tourist bus market is expected to increase at a compound annual growth rate (CAGR) of 8.62% from 2023 to 2032, from USD 42.15 billion in 2023 to USD 77.04 billion.

The tourist bus sector is being propelled by several key factors. A notable shift towards experiential travel is encouraging a preference for distinctive and immersive journeys, prompting more individuals to select bus tours that facilitate social connections. Additionally, rising disposable incomes in developing regions are enhancing travel spending, making bus tours an increasingly attractive option for consumers who prioritize value and convenience. Growing awareness around environmental sustainability is also influencing tourist choices, as buses typically offer a more eco-friendly alternative to personal vehicle travel. Technological advancements, including GPS technology and mobile apps for booking and itinerary management, have further improved the travel experience, rendering bus tours more enticing. Moreover, the recovery phase following the COVID-19 pandemic has sparked a revival in domestic and regional tourism, increasing the demand for organized transportation methods like tourist buses, which provide safety and efficiency for group travel.

Tourist Bus Market Definition

A tourist bus is a specialized vehicle crafted to carry travelers or groups to a range of attractions and locations. These buses typically boast comfortable seating and various amenities aimed at improving the overall journey for passengers.

The Tourist Bus plays a critical role as an essential transportation option for travelers, enabling them to effectively visit major attractions. It supports sustainable tourism by minimizing the reliance on private vehicles, which helps decrease carbon footprints. Furthermore, these buses frequently provide guided tours that deepen the visitor's experience, offering valuable historical information and cultural perspectives that enhance the enjoyment of the locale. By catering to larger groups, the Tourist Bus also stimulates local economies through ened visitor activity at various sites and businesses. In summary, the Tourist Bus is integral to making travel more accessible, pleasurable, and eco-friendly.

Tourist Bus Market Segmental Analysis:

Insights On Product Type

Electric Bus

The electric bus is expected to dominate the Global Tourist Bus Market due to a combination of factors such as increasing environmental awareness, government incentives, and advancements in battery technology. These buses provide a sustainable transportation option, making them an attractive choice for tourists looking for eco-friendly travel solutions. Additionally, urban areas are implementing policies that favor electric vehicles over traditional fuel-based options. Tour operators and companies are recognizing the long-term cost savings associated with zero-emission vehicles, driving demand. As cities worldwide continue to prioritize green initiatives, the popularity of electric buses is anticipated to surge, leading them to take the lead in the market.

Petrol and Diesel Bus

The petrol and diesel bus category, while not in line with current environmental trends, still holds a significant share in the Global Tourist Bus Market, primarily due to infrastructure compatibility and broader availability. Many regions have established infrastructure that supports traditional fuel buses, making them easier to deploy. This attracts operators who prioritize upfront costs and access over sustainability, providing a practical solution for areas lacking electric vehicle charging facilities. Various operators might continue to use petrol and diesel buses until transitioning to greener solutions becomes more feasible.

Insights On Seating Capacity

40 Seater

Based on extensive market research, the 40 Seater capacity category is expected to dominate the Global Tourist Bus Market. This appeals to tour operators targeting larger groups, including corporate outings and family vacations, effectively optimizing cost per passenger. The growing trend of group travel and the increased preference for organized tours have led to higher demand for larger buses, making them a favorable choice for transportation service providers. New market entrants are focusing on enhancing the comfort and modern amenities of 40 Seater buses, which further solidifies this capacity as the leading choice among consumers.

32 Seater

The 32 Seater category has carved out a niche for itself by catering to medium-sized groups such as school trips and smaller corporate events. Its popularity can be attributed to the balance it offers between space and maneuverability, making it ideal for urban settings where larger buses may struggle. Furthermore, 32 Seater buses are often equipped with modern amenities while still being cost-effective. As sustainability becomes a priority, operators using 32 Seater buses can achieve better fuel efficiency per passenger compared to larger buses, thus appealing to eco-conscious consumers.

20 Seater

The 20 Seater option serves a dedicated market where travel groups are smaller, such as private tours or intimate gatherings. This size appeals to those seeking personalized experiences and flexibility in their travel plans. Companies focusing on unique travel experiences are increasingly utilizing 20 Seater buses, as they allow for easier navigation in crowded or narrower roads. Additionally, this class is favored for its affordability and is often seen as a cost-effective solution for smaller businesses and event organizers looking to transport clients comfortably.

Others

The "Others" category encompasses various configurations that may not fit neatly into the more common sizes like 20, 32, or 40 Seater. This includes specialized vehicles that can cater to specific niche markets such as luxury travel or themed tours. However, this category tends to be less dominant due to its fragmented nature. The appeal lies in customization options and the possibility of tailored experiences; for instance, smaller luxury buses provide a high-end travel solution for affluent clients seeking exclusive experiences. Nevertheless, the relatively smaller market size makes it less impactful compared to the more standard offerings.

Insights On Application

Tourism

The expected to dominate the Global Tourist Bus Market is Tourism. This is driven by the increasing interest in travel and leisure activities, as more people seek unique experiences and more personalized tours. The rise in international and domestic tourism, supported by an expanding economy and the ease of movement for travelers, contributes significantly to higher demand for tourist bus services. Moreover, a growing trend toward eco-friendly transportation options in the tourism sector also highlights the need for accessible and efficient bus services tailored to explore popular tourist destinations, which consolidates the Tourism 's dominant position in the market.

Scheduled Bus Transport

Scheduled Bus Transport provides a reliable means for travelers, particularly in urban areas where efficiency is crucial. This application is significant as it ensures passengers can transit between points on time, which appeals to both business and vacation travelers who prioritize punctuality. Additionally, advancements in technology, including real-time tracking and online reservations, enhance the customer experience, making scheduled bus transport attractive for those seeking convenience during their travel.

Intercity

Intercity transportation is vital for connecting different regions and facilitating longer travel distances. This application caters to a broad audience, including families on vacation, students traveling between cities, and business professionals. The demand for rapid and comfortable transportation options has led to enhanced intercity bus services, with modern amenities that make long-distance travel more appealing. This growth is supported by an increasing focus on affordability and the environmental benefits of using a bus over private cars.

School Transport

School Transport serves an essential role in providing safe and reliable transportation for students. This application focuses on ensuring that children can commute to and from school securely, which is a priority for parents and educational institutions. Additionally, enhanced safety measures, regulations, and specialized vehicles have increased confidence among parents regarding the safety of school bus services. As the awareness of child safety and community support grows, this mode of transport remains a crucial aspect of daily logistics in many regions.

Private Purposes

Private Purposes in bus transport represent a growing trend as individuals seek personalized travel experiences. This application includes services for family outings, events, and celebrations. It increasingly appeals to groups wanting a cost-effective means of transportation, reducing the hassle of parking and navigation. Demand in this category is fueled by the rise of group activities and tourism-focused experiences, often considered a more social and enjoyable way to travel. Moreover, the flexibility and exclusivity offered by private bus rentals attract many customers looking for unique travel options tailored to their needs.

Others

The 'Others' category encapsulates a variety of applications that don’t neatly fit into the previous classifications but still play a role in the market. This may include shuttle services for businesses, airport transfers, and transportation for special events or organizations. As travel patterns shift and new needs arise, this category may grow, reflecting emergent transport demands. Innovations and evolving customer preferences are likely to drive future adaptations in this application, leading to more diverse service offerings for various niche traveling requirements.

Global Tourist Bus Market Regional Insights:

Asia Pacific

The Asia Pacific region is expected to dominate the Global Tourist Bus Market due to several compelling factors. Increasing urbanization and a burgeoning middle class in countries such as China and India are driving demand for tourism. Furthermore, the rise of international travel and regional tourism initiatives, supported by government investment in infrastructure, are boosting the sector. Public transportation growth, coupled with the expansion of travel agencies offering bus tours, significantly contributes to the rise in tourist bus services. Additionally, the region is witnessing a shift toward eco-friendly transportation solutions, further enhancing market opportunities in this and solidifying its dominance.

North America

In North America, the tourist bus market is growing steadily, driven by a strong economy and a high level of domestic travel. The demand for luxury charter services and personalized tours is on the rise, particularly in major tourist destinations like New York and California. Moreover, the increasing interest in eco-tourism and road trips enhances the appeal of bus travel. However, limited growth prospects compared to the Asia Pacific region suggest that North America may occupy a secondary position in the global market.

Latin America

Latin America also presents a notable potential for growth in the tourist bus market. Countries like Brazil and Argentina are significant tourist destinations, attracting visitors with their diverse cultures and natural landscapes. The rise of local tourism initiatives, along with partnerships between bus operators and government incentives, is driving the market forward. However, challenges such as political instability and economic fluctuations may hinder consistent growth across the region, making it less dominant compared to Asia Pacific.

Europe

Europe remains a vital player in the tourist bus market, fueled by its rich history and cultural heritage that attract millions of tourists annually. The integration of transportation systems within the European Union facilitates seamless travel between countries, enhancing the appeal of bus tours. Nonetheless, the high competition from other modes of transport, such as trains and budget airlines, may limit growth potential. While Europe holds a significant share of the market, it struggles to match the rapid expansion observed in the Asia Pacific region.

Middle East & Africa

The Middle East & Africa region is experiencing a growing interest in tourist transportation services, driven partly by increased tourism infrastructure investments in countries like the UAE and South Africa. However, the market is still relatively nascent compared to other regions, with various logistical challenges and economic inconsistencies. Investors are optimistic about future growth prospects, particularly in tourism-driven economies, but the region currently lags behind powerhouse areas like Asia Pacific in overall market share and growth velocity.

Tourist Bus Competitive Landscape:

Prominent participants in the worldwide tourist bus sector, including producers, service providers, and travel operators, work together to improve their product offerings, prioritizing the safety and comfort of passengers. Their responsibilities encompass driving innovation, broadening market reach, and forging strategic alliances to adapt to the changing needs of the tourism sector.

Leading companies in the tourist bus industry consist of Greyhound Lines, Inc., FlixMobility GmbH, Stagecoach Group plc, National Geographic Expeditions, OUIBUS, Megabus, Coach USA, Greyhound Canada, ALSA, and LuxBus. Other important entities include Tufesa, Avanza, Wanderu, SGR, Prince Tours, Peter Pan Bus Lines, and Eurolines. Furthermore, regional operators like FirstGroup plc, BoltBus, and Intercape also play a crucial role in this sector.

Global Tourist Bus COVID-19 Impact and Market Status:

The Covid-19 pandemic profoundly impacted the global tourist bus industry, causing a dramatic drop in demand as a result of travel limitations and health-related anxieties. This situation compelled numerous operators to reevaluate their business strategies and prioritize safety protocols.

The COVID-19 pandemic had a profound effect on the tourist bus industry, leading to an extraordinary drop in demand due to widespread travel restrictions. With international borders shut and health concerns prevalent, numerous tour operators experienced a surge in cancellations and a steep decline in bookings, resulting in significant losses in revenue. In response, these operators took steps to strengthen health and safety measures, incorporating social distancing protocols and rigorous cleaning routines. There was also a notable trend towards utilizing smaller vehicles and offering private tours, as travelers became more focused on their personal safety. As vaccination rates improved and restrictions were lifted, there was a gradual revival in travel enthusiasm; however, the recovery has been uneven, with persistent worries regarding new variants and changing health regulations. The industry is now pivoting towards sustainability and embracing digital advancements to appeal to travelers who are more mindful of their travel decisions in the post-pandemic landscape, indicating a transition toward a more resilient and flexible tourist bus sector.

Latest Trends and Innovation in The Global Tourist Bus Market:

- In January 2023, FlixMobility acquired the German bus company, Postbus, expanding its operational footprint in Germany and increasing its route offerings significantly.

- In March 2023, National Geographic Expeditions partnered with a major bus tour company to offer exclusive travel experiences, integrating educational content into their itineraries in several North American national parks.

- In April 2023, Greyhound Lines announced the launch of an innovative mobile app designed to enhance user interaction, providing real-time tracking of buses and personalized travel recommendations based on customer preferences.

- In August 2023, Eurolines expanded its network by acquiring the assets of the struggling bus operator, Albanian Bus Services, thus strengthening its presence in Eastern Europe.

- In September 2023, Busabout unveiled a new sustainable travel initiative aimed at minimizing carbon footprints, which involves using electric buses for city tours in major European destinations.

- In October 2023, the luxury bus brand, The Bus Company, introduced a line of eco-friendly coaches equipped with the latest technology for passenger comfort, including onboard Wi-Fi and luxury seating features.

- In November 2023, Klook expanded its online booking platform by integrating several tourist bus service providers, enhancing customer options for exploring popular destinations across Asia.

Tourist Bus Market Growth Factors:

The primary drivers contributing to the expansion of the Tourist Bus Market encompass the growth in disposable income levels, a surge in both domestic and international travel, and an escalating interest in eco-friendly travel alternatives.

The expansion of the tourist bus market is influenced by several pivotal elements. Firstly, the escalating travel and tourism sector on a global scale, driven by increasing disposable incomes and an expanding middle-class population, creates a ened demand for effective and comfortable transport solutions. Furthermore, a rise in both domestic and international travel—particularly in developing countries—favors group travel arrangements, significantly boosting the need for tourist bus services.

Additionally, the movement towards sustainable transport options is spurring the uptake of electric and hybrid buses, in alignment with environmental initiatives and governmental policies aimed at lowering emissions. Technological innovations, such as GPS navigation, real-time updates for passengers, and enhanced safety measures, are essential for improving operational efficiency and enhancing customer experience.

Moreover, collaborations between travel agencies and bus companies are facilitating comprehensive travel packages, which increases the usage of bus services. The growing trend of adventure and experiential travel, amplified by the influence of social media, has also contributed to the rising interest in distinct travel experiences, many of which feature bus tours. Together, these dynamics foster a vibrant evolution in the tourist bus sector, presenting substantial opportunities for growth and innovation across diverse global markets.

Tourist Bus Market Restaining Factors:

The Tourist Bus Market faces several significant obstacles, such as escalating fuel prices, regulatory hurdles, and growing competition from other modes of transportation.

The Tourist Bus Market encounters numerous obstacles that may impede its expansion. Among the primary issues is the escalation of fuel costs, which elevates operational expenses for tour providers, consequently affecting their pricing strategies and overall profitability. Furthermore, demand fluctuations influenced by seasonal trends can result in lower occupancy rates, particularly during off-peak seasons, leading to inefficiencies in resource utilization. Stringent regulations aimed at emission control and safety compliance can impose hefty costs on operators, complicating their market operations.

Additionally, fierce competition from alternative transportation options, such as ride-sharing platforms and private car rentals, poses a significant challenge, potentially diminishing the market share of conventional tourist bus services. Problems related to infrastructure, including insufficient bus terminals and traffic congestion in key tourist destinations, can also create operational hurdles. The residual impacts of the COVID-19 pandemic have further shifted consumer preferences, with many travelers now opting for smaller, private group experiences as opposed to traditional bus tours.

Nevertheless, the market presents avenues for innovation and advancement, especially through the integration of environmentally friendly buses, enhanced technology for ticketing and route optimization, and strategies focused on improving customer experiences. These initiatives can enable the industry to adapt and prosper amid an evolving travel environment.

Key Segments of the Tourist Bus Market

By Product Type:

- Electric Bus

- Petrol and Diesel Bus

By Seating Capacity:

- 20 Seater

- 32 Seater

- 40 Seater

- Others

By Application:

- Scheduled Bus Transport

- Intercity, School Transport

- Tourism

- Private Purposes

- Others

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America