Market Analysis and Insights:

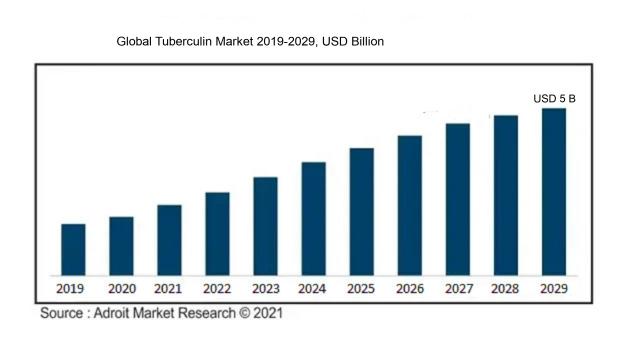

The market for Tuberculin was estimated to be worth USD 3.5 billion in 2022, and from 2023 to 2029, it is anticipated to grow at a CAGR of 5.3%, with an expected value of USD 5 billion in 2029.

The tuberculin market is largely influenced by the rising global incidences of tuberculosis (TB), increasing awareness about the importance of early detection, and supportive governmental efforts to manage TB infections. The growing numbers of latent TB cases highlight the necessity for effective screening methods, which in turn drives the demand for tuberculin skin testing. Innovations in diagnostic technologies, such as the introduction of more precise and quicker testing solutions, also aid in fostering market expansion. Moreover, the emphasis on vaccination and preventative health approaches further enhances the requirement for tuberculin tests, especially among populations at higher risk. The ongoing development of healthcare infrastructure worldwide, along with partnerships between public and private entities, significantly improves accessibility to tuberculin testing, thereby facilitating market growth. Furthermore, increased investments in research and development aimed at formulating advanced tuberculin products are anticipated to stimulate future advancements in this sector.

Tuberculin Market Scope :

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2020-2023 |

| Forecast Period | 2023-2029 |

| Study Period | 2022-2029 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2029 | USD 5 billion |

| Growth Rate | CAGR of 5.3% during 2023-2029 |

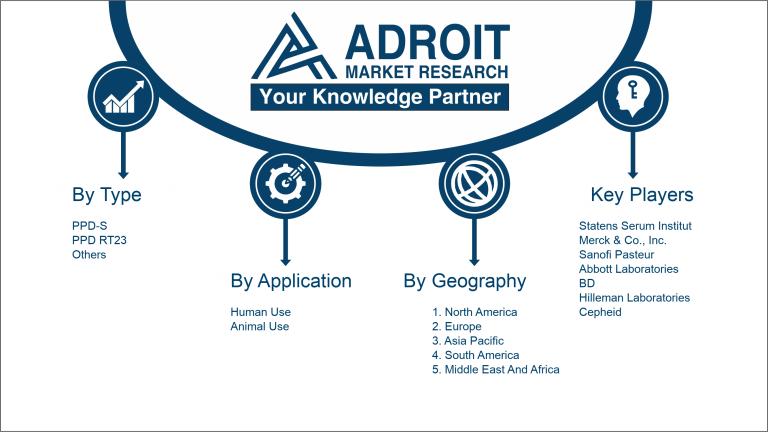

| Segment Covered | By Type, By Application, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Statens Serum Institut, Merck & Co., Inc., Sanofi Pasteur, Abbott Laboratories, BD (Becton, Dickinson and Company), Hilleman Laboratories, Cepheid, Pfizer Inc., QuantuMDx Limited, Mylan N.V., Biocorp Production, Euroimmun Medizinische Labordiagnostika AG, Thermo Fisher Scientific Inc., Genzyme Corporation, United Biomedical, Inc., Radian BioMedical, Inc., Immune Response BioPharma, Inc., Inovio Pharmaceuticals, Inc., and Seqirus. |

Market Definition

Tuberculin is a protein extract sourced from the Mycobacterium tuberculosis bacterium, primarily utilized in skin testing to identify tuberculosis infections. It functions as an antigen, eliciting an immune reaction in those who have been sensitized to the bacteria.

Tuberculin, known as a purified protein derivative (PPD) obtained from Mycobacterium tuberculosis, is essential for diagnosing tuberculosis (TB). The tuberculin skin test (TST) employs this compound to detect individuals who have had contact with the TB bacterium, facilitating early disease identification and management. Positive test results suggest previous exposure or infection, guiding healthcare providers in deciding whether additional assessment or treatment is necessary. Furthermore, tuberculin testing serves as a tool for evaluating public health initiatives aimed at reducing TB transmission. In summary, tuberculin is vital for diagnosing latent TB infection, thereby playing a key role in global TB prevention and control efforts.

Key Market Segmentation:

Insights On Key Type

PPD-S

The PPD-S is expected to dominate the Global Tuberculin Market due to its extensive utilization in screening for tuberculosis (TB) infections. PPD-S is recognized for delivering reliable and consistent results, making it a preferred choice among healthcare professionals. The increasing prevalence of TB globally further propels the demand for accurate diagnostic tools, with PPD-S leading the charge. Moreover, PPD-S has been the traditional standard in public health assessments, fostering trust among practitioners and contributing to its strong market position. The growing focus on preventive healthcare and early diagnosis is also working in favor of this widely accepted form of tuberculin testing.

PPD RT23

The PPD RT23 category plays a significant role in the Global Tuberculin Market but does not dominate like PPD-S. PPD RT23 is typically used in specialized settings and stands out due to its greater potency and efficiency in eliciting a robust immune response, particularly among populations at higher risk, such as immunocompromised individuals. However, its more limited application compared to PPD-S limits its broad market appeal. Despite this, PPD RT23 remains relevant in targeted diagnostics and research contexts, particularly when assessing potentially latent TB infections, thus ensuring its continued presence in the market.

Others

The "Others" category includes various tuberculin formulations and alternatives that are occasionally employed in specific diagnostic settings. This, while not as prominent as PPD-S and PPD RT23, offers innovations that may cater to niche markets or emerging diagnostic preferences. These alternatives may arise from advancements in technology or shifts in medical practices but struggle to achieve widespread acceptance due to a lack of extensive clinical validation. Nonetheless, they reflect the evolving landscape of tuberculin testing and the ongoing search for improvements in tuberculosis diagnostics, albeit at lower market shares compared to the leading types.

Insights On Key Application

Human Use

The Human Use category is anticipated to dominate the Global Tuberculin Market. This expectation arises from the increasing prevalence of tuberculosis (TB) worldwide, which necessitates effective screening and diagnostics, particularly in high-risk populations. Government initiatives supporting TB vaccination and testing further enhance the demand within this category. Furthermore, ened awareness of TB and the importance of early detection drives healthcare providers to utilize tuberculin for identifying latent infections and ensuring timely treatment. As a result, the focus on improving public health and combatting communicable diseases significantly contributes to the human use 's prominence in the market.

Animal Use

The Animal Use is also notably important, albeit secondary to human use. This part primarily involves utilizing tuberculin for testing and diagnosing tuberculosis in livestock, particularly in cattle, where the disease can have severe economic implications for the agricultural industry. The rise in global livestock farming and stringent veterinary regulations for TB management contribute to the demand for tuberculin in this field. Animal health organizations and governments have established guidelines promoting regular testing and monitoring, encouraging veterinarians to use tuberculin as a standard diagnostic tool, solidifying its presence in the market.

Insights on Regional Analysis:

Asia Pacific

The Asia Pacific region is expected to dominate the Global Tuberculin market due to a combination of high tuberculosis prevalence rates, increasing awareness of diagnosis, and government initiatives aimed at TB control and eradication. Countries such as India and China have substantial populations and are experiencing a growing burden of tuberculosis. The region's rapid urbanization, healthcare investments, and rising demand for advanced diagnostic tools further contribute to its dominance. Moreover, the presence of a large number ofmanufacturers and an increasing focus on research and development within this region enhances its market position. All these factors combined indicate a strong growth trajectory for the tuberculin market in Asia Pacific.

North America

North America is characterized by robust healthcare infrastructure and significant government funding for tuberculosis research and control programs. The region has a lower incidence of TB compared to Asia Pacific but benefits from advanced diagnostic techniques and effective treatment protocols. Increased collaborations between public and private sectors, including pharmaceutical innovations, are set to enhance the tuberculin market. However, the overall market size is comparatively smaller due to the lower prevalence of TB, which restricts robust growth that could compete with Asia Pacific's potential.

Europe

Europe exhibits a relatively mature tuberculin market marked by comprehensive healthcare policies and a steady focus on public health initiatives to control tuberculosis. The region has made strides in early detection and treatment, though it faces challenges with the re-emergence of multi-drug-resistant TB strains. Countries like Germany and the UK have been actively engaged in TB prevention and management programs. However, the diverse healthcare policies across various European countries may limit the uniform growth of the tuberculin market, making it less dominant compared to Asia Pacific.

Latin America

In Latin America, the tuberculin market is growing, driven by increased awareness and regional health initiatives focusing on tuberculosis prevalence. Countries like Brazil and Mexico are ramping up efforts to combat TB, which is expected to fuel demand for tuberculin testing. However, limited healthcare access, socioeconomic factors, and an uneven distribution of healthcare resources may hinder the rapid growth of this market. While there is potential, the region’s overall market influence remains lower compared to the larger and more rapidly developing Asia Pacific.

Middle East & Africa

The Middle East & Africa region is confronted with significant healthcare challenges, including a high burden of tuberculosis and variable healthcare infrastructure. Although there are increasing efforts to combat TB through international aid and local government initiatives, the market for tuberculin is still in nascent stages. The presence of endemic TB in some areas highlights the importance of faster testing and treatment options. However, overall healthcare investments remain limited, inhibiting substantial market growth as compared to the Asia Pacific region, which is more advanced in tackling tuberculosis.

Company Profiles:

Prominent entities in the global tuberculin market, encompassing pharmaceutical firms and diagnostic laboratories, play a crucial role in the creation and distribution of tuberculin products used for the detection and management of tuberculosis. These organizations prioritize innovation, adherence to regulations, and the enhancement of access to precise diagnostic tools on a global scale.

The prominent entities operating within the Tuberculin sector consist of Statens Serum Institut, Merck & Co., Inc., Sanofi Pasteur, Abbott Laboratories, BD (Becton, Dickinson and Company), Hilleman Laboratories, Cepheid, Pfizer Inc., QuantuMDx Limited, Mylan N.V., Biocorp Production, Euroimmun Medizinische Labordiagnostika AG, Thermo Fisher Scientific Inc., Genzyme Corporation, United Biomedical, Inc., Radian BioMedical, Inc., Immune Response BioPharma, Inc., Inovio Pharmaceuticals, Inc., and Seqirus..

COVID-19 Impact and Market Status:

The Covid-19 pandemic profoundly impacted the Global Tuberculin market by reallocating healthcare resources and focus from tuberculosis screening and prevention initiatives, resulting in a decline in both testing and treatment rates.

The COVID-19 pandemic had a profound effect on the tuberculin market, mainly by disrupting supply chains and healthcare operations. As hospitals focused on managing COVID-19 cases, regular tuberculosis screenings and vaccination efforts were postponed, resulting in a short-term reduction in demand for tuberculin skin tests. Furthermore, the pandemic shifted attention and resources away from tuberculosis control strategies, exacerbating already significant public health issues. Nevertheless, the increased global awareness of respiratory illnesses during this time has reignited interest in tuberculosis diagnostics and therapies, suggesting potential growth opportunities for the market in the aftermath of COVID-19. Health authorities and governments are progressively acknowledging the critical need for comprehensive disease management, which may lead to increased funding and improved support for tuberculosis initiatives. In summary, while the immediate repercussions of COVID-19 caused a temporary dip in the tuberculin market, the long-term prospects could be positive as healthcare systems evolve to simultaneously address both COVID-19 and tuberculosis challenges.

Latest Trends and Innovation:

- In April 2023, Quanterix Corporation announced advancements in their Ultra-Sensitive Immunoassay technology which is aimed at improving the detection of Tuberculosis biomarkers, potentially leading to earlier diagnosis and better patient management.

- In February 2023, Siemens Healthineers completed the acquisition of Varian Medical Systems, enhancing their portfolio in diagnostic imaging, including tuberculosis screening technologies.

- In July 2022, Thermo Fisher Scientific introduced the Thermo Scientific TaqMan TB Test, an innovative approach integrating molecular testing for rapid detection of Mycobacterium tuberculosis, thereby aiming to improve diagnostic speed and accuracy.

- In October 2022, Abbott Laboratories launched a digital tuberculosis screening program in partnership with local health authorities in India, utilizing innovative data analytics to enhance TB detection in underserved populations.

- In March 2022, Becton, Dickinson and Company partnered with Xpert to integrate advanced tuberculosis detection solutions into its diagnostic portfolio, focusing on expanding access to diagnostics in low-resource settings.

- In November 2021, Cepheid announced significant improvements to its GeneXpert platform, increasing the testing capacity for TB in high-burden regions, thereby facilitating quicker diagnosis and treatment initiation.

- In January 2021, Hologic Inc. announced the launch of its Panther Fusion system, which aimed to streamline the detection of both the bacterium causing tuberculosis and its resistance to certain antibiotics.

Significant Growth Factors:

The primary drivers fueling the expansion of the Tuberculin market encompass the growing incidence of tuberculosis, ened awareness surrounding screening practices, and innovations in diagnostic technologies.

The tuberculin market is on a pronounced upward trajectory, influenced by several critical factors. A primary driver is the escalating incidence of tuberculosis (TB) worldwide, which mandates extensive screening and diagnostic efforts, thereby amplifying the demand for tuberculin products. Moreover, the increased awareness surrounding TB, fueled by recent health emergencies like the COVID-19 pandemic, has ignited initiatives aimed at early detection and preventive strategies, further propelling market expansion.

Government initiatives and financial support directed towards TB elimination are instrumental in encouraging the use of tuberculin, as are the advancements in diagnostic technologies that enhance the accuracy and efficiency of TB testing. The growing healthcare infrastructure, particularly in regions where TB prevalence remains high, is also improving access to tuberculin testing.

In addition, innovations in testing methodologies, including the creation of more accurate and rapid diagnostic tools, are significantly boosting the appeal among healthcare providers. Collaborative efforts between public health entities and pharmaceutical firms are leading to the establishment of creative programs designed to enhance TB screening and management, thereby fostering market growth.

Finally, the increasing focus on research and development in TB-related healthcare solutions is poised to strengthen the tuberculin market, ensuring a well-rounded approach to addressing this persistent global health issue. Collectively, these elements set the stage for substantial growth within the tuberculin market in the years ahead.

Restraining Factors:

Critical hindrances in the Tuberculin market encompass rigorous regulatory requirements and a decrease in tuberculosis occurrence in certain areas, resulting in diminished demand for testing services.

The Tuberculin Market is influenced by numerous factors that may hinder its growth and overall demand. Significant obstacles include the elevated expenses related to the manufacturing and distribution of Tuberculin tests, which can restrict access in economically disadvantaged areas. Furthermore, the emergence of alternative diagnostic options, such as interferon-gamma release assays (IGRAs), could lead to a decline in preference for traditional Tuberculin skin tests, ultimately affecting the market's share. Additionally, a lack of accurate information regarding tuberculosis and associated testing may reduce public knowledge, resulting in diminished screening participation. Regulatory challenges and rigorous approval requirements for new Tuberculin products can also impede innovation and slow down market progression. Moreover, the stigma surrounding tuberculosis may discourage individuals from pursuing testing or vaccinations, complicating market dynamics even further. Nevertheless, an increase in global awareness of tuberculosis, spurred by health organizations, presents a promising opportunity for market growth. Investments in research and development focused on improving Tuberculin sensitivity and specificity could rejuvenate interest among healthcare professionals, positively impacting tuberculosis control initiatives. As global efforts to enhance tuberculosis management continue, there exists a potential for the Tuberculin Market to evolve and flourish within the changing healthcare environment.

Key Segments of the Tuberculin Market

By Type

• PPD-S

• PPD RT23

• Others

By Application

• Human Use

• Animal Use

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America