The global urea market size was estimated at nearly USD 38 billion in 2017. The global urea market is likely to expand at a CAGR of more than 3% from 2018 to 2025. Based on the process of technology, the key segments include Stamicarbon, SnamProgetti / Saipem, conventional, and others. Based on the product end-use, the market is categorized as agriculture, industrial and others.

The agriculture segment constituted the largest share, both in terms of volume and value. However, in the long run, this segment is expected to display slower growth owing to the numerous regulations against synthetic fertilizers along with the rising product usage in industrial and other niche application sectors. In terms of volume, the agriculture segment held a market share of over 80% in the year 2017.

The global Urea market is anticipated to increase at a 2.8% CAGR to reach value US$ 52 Bn. in 2029

.jpg)

Urea is applied to different types of crops. It is used extensively as a fertilizer as the soil loses a significant amount of nitrogen after harvest. Positive agricultural characteristics from developing economies such as India and China is driving the demand for urea in the agriculture segment. Furthermore, an optimistic outlook towards the plastic industry is aiding application of urea in adhesives, resins, plastics. Growing application from other end-user industry such as cattle feed, plywood production, cosmetics, and paints is also expected to drive the global urea market growth over the forecast period.

Urea Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2029 |

| Study Period | 2018-2029 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2029 | US$ 52 Bn |

| Growth Rate | CAGR of 2.8% during 2019-2029 |

| Segment Covered | By Grade, By Technology, By End-Use, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Yara International ASA, Qatar Fertiliser Company (QAFCO), PT Pupuk Kaltim,Indian Farmers Fertiliser Cooperative Ltd. (IFFCO), CF Industries Holdings, Inc.,Nutrien Ltd., National Fertilizers Ltd (NFL), Saudi Arabian Fertilizer Company (SAFCO), |

Key Segments of the Global Urea Market

Technology Overview

- Stamicarbon technology

- SnamProgetti / Saipem technology

- Conventional technologies

- Others

Application Overview

- Agriculture

- Industrial

- Others

Regional Overview

- North America

- U.S.

- Rest of North America

- Europe

- Western Europe

- Central and Eastern Europe (CEE)

- Asia-Pacific

- China

- India

- ASEAN

- Rest of Asia Pacific

- South America

- Brazil

- Rest of South America

- Middle East & Africa

- Egypt

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ) :

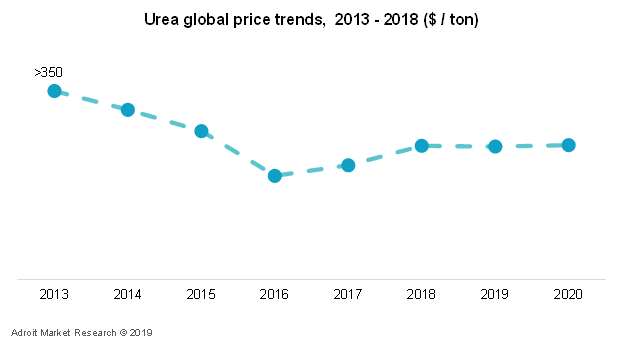

1.2.1 The global urea price trends

Significant price volatility has been illustrated by the global urea sector over the past few years. The global urea market price witnessed a downturn beyond 2013 falling at a low price level in 2016, nearly approaching the price levels of the 2008 – 09 global economic crisis. This price fall has been a consequence of the overall urea production growth superseding the demand growth. Furthermore, this adversely influenced the bargaining power of nitrogen fertilizer producers to a certain extent.

A stable price trend is likely to reflect by the end of 2020, owing to the combined effect of declining urea supply in developed regions and strong consumption growth in the Asia Pacific region. The urea price recovery in 2017 and 2018, was supported by a steadily increasing grain consumption and production, thus boosting the fertilizer usage. This trend is expected to continue over the next couple of years. Rise in the non-fertilizer application segment is also considered as a supporting factor for the stable price trends in the urea market.

The global urea market is highly fragmented in nature, owing to the massive presence of numerous regional and local players. In terms of manufacturing capacity expansion, the regional and local players in China, India, and Russia are expected to strengthen their presence over the forecast period. This not only implies for urea but also for its upstream and downstream markets across the value chain.

1.2.2 Mergers & acquisition developments and expansion of urea production over the recent years have created a significant impact on the global urea market

In January 2018, YARA International ASA completed the acquisition of urea business assets of Tata Chemicals based in Uttar Pradesh to form Yara Fertilisers India. The acquisition included all assets as well as liabilities of the urea plant located in Babrala, Uttar Pradesh. This acquisition is the foremost foreign direct investment (FDI) in the country’s urea sector, thus marking its entry into the Indian fertilizer industry. Furthermore, the company aims to achieve business expansion through foraying into agriculture and crop processing. For instance, in February 2018, Yara International ASA (Norway), Qatar Fertiliser Company (QAFCO), and Hassad Food signed a Memorandum of Understanding (MoU) to support efforts to increase food production from the Qatari agricultural sector.

In June 2015, Yara International ASA together with BASF SE announced the development of a world scale ammonia production terminal located in Freeport, Texas. The total capital investment for the plant was USD 600 million. Yara will construct an ammonia tank at the BASF terminal while BASF will focus on the existing terminal and pipeline assets upgrade for the export of ammonia from the new plant. This partnership is expected to benefit Yara in enhancing its backward integrated urea operations over the years ahead.

Formation of Nutrien Ltd. in 2017, has been one of the recent mergers to impact the global urea market over recent years. In September 2017, Agrium Inc. and PotashCorp received clearance for their merger that combined their fertilizer operations based in Russia, Canada, and Brazil. This collaboration is expected to leverage the market presence of both the firms in North America and Europe in the future.

In October 2017, KOCH Industries announced the partial completion of expanded urea production. This expansion includes a new urea plant of 900 kilo ton annual capacity, electric power substation, high-speed rail and truck transport terminals, and a urea storage facility. The company aims at improving its high-purity urea production capabilities to cater to the diesel exhaust fluid (DEF) market demand. Additionally, the company announced its future plans of introducing SUPERU Fertilizer product line under its Koch Agronomic Services division for nitrogen fertilizer applications. Thus, through production operations and product innovation KOCH has focused on strengthening its business penetration in the global urea market value chain.

In mid-2014, SABIC announced the expansion of technical grade urea production. This technical grade urea product line has been introduced to target non-fertilizer applications mainly on diesel engines. The production operations of this new grade are based at the Al-Jubail Fertilizer Company (Al-Bayroni) site, the company’s manufacturing affiliate, and has an annual production capacity of 80 kilo tons. This capacity expansion is likely to benefit SABIC in meeting the demand of the Middle East & Africa automotive lubricants and fuel sectors.

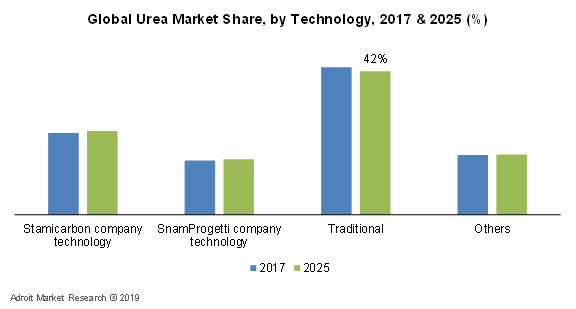

Urea market has seen an enormous expansion and popularity owing to favorable properties, such as higher nitrogen content, easy to handle and easy to transport. At present, some technologies to manufacture urea are well-established, some are matured, and some are ready for a license. carbamate recycle process (SnamProgetti and Stamicarbon), and traditional process technologies are the major technologies that have been dominating the global urea market. Among all the technologies, traditional urea manufacturing technology still holds a major market revenue share owing to its early implementation among the rest of the technology categories.

The Stamicarbon company technology consists of a high-pressure CO2 stripper that separates ammonium carbamate from urea and water at synthesis pressure. This has resulted in water saving, increase in efficiency up to 80% and reduction of the overall steam consumption of a urea plant with a factor two. In the Stamicarbon process, one does not need a medium pressure recirculation section and there is no pure ammonia recycle. These facts have a significant impact on the chosen process parameters in the urea synthesis reactor.

SnamProgetti technology has been one of the world renowned process technologies to be incorporated in the production of urea. Key performance aspects of this technology include low energy and raw material utilization, high-quality product yield, process condensate recovery, environmentally sustainable, and suitable for mega capacity urea plants.

Traditional or conventional technologies segment is expected to account for a decreased market share of 42% by the end of the forecast period. “Once through” process is the most commonly used traditional urea manufacturing technology that held a significant share in the year 2017. However, these conventional urea manufacturing technologies are now being replaced by Stamicarbon and SnamProgetti technologies, hence leading to a decrease in the share of the conventional method. Both the technologies, Stamicarbon and SnamProgetti are expected to witness an optimistic growth over the forecast period, owing to high conversion of carbamate to urea and high-performance efficiencies. QAFCO, Yara International, and SABIC are a few of the leading players that are engaged in the production of urea via SnamProgetti and Stamicarbon technologies.

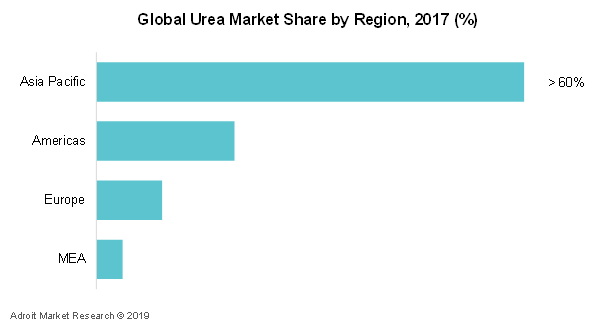

In terms of region, Asia Pacific generated the maximum market revenue of more than 60% and is expected to show an optimistic growth rate over the forecast period. Growing population coupled with expansion in the ammonia and urea capacity since the past is the key factor driving the demand of urea in this region.

Indian Prime minister Narendra Modi had called for cutting of urea consumption by half by 2022. Also, Road Transport and Highways Minister of India suggested a way to manufacture urea by storing the urine of people so that it would no longer need to import the chemical composite used to manufacture fertilizer outside India. Similarly, Indian prices of urea are already low in comparison to neighboring countries and are likely to show a similar trend over the forecast period.

South America is estimated to be the fastest growing region over the forecast period and is estimated to grow at a CAGR of more than 3% by 2025. The Middle East & Africa is projected to show an optimistic growth rate over the forecast period followed by North America and Europe. Over two-thirds of the urea demand in North America was captured by fertilizers and this segment is anticipated to show a similar trend over the foreseeable future.

The ammonia industry in Western European is estimated to be more energy efficient in comparison to ammonia producers in other parts of the globe. The European fertilizer industry has upgraded its nitrate plants. Furthermore, the presence of well-established market players in the fertilizer market such as Yara is likely to provide positive growth aspects over the foreseeable future. Such positive attributes across the region are expected to uplift the European urea industry across the globe.

However, the European retail and farming sectors have a negative perspective towards urea. Some European farmers have moved towards organic crop production because of this situation. The increasing amount of regulations on using and storing the fertilizer is likely to display a detrimental effect on urea industry over the forecast period.