Market Analysis and Insights:

The market for Global Used Cars was estimated to be worth USD 1.7 trillion in 2024, and from 2024 to 2034, it is anticipated to grow at a CAGR of 7%, with an expected value of USD 3.4 trillion in 2034.

.jpg)

The market for pre-owned vehicles is propelled by several crucial elements. To begin with, there is a marked increase in the desire for economical transportation solutions, especially among budget-conscious individuals and those purchasing their first car, which significantly enhances sales figures. Economic factors, such as variability in the pricing of new vehicles and the advantages of potentially lower insurance rates, also play a pivotal role in influencing buyer choices. Furthermore, the rise of online marketplaces and digital platforms has made it more convenient for consumers to access used vehicles, allowing them to compare prices and secure favorable offers. Another important aspect is the growing emphasis on sustainability, leading many consumers to view pre-owned cars as a greener option, thereby contributing to waste and resource conservation. Lastly, the recent disruptions in supply chains and shortages of semiconductors affecting the production of new cars have resulted in increased interest in used vehicles, further elevating their market attractiveness. Together, these dynamics have fostered substantial growth in the pre-owned vehicle sector in recent times.

Used Cars Market Scope :

| Metrics | Details |

| Base Year | 2024 |

| Historic Data | 2020-2023 |

| Forecast Period | 2024-2034 |

| Study Period | 2023-2034 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2034 | USD 3.4 trillion |

| Growth Rate | CAGR of 7% during 2024-2034 |

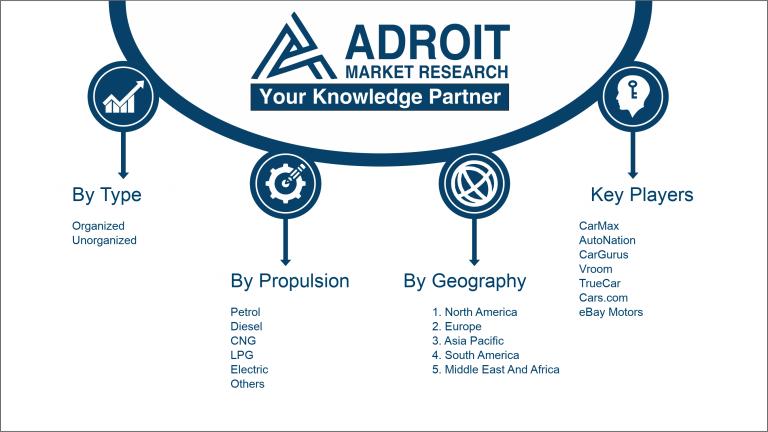

| Segment Covered | By Vendor Type, By Propulsion, By Engine Capacity, By Dealership, By Vehicle Type, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | CarMax, AutoNation, CarGurus, Vroom, TrueCar, Cars.com, eBay Motors, Hertz Car Sales, Enterprise Car Sales, and Shift Technologies. Additional key players consist of Carvana, Beepi, Web2Carz, and DriveTime, |

Market Definition

Pre-owned vehicles, commonly referred to as used cars, are those that have had one or multiple previous owners prior to being resold. These vehicles can differ significantly in terms of age, condition, and mileage, providing potential buyers with a wide array of choices.

The importance of pre-owned vehicles is rooted in their cost-effectiveness and widespread availability, enabling a larger of the population to attain vehicle ownership. They present a sensible option for those in need of transportation while avoiding the steep financial implications tied to new cars, which typically lose value quickly. Additionally, the market for used cars contributes to environmental sustainability by prolonging the lifespan of vehicles, thereby minimizing waste and the ecological consequences linked to the production of new automobiles. Moreover, used cars offer a broad array of brands and models, enhancing consumer options. In summary, the pre-owned car industry is vital to the automotive landscape, fostering economic development and facilitating transportation solutions.

Key Market Segmentation:

Insights On Key Vendor Type

Organized

The organized is expected to dominate the Global Used Cars Market due to the increasing consumer preference for reliability, transparency, and quality assurance associated with certified dealerships. Organized vendors often provide warranty options, financing, and after-sales services, which enhance customer trust and satisfaction. Enhanced digital platforms are allowing organized vendors to reach a broader audience, streamlining the purchasing process through online listings and virtual showrooms. This structured approach caters to the demand for convenience and security, particularly as consumers seek credible sources for their used vehicle purchases. The ability to guarantee the condition of vehicles and offer comprehensive service packages positions organized vendors favorably in this competitive landscape.

Unorganized

The unorganized , while operating on a larger scale in terms of sheer volume, has faced challenges in gaining consumer trust. Vehicles sold through unorganized channels are often perceived as having uncertain histories, leading to skepticism among potential buyers. Limited warranties and lack of after-sales support contribute to the perception of risk associated with this category, thereby affecting its ability to compete with organized vendors. Additionally, as consumers become more educated and reliant on verified information, the unorganized channel struggles to address these concerns effectively, leading to a gradual decline in its prominence.

Insights On Key Propulsion

Electric

Electric vehicles are expected to dominate the global used cars market due to the increasing demand for sustainable and eco-friendly automotive solutions. Consumer awareness about environmental issues and the advantages of electric cars, including lower running costs and reduced emissions, have led to a significant shift in buying behaviors. Governments worldwide are also encouraging electric vehicle adoption through various incentives and tax rebates. The extensive development of charging infrastructure further boosts consumer confidence in electric cars. As the technology improves and battery prices continue to decrease, the availability and attractiveness of used electric vehicles are expected to rise, making them the top choice among consumers.

Petrol

The petrol-powered vehicle market remains highly influential as it currently holds a significant share in the global used cars market. These vehicles are comfortable and offer robust performance, catering to various consumer preferences. Their widespread availability in the aftermarket makes it easier for buyers to find models that suit their needs. Furthermore, petrol vehicles typically have lower initial costs compared to electric options, making them appealing for budget-conscious consumers. As petrol continues to be a mainstream propulsion option globally, it remains a substantial part of the used vehicle landscape.

Diesel

Diesel vehicles have traditionally been popular, especially in regions where long-distance travel and towing are common due to their superior fuel efficiency and torque. While concerns regarding emissions have led to a decline in new diesel vehicle sales, the used diesel market still holds its ground, particularly among fleet owners and commercial users seeking durability and longevity. This is likely to maintain relevance as many consumers still prioritize fuel efficiency and performance, ensuring a continued demand for used diesel cars in specific markets.

CNG

Compressed natural gas (CNG) vehicles have been gaining traction as an alternative to conventional fuels, presenting a cleaner option with lower emissions. While the market share for used CNG vehicles is smaller compared to petrol and diesel, it appeals to environmentally conscious consumers and businesses focused on sustainability. The infrastructure for CNG refueling is still limited, which restricts broader adoption, but in regions where availability is higher, used CNG cars provide a viable option for buyers looking to optimize fuel costs and reduce their carbon footprint.

LPG

Liquefied petroleum gas (LPG) vehicles have niche appeal in several markets, offering a cleaner burning option which can be more cost-effective than petrol or diesel. This alternative fuel source allows for reduced emissions while providing adequate performance for daily driving needs. However, the adoption of used LPG vehicles largely depends on regional availability and the presence of refueling infrastructure. Consequently, while they offer unique advantages, the scale of their impact on the market is limited compared to other propulsion types, confining their dominance to specific geographic areas and consumers.

Others

The Others subsegment refers to vehicles powered by alternative or hybrid technologies not covered by traditional categories like petrol, diesel, CNG, LPG, or electric. This includes hybrid vehicles, which use a combination of internal combustion engines and electric motors, and hydrogen fuel cell vehicles, which generate electricity from hydrogen gas. These technologies are gaining attention due to their environmental benefits and fuel efficiency. While still niche, their presence is expected to grow as sustainability becomes a key focus in the automotive industry.

Insights On Key Engine Capacity

Small (Below 1499 CC)

The dominance of the small engine capacity category in the global used cars market can primarily be attributed to the rising demand for fuel-efficient and compact vehicles. As urbanization continues to increase, consumers are seeking cars that are easier to maneuver and park in congested city environments. Additionally, small cars are generally more affordable, making them attractive options for budget-conscious buyers, particularly in developing markets. Their lower maintenance costs and better fuel economy further enhance their appeal, allowing them to cater to a broader audience. Consequently, small vehicles are expected to lead the market, as they align closely with modern consumer preferences for practicality and cost-effectiveness.

Mid-size (Between 1500-2499 CC)

Mid-size vehicles have carved out a significant niche in the used cars market due to their balance between performance and efficiency. These cars typically offer more space than compact models, making them suitable for small families. The versatility in engine size allows buyers to choose models that provide adequate power without compromising on fuel economy. Their popularity stems from their ability to fulfill a wide variety of consumer needs, including commuting and family outings, making them a favored choice among used car shoppers.

Full Size (Above 2500 CC)

Full-size vehicles, while often seen as premium options, have faced challenges in the used cars market. Higher fuel consumption and maintenance costs can deter potential buyers who are increasingly conscious of economic factors. However, there remains a specific audience for these vehicles, particularly among buyers looking for luxury, towing capacity, or durability. They are often favored by those requiring larger cargo space or transport capability. Despite the hurdles, this attracts enthusiasts and those needing a robust vehicle for specific purposes, ensuring it maintains a dedicated consumer base.

Insights On Key Dealership

Franchised

Franchised dealerships are poised to dominate the Global Used Cars Market due to their established reputation, brand recognition, and comprehensive customer service. These dealerships have a significant advantage as they often offer certified pre-owned vehicles, which provide consumers with warranties and assurance of quality, making them a preferred choice for many buyers. Additionally, franchised dealerships benefit from their associations with specific brands that attract loyal customers looking for used cars. The structured environment of franchised dealerships often includes certified technicians and formal financing options, enhancing overall buyer confidence. Consequently, the combination of brand trust and service quality ensures that franchised dealerships will likely lead the market.

Independent

Independent dealerships face stiff competition but have carved out a niche by offering lower prices and a diverse range of used vehicles. They often cater to budget-conscious consumers who prioritize cost over brand loyalty. Independent dealerships can provide a more personalized customer experience and flexible negotiations, which appeal to those who dislike the rigid purchasing procedures often found in franchised locations. While they may lack the assurance of certified vehicles, their ability to stock unique and varied inventory makes them attractive to specific demographics, such as first-time buyers or those seeking more affordable options.

Insights On Key Sales Channel

Online

The online sales channel is expected to dominate the Global Used Cars Market due to the increasing reliance on digital platforms for purchasing vehicles. Consumers today prefer the convenience of browsing a wide selection from the comfort of their homes, leading to a significant rise in online marketplaces and car-selling apps. The ease of comparing prices, reading reviews, and accessing vehicle history reports also plays a crucial role in shaping consumer preferences. Furthermore, the COVID-19 pandemic accelerated the shift towards online transactions, and this trend is anticipated to continue as retailers enhance their digital presence and improve customer engagement.

Offline

The offline sales channel remains an important aspect of the used cars market, especially for buyers who prefer a hands-on experience. Many consumers appreciate the ability to physically inspect and test drive vehicles before making a purchase, which is often only possible through traditional dealerships or local sellers. Additionally, personal interactions with sales representatives can foster trust and offer additional information about the car's history, which is significant for many buyers. Despite the growing online trend, a substantial number of consumers still value face-to-face interactions when making significant investments like a used car.

Insights On Key Vehicle Type

Passenger Car

Passenger cars are expected to dominate the Global Used Cars Market due to their widespread appeal and practicality. They represent the most significant portion of the automotive market, driven by consumer demand for personal transport that balances affordability, fuel efficiency, and convenience. This is favored by individual users, particularly in urban areas where compact and efficient vehicles are preferred. Additionally, the increasing economy and the continuous growth of the middle class have led to higher ownership rates of such vehicles, making them readily available in the used market. The availability of a wide variety of models and price ranges further enhances their appeal, cementing their leading position in the used vehicles category.

LCV (Light Commercial Vehicle)

Light Commercial Vehicles are seeing increased traction in the used car market, primarily fueled by the rise of e-commerce and last-mile delivery services. Businesses often prefer to purchase used LCVs to reduce operational costs, which enhances their marketability. The practicality of LCVs, offering a balance between passenger comfort and cargo capacity, makes them popular among small business owners. This supports supply chains and plays a crucial role in local economies, which allows it to maintain a stable presence in the used car market.

HCV (Heavy Commercial Vehicle)

The Heavy Commercial Vehicle sector is characterized by its susceptibility to economic fluctuations, as these vehicles are typically utilized for substantial logistics and transportation needs. While not as prominent in the used market compared to passenger cars, HCVs maintain their niche, particularly for businesses in construction and large-scale freight operations. Their durability and longevity are essential for users who seek to invest in vehicles that can withstand rigorous use. Consequently, the market for used HCVs consists of operators looking to enhance their fleets while avoiding the high costs associated with new purchases.

Electric Vehicle

Electric Vehicles (EVs) have made significant strides in the automotive industry, with increasing recognition and acceptance among consumers. However, the market for used EVs is still in its emerging phase, as initial costs and battery concerns remain prominent deterrents for potential buyers. As technology continues to advance and the infrastructure for electric charging expands, the used EV market is predicted to grow. Although currently smaller compared to other vehicle types, it holds potential for future dominance as sustainability becomes a more pressing issue and consumers seek economically viable eco-friendly options.

Insights on Regional Analysis:

North America

North America is expected to dominate the Global Used Cars Market due to several key factors that create a robust environment for used car sales. The region has a high vehicle ownership rate, extensive financing options, and a strong consumer preference for used vehicles driven by cost-effectiveness. Furthermore, companies focused on online platforms for buying and selling used cars have gained considerable traction, enhancing accessibility and convenience for consumers. Additionally, regions like the U.S. exhibit mature markets with established supply chains and infrastructure supporting used vehicle transactions. The presence of numerous dealers and a wide variety of vehicles contribute to North America's leading position in this market.

Latin America

Latin America is characterized by a burgeoning used cars market, primarily driven by economic growth and increasing urbanization. Many consumers in countries like Brazil and Argentina tend to favor used vehicles due to their affordability in comparison to new cars. However, the market faces hurdles due to fluctuating economic conditions and regulatory challenges affecting vehicle imports. Nevertheless, initiatives to promote vehicle financing and a growing e-commerce are poised to boost the used car market in the coming years.

Asia Pacific

The Asia Pacific region is witnessing rapid growth in the used cars market, largely fueled by increasing disposable incomes and a growing middle class, especially in countries like India and China. The rising demand for affordable mobility options, coupled with urban congestion issues, has led more consumers to consider pre-owned vehicles. However, the market is fragmented with varying consumer preferences and regulatory frameworks across different nations, which makes standardization a challenge. Nonetheless, the potential for expansion remains significant, especially as digital auto platforms continue to advance.

Europe

Europe's used car market is characterized by a strong consumer mindset favoring sustainability and value for money. Various countries, including Germany and France, report high volumes of used car transactions, and the region enjoys well-established resale networks. Regulatory frameworks supporting vehicle emissions and environmental laws tend to shape consumer choices, pushing them towards pre-owned vehicles. Despite facing challenges from restrictive auto market conditions and shifting consumer habits towards car-sharing services, the demand for used cars remains robust, supported by ongoing trends in online sales channels.

Middle East & Africa

The used cars market in the Middle East & Africa is relatively nascent compared to other regions, though it shows promise due to rapid urbanization and population growth. In this region, there is a rising demand for budget-friendly transportation options, leading to an increasing interest in pre-owned vehicles. However, the market faces challenges, including lack of reliable data regarding vehicle history and inconsistent regulatory standards. Despite these obstacles, initiatives aimed at improving transparency in transactions and the growing influence of online platforms could enhance the market landscape significantly in the coming years.

Company Profiles:

Prominent participants in the international pre-owned vehicle sector encompass dealerships, digital marketplaces, and auction sites, which streamline the transaction processes. Furthermore, automotive service providers are essential in improving vehicle standards and boosting consumer trust by offering inspections and warranties.

The used car market features several prominent companies such as CarMax, AutoNation, CarGurus, Vroom, TrueCar, Cars.com, eBay Motors, Hertz Car Sales, Enterprise Car Sales, and Shift Technologies. Additional key players consist of Carvana, Beepi, Web2Carz, and DriveTime, along with platforms like Facebook Marketplace and Craigslist. Traditional car dealerships, including Penske Automotive Group, Lithia Motors, and Asbury Automotive Group, also play a vital role in this sector. Within the online marketplace, major contenders encompass AutoTrader, Edmunds, and Facebook Marketplace, which have established a significant presence in the sales of used vehicles.

COVID-19 Impact and Market Status:

The Covid-19 pandemic notably impacted the worldwide used vehicle market by enhancing demand, driven by disruptions in supply chains and a growing preference for personal transportation as opposed to public transit.

The COVID-19 pandemic had a profound effect on the market for pre-owned vehicles, presenting both challenges and opportunities. At the onset, lockdown measures and restrictions caused a significant drop in sales as individuals confronted economic instability, and dealerships were compelled to shut their doors. As time progressed, however, a notable increase in demand emerged due to disruptions in supply chains that curtailed the production of new vehicles. This situation prompted many buyers to seek alternatives in the used car market. Consequently, inventory levels plummeted, leading to a spike in prices, with certain pre-owned vehicles reaching unprecedented sale figures. Furthermore, the growing trend of online platforms for car sales streamlined the purchasing process, allowing consumers to easily compare options. In summary, despite the initial turmoil brought on by the pandemic, the used car market ultimately thrived, reshaping consumer behavior and transforming dealership practices in the aftermath.

Latest Trends and Innovation:

- In February 2023, Carvana announced the acquisition of an Arizona-based vehicle inspection company to enhance its vehicle condition and inspection capabilities, aiming to improve customer trust and satisfaction.

- In March 2023, Vroom, a leading online used car retailer, announced a strategic partnership with a major logistics provider to streamline its vehicle delivery processes, reducing delivery times and improving operational efficiency.

- In June 2023, CarMax introduced a new digital tool that utilizes artificial intelligence to personalize the used car shopping experience for customers, allowing for tailored recommendations based on individual preferences and past behavior.

- In July 2023, AutoNation announced the launch of its new used vehicle platform, allowing customers to browse, purchase, and schedule delivery of used cars entirely online, aiming to capture the growing demand for digital experiences in the auto retail space.

- In September 2023, TrueCar expanded its dealer network by acquiring several regional dealerships, increasing its presence in key markets and enhancing the variety of used vehicles available to customers through its platform.

- In October 2023, CarGurus launched a new feature enabling consumers to receive real-time price estimates and appraisals on used cars, leveraging data analytics to provide a more informed buying experience.

Significant Growth Factors:

The expansion of the pre-owned automobile market is largely fueled by a ened consumer inclination towards cost-effectiveness, improved vehicle reliability, and the emergence of digital sales channels.

The market for pre-owned vehicles is undergoing notable expansion, fueled by several pivotal influences. Economic uncertainties compel many consumers to turn to more budget-friendly options, thus boosting the demand for used cars. Moreover, the escalating prices of new vehicles, driven by ongoing supply chain challenges and a shortage of semiconductors, have intensified the shift towards buying used cars.

Advancements in digital platforms have enhanced consumers' ability to explore a broader array of choices, promoting increased transparency and competitive pricing among sellers. The acceptance of online transactions has surged, particularly in the wake of the COVID-19 pandemic, which has simplified the process of purchasing pre-owned vehicles. Additionally, a growing awareness of environmental issues is prompting consumers to view pre-owned cars as more sustainable alternatives, contributing to a reduced carbon footprint linked to the production of new vehicles.

The proliferation of financing solutions, including adaptable payment schemes and specialized loans for used vehicles, has further facilitated market growth by improving accessibility for buyers. Lastly, the overall enhancement in the quality of used cars, supported by stringent inspections and certified pre-owned initiatives, has increased consumer trust and further stimulated sales in this market. Collectively, these elements are driving the significant growth of the pre-owned vehicle sector.

Restraining Factors:

Significant hindrances in the pre-owned automobile market consist of variable pricing, economic instability, and a growing inclination among consumers towards electric vehicles.

The market for pre-owned vehicles is confronted with various limiting factors that may hinder its expansion. Economic instability, characterized by variable interest rates and inflation, can reduce consumers' purchasing capabilities, resulting in a decline in market demand. Furthermore, the increasing trend toward electric and hybrid automobiles may diminish the appeal of conventional used cars, as buyers lean towards more sustainable alternatives. Concerns regarding quality significantly influence potential purchases; many consumers hesitate due to apprehensions about the mechanical integrity and service history of second-hand cars. Additionally, the introduction of cutting-edge technologies in newer models fosters a belief that older vehicles lack desirability because of their outdated features. Regulatory hurdles, such as evolving emissions standards and warranty conditions, also pose challenges for both buyers and sellers within this sector. Nevertheless, the pre-owned vehicle market demonstrates remarkable resilience, driven by a growing focus on cost-effectiveness and a rise in certified pre-owned options that provide warranties and quality guarantees. This shifting environment creates avenues for consumers to discover vehicles that align with their preferences, while simultaneously promoting innovation in the market.

Key Segments of the Used Cars Market

By Vendor Type

- Organized

- Unorganized

By Propulsion

- Petrol

- Diesel

- CNG

- LPG

- Electric

- Others

By Engine Capacity

- Full Size (Above 2500 CC)

- Mid-size (Between 1500-2499 CC)

- Small (Below 1499 CC)

By Dealership

- Franchised

- Independent

By Sales Channel

- Online

- Offline

By Vehicle Type

- Passenger Car

- LCV

- HCV

- Electric Vehicle

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America