Previously in 2018, the global video surveillance market size was valued at USD 38.9 billion and expected to grow significantly over the forecast period. Increasing demand for security observation products on account of rising criminal and threat activities is the key factor to propel the video surveillance systems market by 2025.

Video surveillance systems are an integrated arrangement of hardware and software components including CCTV cameras, monitors, and storage media among others. These systems are utilized across several commercial and industrial spaces as a measure to protect valuable belongings and ensure security. Growing adoption of analytics in the construction of video surveillance systems is considered as one of the major driving forces of market growth.

The global Video Surveillance market size is expected to reach close to USD 76.4 bn 2029 with an annualized growth rate of 9.4% through the projected period.

.jpg)

Discussing the current scenario, the global video surveillance market is witnessing substantial product developments. Technological advancements such as license plate recognition, queue management analysis, facial surveillance, and advanced objected tracking considered the newest technologies in the industry.

The market for VSaaS is likely to witness significant growth in the near future. Moreover, the rising acceptance of do-it-yourself (DIY) video surveillance for residential security, the market will have increased momentum in the near future.

The advancement of different types of smart cameras and associated sensors has positively affected the video surveillance market. Data Analytics is also playing a key role in the growth of the video surveillance market. For example, surveillance services are consolidated in commercial locations where they use smart cameras, along with in-band analytics and other associated sensors for programming functions that require multiple workforces. These features have permitted a more practical approach to perform surveillance and join the gaps between prosecution models, with a more efficient safety system.

Key players operating in the video surveillance market are FLIR Systems Incorporation, Avigilon Corporation, Bosch Security Systems Incorporation, Hangzhou Hikvision Digital Technology Company Limited, Axis Communications AB, and others.

Video Surveillance Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2029 |

| Study Period | 2018-2029 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2029 | USD 76.4 billion |

| Growth Rate | CAGR of 9.4 % during 2019-2029 |

| Segment Covered | Component ,customer, Regions |

| Regions Covered | North America, Europe, Asia Pacific, Middle East and Africa, South America |

| Key Players Profiled | Honeywell International Inc., Hanwha Techwin Co. Ltd., Agent Video Intelligence Ltd., Tiandy Technologies Co. Ltd., Genetec Inc., Dahua Technology USA Inc., MOBOTIX |

Key segments of the global video surveillance market

System type overview (USD Billion)

- Analog Based

- IP Based

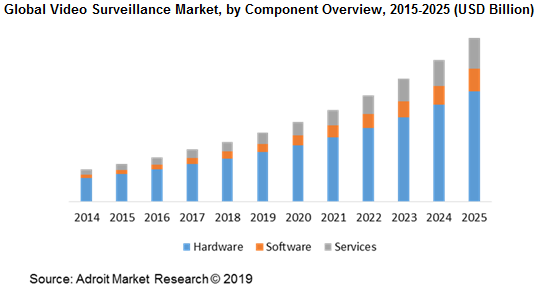

Component Overview, (USD Billion)

- Hardware

- Camera

- By type

- Analog

- IP

- By resolution

- SD

- HD

- 4K

-

- Monitor

- Storage media (Thousand Units) (USD Million)

- By type

- DVR

- NVR

- Software

- Services

Vertical Overview, (USD Billion)

- Law Enforcement

- Military & Defense

- Commercial & industrial

- Educational Institutes

- Transportation & logistics

- Residential

- BFSI

- Others

Regional Overview, (USD Billion)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Asia Pacific

- China

- Japan

- India

- South Korea

- South America

- Brazil

- Middle East & Africa

Frequently Asked Questions (FAQ) :

As the crime rate has increased in recent years due to increasing population, low-income rate, and other related concerns, national governments have started implementing initiatives and investments in the security field so as to curb these threats. Furthermore, as the income level of masses has increased over time, they are now more open to investing in security. Consumer awareness of new product developments has considerably increased, owing to their exposure to online media. As a consequence, this is expected to boost the demand for video surveillance systems in the future.

The recently enclosed trend in surveillance involves the sheer volume of data is majorly created by video security systems in every individual time period. Modern surveillance systems are creating maximum data, and on the verge to increase in the coming years. This tremendous growth data results to the wider execution of video surveillance by a range of industries and organizations such as government organizations, transportation businesses, health providers, technology companies, banking, and financial institutions, retailers, and manufacturing firms.

Based on the type overview, the global video surveillance market is segmented into analogy based and IP based. Analog and IP based systems are the main categories of the global video surveillance industry. The IP-based video surveillance offers several benefits over analog-based video surveillance systems such as better recording features, storage, and connectivity among others. Owing to this, the IP based systems segment is projected to grow ~3x times in terms of revenue over the forecast period. The IP systems accounted for more than half of the global industry share in 2018.

In terms of component overview, the global video surveillance market is categorized into hardware, software, and services. The hardware segment constituted the largest share as compared to software and services. Monitoring devices, camera, and storage media are the major sub-segments of the hardware category.

Furthermore, on the basis of vertical overview, the global video surveillance market is fragmented into commercial & industrial, law enforcement, BFSI, educational institutes, military & defense, transportation & logistics, residential, and others.

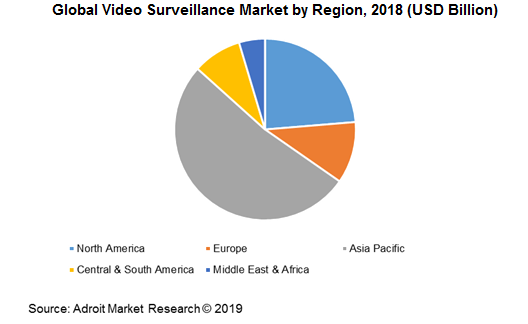

The global video surveillance market is a wide range to North America (US, Canada, Mexico), Europe (Germany, UK, and France), Asia Pacific (China, Japan, India, and South Korea), South America (Brazil), and Middle East & Africa.

Looping on to the detailed view of the region, Europe is majorly driven by the commercial sector as retailers are increasingly investing in security technologies. Furthermore, recent incidences of threat activities in some parts of Europe has created demand for effective security and hence the demand for advanced technologies is anticipated to grow at large scale over coming years. Development in analytics is anticipated to drive the growth for video surveillance in Europe over the forecast period. Asia-Pacific holds the largest market share in the global video surveillance market. The region is expected to dominate the market during forecast year primarily due to industrial growth, government initiatives to enhance public security, and high disposable income in countries such as China, India, and many South East Asian countries.