Market Analysis and Insights:

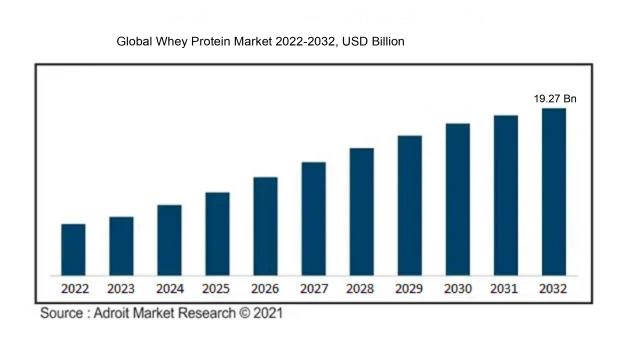

The market for Whey Protein was estimated to be worth USD 8.26 billion in 2022, and from 2023 to 2032, it is anticipated to grow at a CAGR of 8.91%, with an expected value of USD 19.27 billion in 2032.

The whey protein industry is being largely propelled by the rise in consumer knowledge regarding the various health advantages linked to its consumption. Whey protein is recognized for its ability to assist in weight control, stimulate muscle development, enhance immune function, and elevate athletic performance. As the number of health-aware individuals and fitness enthusiasts continues to grow, there is an increasing demand for whey protein as a dietary addition. Moreover, the surge in popularity of vegetarian and vegan diets has prompted the introduction of plant-based alternatives to whey protein, further broadening the market scope.

Additionally, the aging demographic and the uptick in chronic ailments like diabetes and cardiovascular issues have fostered a requirement for protein supplementation, thereby propelling the demand for whey protein.

Furthermore, ongoing advancements in product formulations and manufacturing techniques leading to better taste, solubility, and consistency have further bolstered market expansion.

The widespread presence of fitness centers, gyms, sports nutrition outlets, and online retail platforms has made whey protein products more easily accessible, thereby aiding in their distribution and contributing to overall market growth. Nevertheless, factors such as the relatively high cost and the availability of alternative protein sources could pose some hindrances to market progression. In conclusion, the whey protein sector is anticipated to experience substantial growth in the future owing to the increasing focus on health, evolving dietary trends, and technological innovations within the field.

Whey Protein Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 19.27 billion |

| Growth Rate | CAGR of 8.91%, during 2023-2032 |

| Segment Covered | By Type , By Application ,By Distribution channel,By Region . |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Glanbia Plc., Hilmar Cheese Company Inc., Arla Foods Ingredients Group P/S, Fonterra Co-operative Group Ltd., Davisco Foods International Inc., Maple Island Inc., Milk Specialties Global, Leprino Foods Company, Westland Milk Products, and Grande Cheese Company. |

Market Definition

Derived from milk, whey protein is a nutritional supplement packed with crucial amino acids, sought after by individuals in the athletic and fitness community for its ability to aid in muscle recovery and development. It is frequently integrated into diets to boost protein consumption and advance wellness objectives.

Derived from milk in the cheese-making process, whey protein is a vital nutritional supplement renowned for its multitude of health advantages. Packed with essential amino acids, it is a key factor in muscle growth and repair, appealing to both athletes and those involved in demanding physical activities. Its benefits extend to weight management by enhancing satiety and preserving lean muscle mass. Whey protein further bolsters immune function through its content of immunoglobulins and lactoferrin, crucial elements in the body's defense against infections. With its easy digestibility and rapid absorption, whey protein is a convenient choice for individuals with digestive sensitivities or those seeking a swift and effective source of protein. In essence, the significance of whey protein lies in its contributions to muscle development, weight control, immune reinforcement, and general well-being.

Key Market Segmentation:

Insights On Key Type

Isolates

Isolates are expected to dominate the global whey protein market due to their high protein content and lower lactose content compared to other parts. Isolates are further processed to remove most of the fats and carbohydrates, resulting in a product that is about 90% or more protein. This makes isolates highly desirable for individuals seeking a protein supplement without unnecessary calories or lactose, such as athletes, bodybuilders, and those with lactose intolerance. The increasing popularity of sports nutrition and the growing awareness of the health benefits of protein consumption are driving the demand for isolates in the global whey protein market.

Concentrates

Concentrates are another significant part in the global whey protein market. Whey protein concentrates typically contain around 70-80% protein, with the remaining percentage consisting of lactose, fats, and carbohydrates. This part is favored for its relatively lower cost compared to isolates and its moderate protein content. Concentrates find applications in the food and beverage industry, including the production of protein bars, ready-to-drink beverages, and bakery products. Additionally, concentrates are also used as feed supplements for livestock.

Demineralized

Demineralized whey protein part is characterized by the removal of minerals, particularly calcium, from whey. This process is conducted primarily to improve the taste and solubility of the whey protein. Demineralized whey protein finds application in the infant formula industry, as it is easier for infants to digest and has reduced levels of minerals that could overload their kidneys. The demand for demineralized whey protein is driven by the increasing population of infants and the rising adoption of infant formulas across the globe.

Hydrolysate

Hydrolysate, also known as hydrolyzed whey protein, is obtained by breaking down whey protein into smaller peptides through the process of hydrolysis. This part is popular among athletes and bodybuilders due to its rapid absorption and easier digestion compared to other parts. Hydrolysate is considered a premium whey protein product, as it undergoes additional processing to enhance its bioavailability. The high cost associated with hydrolysates limits its wider adoption, but the part continues to witness growth due to the demand for convenient and fast-acting protein supplements in the sports nutrition market.

Insights On Key Application

Sports and Performance Nutrition

The sports and performance nutrition part is expected to dominate the global whey protein market. With the increasing popularity of sports and athletic activities, the demand for whey protein as a dietary supplement for improving athletic performance, enhancing muscle strength, and promoting muscle recovery has been growing significantly. Athletes and fitness enthusiasts are increasingly incorporating whey protein into their diet to meet their protein requirements and support their fitness goals. This part is projected to witness substantial growth due to the rising fitness consciousness and the growing market for sports nutrition products.

Nutritional

The nutritional part focuses on the use of whey protein as a nutritional supplement for various purposes, including weight management, muscle building, and improving overall health. This part is expected to witness steady growth due to the increasing awareness regarding the benefits of whey protein as a high-quality source of protein and its potential role in maintaining a healthy diet.

Personal Care

In the personal care part, whey protein is utilized for its skin and hair nourishing properties. It is incorporated into skincare and haircare products to provide moisturization, improve skin elasticity, and enhance hair strength. The personal care part is anticipated to experience moderate growth as consumers seek natural and effective ingredients for their personal care routines.

Food

The food part includes the use of whey protein in various food products, such as bakery items, dairy products, breakfast cereals, and snacks. Whey protein enhances the nutritional value and functional properties of these food products, making them more appealing to health-conscious consumers. The food part is expected to grow steadily as the demand for protein-fortified food products continues to rise.

Feed

Whey protein finds application in animal feed to support animal growth, development, and overall health. It is used in feed formulations for livestock, poultry, and aquaculture. The feed part is anticipated to witness moderate growth due to the increasing demand for high-quality animal feed and the focus on optimal animal nutrition and performance.

Infant Formula

In the infant formula part, whey protein is used as a vital ingredient to mimic the composition of human breast milk and provide essential nutrients to infants. The infant formula part is projected to experience steady growth as the demand for infant nutrition products continues to increase globally.

Functional/Fortified Food

The functional/fortified food part focuses on the use of whey protein in functional foods, which are specifically formulated to offer additional health benefits beyond basic nutrition. Whey protein is added to these products to enhance their nutritional profile and provide specific health benefits. This part is expected to witness moderate growth as consumers seek functional foods that offer nutritional value and added health advantages.

Insights On Key Distribution channel

Specialty Stores

The specialty stores part is likely to dominate the Global Whey Protein market. Specialty stores typically offer a wide range of health and fitness products, including various types of protein supplements. This part is expected to dominate as it focuses exclusively on health-conscious individuals seeking specific products like whey protein. Specialty stores provide targeted and knowledgeable advice about different brands and types of whey protein, catering to the specific needs and preferences of customers.

Supermarkets/Hypermarkets

Supermarkets/hypermarkets are also a significant part of the Global Whey Protein market. These retail outlets provide convenience and easy access to a wide range of products, including whey protein supplements. They cater to a broader customer base, including both health-conscious individuals and the general population. Supermarkets/hypermarkets benefit from their extensive presence and strong distribution network, making them a reliable source for purchasing whey protein supplements.

Convenience Stores

Convenience stores play a relatively smaller role in the Global Whey Protein market compared to specialty stores and supermarkets/hypermarkets. While they offer convenience by being located in easily accessible areas, their limited shelf space and product variety may hinder the availability of a wide range of whey protein options. However, convenience stores can attract impulse buyers or those seeking immediate protein supplement options.

Online Stores

Online stores have gained significant traction in recent years and are fast-growing part in the Global Whey Protein market. They offer a convenient shopping experience, with the ability to compare prices, read customer reviews, and access a wide variety of whey protein brands and types. Online stores provide a platform for both small and large suppliers to reach a global customer base, making it easier for consumers to find their preferred whey protein products and flavors.

Other

The Other part within the distribution channel of the Global Whey Protein market includes various channels that are not explicitly categorized as supermarkets/hypermarkets, convenience stores, specialty stores, or online stores. This part can consist of wholesalers, discount stores, and independent retailers. While the precise details of this part may vary, it is likely to have a relatively smaller market share compared to the dominant parts mentioned above.

Insights On Key End Users

Athletes

The Athletes part is expected to dominate the Global Whey Protein market. Athletes have specific nutritional needs to support their rigorous training and enhance their performance. Whey protein is known for its ability to provide high-quality protein, essential amino acids, and promote muscle recovery and growth. The demand for whey protein among athletes is high due to its effectiveness in aiding muscle protein synthesis and improving athletic performance.

Bodybuilders

Bodybuilders are another significant part of the Global Whey Protein market. Similar to athletes, bodybuilders require high protein intake to support their muscle building and recovery goals. Whey protein offers fast digestion and absorption, making it an ideal choice for post-workout nutrition. It provides the necessary amino acids to stimulate muscle protein synthesis, helping bodybuilders achieve their desired physique.

Lifestyle Users

While athletes and bodybuilders dominate the market, there is also a substantial market for whey protein among lifestyle users. Lifestyle users encompass individuals who are health-conscious and seek to supplement their daily protein intake for overall well-being and maintaining muscle mass. Whey protein offers a convenient and easily digestible protein source for individuals with active lifestyles or those who simply aim to meet their daily protein requirements.

In conclusion, the Athletes part is anticipated to dominate the Global Whey Protein market, followed by bodybuilders and lifestyle users, respectively. Each part has unique nutritional needs and preferences, driving the demand for whey protein in different consumer groups.

Insights on Regional Analysis:

North America

North America is expected to dominate the global whey protein market due to factors such as a growing health-conscious population, increased demand for protein-rich diets, and the presence of key market players. Moreover, the region's robust food and beverage industry further fuels the demand for whey protein. Additionally, the increasing adoption of sports nutrition and fitness activities contributes to the market's growth. The use of whey protein as an ingredient in various food and beverage products, including protein bars, sports drinks, and meal replacements, also drives the market's dominance in North America.

Latin America

In Latin America, the whey protein market is showing significant growth potential. The region is witnessing a rise in health awareness and an increasing focus on fitness and sports activities. With a growing middle class and increasing disposable incomes, consumers are looking for healthier food options, including protein-rich products. Manufacturers have recognized this trend and are launching various whey protein-based products, thereby driving market growth in Latin America. Additionally, the presence of a large population and a thriving food and beverage industry make Latin America an emerging market for whey protein.

Asia Pacific

Asia Pacific is witnessing substantial growth in the whey protein market. Factors such as a large population base, rising disposable incomes, increasing consumer awareness about health and wellness, and changing dietary preferences contribute to the market's expansion in the region. The demand for sports nutrition products and dietary supplements is also on the rise. Furthermore, the presence of key market players, investments in product development, and the growing penetration of e-commerce platforms further propel the growth of the whey protein market in Asia Pacific.

Europe

Europe is a mature market for whey protein, characterized by a high consumption rate and a well-established food and beverage industry. Growing health consciousness, the popularity of fitness activities, and increasing demand for protein-rich diets contribute to the continued growth of the whey protein market in Europe. Moreover, the region's focus on research and development and technological advancements in whey protein production are driving market growth. However, stringent regulations and high competition pose challenges to new entrants in the European whey protein market.

Middle East & Africa

The whey protein market in the Middle East and Africa is witnessing steady growth. Factors such as increasing health consciousness, rising disposable incomes, and the growing demand for nutritional supplements and functional foods drive market expansion. Additionally, the presence of international whey protein manufacturers and retailers in the region contributes to market growth.

However, challenges such as limited awareness among consumers and the presence of traditional dietary preferences hinder the market's full potential in the Middle East and Africa. Despite these challenges, the whey protein market in the region is expected to grow steadily in the coming years.

Company Profiles:

Prominent entities within the worldwide whey protein industry, including Glanbia plc, Fonterra Co-operative Group, and Kerry Group, are instrumental in providing an extensive array of novel whey protein solutions. They are actively involved in research and development ventures to address the changing preferences of consumers.

Moreover, these key market participants prioritize strategic collaborations, consolidations, and takeovers to amplify their international market reach and boost production capabilities. This is done with a focus on maintaining top-notch standards and sustainable procurement of whey protein to fulfill the rising requirements across different consumer sectors.

Prominent contributors in the whey protein sector comprise Glanbia Plc., Hilmar Cheese Company Inc., Arla Foods Ingredients Group P/S, Fonterra Co-operative Group Ltd., Davisco Foods International Inc., Maple Island Inc., Milk Specialties Global, Leprino Foods Company, Westland Milk Products, and Grande Cheese Company. These distinguished entities are highly regarded within the industry, holding substantial positions in the global whey protein market. They present a diverse array of whey protein products, continually engaging in research and development efforts to enrich their product offerings.

Through robust distribution channels and adept marketing tactics, these leading figures play a pivotal role in molding the whey protein landscape and addressing the diverse needs of consumers on a worldwide scale.

COVID-19 Impact and Market Status:

The global whey protein market has been adversely affected by the Covid-19 pandemic, experiencing challenges such as supply chain disruptions, reduced consumer spending, and decreasing demand due to gym closures.

The global whey protein market has been significantly impacted by the COVID-19 pandemic. The outbreak has led to disruptions in supply chains, manufacturing processes, and distribution networks due to lockdowns and movement restrictions imposed in various countries. The closures of gyms, fitness centers, and sporting events as part of social distancing measures have resulted in a decrease in the demand for whey protein among athletes and fitness enthusiasts. Moreover, the economic downturn caused by the pandemic has led to a decline in disposable incomes, thereby reducing consumer spending on premium health supplements such as whey protein.

Nevertheless, there has been a growing demand for essential nutrition and dietary supplements, including whey protein, as individuals prioritize their health and well-being in these challenging times. The shift towards online shopping and home-based workouts has made e-commerce platforms and direct-to-consumer channels pivotal in the distribution of whey protein products. As economies start to recover from the pandemic, the whey protein market is anticipated to experience steady growth, driven by the increasing health awareness and the growing emphasis on personal fitness.

Latest Trends and Innovation:

• Arla Foods announced the acquisition of Mengniu Dairy's 51% stake in Arla Foods Ingredients on June 16, 2020.

• Glanbia plc launched BEVATM Proteins in November 2020, a groundbreaking technology that delivers a 100% whey-based protein solution for clear and refreshing high-protein beverages.

• Hilmar Ingredients expanded its whey and milk protein offerings with the launch of HMOPro™, a human milk oligosaccharide (HMO) fortified whey protein ingredient, in September 2020.

• Lactalis Ingredients acquired Epi Ingredients, a company specialized in dairy ingredients aimed at the food and nutrition industries, on October 22, 2019.

• Fonterra Co-operative Group introduced its new high-quality whey protein concentrate, NZMP SureStartTM Whey Protein 4866, on November 5, 2019, specifically designed for high-protein nutritional products for infants.

• Kerry Group enhanced its clean label portfolio with the introduction of two new probiotic ingredients, ProDiem™ Refresh and ProDiem™ Refresh+, which contain whey protein along with probiotics, on March 4, 2020.

• Saputo Inc. completed the acquisition of Dairy Crest Group plc, a leading UK-based dairy company, on April 15, 2019, expanding its presence in the European market.

• Glanbia Nutritionals launched HarvestPro Vegan Protein, a plant-based protein blend that includes pea and brown rice proteins in September 2020 to cater to the growing demand for vegan protein options.

• Arla Foods Ingredients developed Lacprodan® ISO.Water, a natural whey protein isolate solution that offers enhanced stability in clear beverages, launched on May 4, 2021.

• Fonterra Co-operative Group partnered with Apollo Hospitals, India's leading healthcare service provider, to launch a range of fortified dairy products, including a whey protein-based nutrition product line, in November 2020.

Significant Growth Factors:

The expansion of the Whey Protein Market can be ascribed to the growing awareness of health among individuals and the increasing need for sports nutrition items.

The market for whey protein has seen significant growth in recent years due to several influential factors. One of the main drivers is the growing consumer awareness and focus on health and fitness, leading to a ened demand for whey protein products. As individuals increasingly prioritize maintaining a healthy lifestyle and achieving their fitness goals, there is a rising interest in protein-rich supplements, particularly those sourced from high-quality options like whey protein. Furthermore, the increasing prevalence of chronic diseases and the aging population have contributed to the ened demand for whey protein, known for its potential health advantages. Research has demonstrated that the consumption of whey protein can aid in muscle recovery, weight management, and enhancing overall immune function.

Moreover, the trend towards adopting vegetarian and vegan lifestyles has propelled the need for plant-based whey protein alternatives, targeting those seeking dairy-free protein options. The proliferation of e-commerce platforms and convenience stores has also played a role in making whey protein more accessible to a broader consumer base, further spurring its market expansion. Additionally, there have been advancements in product offerings, such as flavored protein shakes and protein bars, to accommodate changing consumer preferences. In conclusion, the growth of the whey protein market can be attributed to the increasing focus on health, aging population, escalating chronic illnesses, emergence of plant-based alternatives, and the widening availability through various distribution channels.

Restraining Factors:

Factors such as market competition, potential adverse effects, and the presence of alternative protein supplements serve as constraints for the whey protein market.

The whey protein industry has seen a significant upsurge in recent years, chiefly propelled by the escalating awareness among consumers regarding its beneficial health properties. Nonetheless, there exist various factors that could impede the market's growth trajectory. A primary concern revolves around the relatively higher cost of whey protein compared to alternative protein sources, rendering it less accessible to price-conscious consumers. Moreover, constraints related to the availability, sourcing, and production of whey protein in specific geographic regions present formidable barriers, particularly in emerging economies. Additionally, the increasing incidence of lactose intolerance and dairy allergies among the populace acts as a deterrent to whey protein consumption, given its milk-derived nature.

Furthermore, the advent of cost-effective substitutes like plant-based proteins such as soy or pea protein stands to affect the demand for whey protein. The imposition of rigorous regulations and quality standards by governing bodies poses another challenge, potentially encumbering companies in adhering to compliance requirements. Despite these hurdles, the whey protein sector persists in its growth trajectory due to the surge in demand for sports nutrition commodities, burgeoning fitness trends, and the ening health consciousness among consumers worldwide. Market participants are proactively engaged in crafting innovative products and strategies to surmount these obstacles and capitalize on untapped market opportunities, thereby fostering the favorable advancement of the whey protein industry.

Key Segments of the Whey Protein Market

Type Overview

- Isolates

- Concentrates

- Demineralized

- Hydrolysate

Application Overview

- Nutritional

- Personal Care

- Food

- Feed

- Infant Formula

- Sports and Performance Nutrition

- Functional/Fortified Food

Distribution Channel Overview

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Other

End Users Overview

- Athletes

- Bodybuilders

- Lifestyle Users

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America