Market Analysis and Insights:

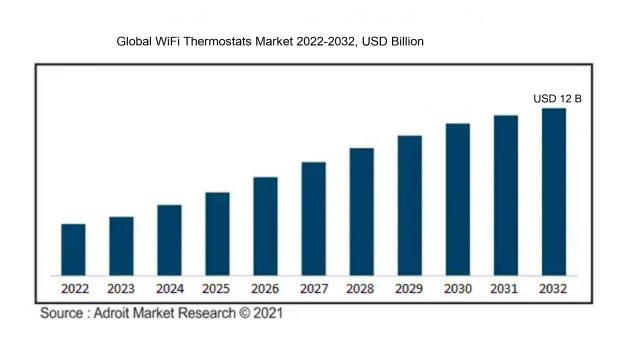

The market for WiFi Thermostats was estimated to be worth USD 2.5 billion in 2023, and from 2024 to 2032, it is anticipated to grow at a CAGR of 20.5%, with an expected value of USD 12 billion in 2032.

The market for WiFi-enabled thermostats is significantly propelled by a rising interest in energy efficiency and automation within smart homes. As public awareness regarding environmental issues grows, the demand for technologies that effectively manage energy use has surged. Moreover, advancements in Internet of Things (IoT) capabilities are enhancing both connectivity and user interaction, which encourages more homeowners to incorporate smart thermostats into their living spaces. The popularity of remote monitoring and operational control through mobile devices adds a layer of convenience, particularly appealing to technology-oriented consumers. Additionally, governmental programs offering incentives and rebates for energy-efficient products play a pivotal role in the expansion of this market. The increase in disposable income and the growth of both residential and commercial building sectors further stimulate this demand. As more individuals pursue cohesive home automation solutions, the awareness and integration of WiFi thermostats continue to grow, establishing it as a vital of the larger home automation market.

WiFi Thermostats Market Scope :

| Metrics | Details |

| Base Year | 2024 |

| Historic Data | 2020-2023 |

| Forecast Period | 2024-2032 |

| Study Period | 2023-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 12 billion |

| Growth Rate | CAGR of 20.5% during 2024-2032 |

| Segment Covered | By Product Type, By Application, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Nest Labs (a subsidiary of Google LLC), Ecobee Inc., Honeywell International Inc., Emerson Electric Co., Johnson Controls International plc, Schneider Electric SE, Siemens AG, Tado GmbH, Netatmo SAS, and Viega LLC. Other significant firms in this sector include Lux Products Corporation, Sensi (part of Emerson), Ecobee, and Aprilaire. |

Market Definition

WiFi-enabled thermostats are advanced temperature regulation devices that link to a household's wireless network, enabling users to control their heating and cooling systems remotely through smartphone applications or online platforms. These devices provide improved energy efficiency, customizable scheduling options, and real-time oversight of HVAC operations.

WiFi-enabled thermostats play a crucial role in contemporary home automation, providing improved convenience and energy efficiency. These devices allow homeowners to manage heating and cooling systems from afar using smartphones or tablets, facilitating customized temperature adjustments tailored to personal routines and preferences. This remote functionality aids in maximizing energy efficiency, which can lead to reduced utility expenses. Moreover, numerous WiFi thermostats feature intelligent learning abilities, adjusting to users' habits over time to enhance their effectiveness. In summary, they not only foster a more comfortable home atmosphere but also encourage responsible energy usage, establishing them as essential components in the modern interconnected household.

Key Market Segmentation:

Insights On Key Product Type

Connected

Connected WiFi thermostats are projected to dominate the Global WiFi Thermostats Market due to the increasing demand for smart home technologies and IoT (Internet of Things) integration. These devices offer features such as remote access, energy scheduling, and data analytics, which enhance user convenience and energy efficiency. The growing trend towards home automation is also contributing to the expansion of the connected, as consumers seek devices that can communicate and work together seamlessly. Additionally, advancements in voice control technologies and mobile compatibility further enhance the appeal of connected thermostats, positioning them as the preferred choice for modern households.

Standalone

Standalone WiFi thermostats are gaining traction among consumers looking for straightforward solutions to regulate their home temperature without the complexities associated with connected devices. These products typically offer ease of installation, lower upfront costs, and reliable performance, appealing to those who might not prioritize smart home integrations. While they lack advanced features such as remote connectivity, standalone units provide an attractive option for budget-conscious consumers or those simply seeking a user-friendly approach to temperature management.

Learning

Learning WiFi thermostats are known for their adaptive technology, which uses user behaviours and preferences to optimise heating and cooling schedules. This capability can result in significant energy savings over time, making them an appealing option for environmentally conscious consumers. While this presents unique advantages, such as automation based on user patterns, the higher price point and the complex setup may deter some buyers. However, as awareness of energy conservation increases, learning thermostats may capture a niche market focused on efficiency and sustainability.

Insights On Key Application

Residential

The residential sector is expected to dominate the Global WiFi Thermostats Market due to the increasing demand for smart home technology. Homeowners are increasingly recognizing the benefits of WiFi thermostats, such as energy savings, remote temperature control, and integration with other smart devices. Furthermore, as energy efficiency becomes a key focus in residential settings, consumers are inclined towards products that enhance comfort while reducing utility costs. The growing awareness of climate change and the need for sustainable living is driving homeowners to invest in smart solutions to optimise their energy consumption. This trend is expected to support the growth of WiFi thermostats in the residential domain.

Commercial

In the commercial sector, WiFi thermostats are slowly gaining traction as businesses become more concerned about energy efficiency and operational costs. The importance of smart technologies in enhancing building management systems is increasingly recognized, leading to installations that provide centralized control over heating, ventilation, and air conditioning. While this sector acknowledges the benefits, the adoption rate has been comparatively slower than residential settings due to higher initial investment costs and the complexity of existing systems. Nevertheless, as energy regulations tighten and the push for greener practices grows, a gradual shift towards these smart thermostatic solutions is expected in the commercial market.

Industrial

The industrial application of WiFi thermostats is characterized by a more complex landscape. In many industries, traditional HVAC systems dominate, and the integration of smart thermostatic controls is often hindered by the scale and intricacies of existing setups. Industrial facilities tend to prioritize robust, durable solutions over the conveniences offered by smart technologies. While there is potential for growth as industries seek to enhance efficiency and reduce operational costs, current adoption rates remain low. However, as industries face greater scrutiny regarding sustainability, there is an opportunity for WiFi thermostats to become part of broader automation and energy management initiatives in the long run.

Insights on Regional Analysis:

North America

North America is expected to dominate the Global WiFi Thermostats market. This region leads primarily due to the high adoption of smart home technology and the increasing awareness of energy efficiency among consumers. The presence of major players such as Nest Labs and Ecobee in the USA contributes significantly to the market's growth in this region. Moreover, supportive government initiatives promoting energy efficiency and smart grid technologies further boost market expansion. A well-established distribution network and advancements in technology, particularly in the United States and Canada, enhance consumer access to innovative WiFi thermostat solutions, solidifying the region's dominance.

Latin America

In Latin America, the WiFi Thermostats market is gradually expanding, owing primarily to rising urbanisation and disposable incomes. Countries such as Brazil and Mexico are becoming more aware of smart home devices, resulting in increased demand. However, the market is still in its early stages when compared to North America and Europe. Limited internet infrastructure and economic instability can slow adoption. Nevertheless, partnerships with local manufacturers and increased consumer education about energy efficiency features are likely to drive growth in the coming years.

Asia Pacific

The Asia Pacific region shows considerable potential in the WiFi Thermostats market, with rapid advancements in home automation and smart technologies. Countries such as China and Japan are driving this trend with significant investments in smart city projects and technological innovations. However, challenges such as varying consumer preferences and low penetration of smart home devices in certain countries can slow down rapid growth. As internet connectivity improves and the middle class expands, manufacturers are expected to focus on expanding their product offerings and marketing strategies tailored to local needs, which may increase market traction.

Europe

Europe is steadily growing in the WiFi Thermostats market, thanks to stringent regulations regarding energy efficiency and sustainability in the European Union. The increasing emphasis on reducing carbon footprints has led to a rise in demand for intelligent heating solutions. Leading European players like Honeywell and Tado are already catering to the need for technologically advanced, energy-saving thermostats. However, market growth may be challenged by regional differences in purchasing power and varying levels of awareness regarding smart home technologies. Adoption rates are likely to vary between Western and Eastern European countries, impacting overall market potential.

Middle East & Africa

In the Middle East and Africa, the WiFi Thermostats market is still underdeveloped, with limited penetration compared to other regions. However, growing interest in home automation, coupled with an emerging middle class, presents an opportunity for growth. Urban areas in countries like the UAE and South Africa are seeing increasing investments in smart technologies. One significant challenge is the lack of infrastructure and high initial costs of smart devices, which may restrict wider adoption. Nevertheless, as economies continue to develop and awareness increases, the market for WiFi thermostats is expected to slowly gain momentum in this region.

Company Profiles:

Leading entities in the Global WiFi Thermostats market prioritize innovation and technological progress, offering intelligent solutions that improve energy efficiency and user engagement. They propel market expansion by focusing on product enhancement, forming strategic alliances, and broadening their distribution networks to align with consumer needs.

The prominent participants in the market for WiFi-enabled thermostats comprise Nest Labs (a subsidiary of Google LLC), Ecobee Inc., Honeywell International Inc., Emerson Electric Co., Johnson Controls International plc, Schneider Electric SE, Siemens AG, Tado GmbH, Netatmo SAS, and Viega LLC. Other significant firms in this sector include Lux Products Corporation, Sensi (part of Emerson), Ecobee, and Aprilaire. Furthermore, there are several emerging companies such as Mysa, Moes, and Wyze Labs making their mark in this industry.

COVID-19 Impact and Market Status:

The Covid-19 pandemic significantly boosted interest in smart home technologies, particularly WiFi-enabled thermostats, as individuals looked for greater convenience and energy savings during periods of confinement.

The COVID-19 pandemic had a significant impact on the market for WiFi thermostats, prompting a rapid increase in the use of smart home technologies. As more people started working remotely, there was a greater emphasis on creating comfortable and efficient living spaces. This period saw a significant increase in consumer awareness of energy conservation and the benefits of remote temperature control, which fuelled demand for WiFi-enabled thermostats. Although the pandemic initially disrupted supply chains, affecting production and distribution, manufacturers quickly adapted and innovated in response to evolving consumer needs. Furthermore, with a growing emphasis on health and safety, there was an increased interest in contactless and automated home devices, which contributed to the market's expansion. As we move beyond the pandemic, the trend towards smart home technology remains strong, with consumers increasingly valuing solutions that offer convenience, effective energy management, and enhanced indoor environments. This positions the WiFi thermostat market for sustained growth in the future.

Latest Trends and Innovation:

- In September 2023, Ecobee announced the launch of its latest SmartThermostat with Voice Control, which includes enhanced energy-saving features, improved voice assistant capabilities, and integration with smart home ecosystems.

- In August 2023, Honeywell Home updated its Home app to improve connectivity and user experience for its WiFi-enabled thermostats, allowing for seamless interaction with other smart devices in the home.

- In July 2023, Nest (a subsidiary of Google) introduced advanced machine learning algorithms in its Nest Learning Thermostat, which optimizes temperature settings based on user behavior and preferences, enhancing energy efficiency.

- In June 2023, Emerson Electric completed the acquisition of a small tech startup specializing in smart home products, aiming to integrate advanced HVAC technologies into its existing WiFi thermostat lineup to enhance smart home compatibility.

- In May 2023, Lyric, a subsidiary of Honeywell, launched its Lyric T6 Wi-Fi Thermostat model, which features a user-friendly interface and geofencing technology that adjusts the temperature based on user location.

- In March 2023, Tado, a European smart heating company, introduced an updated version of its smart thermostat that uses weather data and occupancy models to provide even greater energy savings.

- In January 2023, Lutron Electronics launched a WiFi-enabled thermostat as part of its HomeWorks integration, allowing users to control lighting and temperature seamlessly from one app.

- In December 2022, Schneider Electric announced the rollout of its EcoStruxure solution which includes WiFi-enabled thermostats, focusing on energy management for homes and small businesses aiming to reduce energy consumption.

Significant Growth Factors:

The growth of the WiFi thermostat market is fueled by a rising consumer desire for energy-efficient solutions, the integration of smart home technologies, and progress in Internet of Things (IoT) innovations.

The market for WiFi-enabled thermostats is witnessing significant expansion driven by several pivotal factors. Primarily, the demand for energy-efficient systems is prompting both residential and commercial entities to implement smart thermostats that enhance energy management and subsequently lower utility expenses. In addition, advancements in Internet of Things (IoT) technology have improved connectivity and control, empowering users to oversee their heating and cooling systems remotely through smartphones or tablets, thereby enhancing convenience and user involvement.

Moreover, the increasing popularity of home automation—characterized by the interconnection of various devices and systems—assists in promoting WiFi thermostats, making them essential components of modern smart homes. Heightened awareness of climate change and a growing commitment to sustainable living are further motivating consumers to invest in intelligent gadgets that help minimize carbon footprints. Government initiatives, including incentives and rebates for energy-efficient products, are also fueling purchases in this sector.

Additionally, the widespread availability of high-speed internet and the rise of smart home technologies, alongside an increase in disposable incomes, are cultivating an encouraging landscape for the uptake of WiFi thermostats. Collectively, these elements are driving the robust growth trajectory of the WiFi thermostat market, indicating a shift in consumer preferences towards more intelligent and efficient home technology solutions.

Restraining Factors:

The primary challenges facing the WiFi thermostat market involve substantial initial investment, insufficient consumer understanding, and apprehensions about data privacy and security.

The market for WiFi-enabled thermostats encounters various challenges that may impede its expansion. A major obstacle is the comparatively steep upfront price associated with these intelligent devices, potentially discouraging budget-conscious consumers from transitioning from traditional thermostats. Moreover, apprehensions surrounding data privacy and security can restrict consumer uptake, as individuals may be wary of the possible cyber risks tied to smart technologies. The intricacies involved in the installation and integration with current HVAC systems can also present difficulties for those less familiar with technology, resulting in frustration and hesitance to embrace such innovations. Furthermore, the absence of uniform compatibility standards across different brands may generate confusion and restrict market growth. In certain areas, inadequate access to dependable internet service can limit the operational capabilities of WiFi thermostats, further diminishing their attractiveness. Nevertheless, ongoing technological advancements, ened awareness regarding energy efficiency, and a rising inclination toward smart home solutions are expected to stimulate future development in the WiFi thermostat market, indicating a favorable outlook as manufacturers strive to overcome these obstacles and improve user experiences.

Key Segments of the WiFi Thermostats Market

By Product Type

• Connected

• Standalone

• Learning

By Application

• Residential

• Commercial

• Industrial

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America