Market Analysis and Insights:

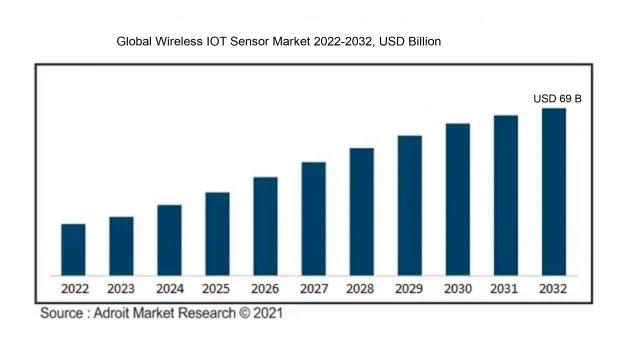

The market for Global Wireless IoT Sensor was estimated to be worth USD 9 billion in 2023, and from 2024 to 2032, it is anticipated to grow at a CAGR of 25%, with an expected value of USD 69 billion in 2032.

The Wireless IoT Sensor Market is largely propelled by the growing desire for automation in diverse fields such as industry, healthcare, and agriculture. The rapid rise of smart devices, along with innovations in wireless communication technology, significantly boost connectivity and data gathering, resulting in improved operational efficiency. Moreover, the ened focus on environmental surveillance and the development of smart city projects drive the uptake of wireless IoT sensors for immediate data collection and evaluation. Increasing awareness regarding energy usage and the demand for affordable monitoring solutions further stimulate market expansion. Additionally, government support for IoT projects and increased funding for research and innovation play crucial roles in advancing the development and deployment of these sensors. The incorporation of artificial intelligence and machine learning within IoT frameworks is also augmenting their capabilities, making them more appealing to organizations aiming to enhance decision-making and adopt predictive maintenance strategies. Together, these elements contribute to the growth trajectory of the wireless IoT sensor market.

Wireless IOT Sensor Market Scope :

| Metrics | Details |

| Base Year | 2024 |

| Historic Data | 2020-2023 |

| Forecast Period | 2024-2032 |

| Study Period | 2023-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 69 billion |

| Growth Rate | CAGR of 25% during 2024-2032 |

| Segment Covered | By Component, By Type, By Technology, By Vertical, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Bosch Sensortec, Siemens AG, Texas Instruments, Honeywell International Inc., STMicroelectronics, Analog Devices, Inc., NXP Semiconductors, General Electric, Qualcomm Technologies, Inc., IBM Corporation, Cisco Systems, Inc., Schneider Electric, Murata Manufacturing Co., Ltd., Omron Corporation, and Huawei Technologies Co., Ltd. |

Market Definition

A wireless IoT sensor is an innovative device designed to sense and gather data from its surroundings and relay this information through a wireless network. Such sensors enable remote observation and management across a range of applications, including smart home systems, industrial automation, and environmental monitoring.

Wireless IoT sensors are integral to contemporary data acquisition and oversight in multiple fields. Their significance lies in their capability to collect real-time information without the limitations of wired connections, fostering remote surveillance and automation. This adaptability enhances efficiency in areas like precision farming, ecological monitoring, and automation in industry, where swift decision-making is vital. Furthermore, wireless sensors improve data precision and scalability, meeting the increasing need for interconnected solutions in the Internet of Things ecosystem. In essence, they enable valuable insights through analytics, boosting operational performance and fostering innovation across various sectors.

Key Market Segmentation:

Insights On Key Component

Hardware

The component that is poised to dominate the Global Wireless IoT Sensor Market is hardware. The growing demand for smart devices and automation solutions across various industries has significantly increased the use of wireless sensors. These hardware components serve as the backbone of IoT ecosystem deployments, providing essential functions like data collection, communication, and real-time monitoring. Innovations in sensor technology, such as miniaturization and enhanced energy efficiency, further bolster hardware's position in the market. Additionally, industries such as healthcare, agriculture, and smart cities are increasingly integrating advanced sensors into their operations, fueling growth and offering robust opportunities for hardware manufacturers.

Service

The service sector within the Global Wireless IoT Sensor Market plays a crucial role in ensuring the effective deployment and maintenance of sensor networks. This includes installation, technical support, data management, and system integration. As organizations seek to optimize their operations through analytics and connectivity, there is a rising demand for specialized service providers who can offer tailored solutions. Moreover, as the complexity of IoT deployments increases, compatible service offerings that ensure reliability and continuous improvements will become essential for businesses looking to leverage sensor technology fully.

Software

The software component of the Global Wireless IoT Sensor Market is vital for processing and analyzing the data generated by the sensors. It encompasses applications for device management, data analytics, and cloud integration, which are pivotal for transforming raw sensor data into actionable insights. The increase in demand for real-time data processing and monitoring solutions has led to significant investments in software development. Additionally, compatibility with various hardware and the implementation of advanced technologies like machine learning and artificial intelligence are enhancing software's relevance, even if it does not dominate the market directly.

Insights On Key Type

Temperature Sensor

The Temperature Sensor is expected to dominate the Global Wireless IoT Sensor Market due to its critical role in various applications, such as smart HVAC systems, environmental monitoring, and industrial automation. With the increasing need for precise temperature management in healthcare, agriculture, and supply chain logistics, the demand for temperature sensors continues to rise. As industries adopt IoT technologies to enhance efficiency and safety, the reliance on accurate temperature readings becomes even more paramount. Additionally, advancements in wireless technology allow for seamless integration of temperature sensors within IoT ecosystems, further driving their market presence.

Image Sensor

Image Sensors are essential for applications like surveillance, smart homes, and autonomous vehicles. As security concerns escalate and the need for real-time visual data increases, the adoption of image sensors is on the rise. Technological advancements, such as higher resolutions and improved sensitivity in low-light conditions, contribute to their growing appeal in various sectors.

Motion Sensor

Motion Sensors play a vital role in security systems, energy-efficient lighting, and smart home applications. Their ability to detect movement enables enhanced safety and automation, making them highly desirable in residential and commercial settings. As more consumers seek smart home solutions, the demand for motion sensors is likely to continue ascending.

Proximity Sensor

Proximity Sensors are widely utilized in mobile devices and industrial automation for detecting nearby objects without physical contact. Their application in automotive safety systems and consumer electronics, coupled with the increasing adoption of smart technologies, is driving their growth. As industries focus on enhancing user experience and safety, the relevance of proximity sensors is steadily rising.

Pressure Sensor

Pressure Sensors are critical for applications in healthcare, automotive, and industrial processes. They monitor fluid dynamics and pressure changes, ensuring operational safety and efficiency. The increasing emphasis on process optimization and the rise of wearables in the healthcare industry are contributing to the demand for sophisticated pressure monitoring solutions.

Magnetometer

Magnetometers are primarily used in navigation and mapping applications, particularly in smartphones and automotive systems. As the need for accurate positioning and orientation expands with the growth of GPS-dependent technologies, the usage of magnetometers rises. Their capability to measure magnetic fields ensures they remain crucial for both consumer and industrial applications.

Humidity Sensor

Humidity Sensors are essential for climate control in buildings, agriculture, and food storage. Accurate humidity monitoring is pivotal for maintaining quality and efficiency in various sectors. With the growing awareness of the role of humidity in product preservation and comfort, the demand for these sensors is witnessing a significant increase.

Touch Sensor

Touch Sensors are ubiquitous in consumer electronics, enhancing user interaction and experience. Their incorporation into smartphones, tablets, and smart home devices drives their prevalence in the market. The trend towards increasingly intuitive and seamless user interfaces is likely to continue supporting the growth of touch sensor technology.

Accelerometer

Accelerometers are crucial in applications ranging from automotive safety systems to mobile devices for measuring acceleration and tilt. As the demand for motion-based functionality in technology increases, such as in gaming and fitness tracking, the relevance of accelerometers is expected to remain strong. Their ability to enhance user experience and provide real-time data solidifies their market position.

Gyroscope

Gyroscopes are vital for navigation and stabilization in various technologies, including drones and smartphones. Their role in enhancing spatial awareness and motion detection ensures their continued importance in emerging applications. As industries push for advancements in robotics and automation, gyroscopes are likely to be integral components in system designs.

Flow Sensor

Flow Sensors are essential in applications related to fluid dynamics, such as in HVAC systems and irrigation. Their ability to measure the flow rate of liquids and gases is critical for process control. As industries increasingly prioritize efficiency and resource management, the relevance of flow sensors will continue to grow.

Others:

Other types of wireless IoT sensors include gas sensors for detecting hazardous gases, vibration sensors for monitoring equipment health, acoustic sensors for sound detection, and light sensors for ambient lighting adjustments. These sensors enhance IoT capabilities across diverse applications.

Insights On Key Technology

Bluetooth

Bluetooth is expected to dominate the Global Wireless IoT Sensor Market due to its extensive use in various consumer electronics and smart devices. Its low power consumption, reliable connectivity, and broad ecosystem support make it a preferred choice for manufacturers integrating IoT sensors in wearable technology, automotive applications, and smart home devices. As the demand for connected devices increases, Bluetooth's ability to facilitate seamless communication and pairing between devices enhances its relevance in the market. The upcoming advancements in Bluetooth technology, including the introduction of Bluetooth 5.0 and Bluetooth mesh networking, further position it as a leading technology in the growing wireless IoT sensor landscape.

Wi-Fi

Wi-Fi plays a significant role in the Wireless IoT Sensor Market, providing high-speed connectivity and the ability to connect multiple devices simultaneously. Its widespread adoption in homes and enterprises makes it suitable for applications like smart grids, video surveillance, and industrial automation. Wi-Fi's ability to handle large data transfers seamlessly and support a high-density environment enhances its attractiveness for business and connectivity solutions, particularly in environments requiring robust data transfer rates. Moreover, the ongoing improvements in Wi-Fi standards, such as Wi-Fi 6, enhance its capacity and performance, catering to the increasing data needs of IoT applications.

ZigBee

ZigBee is renowned for its low power consumption and efficient mesh networking capabilities, making it ideal for various automation and control applications. It is widely utilized in smart home devices, sensor networks, and industrial monitoring services. ZigBee's ability to support numerous devices interconnected within one network makes it attractive for environments requiring scalability and reliability, such as home automation and energy management systems. Its robustness in maintaining communication over long periods with minimal energy use encourages adoption among manufacturers focusing on long-term operational efficiency and lower operational costs.

NFC

NFC (Near Field Communication) excels in scenarios requiring secure, short-range communication. It is increasingly integrated into smart payment systems, access control solutions, and personal identification applications. NFC's user-friendly and intuitive interface allows users to interact with devices by simply tapping, making it ideal for consumer engagement and data exchange in mobile commerce. Although its range is limited compared to other technologies, its security features and low latency make it the preferred choice for applications demanding immediate transactions and secure data transfer, particularly in retail and service sectors.

Z-Wave

Z-Wave technology specializes in home automation, enabling low-power, low-bandwidth communication among devices within a close range. As a standard for home control, Z-Wave is extensively used in smart home products like lighting, lock, and thermostat devices. Its ability to form reliable mesh networks enhances communication reliability across multiple connected devices, making it attractive to manufacturers focused on creating cohesive smart home ecosystems. Z-Wave's established certification program also encourages compatibility among various smart devices, boosting its foothold in the growing demand for integrated home automation solutions.

RFID

RFID (Radio Frequency Identification) is predominantly used for tracking and identifying objects using radio waves. Commonly employed in inventory management and supply chain applications, RFID technology facilitates real-time visibility and data accuracy, proving essential in logistics. Its ability to quickly scan multiple tags without line-of-sight provides significant operational efficiencies for manufacturers and retailers. Additionally, advancements in passive RFID systems allow for longer-range identification and data capture, helping industries enhance their operational processes. As industries increasingly realize the advantages of IoT integration, RFID technology is expected to maintain relevance across various tracking applications.

Others

Other technologies in the global wireless IoT sensor market include emerging solutions like LoRaWAN, Sigfox, and cellular IoT (e.g., LTE-M, NB-IoT), which support long-range, low-power applications. These options enable cost-effective, wide-area IoT deployments, especially for industrial and smart city projects, where extended battery life and coverage are critical for seamless, large-scale data transmission.

Insights On Key Vertical

Industrial IoT

The Industrial IoT vertical is expected to dominate the Global Wireless IoT Sensor Market due to its extensive applications across manufacturing, supply chain management, and ongoing advancements in automation technologies. Industries increasingly leverage IoT sensors to optimize processes, enhance efficiency, and reduce operational costs. The integration of smart sensors provides real-time monitoring of equipment health, predictive maintenance, and energy management, driving up demand in sectors such as automotive, power generation, and chemicals. Moreover, the government initiatives promoting digital transformation and Industry 4.0 further accelerate investments in wireless IoT sensor technologies, solidifying the Industrial IoT's leading position in the marketplace.

Consumer IoT

The Consumer IoT sector focuses on applications related to home automation, wearables, healthcare devices, and smart appliances. While it is experiencing rapid growth, the evolving demand for connected devices aimed at improving consumer convenience, safety, and energy efficiency fuels expansion in this . Innovations in smart home technologies allow users to manage appliances through mobile applications, enhancing everyday experiences. However, market penetration is still hampered by privacy concerns and the need for standardized solutions, which could slow down its ascendance relative to Industrial IoT applications.

Commercial IoT

In the Commercial IoT vertical, applications include smart buildings, asset and inventory management, and enhanced customer experiences in retail. Although it's growing, challenges such as integration complexities and the need for substantial upfront investments can hinder widespread adoption. Nevertheless, as businesses seek enhanced operational efficiency and customer engagement, the uptake of IoT sensors within commercial environments is likely to gradually progress. The focus on improving energy management and sustainability in commercial buildings adds another layer of complexity and opportunity within this , which continues to develop in alignment with technological advancements.

Insights on Regional Analysis:

Asia Pacific

Asia Pacific is expected to dominate the Global Wireless IoT Sensor Market due to several key factors. The region benefits from rapid industrialization, increased investment in smart technologies, and a burgeoning Internet of Things ecosystem, with countries like China, Japan, and India leading in technological advancements. The growing demand for automation in sectors such as manufacturing, agriculture, and healthcare drives substantial adoption of wireless IoT sensors. Moreover, the expanding connectivity infrastructure, coupled with government initiatives aimed at digitization and smart city projects, underlines the predominant role that Asia Pacific will play in shaping the future of the Wireless IoT Sensor Market.

North America

North America holds a significant position in the Wireless IoT Sensor Market, mainly driven by the presence of leading technology firms and innovations in wireless communication. The U.S. and Canada are at the forefront of deploying advanced IoT solutions across various sectors, including healthcare, smart cities, and agricultural technology. Additionally, the growing adoption of IoT devices and an aggressive push towards digital transformation are expected to bolster market growth. However, the region faces competition from the emerging Asia Pacific market, which is rapidly adapting and evolving technologically.

Europe

Europe is a prominent player in the Wireless IoT Sensor Market, buoyed by stringent regulations promoting energy efficiency and smart technology adoption. Nations like Germany, the UK, and France have invested heavily in IoT infrastructure, particularly in industrial applications, automotive, and smart home technology. The European market benefits from a strong focus on sustainability, driving the demand for wireless sensors that monitor energy consumption and optimize operations. The region also collaborates extensively on research initiatives, further enhancing its technology landscape, albeit encountering stiff competition from both Asia Pacific and North America.

Latin America

Latin America is gradually emerging in the Wireless IoT Sensor Market, driven by the increasing need for connectivity and digital transformation. Countries such as Brazil and Mexico are witnessing growth in IoT adoption due to urbanization and government initiatives aimed at enhancing infrastructure and services. However, widespread challenges, including economic disparities and regulatory hurdles, can impede the rapid uptake of technology. While there is potential for growth, the region still lags behind North America and Asia Pacific, where advancements are more pronounced and established.

Middle East & Africa

The Middle East & Africa is positioned as a developing market for Wireless IoT Sensors, propelled by infrastructural development and digital transformation initiatives, particularly in the Gulf Cooperation Council (GCC) countries. The region is embracing smart city projects, which increases the demand for wireless sensors in sectors like healthcare, transportation, and utilities. However, challenges such as political instability, limited investment, and varying levels of technological adoption across countries hinder rapid growth. While there is progress in awareness and interest, the region remains behind the leading markets in North America and Asia Pacific.

Company Profiles:

The primary contributors in the global Wireless IoT Sensor market propel advancements by creating cutting-edge sensor technologies and solutions, enabling effortless data exchange across a range of applications. Additionally, they impact market expansion through strategic collaborations, financial investments, and the broadening of their product offerings to address the varying requirements of different industries.

Prominent participants in the Wireless IoT Sensor sector comprise Bosch Sensortec, Siemens AG, Texas Instruments, Honeywell International Inc., STMicroelectronics, Analog Devices, Inc., NXP Semiconductors, General Electric, Qualcomm Technologies, Inc., IBM Corporation, Cisco Systems, Inc., Schneider Electric, Murata Manufacturing Co., Ltd., Omron Corporation, and Huawei Technologies Co., Ltd. Furthermore, entities like Sigfox, Semtech Corporation, Libelium, and Particle Industries contribute notably to the market ecosystem.

COVID-19 Impact and Market Status:

The Covid-19 pandemic significantly hastened the integration of wireless IoT sensors in multiple industries, propelled by a ened demand for remote monitoring and automation technologies.

The COVID-19 pandemic has profoundly influenced the Wireless IoT Sensor Market, presenting both hurdles and prospects. Initially, the outbreak caused significant disruptions in supply chains, hampering the production and rollout of IoT devices due to constraints on manufacturing and logistics. Nevertheless, the surge in demand for remote monitoring and automation solutions during this period expedited the integration of wireless IoT sensors across a broad array of industries, including healthcare, smart cities, and manufacturing. Organizations increasingly acknowledged the importance of real-time data collection for resource management and safety assurances, leading to a notable increase in investments in IoT technologies. Additionally, as companies transitioned to remote operations, the necessity for dependable connectivity and data analytics became more pronounced, further propelling market growth. Looking ahead, the emphasis on improving operational efficiency and resilience in the wake of the pandemic is anticipated to stimulate ongoing development in the wireless IoT sensor market, as businesses prioritize their digital transformation initiatives.

Latest Trends and Innovation:

- In March 2023, Texas Instruments expanded its portfolio of low-power wireless IoT sensors by introducing the SimpleLink™ CC2652R7 multiprotocol wireless microcontroller, enhancing battery life and range for various IoT applications.

- In January 2023, STMicroelectronics announced a partnership with Cisco to develop new IoT endpoint solutions, focusing on enhancing security and connectivity for industrial wireless sensor networks.

- In February 2023, Siemens acquired a majority stake in C&S Electric, which specializes in IoT-enabled power monitoring solutions, aiming to enhance its smart building offerings and integrate more wireless sensors into power distribution systems.

- In April 2023, Honeywell introduced the Sage Glass Smart Tinting Technology for IoT buildings, which integrates wireless sensors to adapt the tint of glass in response to environmental changes, enhancing energy efficiency.

- In June 2023, Zebra Technologies launched its ZC300 series of thermal printers with integrated wireless IoT sensor options, enabling real-time tracking and monitoring of inventory and assets throughout supply chains.

- In July 2023, EnOcean GmbH announced a collaboration with Siemens to develop energy-harvesting wireless sensors for smart building applications, significantly improving sustainability by eliminating the need for battery replacements.

- In September 2023, Nokia completed its acquisition of Elenion Technologies, enhancing its capabilities in optical silicon products and allowing for advanced wireless IoT sensor solutions in telecommunications.

- In October 2023, Qualcomm Technologies launched the QCA6531 chipset, specifically designed for industrial IoT applications with enhanced wireless connectivity and security features for IoT sensors deployed in challenging environments.

Significant Growth Factors:

The Wireless IoT Sensor Market is experiencing growth driven by several key factors, such as innovations in sensor technology, a rising need for automation across various sectors, and the proliferation of smart city initiatives and infrastructure enhancements.

The Wireless IoT Sensor Market is witnessing remarkable expansion attributed to multiple crucial elements. Primarily, the swift progress of Internet of Things (IoT) technologies fosters enhanced connectivity, which is catalyzing the widespread use of wireless sensors in diverse fields such as agriculture, healthcare, and industrial automation. Furthermore, the escalating need for smart cities and smart homes significantly boosts the demand for these sensors, enabling prompt data gathering and ongoing monitoring.

Advancements in sensor technology, particularly in miniaturization and energy efficiency, contribute to the creation of more adaptable and economically viable solutions. The growing focus on sustainability and energy management fuels market growth, as companies adopt wireless sensors to optimize resource use. In addition, the rise of mobile devices and cloud computing improves data accessibility and analytical capabilities, driving interest in integrated sensor solutions.

Government initiatives aimed at fostering digital transformation and promoting smart infrastructure development are likely to further stimulate market growth. Moreover, the increasing recognition of predictive maintenance advantages in various industries is leading to higher adoption rates of wireless IoT sensors, rendering them essential in contemporary operations. Collectively, these elements foster a favorable landscape for the continued advancement of the Wireless IoT Sensor Market.

Restraining Factors:

The expansion of the Wireless IoT Sensor Market faces several obstacles, including worries about data security, elevated implementation expenses, and compatibility challenges among various devices.

The Wireless IoT Sensor Market encounters several obstacles that could impede its growth trajectory. A major issue is the restricted range and dependability of wireless communication technologies, which can hinder both connectivity and the efficacy of sensor networks in specific settings. Moreover, apprehensions about data security and the possibility of breaches pose significant challenges to the broader adoption of IoT sensors, resulting in hesitation among potential users. The substantial costs involved in the development, deployment, and upkeep of these sensor systems may discourage smaller businesses from entering the market, further contributing to stagnation. Additionally, integrating these modern solutions with existing legacy systems can be complicated, presenting hurdles for organizations aiming for a smooth transition to IoT implementations. The absence of universal standards can also result in interoperability challenges between diverse devices and platforms, leading to a fragmented market. Nonetheless, the rising demand for intelligent infrastructure, automation, and sophisticated analytics continues to stimulate innovation in the IoT domain. As advancements in technology emerge and solutions to these challenges are formulated, businesses have the potential to surmount current limitations and discover new growth opportunities, ultimately fostering a more interconnected and efficient future.

Key Segments of the Wireless IoT Sensor Market

By Component:

- Hardware

- Service

- Software

By Type:

- Image Sensor

- Motion Sensor

- Proximity Sensor

- Pressure Sensor

- Magnetometer

- Humidity Sensor

- Temperature Sensor

- Touch Sensor

- Accelerometer

- Gyroscope

- Flow Sensor

- Others

By Technology:

- Wi-Fi

- Bluetooth

- ZigBee

- NFC

- Z-Wave

- RFID

- Others

By Vertical:

- Industrial IoT

- Consumer IoT

- Commercial IoT

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America