Wireless IoT Sensors Market Analysis and Insights:

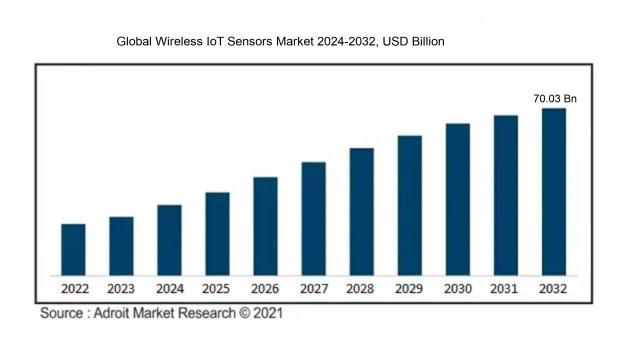

In 2023, the market for wireless IoT sensors was estimated to be worth USD 10.01 billion. The market for wireless IoT sensors is expected to expand at a compound annual growth rate (CAGR) of 25.11% from 2024 to 2032, from USD 12.40 billion in 2024 to USD 70.03 billion.

The expansion of the Wireless IoT Sensors Market is largely fueled by an increasing need for automation in various sectors, such as manufacturing, healthcare, and smart home technologies. The surge in the use of intelligent devices coupled with the transition to Industry 4.0 is driving the necessity for effective data gathering and oversight, which wireless IoT sensors provide. In addition, developments in wireless communication technologies, including 5G and Low Power Wide Area Networks (LPWAN), significantly improve sensor connectivity and reliability, making them more suited for applications requiring real-time data. The growing focus on energy-efficient solutions, driven by sustainability goals, also plays a critical role in the market's expansion, as these sensors typically operate with lower power consumption. Furthermore, the increasing priority for predictive maintenance and remote monitoring within industrial contexts is ening the demand for IoT sensor integration. Finally, governmental support for smart city initiatives further enhances the requirement for wireless IoT sensors, as they are vital for fostering interconnected urban environments.

Wireless IoT Sensors Market Definition

Wireless IoT sensors are innovative devices designed to gather environmental data and send it seamlessly to centralized systems for further analysis. These sensors facilitate immediate monitoring and automation across a range of applications, spanning from smart residential spaces to industrial environments.

Wireless IoT sensors are vital in today's technological ecosystem, facilitating effortless data gathering and interaction across multiple sectors. Their wireless data transmission capabilities eliminate the necessity for physical links, which improves both flexibility and scalability. This allows organizations to track resources, streamline processes, and enhance real-time decision-making. Such sensors play a significant role in the development of intelligent urban environments, optimized supply logistics, and ecological surveillance, resulting in reduced costs and enhanced productivity. In addition, their implementation fosters the growth of automation and data-centric approaches, making them indispensable for sectors aiming to innovate and stay ahead in a fast-paced digital marketplace.

Wireless IoT Sensors Market Segmental Analysis:

Insights On Component

Service

The Global Wireless IoT Sensors Market is expected to be predominantly driven by the service component. This is primarily due to the growing need for operational support, system integration, maintenance, and analytics services associated with IoT deployments. As businesses increasingly rely on wireless IoT sensors for efficient operations, the demand for comprehensive services that ensure optimal performance and troubleshooting becomes critical. Additionally, the complexity of managing interconnected devices fuels the need for consulting and development services, reinforcing the expectation that the services aspect will dominate the market.

Hardware

The hardware component of Wireless IoT Sensors includes all the physical devices necessary for sensor operation, such as transmitters, receivers, and network devices. Although the market is expected to see some growth in this area, it is anticipated that hardware will not control the landscape due to rapid technological advancements and the shift toward more sophisticated solutions that integrate these devices. As industries move towards software-driven and service-oriented models, the focus on hardware may diminish, leading to a more supportive role in the overall ecosystem rather than a leading one.

Software

The software within the Wireless IoT Sensors Market plays a vital role in data processing, device management, and application integration. Even though software solutions are crucial for analyzing data generated by sensors, facilitating communication, and providing user interfaces, they lack the immediate influence that services offer in terms of direct client engagement. Software continues to evolve but is increasingly packaged together with services, thereby reducing its standalone prominence in the market. Consequently, while important, software is likely to follow behind in terms of market domination.

Insights On Type

Temperature Sensor

The Temperature Sensor is anticipated to dominate the Global Wireless IoT Sensors Market due to its widespread application across various industries and sectors, including healthcare, manufacturing, agriculture, and smart home solutions. The increasing demand for real-time temperature monitoring to enhance safety, efficiency, and regulatory compliance has made this type essential. With the rise of IoT adoption, especially in smart cities and connected devices, Temperature Sensors provide critical data insights that drive operational improvements and consumer applications such as climate control and food safety. Furthermore, the integration of machine learning and AI optimizations in temperature monitoring solutions increases their reliability, contributing to the forecasted dominance of this.

Image Sensor

Image Sensors play a significant role in the market, particularly in sectors such as security, automotive, and healthcare. They facilitate advanced imaging capabilities essential for applications like surveillance, driver assistance systems, and remote patient monitoring. Their ability to capture high-quality visual data is essential for facilitative decision-making processes. However, despite their importance, they are more niche compared to Temperature Sensors, which serve more universal demands across industries.

Motion Sensor

Motion Sensors are widely used for security applications, smart homes, and gaming systems. Their ability to detect movements efficiently enhances security measures and adds functionality to various consumer electronics. However, while they provide valuable data for specific applications, they may not have the same broad applicability or essentiality across multiple industries as Temperature Sensors, limiting their dominance in the market.

Proximity Sensor

Proximity Sensors are increasingly integral in manufacturing and consumer electronics for convenience and safety. They allow devices to detect the presence of objects without physical contact, making them ideal for automation and smart devices. However, their market share is constrained by their reliance on specific applications, making it challenging for them to achieve the widespread impact of Temperature Sensors.

Pressure Sensor

Pressure Sensors find extensive applications in industrial automation, automotive systems, and medical devices. They monitor pressure levels crucial for operational efficiency and safety in these sectors. However, while they hold a significant market value, their specialized uses compared to the ubiquitous need for temperature monitoring in various domains contribute to a lesser market dominance.

Magnetometer

Magnetometers are essential for applications like navigation and geophysical surveys, particularly in automotive and aerospace sectors. They provide valuable magnetic field data necessary in these specialized fields. However, their requirement is more niche and technical, limiting their competitive position in the market dominated by broader and more widely used types.

Humidity Sensor

Humidity Sensors are crucial in HVAC systems, agriculture, and environmental monitoring, where humidity levels significantly influence performance and health. They assist in maintaining optimal conditions across different settings, but their target applications are more localized compared to the broader and more essential temperature monitoring requirements, making them less dominant in the market.

Touch Sensor

Touch Sensors are integral to user interface technologies, contributing to devices ranging from smartphones to smart appliances. Their role in enhancing user experience cannot be understated, yet the market is saturated with alternatives, and their dependency on electronics diminishes their overall impact compared to the vital necessity of temperature monitoring in more diverse applications.

Accelerometer

Accelerometers serve critical functions in consumer electronics, automotive systems, and fitness applications for motion sensing and orientation. They are essential for various devices like smartphones, wearables, and vehicles. However, their specialized usage cases and reliance on electronics limit their growth potential compared to Temperature Sensors, which have extensive applications across multiple sectors.

Gyroscope

Gyroscopes are crucial in navigation systems and motion-tracking devices, providing vital orientation data. They find applications in aerospace, robotics, and consumer electronics, enhancing the functionality of many systems. However, similar to accelerometers, their niche application scope limits their competitive edge against universally relevant sensors like Temperature Sensors.

Flow Sensor

Flow Sensors are primarily used in fluid management applications, including water, oil, and gas industries. They are critical for ensuring efficient resource utilization and monitoring processes. Despite their importance in specific sectors, their limited breadth compared to Temperature Sensors-applicable across a multitude of industries—hampers their overall market dominance.

Insights On Technology

Wi-Fi

Wi-Fi is positioned to dominate the Global Wireless IoT Sensors Market due to its widespread adoption and established infrastructure. With the increasing demand for high-speed connectivity and bandwidth to support numerous devices, Wi-Fi technology caters to various applications across multiple sectors, including smart cities, healthcare, and industrial automation. Additionally, the seamless integration of Wi-Fi with cloud services allows for real-time data access and analytics, significantly enhancing operational efficiency. Its capability to handle a large number of devices simultaneously while maintaining strong connectivity makes it the preferred choice among manufacturers and consumers, further reinforcing its leading position in the market.

Bluetooth

Bluetooth technology serves as a reliable, low-energy solution for numerous IoT applications, particularly in personal and wearable devices. Its ability to facilitate seamless short-range communication has made it favored among consumers for smart home solutions and health monitoring systems. Additionally, Bluetooth’s advancements, such as Bluetooth Low Energy (BLE), have bolstered its position in the market, allowing for extended battery life, which is crucial for portable devices. These features contribute to Bluetooth's significant traction in sectors requiring efficient resource utilization and is often utilized in conjunction with Wi-Fi in various systems.

ZigBee

ZigBee technology is recognized for its robust mesh networking capabilities, making it ideal for home automation and industrial IoT applications. The low power consumption and ability to support a multitude of connected devices in a single network enhance its appeal, especially in applications where longevity and battery life are paramount. ZigBee is frequently employed in smart meters, lighting controls, and security systems, promoting efficient energy management and communication. Its niche usage aligns well with requirements in smart buildings and various industrial settings, but it has not gained the mainstream dominance of Wi-Fi and Bluetooth.

NFC

NFC technology offers secure, short-range communication, mainly utilized in payment systems and access controls. Its growing application in mobile wallets and smart cards provides added convenience for users, facilitating quick transactions. While NFC has carved out its own space in the market, particularly in retail and logistics, it is limited by its short range. Although it is valuable for secure interactions, its functionality is not as diverse as that of other technologies, thus hindering its overall growth potential compared to its counterparts.

Z-Wave

Z-Wave technology is tailored primarily for home automation, focused on creating control networks for smart devices. With its strong emphasis on low-power consumption and reliability, Z-Wave enables efficient communication between various smart products like locks, lights, and thermostats. Its interoperability among devices from different manufacturers enhances its appeal, but its market presence is limited compared to technologies like Wi-Fi and Bluetooth. As homes continue to embrace automation, Z-Wave remains an essential player, though it firmly occupies a niche rather than leading the broader wireless sensors landscape.

RFID

RFID technology is predominantly employed in asset tracking and inventory management, allowing for rapid scanning and identification of products. Its ability to operate without line-of-sight makes it invaluable in logistics and supply chain applications. However, RFID's market reach may be limited when compared to more versatile solutions like Wi-Fi and Bluetooth, which cater to a broader range of applications. Despite these constraints, RFID’s effectiveness in enhancing efficiency in specific sectors like retail and manufacturing ensures its continued relevance in the wireless IoT landscape.

Others

The category of ‘Others’ encompasses various emerging wireless technologies that are being explored for IoT applications, such as LoRa, Sigfox, and others that focus on long-range communication with low power consumption. Though these technologies showcase innovative features, their market adoption is relatively lower than the more established options. It is crucial for these players to demonstrate unique advantages or significant cost-effectiveness to compete with more widely accepted technologies. While they offer potential solutions for specialized needs, the overall impact of other technologies remains more supplementary within the market.

Insights On Vertical

Industrial IoT

Industrial IoT is anticipated to dominate the Global Wireless IoT Sensors Market due to the rapid digital transformation within manufacturing and industrial sectors. The increasing demand for automation, predictive maintenance, and real-time monitoring drives a strong need for wireless sensors in various applications, such as process automation, equipment health tracking, and safety monitoring. Moreover, governments and industries are increasingly investing in advanced technologies to enhance productivity and reduce operational costs, leading to a surge in wireless sensor deployment. This trend is further amplified by the adoption of Industry 4.0 initiatives, where data-driven decision-making and interconnected machinery are crucial, solidifying the dominance of Industrial IoT in this market.

Consumer IoT

Consumer IoT represents a growing characterized by smart home devices, wearables, and personal smart assistants. This market is witnessing considerable growth driven by consumer demand for convenience, energy efficiency, and enhanced lifestyle features. Smart health wearables, such as fitness trackers and smartwatches, are particularly gaining traction among health-conscious consumers. With the rise in smart home automation solutions, such as smart lighting, security systems, and energy management devices, the consumer sector plays a vital role in reshaping how users interact with technology daily.

Commercial IoT

Commercial IoT is primarily focused on enhancing business operations through connectivity in sectors such as retail, logistics, and healthcare. The focus of this market is on optimizing operations, improving customer experiences, and driving efficiencies through data analytics. For instance, smart inventory management solutions and connected retail experiences are transforming the way businesses engage with consumers. The healthcare industry is also leveraging IoT technologies for remote patient monitoring and telemedicine services, indicating a growing reliance on connected devices to streamline processes, verify data, and improve service delivery within business environments.

Global Wireless IoT Sensors Market Regional Insights:

Asia Pacific

The Asia Pacific region is expected to dominate the Global Wireless IoT Sensors market due to rapid industrialization, significant investments in technology, and growing demand for automation in various sectors. Countries like China, Japan, and India are at the forefront of adopting IoT technologies across manufacturing, healthcare, and transportation industries. Additionally, the escalating population and urbanization in this region create an extensive need for efficient resource management, driving the growth of wireless IoT sensors. Moreover, significant government initiatives to promote smart cities and sustainable infrastructure contribute further to the expansion, reinforcing the Asia Pacific's leadership position.

North America

North America is a strong contender in the Global Wireless IoT Sensors market, primarily driven by advanced technological infrastructure and high adoption of smart home and industrial IoT applications. The presence of key market players and a robust supply chain enhances the region's growth potential. Furthermore, increasing investment in research and development related to IoT solutions solidifies North America's status as a significant market, although it may not surpass the Asia Pacific in overall growth prospects.

Europe

Europe is witnessing significant growth in the Wireless IoT Sensors market due to stringent regulations around energy efficiency and sustainability driving innovation. The European Union's initiatives towards green technologies encourage widespread IoT sensor adoption in various sectors, including agriculture and manufacturing. Additionally, increased collaboration between industries and tech firms for developing interconnected systems is expected to enhance the market's landscape in the coming years.

Latin America

In Latin America, the Wireless IoT Sensors market is gradually gaining traction, driven by the growing need for digital transformation across several industries. However, limitations in infrastructure and investment compared to other regions may impede rapid growth. Government initiatives aimed at promoting smart technologies in urban development could enhance the adoption of IoT sensors, but it still lags behind more developed regions.

Middle East & Africa

The Middle East & Africa region presents a developing market for Wireless IoT Sensors, with an increasing focus on smart city projects and digital transformation initiatives in countries like the UAE and South Africa. However, challenges such as geopolitical instability and limited technology penetration restrict the overall market growth. While there is potential for future expansion, the region currently remains the smallest contributor when compared to North America, Europe, and especially Asia Pacific.

Wireless IoT Sensors Competitive Landscape:

Leading figures in the Global Wireless IoT Sensors sector are continually pushing the envelope in sensor technology innovation, enhancing aspects like connectivity, data transfer, and energy efficiency. They engage in partnerships across diverse industries to formulate customized solutions, enabling the seamless adoption of IoT applications in fields such as healthcare, agriculture, and smart city initiatives.

Major contributors in the Wireless IoT Sensors sector encompass Analog Devices, Inc., Cisco Systems, Inc., Honeywell International Inc., IBM Corporation, Intel Corporation, Siemens AG, Texas Instruments Incorporated, STMicroelectronics N.V., NXP Semiconductors N.V., GE Digital, Accenture, Schneider Electric, Qualcomm Technologies, Inc., LoRa Alliance, and Bosch Sensortec GmbH.

Global Wireless IoT Sensors COVID-19 Impact and Market Status:

The Covid-19 pandemic significantly boosted the expansion of the Global Wireless IoT Sensors market by increasing the need for remote monitoring and automation technologies across diverse sectors.

The COVID-19 pandemic has profoundly affected the Wireless IoT Sensors Market, presenting both obstacles and avenues for growth. Initially, disruptions in supply chains and interruptions in manufacturing led to delays in product launches and a decline in consumer interest, particularly in industries like automotive and industrial automation. Conversely, the pandemic has hastened the integration of IoT technologies, as businesses sought solutions for remote management and automation to maintain operations in light of health regulations. The ened focus on health and safety, alongside the increasing demand for smart home technologies and healthcare applications, has significantly boosted the need for wireless IoT sensors. Additionally, government initiatives aimed at enhancing smart city developments and improving infrastructure have further stimulated market expansion. As various sectors adjust to this changing landscape, investments in IoT solutions are projected to grow, setting the stage for substantial market development in the post-pandemic era as companies look to reinvest in technology to bolster resilience and efficiency.

Latest Trends and Innovation in The Global Wireless IoT Sensors Market:

- In March 2023, Silicon Labs announced its acquisition of NXP Semiconductors' wireless connectivity business, aiming to enhance its portfolio in the IoT market and leverage NXP's expertise in automotive and industrial sectors.

- In June 2023, Honeywell launched its new line of wireless IoT sensors for industrial applications, including advanced environmental monitoring capabilities, emphasizing sustainability and energy efficiency.

- In September 2023, Amazon Web Services (AWS) unveiled IoT Core for LoRaWAN, allowing businesses to connect and manage LoRaWAN devices securely, thereby expanding its IoT portfolio and enabling developers to utilize more wireless sensor options.

- In August 2023, Qualcomm Technologies announced the introduction of its new low-power, long-range connectivity solution, specifically designed for IoT sensor applications, promising extended battery life and improved device communication.

- In April 2023, Advantech partnered with Microsoft to integrate its IoT sensor solutions with Azure IoT services, providing enhanced data analytics and smart city applications.

- In February 2023, Cisco introduced new innovations in IoT security, including advanced wireless sensors that provide real-time data integrity and threat detection, reinforcing its commitment to secure IoT deployments.

- In October 2023, STMicroelectronics released its latest IoT sensor platforms that incorporate cutting-edge MEMS technology, enabling high precision and lower energy consumption for applications in smart homes and industrial automation.

Wireless IoT Sensors Market Growth Factors:

The expansion of the Wireless IoT Sensors Market is fueled by innovations in connectivity, a rise in the adoption of intelligent devices, and a growing need for real-time data analysis in diverse sectors.

The Wireless IoT Sensors Market is undergoing substantial expansion, driven by a variety of crucial elements. Firstly, the ened need for automation within sectors such as manufacturing, healthcare, and smart city initiatives has spurred demand for immediate data acquisition and surveillance, a niche effectively addressed by wireless IoT sensors. Additionally, innovations in sensor technologies and communication protocols have improved the functionality and efficiency of these devices, enhancing their attractiveness to enterprises. The rise of 5G technology is also pivotal, as it enables quicker data transfers and superior connectivity, expanding the range of applications for wireless sensors. Furthermore, an increasing emphasis on energy-efficient and sustainable practices encourages advancements in sensor design and energy management systems.

The growing trend of smart homes and wearable technology has played a significant role in market augmentation, with consumers looking for more cohesive and smarter living spaces. The COVID-19 pandemic has catalyzed the digital transformation, accentuating the necessity for remote monitoring and contactless technology, which has further intensified demand. Lastly, ened investment in research and development alongside proactive governmental policies aimed at enhancing smart infrastructure fosters a favorable environment for market growth. Collectively, these dynamics set the stage for the Wireless IoT Sensors Market to continue its upward trajectory in the years ahead.

Wireless IoT Sensors Market Restaining Factors:

Critical limitations within the Wireless IoT Sensors Market encompass difficulties regarding data protection, elevated implementation expenses, and compatibility challenges among various devices.

The expansion of the Wireless IoT Sensors Market faces multiple challenges, including concerns over security, regulatory hurdles, and elevated implementation expenses. As these sensors become more integrated with essential infrastructure and individual devices, the potential for cyber threats presents a major obstacle for prospective users. Furthermore, the lack of uniform regulations in different regions complicates the technology's rollout, creating hurdles for both manufacturers and service providers. The upfront investment for the procurement and installation of sophisticated wireless IoT sensors can be a significant barrier for smaller businesses, which restricts their presence in the market. Additionally, issues surrounding data privacy and the efficient handling of the substantial volume of data produced by IoT devices add to the complications of adoption. Lastly, the fragmentation of technology and the lack of standard protocols can result in interoperability issues among devices from various manufacturers. Nevertheless, the market is progressing rapidly, fueled by the rising demand for automation, enhanced efficiency, and improved decision-making across diverse sectors. Ongoing innovations in security protocols, alignment of regulations, and strategies to lower costs are paving the way for a promising future for wireless IoT sensors.

Key Segments of the Wireless IoT Sensors Market

Segmentation by Component:

- Hardware

- Service

- Software

Segmentation by Type:

- Image Sensor

- Motion Sensor

- Proximity Sensor

- Pressure Sensor

- Magnetometer

- Humidity Sensor

- Temperature Sensor

- Touch Sensor

- Accelerometer

- Gyroscope

- Flow Sensor

- Others

Segmentation by Technology:

- Wi-Fi

- Bluetooth

- ZigBee

- NFC

- Z-Wave

- RFID

- Others

Segmentation by Vertical:

- Industrial IoT

- Consumer IoT

- Commercial IoT

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America