March 2019: The global cobalt market size is projected to be valued at USD 12.93 billion by 2025, according to a new study by Adroit Market Research. The “Global Cobalt Market Size 2017 By Application (Battery Chemicals (LCO, NMC, NCA), Super Alloys, Hard Metals, Ceramics & Pigments, Catalysts, Others), By Region (North America, Europe, Asia Pacific, Rest of the World) and Forecast 2018 to 2025” study covers key trends, such as drivers, restraints, and opportunities. The study contains global cobalt indicators in terms of value (USD Million) and volume (Tons) for a period ranging between 2015 and 2025. Furthermore, the study encompasses PESTLE analysis, value chain analysis, Porter’s Five Forces’ analysis, and vendor landscape analysis.

Cobalt is one of the most important critical raw materials among the list of 26 materials, according to the European Commission. China is by far the largest player in the market and supplies the world with the majority of critical materials, for instance, refined cobalt. It is also worth noting that at the same time China is the biggest consumer of many of those materials which create competition for supplies across the globe.

Less than 6% of total cobalt is mined in the form of a primary product. The largest global cobalt producers are Democratic Republic of Congo (DRC) with a 64% share, China with 5% and Canada with 5%. In Europe, cobalt is presently mined in New Caledonia and Finland, with a global share of 2% and 1%, respectively. In Finland, cobalt is mined in four plants and the production is around 1,200 tones. The EU’s reliance on the import of cobalt ores and concentrates is estimated as 32%.

Cobalt is a valuable metal due to its properties namely high melting point and good corrosion resistance. This is crucial for withstanding the high temperatures in batteries as well as superalloys. On average, a NiMH battery contains 15% by weight of cobalt, while the Li-ion battery uses up to 50% by weight of this metal.

An unfavorable aspect of cobalt is the level of difficulty and the high cost of its separation from nickel and copper. Political instability and fluctuating supply are the other key restraints slowing down its application in the battery and metallurgical applications of cobalt. Katanga is the new source of supply for the future cobalt market however, any disturbances to this mine causing a ramp-up could cause the cobalt market to return to its current deficit state in the coming years.

Several factors that have impacted the cobalt market in terms of price increase include lack of credit tied to Chinese deleveraging, changes in payment terms in China, new EVs subsidiary policy in China, and tensions in the trade with the US. However, companies that were optimistic about the future demand for the battery metal in 2017 faced challenges in 2018 owing to increase in prices and supply shortage that are likely caused owing to artisanal supply-side response out of the Democratic Republic of Congo that created pressure on the prices.

Key players in this market include Umicore, Glencore Xstrata plc, Jinchuan Gr Intl, Huayou Cobalt Co. Ltd., Freeport-McMoRan Inc., Sherritt International Corporation, Nippon Steel & Sumitomo Metal Corporation, Jiangsu Cobalt Nickel Metal Co., Ltd., Eramet, and BHP.

Key Segments of the Global Cobalt Market

Application Overview, 2015-2025 (Tons) (USD Million)

- Battery Chemicals

- (LCO) Lithium cobalt oxide

- (NMC) Lithium nickel manganese cobalt

- (NCA) Lithium nickel cobalt aluminum oxide

- Superalloys

- Hard Metals

- Ceramics & Pigments

- Catalysts

- Others

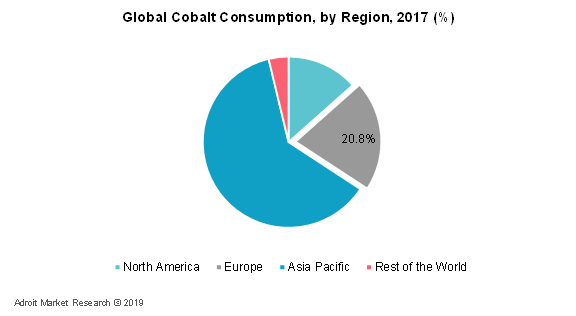

Regional Overview, 2015-2025 (Tons) (USD Million)

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- Rest of the Europe

- Asia-Pacific

- China

- Japan

- Rest of Asia Pacific

- Rest of the World

- Rest of Middle East & Africa