March 2019: The global copper demand is projected to reach more than 30 million tons by 2025, based on findings from Adroit Market Research. The study on the “Global Copper Market Size 2017 By Application (Building & Construction, Electrical & Electronics, Industrial Machinery & Equipment, Transportation, Consumer & General Products), By Region and Forecast 2018 to 2025” provides the various key strategies adopted by the leading players to strengthen their distribution channels. The global copper market size is estimated based on the ongoing trend and consumption patterns of the metal across the globe. The global copper market size has also been calculated based on an extensive value chain and a better understanding of Porter’s Five Forces’ analysis for the industry players’ decision making.

Growing penetration of electric vehicles, rising construction activities for power generation, and increasing consumer electronics industry is expected to boost copper demand over the coming years. In 2017, global electric cars sales surpassed 1 million units. New electric car sales increased by more than 50% in 2017 as compared to 2016. Moreover, increasing investment and government support for the promotion of electric vehicles is expected to drive the copper demand over the coming years. For instance, Nissan-Renault-Mitsubishi has announced an investment of USD 9 billion to offer 12 electric models by 2022. Increasing reliance on electricity from the automotive industry is expected to drive the consumption of copper for auto manufacturing.

Copper plays an important role in the renewable energy industry. Over the past few years, the consumption of copper in renewable energy has increased and the trend is expected to continue over the coming years. Moreover, the utilization of copper in solar and wind power generation equipment is significantly higher than that for non-renewable energy sources. Global renewable energy industry size was valued at more than USD 1 trillion in 2017. Moreover, according to the Copper Development Association (CDA), the copper demand for wind energy in 2018 accounted for more than 38 kilo tons and is expected to reach nearly 50 kilo tons by 2020. Expansion of renewable energy sources is expected to drive copper demand.

Growing electrical & electronics industry in China, Japan, India, and South Korea is expected to prompt copper producers to expand their production capacity. China accounted for more than 50% of the global electrical & electronics production in 2017. Presence of well-established electronics manufacturers and continuous demand for consumer electronic products is expected to increase copper demand over the coming years. The growth of the building & construction industry in India is expected to increase copper demand. In 2017, the Indian construction market size exceeded USD 400 billion. Smart city project, metro project, and rising residential construction will fuel market growth.

The global copper industry is competitive in nature as well-established miners are operating in this industry. The top 10 mining companies accounted for nearly 50% of the global market share in 2017. Prominent copper producers are Codelco, Freeport-McMoRan, BHP, Glencore, Rio Tinto, Anglo American, Grupo México, KGHM, Antofagasta, and First Quantum Minerals Ltd.

Manufacturers operating in this industry are adopting M&A strategy to gain a competitive advantage over other producers. For instance, in January 2018, Aurubis, a prominent copper producer and recycler in Europe acquired Codelco’s shares in Deutsche Giessdraht. Deutsche Giessdraht, a German manufacturer of copper products, produces more than 200 kilo tons of copper wire rod per year out of high-quality Grade A cathodes. This acquisition will allow Aurubis a sole marketer of the brand Rhein-Rod. Moreover, in October 2018, BHP doubled stakes in a promising Ecuador copper project. According to BHP, this additional investment in SolGold strengthens its strategic position in the Cascabel copper exploration project.

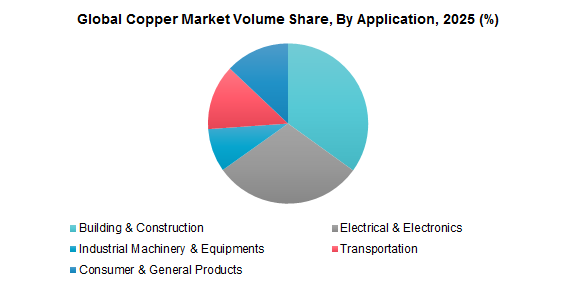

Key Segments of the Global Copper Market

Application Overview, 2015-2025 (Kilo Tons, USD Billion)

- Building & Construction

- Electrical & Electronics

- Industrial Machinery & Equipment

- Transportation

- Consumer & General Products

Regional Overview, 2015-2025 (Kilo Tons, USD Billion)

- North America

- U.S.

- Europe

- Germany

- Italy

- Asia-Pacific

- India

- China

- Japan

- Rest of the World

- Brazil