November 27, 2018: Adroit Market Research launched a study titled, “Global Cyber Security Market Size 2017 By Solution (Identity access management, End-point, Web security, Network, Security & vulnerability management (SVM), Messaging, Education & training, Consulting, Integration, Managed services and others), By Deployment type (Cloud and on premise), By Industry vertical (BFSI, ICT, Healthcare, Government, Manufacturing, Retail and others), By Region and Forecast 2018 to 2025”. The study covers the global cybersecurity market value and volume for a period ranging from 2012 to 2025, where 2012 to 2017 imply the actual annual consumption with forecast between 2018 and 2025. The global cybersecurity market report also includes qualitative insights of the market such as drivers, restrains, value chain, regulatory framework, PESTLE analysis and Porter’s analysis. The value chain has been analyzed in detail covering key stages. Additionally, we have provided a glimpse of the global identity theft market. The global cybersecurity market 2018 gives a holistic view encompassing production, consumption, import and export for key regions and countries.

The global cybersecurity market size is estimated to reach almost USD 395 billion by 2025 owing to the rise in data breaches globally. Year 2017 saw the most number of cybersecurity breaches with a total of 5,000 plus breaches and around 8 billion records exposed. Amongst these breaches, the theft from a cryptocurrency exchange in Japan was the biggest affecting computers worldwide with a ransomware attack called “WannaCry” and costing around USD 570 million.

The increasing measures taken by governments and organizations of various countries worldwide also contribute majorly to the growth of cybersecurity market. For instance, the Australian Cyber Security Growth Network Ltd (ACSGN), which is a key initiative launched by the Australian government, identifies the cyber security growth and innovation to tackle cyber threats. Many governments across the globe are issuing new laws and regulations which challenge organizations to have the right cyber security controls in place and will require further security spending resulting in proliferation of cybersecurity market.

The evolution of cloud computing technologies is becoming the major driver of cybersecurity market. The increasing adoption of cloud computing has moved the potential area of cyber-attacks from the corporate network to the cloud networks managed by third party across different geographies. In the era of industry 4.0, the organizations are connected with their smart devices and networks. This offers a very lucrative target for the cyber criminals to penetrate more easily through the connected devices and networks. Hence, increasing adoption of IoT devices will help in the growth of cybersecurity market.

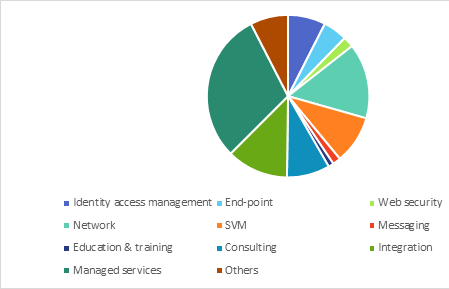

Global cybersecurity share, by solution, 2025 (%)

The current cybersecurity market focuses mainly on the protecting the premises of organizations and companies. This includes preventing the cyber attackers from gaining access to the servers and training employees in order to prevent breaches. In future, the business to consumer aspect will play much bigger role as cybersecurity will enter into daily life activities such as cars and IoT devices which will eventually contribute to the cybersecurity services market.

Cybersecurity is one of the major concerns for healthcare organizations and the economic impact by the breaches has risen dramatically since 2010. According to a study conducted by Ponemon Institute in 2016, 89% of healthcare organizations have experienced a data breach in past two years, costing the industry USD 6.2 billion. Thus, the cybersecurity market in healthcare sector is expected to grow at a CAGR above 20% in the forecast period.

IBM, Microsoft, Oracle, McAfee, Cisco, and Symantec are the leading players present within the global cybersecurity market. These companies are focusing on expanding their presence in the global cybersecurity market over the next few years by adopting strategies such as mergers & acquisitions and product standardization. For instance, in November 2018, Symantec announced the acquisition of Appthority Inc. and Javelin Networks Inc., two startups focused on enterprise network protection.

Key segments of the global cybersecurity market

Deployment type Overview, 2012-2025 (USD Million)

- Cloud

- On premise

Solution Overview, 2012-2025 (USD million)

- Identity access management

- End-point

- Web security

- Network, Security & vulnerability management (SVM)

- Messaging

- Education & training

- Consulting

- Integration

- Managed services

- Others

Industry vertical Overview, 2012-2025 (USD million)

- BFSI

- ICT

- Healthcare

- Government

- Manufacturing

- Retail

- Others

Regional Overview, 2012-2025 (USD million)

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- Rest of Europe

- Asia-Pacific

- Japan

- Australia

- Rest of APAC

- Latin America

- Mexico

- Brazil

- Rest of Latin America

- Middle East & Africa