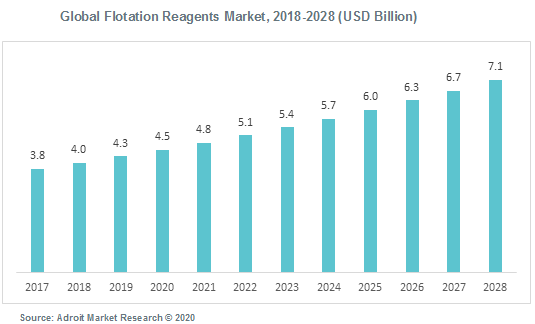

The global flotation reagents market is estimated to reach USD 7.1 Billion by 2028, at a CAGR of 5.8 % during the forecast period from 2021 to 2028. Increasing applications in industrial flooring and increasing demand from the marine industry are driving the market growth. Stringent environmental regulations and other restraints are expected to hinder the growth of the market studied

Growing consumption of flotation reagents, owing to increasing demand for environmentally friendly products is a major factor driving the growth of the global flotation reagents market. Besides, the rising demand for flotation reagents, owing to the rise in population and rapid urbanization is another factor expected to fuel the growth of the target market over the forecast period. Also, growing consumption from the construction sector is a factor expected to propel the growth of the target market soon. Among the resin segments, the flocculants segment is expected to contribute a major share in the global flotation reagents market. Growing demand for flocculants in mineral processing plants and mining applications is anticipated to drive the growth of this segment in the upcoming years. The collector segment is expected to register a higher growth rate in the global market. Growing demand for collectors in mineral processing applications is anticipated to support the growth of this segment.

Explosives & drilling is a major segment that is likely to experience the highest CAGR during the forecast period. Drilling is benefitted by the relaxation flotation reagents caused in the earth and which acts as a non-abrasive method for recovering precious minerals without causing weathering on their surfaces. The water and wastewater treatment segment held the largest market share in the year 2020. This is owing to the major policies and rules regarding the cleaning of industrial effluents and wastewater. Various investors are encouraging the utilization of these chemical reagents along with the support from governing bodies, which is promoting the growth of this market.

Geographically, countries such as Japan, United States, India, China, Germany, and some others are among the largest consumers of flotation reagent products. The growth of population is significantly high in these countries along with the corresponding need for construction of building ultimately leading to consumption of flotation reagents market.

As a result of the development of economies, infrastructure, and industries such as construction, paints, and coatings, and packaging among others in China, East Asia is expected to dominate the global flotation reagents market in terms of consumption. Also, economic production, availability of labor, and raw material in the rest of the Asian countries such as India are expected to result in significant production and consumption of flotation reagents in South Asia. Following these regions in the global flotation reagents market would be North America and Europe which account for a fair share of industries that consume flotation reagents.

Adroit Market Research report on the global flotation reagents market gives a holistic view of the market from 2018 to 2028, which includes factors such as market drivers, restraints, opportunities, and challenges. The market has been studied for historic years from 2018 to 2020, with the base year of estimation as 2020 and forecast from 2021 to 2028. The report covers the current status and future traits of the market at the global as well as country level. Also, the study assesses the market based on Porter's five forces analysis and positions the key players based on their product portfolio, geographic footprint, strategic initiatives, and overall revenue. Prominent players operating in the global flotation market have been studied in detail.

The global flotation reagents market is segmented based on type, and, application. Based on type, the market is segmented into Flocculants, Collectors, Frothers, Dispensers, Others. Based on the application, the market is segmented by powder, mix, aggregate based on application, the market is segmented by Explosives & Drilling, Mineral Processing, Water & Water Management, and Other.

The COVID-19 pandemic is having a significant impact on the flotation reagents industry. Demand for the product is suffering severe shocks across various end-use markets, worldwide supply chains are upset, and the competitive order of manufacturers/producers has witnessed a change. The shortage of demand has fast-tracked the global chemical sector into an oversupply situation. Movement restrictions appear to be a direct and immediate effect, and once the compulsory social distancing ends, it is expected things would get back to normal conditions.

The largest producers of flotation reagents are located in the Asia-Pacific region. Some of the leading companies in the production of flotation reagents are Huntsman, BASF SE, The DOW Chemical Company, and AkzoNobel. The usage of flotation reagents is more dominant in the mining process for froth flotation, wastewater management to separate the pollutants, and others This is one of the major factors driving the regional segment to contribute leading to the fast-paced growth of the Asia Pacific market.

The major players operating in the global flotation reagents market include but are not limited to Huntsman, BASF SE, The DOW Chemical Company, Akzonobel, Clariant AG, Kemira OYJ, Cytec Solvay Group, Evonik Industries, Orica Limited, SNF Floerger SAS, Exxonmobil, Ecolab, IXOM, Nalco Company, Kelco, Solenis, Hychem, Inc., Moly-Cop, Cochran Chemical Company Inc., Nasaco International Ltd., and others.

The flotation reagents market is a moderately consolidated market with the presence of major players in the market. Key players in the market are implementing mergers and acquisitions, product launches, expansions strategy to improve the market share.

Key Segments of the Global Flotation Reagents Market

Type Overview, 2018-2028 (USD Billion)

- Flocculants

- Collectors

- Frothers

- Dispersants

- Other Types

Application Overview, 2018-2028 (USD Billion)

- Explosive & Drilling

- Mineral Processing

- Water & Wastewater Treatment

- Other Applications

Regional Overview, 2018-2028 (USD Billion)

- North America

- The U.S.

- Canada

- Europe

- Germany

- United Kingdom

- France

- Russia

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa